Corporations: Stock Values, Dividends, Treasury Stock, and

advertisement

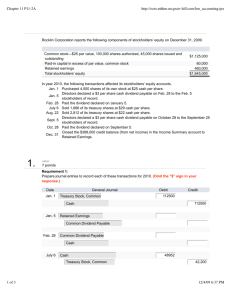

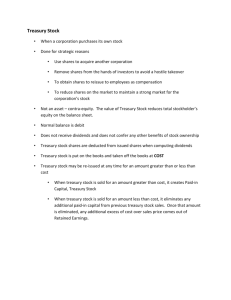

Corporations: Stock Values, Dividends, Treasury Stock, and Retained Earnings Chapter 20 20 - 1 Learning Objective 1 Calculating the book value of preferred and common stock. 20 - 2 Learning Unit 20-1 Corporations often reserve the right to retire or redeem preferred stock at a specific price. This price is called redemption value. Market value is the market value per share in the stock market. 20 - 3 Learning Unit 20-1 Book value per share = Total stockholders’ equity ÷ Total shares outstanding Book value preferred = Redemption value + Dividends in arrears ÷ Number of shares outstanding Book value common = Stockholders’ equity – Amount assigned to preferred ÷ Number of shares outstanding 20 - 4 Learning Unit 20-1 Stockholders’ Equity Paid-in Capital: Common Stock, $25 par value, 10,000 shares authorized, issued, and outstanding $ 250,000 Paid-in Capital in Excess of Par–Common 110,000 Total Paid-in Capital $ 360,000 Retained Earnings 894,000 Total Stockholders’ Equity $1,254,000 Book value per share: $1,254,000 ÷ 10,000 = $125.40 20 - 5 Learning Unit 20-1 Stockholders’ Equity Paid-in Capital: Preferred 7% stock, $100 par value, authorized 3,000 shares cumulative and nonparticipating, 2,000 shares issued and outstanding $200,000 Paid-in Capital in Excess of Par–Preferred 10,000 Total Paid-in Capital, Preferred Stockholders$210,000 Redemption value = $206,000 Dividends in arrears = $ 14,000 20 - 6 Learning Unit 20-1 Book value per share preferred: $206,000 + $14,000 ÷ 2,000 = $110 Book value per share common: $894,000 – 220,000 ÷ 10,000 = $67.40 20 - 7 Learning Objective 2 Journalizing entries to record issuance of a cash dividend and a stock dividend. 20 - 8 Learning Unit 20-2 There are three important dates associated with the dividend process. Date of declaration Date of record Date of payment 20 - 9 Learning Unit 20-2 On March 8, 200x, the board declares a $2 cash dividend per share on the 5,000 shares issued and outstanding. Accounts Affected Retained Earnings Category SE Dividends Payable Liability Rules Dr. 10,000 Cr. 10,000 20 - 10 Learning Unit 20-2 A stock dividend is a distribution of the corporation’s own stock to shareholders. It is a transfer of retained earnings to contributed capital. It does not affect total stockholders’ equity. 20 - 11 Learning Unit 20-2 Jesse Company, with 10,000 shares of $20 par value common stock outstanding, declares a 10% stock dividend when the shares are trading at $30. How many shares are issued in the dividend? 10,000 × 10% = 1,000 shares 20 - 12 Learning Unit 20-2 Retained Earnings 30,000 Common Stock – Dividend Distributable 20,000 Paid-In Capital in Excess 10,000 Declaration of a 10% common stock dividend 20 - 13 Learning Unit 20-2 – – – – Results of a stock split: increases the number of shares outstanding reduces the par or stated value in proportion increases stock prices in the market dividends per share increased 20 - 14 Learning Objective 3 Journalizing the purchase and sale of treasury stock. 20 - 15 Learning Unit 20-3 Treasury stock is the corporation’s own shares of issued stock. Treasury stock has a debit balance. It is not an asset. The corporation buys the shares on the stock market, or directly from shareholders. 20 - 16 Learning Unit 20-3 The stock is held in the treasury and used for issuance in stock options plans, etc. Dividends are not paid on the treasury stock. It is not outstanding. 20 - 17 Learning Unit 20-3 On June 1, 200x, Ashley Corporation purchased 1,000 shares of its own $10 par value common stock at $12 per share (5,000 shares are outstanding). What is the journal entry? Treasury Stock—Common 12,000 Cash 12,000 Purchase of previously issued stock 20 - 18 Learning Unit 20-3 Stockholders’ equity (before purchase of treasury stock): Paid-in capital: common stock, $10 par, 5,000 issued $ 50,000 + Paid-in capital in excess of par 30,000 = Total paid-in capital $ 80,000 + Retained earnings 60,000 = Total stockholders’ equity $140,000 20 - 19 Learning Unit 20-3 After purchase of treasury stock: Common stock, $10 par, 5,000 issued, 4,000 outstanding $ 50,000 + Paid-in capital in excess of par 30,000 + Retained earnings 60,000 = Subtotal $140,000 – Treasury stock, 1,000 shares at cost 12,000 = Total stockholders’ equity $128,000 20 - 20 Learning Unit 20-3 Treasury stock can be reissued at a price above or below the cost of reacquiring the stock. Excess of sales price over cost is credited to Paid-in Capital from Treasury Stock. Assume that on July 8, Ashley Corporation sells 100 shares of treasury stock at $15. 20 - 21 Learning Unit 20-3 Cash 1,500 Treasury Stock 1,200 Paid-In Capital from Treasury Stock 300 Sold 100 shares of treasury stock 20 - 22 Learning Objective 4 Preparing a statement of retained earnings. 20 - 23 Learning Unit 20-4 Retained earnings appropriation is the amount of retained earnings that is not available for dividends. No actual cash “set asides” are involved in the appropriation of retained earnings. 20 - 24 Learning Unit 20-4 It can be noted in a memo entry or an actual journal entry that debits Retained Earnings and credits Appropriation (for a purpose). The restriction can be contractual or voluntary. 20 - 25 Learning Unit 20-4 Statement of Retained Earnings Beginning Retained Earnings Less: Prior Period Adjustments Error corrections Net loss Add: Net Income Error corrections Deduct: Dividends Equals: Ending Retained Earnings 20 - 26 Learning Unit 20-4 Raymond Company Statement of Retained Earnings Year Ended December 31, 20x3 Retained Earnings, Jan. 1, 20x3 Less: Prior Period Adjustments: Correction of 20x1 error Retained Earnings, Jan, 20x3, corrected Add: Net Income for 20x3 Total Deduct: Dividends declared in 20x3 Retained Earnings, Dec. 31, 20x3 $350,000 12,000 $338,000 40,000 $378,000 25,000 $353,000 20 - 27 End of Chapter 20 20 - 28