2.3 Calculate Present or Future Value of a Variety of Cash Flow

advertisement

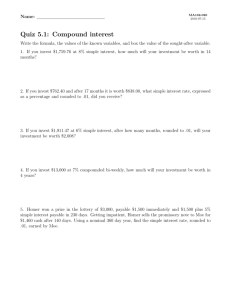

Calculate Present or Future Value of Cash Flows Intermediate Cost Analysis and Management © 2011 1 Time Value of Money Concepts • Is $1 received today worth the same as $1 to be received one year from today? • Is $1 received today worth the same as $1 to be received one hundred years from today? • Why or why not? © 2011 2 Terminal Learning Objective • Action: Calculate Present or Future Value of a Variety of Cash Flow Scenarios • Condition: You are training to become an ACE with access to ICAM course handouts, readings, and spreadsheet tools and awareness of Operational Environment (OE)/Contemporary Operational Environment (COE) variables and actors • Standard: with at least 80% accuracy • Identify and enter relevant report data to solve Present and Future Value equations using macro enabled cash flow templates © 2011 3 Time Value of Money Concepts Money received Today: • Can be invested Today to earn interest Money received in the Future: • Has not yet begun to earn interest • Can be spent Today at Today’s prices • Can be spent in the Future at inflated prices © 2011 4 Simple Interest • Interest earned on Principal only Principal * Annual Interest Rate * Time in Years • Invest $1 today at 10% interest for 3 years Interest = $1 * .10 * 3 = $.30 • $1 grows to $1.30 over 3 years © 2011 5 Compound Interest or Future Value • Invest $1 today at 10% Interest for 3 years Principal * 10% (1 year) = Interest New Balance $1.00 * .10 = $.10 $1.10 $1.10 $1.21 * .10 * .10 = $.11 = $.12 $1.21 $1.33 • This relationship can be expressed as: Principal * (1 + Annual Interest Rate)Time in Years $1*(1+.10)3 = $1.33 © 2011 6 Compound Interest or Future Value • Invest $1 today at 10% Interest for 3 years Principal * 10% (1 year) = Interest New Balance $1.00 * .10 = $.10 $1.10 $1.10 $1.21 * .10 * .10 = $.11 = $.12 $1.21 $1.33 • This relationship can be expressed as: Principal * (1 + Annual Interest Rate)Time in Years $1*(1+.10)3 = $1.33 © 2011 7 Compound Interest or Future Value • Invest $1 today at 10% Interest for 3 years Principal * 10% (1 year) = Interest New Balance $1.00 * .10 = $.10 $1.10 $1.10 $1.21 * .10 * .10 = $.11 = $.12 $1.21 $1.33 • This relationship can be expressed as: Principal * (1 + Annual Interest Rate)Time in Years $1*(1+.10)3 = $1.33 © 2011 8 Compound Interest or Future Value • Invest $1 today at 10% Interest for 3 years Principal * 10% (1 year) = Interest New Balance $1.00 * .10 = $.10 $1.10 $1.10 $1.21 * .10 * .10 = $.11 = $.12 $1.21 $1.33 • This relationship can be expressed as: Principal * (1 + Annual Interest Rate)Time in Years $1*(1+.10)3 = $1.33 © 2011 9 Compound Interest or Future Value • Invest $1 today at 10% Interest for 3 years Principal * 10% (1 year) = Interest New Balance $1.00 * .10 = $.10 $1.10 $1.10 $1.21 * .10 * .10 = $.11 = $.12 $1.21 $1.33 • This relationship can be expressed as: Principal * (1 + Annual Interest Rate)Time in Years $1*(1+.10)3 = $1.33 © 2011 10 Effect of Interest Rate and Time $4.00 $3.00 $2.14 $2.00 10% $1.21 $1.00 After 2 years at 10% …..and after 8 years at 10% $0 2 4 6 X-Axis = Time in Years As Time increases, Future Value of $1 Increases © 2011 8 10 11 Effect of Interest Rate and Time $4.00 A higher interest rate causes the future value to increase more in the same 8 years. $3.00 $3.06 15% $2.14 $2.00 10% 5% $1.48 $1.00 $0 2 4 6 X-Axis = Time in Years As interest rate increases, Future Value of $1 Increases © 2011 8 10 12 The Future Value Table Future Value of $1 (Compound Interest) Years 2% 4% 6% 8% 1 1.020 1.040 1.060 1.080 2 1.040 1.082 1.124 1.166 3 1.061 1.125 1.191 1.260 4 1.082 1.170 1.262 1.360 5 1.104 1.217 1.338 1.469 6 1.126 1.265 1.419 1.587 7 1.149 1.316 1.504 1.714 8 1.172 1.369 1.594 1.851 9 1.195 1.423 1.689 1.999 10 1.219 1.480 1.791 2.159 11 1.243 1.539 1.898 2.332 12 1.268 1.601 2.012 2.518 13 1.294 1.665 2.133 2.720 14 1.319 1.732 2.261 2.937 15 1.346 1.801 2.397 3.172 16 1.373 1.873 2.540 3.426 17 1.400 1.948 2.693 3.700 18 1.428 2.026 2.854 3.996 19 1.457 2.107 3.026 4.316 20 1.486 2.191 3.207© 2011 4.661 10% 1.100 1.210 1.331 1.464 1.611 1.772 1.949 2.144 2.358 2.594 2.853 3.138 3.452 3.797 4.177 4.595 5.054 5.560 6.116 6.727 12% 1.120 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 3.106 3.479 3.896 4.363 4.887 5.474 6.130 6.866 7.690 8.613 9.646 14% 1.140 1.300 1.482 1.689 1.925 2.195 2.502 2.853 3.252 3.707 4.226 4.818 5.492 6.261 7.138 8.137 9.276 10.575 12.056 13.743 The Value of $1 at 10% interest after 8 years is $2.14 The Factors are pre-calculated on the FV Table. 16% 1.160 1.346 1.561 1.811 2.100 2.436 2.826 3.278 3.803 4.411 5.117 5.936 6.886 7.988 9.266 10.748 12.468 14.463 13 16.777 19.461 Learning Check • How does compound interest differ from simple interest? • How does number of years affect the future value of an investment? © 2011 14 Demonstration Problem • If I invest $50,000 today at 8%, what will it be worth in 10 years? • Steps: 1. Identify the key variables • Cash flow • Interest rate • Time in years 2. Build a timeline 3. Multiply cash flow by FV factor from the Table © 2011 15 Identify Key Variables • Cash Flows • $50,000 to be paid now • Cash Payments are negative numbers • Some unknown amount to be received ten years in the future • Cash Receipts are positive numbers • Interest Rate = 8% • Time in Years = 10 © 2011 16 Build a Timeline $ 120K ? 100 $50,000 to be invested now 80 60 Unknown amount to be received in 10 years 40 20 0 -20 0 1 2 3 4 5 6 7 8 9 10 -40 $ -60K $50K X-Axis = Time in Years © 2011 17 Multiply by the FV Factor Future Value of $1 (Compound Interest) Years 2% 4% 6% 8% 1 1.020 1.040 1.060 1.080 2 1.040 1.082 1.124 1.166 3 1.061 1.125 1.191 1.260 4 1.082 1.170 1.262 1.360 5 1.104 1.217 1.338 1.469 6 1.126 1.265 1.419 1.587 7 1.149 1.316 1.504 1.714 8 1.172 1.369 1.594 1.851 9 1.195 1.423 1.689 1.999 10 1.219 1.480 1.791 2.159 11 1.243 1.539 1.898 2.332 12 1.268 1.601 2.012 2.518 13 1.294 1.665 2.133 2.720 14 1.319 1.732 2.261 2.937 15 1.346 1.801 2.397 3.172 16 1.373 1.873 2.540 3.426 17 1.400 1.948 2.693 3.700 18 1.428 2.026 2.854 3.996 19 1.457 2.107 3.026 4.316 20 1.486 2.191 3.207© 2011 4.661 10% 1.100 1.210 1.331 1.464 1.611 1.772 1.949 2.144 2.358 2.594 2.853 3.138 3.452 3.797 4.177 4.595 5.054 5.560 6.116 6.727 12% 1.120 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 3.106 3.479 3.896 4.363 4.887 5.474 6.130 6.866 7.690 8.613 9.646 The Factor of $1 at 8% interest for 10 years is 2.159 $50,000 * 2.159 = $107,950 14% 1.140 1.300 1.482 1.689 1.925 2.195 2.502 2.853 3.252 3.707 4.226 4.818 5.492 6.261 7.138 8.137 9.276 10.575 12.056 13.743 16% 1.160 1.346 1.561 1.811 2.100 2.436 2.826 3.278 3.803 4.411 5.117 5.936 6.886 7.988 9.266 10.748 12.468 14.463 18 16.777 19.461 Using the Formula • The formula proves that the answer from the table is correct: $50,000 * (1 + .08)10 = $107,946 • The difference of $4 is caused by rounding in the table © 2011 19 Proof Year 1 2 3 4 5 6 7 8 9 10 Principal *8% = Interest $50,000 $54.000 $58,320 $62,986 $68,024 $73,466 $79,343 $85,690 $92,545 $99,949 * .08 * .08 * .08 * .08 * .08 * .08 * .08 * .08 * .08 * .08 = $4,000 = $4,320 = $4,666 = $5,039 = $5,442 = $5,877 = $6,347 = $6,855 = $7,404 = $7,996 © 2011 New Balance $54,000 $58,320 $62,986 $68,024 $73,466 $79,343 $85,690 $92,545 $99,949 $107,945 20 Learning Check • What is the first step in solving a future value problem? • How are cash payments represented in the timeline? © 2011 21 Future Value vs. Present Value • Future Value answers the question: • To what value will $1 grow in the Future? • Present Value answers the question: • What is the value Today of $1 to be received in the Future? -or• How much must be invested today to achieve $1 in the Future? © 2011 22 Future Value vs. Present Value Present Value of $1 at 10% Future Value of $1 at 10% $8.00 $7.00 $6.00 $5.00 $4.00 $3.00 $2.00 $1.00 $0.00 $1.00 $0.90 $0.80 $0.70 $0.60 $0.50 $0.40 $0.30 $0.20 $0.10 $0.00 1 3 5 7 9 11 13 15 17 1 19 3 5 7 9 11 13 15 17 19 Periods Periods The value of a dollar received today will increase in the future A dollar to be received in the future is worth less than a dollar received today © 2011 23 Present Value Concepts • What is the value Today of $1 to be received one year in the Future? • How much must be invested Today to grow to $1 one year from Today? • The answer to these two questions is the same! © 2011 24 Present Value Concepts • Discount Rate represents interest or inflation • Assume a rate of 10% • What is the cost expression for this relationship? $Investment Today + Interest = $1.00 -or$Investment + ($Investment * .10) = $1.00 $Investment * (1+ .10) = $1.00 $Investment = $1/(1.10) $Investment = $.91 © 2011 25 Present Value Concepts • Discount Rate represents interest or inflation • Assume a rate of 10% • What is the cost expression for this relationship? $Investment Today + Interest = $1.00 -or$Investment + ($Investment * .10) = $1.00 $Investment * (1+ .10) = $1.00 $Investment = $1/(1.10) $Investment = $.91 © 2011 26 Present Value Concepts • Discount Rate represents interest or inflation • Assume a rate of 10% • What is the cost expression for this relationship? $Investment Today + Interest = $1.00 -or$Investment + ($Investment * .10) = $1.00 $Investment * (1+ .10) = $1.00 $Investment = $1/(1.10) $Investment = $.91 © 2011 27 Present Value Concepts • Discount Rate represents interest or inflation • Assume a rate of 10% • What is the cost expression for this relationship? $Investment Today + Interest = $1.00 -or$Investment + ($Investment * .10) = $1.00 $Investment * (1+ .10) = $1.00 $Investment = $1/(1.10) $Investment = $.91 © 2011 28 Present Value Concepts • Discount Rate represents interest or inflation • Assume a rate of 10% • What is the cost expression for this relationship? $Investment Today + Interest = $1.00 -or$Investment + ($Investment * .10) = $1.00 $Investment * (1+ .10) = $1.00 $Investment = $1/(1.10) $Investment = $.91 © 2011 29 Proof • Plug $.91 in to the original equation: $.91 + ($.91 * .10) = $1.00 $.91 + .09 = $1.00 • This relationship is fairly simple for one period, but what about multiple periods? © 2011 30 Present Value Concepts • How much must be invested today to achieve $1.00 three years from today? • What is the cost expression for this relationship? $Investment * (1 + Rate) #Years = $Future Value $Investment = $Future Value / (1 + Rate) #Years -or$Investment * (1+.10) 3 = $1.00 $Investment = $1.00 / (1+.10) 3 $Investment = $.75 © 2011 31 Present Value Concepts • How much must be invested today to achieve $1.00 three years from today? • What is the cost expression for this relationship? $Investment * (1 + Rate) #Years = $Future Value $Investment = $Future Value / (1 + Rate) #Years -or$Investment * (1+.10) 3 = $1.00 $Investment = $1.00 / (1+.10) 3 $Investment = $.75 © 2011 32 Present Value Concepts • How much must be invested today to achieve $1.00 three years from today? • What is the cost expression for this relationship? $Investment * (1 + Rate) #Years = $Future Value $Investment = $Future Value / (1 + Rate) #Years -or$Investment * (1+.10) 3 = $1.00 $Investment = $1.00 / (1+.10) 3 $Investment = $.75 © 2011 33 Present Value Concepts • The Investment amount is known as the Present Value • The Present Value relationship is expressed in the formula: Future Cash Flow * 1/(1 + Rate) #Years -or$1 * 1/(1.10)3 = $.75 © 2011 34 Proof Principal * 10% (1 year) = Interest $.75 $.83 $.91 * .10 * .10 * .10 = $.075 = $.083 = $.091 New Balance $.83 $.91 $1.00 • There is also a table shortcut for Present Value © 2011 35 The Present Value Table Present Value of $1 Years 2% 1 0.980 2 0.961 3 0.942 4 0.924 5 0.906 6 0.888 7 0.871 8 0.853 9 0.837 10 0.820 11 0.804 12 0.788 13 0.773 14 0.758 15 0.743 16 0.728 17 0.714 18 0.700 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 © 2011 0.350 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.09536 The Present Value of $1 at 10% to be received in 3 years is $.75 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. Effect of Interest Rate and Time $1.20 $1.00 $0.83 $0.80 $0.60 10% $0.47 $0.40 $0.20 $1 to be received in 2 years at 10% …..and in 8 years at 10% $0 2 4 6 X-Axis = Time in Years As Time increases, Present Value of $1 Decreases © 2011 8 10 37 Effect of Interest Rate and Time $1.20 A higher discount rate causes the present value to decrease more in the same 8 years. $1.00 $0.80 $0.68 5% $0.60 10% $0.47 15% $0.40 $0.33 $0.20 $0 2 4 6 X-Axis = Time in Years As Time increases, Present Value of $1 Decreases © 2011 8 10 38 Learning Check • What does Present Value represent? • How does the Present Value table differ from the Future Value table? © 2011 39 Demonstration Problem • What is the Present Value of a $60,000 cash flow to be received 6 years from today assuming 12% discount rate? • Steps: 1. Identify the key variables • Cash flow • Discount rate • Time in years 2. Build a timeline 3. Multiply cash flow by the Factor from the PV Table © 2011 40 Identify Key Variables • Cash Flow • $60,000 to be received in the Future • Is equal to some unknown amount Today • Discount Rate = 12% • Time in Years = 6 © 2011 41 Build a Timeline $ 70K $60K $60,000 to be received in 6 years 60 50 Unknown Present Value 40 30 20 ? 10 0 0 1 2 3 4 5 6 X-Axis = Time in Years © 2011 42 Multiply by the PV Factor Present Value of $1 Years 2% 1 0.980 2 0.961 3 0.942 4 0.924 5 0.906 6 0.888 7 0.871 8 0.853 9 0.837 10 0.820 11 0.804 12 0.788 13 0.773 14 0.758 15 0.743 16 0.728 17 0.714 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 The Factor of $1 at 12% discount for 6 years is 0.507 $60,000 * 0.507 = $30,420 © 2011 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.080 43 Using the Formula • The formula proves that the answer from the table is correct: $60,000 * 1/(1 + .12)6 = $30,398 • The difference of $22 is caused by rounding in the table © 2011 44 Proof Year Principal 1 2 3 4 5 6 30,420 34,070 38,159 42,738 47,866 53,610 *8% = Interest * .12 * .12 * .12 * .12 * .12 * .12 © 2011 = $3,650 = $4,088 = $4,579 = $5,129 = $5,744 = $6,433 New Balance $34,070 $38,159 $42,738 $47,866 $53,610 $60,044 45 Practical Exercise © 2011 46 Time Value of Money Worksheet Enter key variables in the blank white cells to generate the graph shown below © 2011 47 Time Value of Money Worksheet The spreadsheet tool also calculates Present Value © 2011 48 Practical Exercise © 2011 49