Introduction to Financial Management - B-K

advertisement

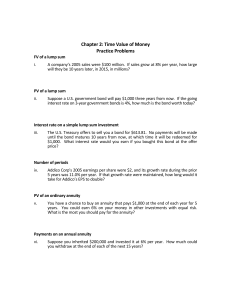

Intro to Financial Management The Time Value of Money Review • Homework • How do you calculate and what do these ratios mean? – Current ratio – Acid-test – Inventory turnover – ROS, Return on sales – ROA, Return on assets – ROE, Return on equity – Debt ratio – Leverage ratio – P/E Review • What is on an income statement? – What is common-sized? – What are gross profit margin, operating profit margin, net profit margin, earnings, and earnings per share? – What do these terms tell you? • What is on a balance sheet? – What is common-sized? – What are book value, working capital, debt and leverage ratios? – What do these terms tell you? • What is on a cash flow statement? – What are the three major areas of cash flow? – Why is this different from profit? • What are the basics of computing corporate taxes? The Time Value of Money • Would you loan $1000 today and want $1000 in ten years? • Examples – Lottery – Mortgage – Banking • Foregoing money today for money in the future – “Opportunity cost” • Interest is the cost of money Future Value (FV) • If you invest a lump sum today, what will it be worth in the future? • Compounding interest – No more new money put in – Receive interest each year; it builds up • Future value – Formula – Future value factor Calculating FV • Calculating future value. Excel and calculator. – Must have both a positive and negative number • May also need to solve for n – E.g. How many years will it take to reach $1M? • May want to know r – E.g. What interest rate do I need to reach $1M in n years? • Examples – How long to get to $1M? • Here you have to solve for n. • On a calculator with PV/FV, enter the data and CPT n • On a calculator without PV/FV, the formula is n = log(FV/PV) / log(1+r) (you can also use ln instead of log) Present Value (PV) • What is a single payment in the future worth today? • Future money can be expressed in today’s dollars. – Formula – Present value factor • Calculate using calculator and Excel • Example – What is $10,000 ten years from now worth today at 4% interest? • How do we deal with two different flows? – E.g. $5k in 5 years plus $10k in 10 years Annuities • Series of equal payments • Want to know either – How much you would pay today to receive those payments in the future or – If you are investing those payments, how much will they be worth in the future Simple Annuity • Receive the same payment every year for n years – What is that worth now? – I.e., what would you pay now to get that annuity? • PV = PMT * (1 – present value factor) / r Compound Annuity • You invest the same amount each period for n periods – The value grows as you: • Receive interest on your balance • Invest new money each year • FV = PMT * (future value factor – 1) / r Amortized Loans • Loans where you pay back the principal plus interest in equal payments throughout the period • E.g. a mortgage • Treat like a simple annuity and solve for PMT • PV is the amount of the loan, what you are given • n is the number of periods • For a 30-year mortgage, you have 12*30 periods because they are paid monthly • r is the interest rate • For a mortgage, take the interest rate and divide by 12 (you pay 1/12th each month) • Solve for PMT • The payments include both interest and principal • Example, how big a mortgage can you get if you can afford $1250 a month for 30 years at a rate of 4%? Comparing Interest Rates • Interest can be calculated in many ways – Compare annual interest of 1% and monthly at 1% – Need a common benchmark • Annual percentage rate (APR) – Also known as effective annual rate (EAR) • FV and PV for non-annual periods (m periods in a year) – General case of a mortgage. – Instead of n, substitute n*m – Instead of r, substitute r/m Perpetuity • An annuity that continues forever PV = PMT / r • What is the value of a perpetuity that pays $1000 if the interest rate is 8%? Summary Today n periods Future Type Formula ?? Discount value by r each period $FV Simple PV PV = Fvfactor * FV $PV Receive return r each period ?? Simple FV FV = PVfactor * PV ?? Receive $PMT each period - - Invest $PMT each period Balance earns r each period ?? Compound Annuity FV = PMT * (future value factor – 1) / r ?? Receive $PMT forever - Perpetuity PV = PMT / r Simple Annuity PV = PMT * (1 – present value factor) / r Problem • Congratulations, you just won the lottery for $25 million. • The lottery will pay you $100,000 a year for 25 years • What is the cash value of this lottery, assuming an interest rate of 8%? • What would you do if the cash value offered by the state was less or more than the amount you calculated?