Chapter 1

advertisement

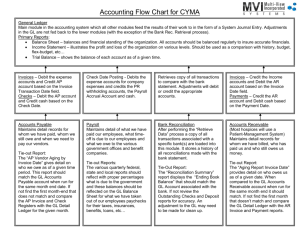

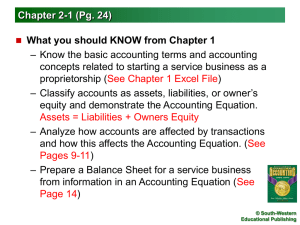

Advanced Accounting Unit 1 - Departmentalized Accounting • Chapter 1 - Recording Departmental Purchases and Cash Payments © South-Western Educational Publishing TERMS REVIEW Lesson 1-1 Asset – anything of value that is owned Liability – Amount owed by a business Equities – Financial rights to assets of a business Owner’s equity – Amount remaining after the value of all liabilities is subtracted from the value of all assets Accounting equation: Assets = Liabilities + Owner’s Equity Source document – Original business papers that contain info about business transactions Journal – Form for recording transactions in aLesson 1-1, page 11 © South-Western chronological order. Educational Publishing TERMS REVIEW Special journal – Journal used to record only one kind of transaction double-entry accounting – Recording of debit and credit portions of each transaction Account – Record summarizing all info pertaining to a single item in the accounting equation Ledger – Group of accounts general ledger – Contains all accounts needed to prepare financial statements Lesson 1-1, page 11 © South-Western Educational Publishing TERMS REVIEW Subsidiary ledger – Ledger that is summarized in a single general ledger account Controlling account – Account in a general ledger that summarizes all accounts in a subsidiary ledger File maintenance – Procedure for arranging accounts in a general ledger, assigning account numbers and keeping records current Lesson 1-1, page 11 © South-Western Educational Publishing THE ACCOUNTING EQUATION (LEFT side of equation) Assets (RIGHT side of equation) = Liabilities + Owner’s Equity Lesson 1-1, page 6 © South-Western Educational Publishing GENERAL JOURNAL Assets = Liabilities + Owner’s Equity Left side Right side T Account DEBIT (Left side) CREDIT (Right side) Lesson 1-1, page 7 © South-Western Educational Publishing TERMS REVIEW Lesson 1-2 Departmental accounting system – Accounting system showing accounting info for two or more departments Merchandising business – Business that purchases and sells goods Posting – transferring info from a journal into a ledger account Debit memorandum – Form prepared by the customer showing the price deduction taken by the customer for returns and allowances Lesson 1-2, page 19 © South-Western Educational Publishing TERMS REVIEW Contra account – Account that reduces a related account on a financial statement; i.e. Purchases returns and allowances is contra account to purchases; Drawing is contra account to capital. Contra balance – Account balance opposite the normal balance Lesson 1-2, page 19 © South-Western Educational Publishing JOURNALIZING PURCHASES ON ACCOUNT June 1. Purchased tennis equipment on account from Tennis Warehouse, $845.00. Purchase Invoice No. 336. TENNIS WAREHOUSE 976 CENTURY BLVD CUBLIN, CA 94565-1101 SOLD TO MasterSport 4750 Appian Way San Jose, CA 95125-0210 TERMS 2/10, n30 2 QUANITY 10 ea. 10 dz. STOCK NO. GRX1 RG TAPE DESCRIPTION Graphite racquet Ready-Grip Tape DATE May 29, 20-OUR ORDER NO. 98-117 CUSTOMER’ ORDER NO. 336 SHIP VIA TRUCK UNIT PRICE 60.00 24.50 TOTAL AMOUNT 600.00 245.00 3 Total Invoice 1 845.00 4 1. Write approval date. 2. Write vendor name. 3. Record invoice number. 4. Write invoice amount. 5. Write invoice amount. 5 Lesson 1-2, page 13 © South-Western Educational Publishing POSTING FROM A PURCHASES JOURNAL 1 2 1. 2. 3. 4. 5. Write the date. Write journal page number. Record credit amount. Calculate new account balance. Write vendor number. 3 5 4 Lesson 1-2, page 14 © South-Western Educational Publishing POSTING THE TOTALS OF A PURCHASES JOURNAL 1 2 5 3 4 1. 2. 3. 4. 5. Write the date. Write journal page number. Write column total. Calculate new account balance. Write account number (in parentheses). Lesson 1-2, page 15 © South-Western Educational Publishing PURCHASES JOURNAL WITH POSTING COMPLETED Lesson 1-2, page 15 © South-Western Educational Publishing JOURNALIZING A DEBIT MEMORANDUM June 3. Returned tennis equipment to Key Tennis Company, $54.50, from Purchase Invoice No 333. Debit Memorandum No 22. 1. Write the date. 2. Enter vendor name. 3. Record debit memo number. 4. Write the amount. 5. Write the amount. 2 1 3 4 5 Lesson 1-2, page 17 © South-Western Educational Publishing POSTING FROM A PURCHASES RETURNS AND ALLOWANCES JOURNAL Lesson 1-2, page 18 © South-Western Educational Publishing TERMS REVIEW Lesson 1-3 Cash discount – Deduction that a vendor allows on the invoice amount to encourage prompt payment Purchases discount – Cash discount on purchases taken by a customer Petty cash – Amount of cash kept on hand and used for making small payments Bank statement – Report of deposits, withdrawals, and bank balance sent to a depositor by a bank Lesson 1-3, page 27 © South-Western Educational Publishing JOURNALIZING A PURCHASES DISCOUNT June 1. Paid cash on account to Champion Tennis Supply, $514.50, covering Purchase Invoice No. 331 for tennis equipment for $525.00 less 2% discount, $10.50. Check No. 315. 1 2 1. 2. 3. 4. 3 Write the date. Enter vendor name. Record the check number. Write the debit amount. 4 5 6 5. Record the discount amount. 6. Enter the credit amount. Lesson 1-3, page 21 © South-Western Educational Publishing TAKING A DISCOUNT AFTER A PURCHASE RETURN June 1. Paid cash on account to Golf-Tee, Inc., $220.50, covering Purchase Invoice No. 332 for golf equipment for $275.00, less Debit Memorandum No. 20 for $50.00, and less 2% discount, $4.50. Check No 316. Amount owed on invoice: Original Purchase Invoice Amount (P332) $275.00 – – Purchases Return (DM20) 50.00 = = Purchase Invoice Amount After Return $225.00 Purchases Discount Rate 2% = = Purchases Discount $4.50 = = Total Amount Due $220.50 Purchases discount: Purchase Invoice Amount After Return $225.00 Amount due after purchases discount: Purchase Invoice Amount After Return $225.00 – – Purchases Discount $4.50 Lesson 1-3, page 22 © South-Western Educational Publishing RECORDING ENTRIES IN A CASH PAYMENTS JOURNAL June 1. Paid cash for office supplies, $136.00. Check No. 317. 1 1. 2. 3. 4. 5. 2 3 Write the date. Enter the account title. Record the check number. Write the debit amount. Enter the credit amount. 4 5 Supplies—Office 136.00 Cash 136.00 Lesson 1-3, page 23 © South-Western Educational Publishing CASH PAYMENT TO REPLENISH PETTY CASH June 30. Paid cash to replenish the petty cash fund, $402.00: office supplies, $164.00; store supplies, $136.00; advertising, $56.00; miscellaneous expense, $46.00. Check No. 350. 2 4 3 5 1 1. Write the date. 2. Enter the account titles. 3. Record check number. 4. Write the debit amounts. 5. Enter the credit amount. Lesson 1-3, page 24 © South-Western Educational Publishing RECONCILING A BANK STATMENT (1) Checkbook Balance 1 33,231.55 $ __________ Date 6/30 Bank Charges Description Amount Service Charge 12.80 Credit Card Fee 340.00 20,525.23 $ __________ 4 (4) Bank Balance Date: June 30, 20-- Outstanding Deposits Amount 12,828.52 5 12,828.52 (5) Add Total Outstanding Deposits $ __________ 2 (6) Total 6 33,353.75 $ __________ 352.80 (2) Deduct Total Bank Charges $ __________ Outstanding Checks Check No Amount 350 402.00 351 73.00 475.00 (7) Deduct Total Outstanding Checks$ __________ 7 3 (3) Adj. Checkbook Balance 1. 2. 3. 32,878.75 $ __________ Enter checkbook balance. Enter and add bank charges. Deduct bank charges to obtain checkbook balance. 4. 5. 6. 7. 8. (8) Adjusted Bank Balance 32,878.75 $ __________ 8 Enter bank balance from statement. Enter and add outstanding deposits. Add outstanding deposits to balance. Deduct total outstanding checks. Verify adjusted checkbook balance and adjusted bank balance are the same. Lesson 1-3, page 25 © South-Western Educational Publishing JOURNALIZING BANK CHARGES June 30. Received bank statement showing bank service charge, $12.80. Memorandum No 18. Miscellaneous Expense 12.80 Cash 12.80 June 30. Recorded credit card fee expense for June, $340.00. Memorandum No. 19. Credit Card Fee Expense 340.00 Cash 340.00 Lesson 1-3, page 26 © South-Western Educational Publishing