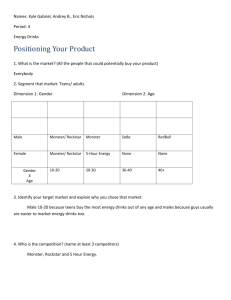

Consumer Insight – Who Drinks Energy Drinks?

advertisement

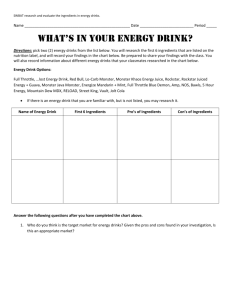

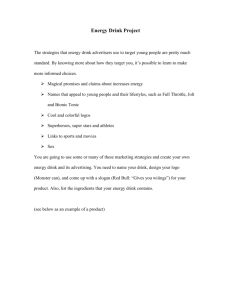

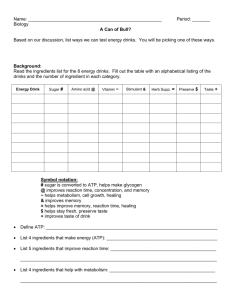

Starbucks BizNuggets Energy Drink Industry Overview of Energy Market •Market of more than 3.2B in 2006 •516% adjusted $ sales growth during 2001-2006 –Can be attributed to: •Proliferation of Distribution channels •Increase number of retailers and brands (emergence from introduction stage of PLC) •Increase in consumer base -Women -Hispanics & African Americans •U.S. sales forecasted for a 10.2% annual increase through 2011 Starbuck’s Overview •Sales in the past year: $10,090.0M •Net Income: $633.65M –1 Year Growth: 19.2% –5 Year Growth: 26.0% •Net Profit Margin: 6.28% •Product Lines: – Doubleshot Energy + Coffee – Frappuccino Beverages – Iced Coffee – Doubleshot – Tazo Bottled Iced Tea & Juices – Coffee & Cream Liquors – Chocolate – Ice Cream Trends Driving Industry Growth •More individuals fighting fatigue and looking for energy boost –Busier/more chaotic lifestyles –Variety of sources for energy boost • • • Supplements (59%) Food (51%) Beverages (30%) –Americans reduction in # of sleep hour per night (6.8 hours, down .2 from 2001) •Young adults driving the market –Marketing aimed at busy, adventurous and extreme individuals, therefore they “need additional energy” •Hybrids –~50% like energy drinks with fruit juice in it –~33% desire use of non-carbonated energy drink and energy drink/soda hybrid –~33% would likely choose an energy drink/tea hybrid •Pre-mixed alcohol energy drinks –Companies such as Anheuser-Busch, Miller, Rockstar, and Monster have already launched or plan to launch alcoholic energy drinks Potential Barriers •Medical Research paying close attention to health effects –Emergency cases from caffeine overdose to refuting functional claims •“Soda Hybrids” –Similar beneficiaries at soda prices, approx. 80% discount from 20oz. Energy drink prices •Competition from outside the industry –Energy bars, food, supplements, and mix products –Energy drinks that don’t “cause the crash” •Forecast of potential factors hurting sales –Obesity, dietary, product safety, innovation, price competition & private label Energy Drink Market Share • – – – – – – – – % Share 2006 Other 7% Tab Energy 2% Full Throttle 7% Red Bull 43% Rockstar Int'l 12% Amp 4% SoBe 9% Hansen (Monster) 16% Sales Figures (in $ Millions) 2006 • Red Bull = 272 Hansen (Monster) = 102 SoBe = 60 Amp = 24 Rockstar = 77 Full Throttle = 44 Tab Energy = 14 Other = 58 Market Share % Change 2004-2006 – – – – – – – – Red Bull = -15.6 Hansen (Monster) = 8.1 SoBe = -.1 Amp = -1.6 Rockstar Int’l = 3.5 Full Throttle = 6.9 Tab Energy = 2.2 Other = -4.4 Key Players in Market • Red Bull – Available in 120 countries with expansion soon into more markets in Asia – “Red Bull Simple Cola” • Launching within next year, a slightly more caffeinated cola to reach larger market with brand exposure – New sports sponsorships with Air Racing, base jumping and “Rampage” – Suicidal-like mountain biking • Monster – Launched new “Java Monster” (15 Oz)within past year • • 7 Flavors “Coffee + Energy” – Big Black, Mean Bean. Loca Moca. Russian, Nut-Up, Lo-Ball & Irish Blend 1 Flavor “Tea + Energy” – Chai Hai –Added Monster Mixxd to portfolio – Energy + Juice (only a grape flavor) Key Players in Market (Cont.) • Amp – – “Hybrid” product that is targeted towards soda drinkers looking for more of a kick and energy Recent launch of new flavors • • SoBe – – “Hybrid” targeted towards tea and juice drinkers familiar with the brand name Multiple product lines • • • • Amp Relaunch (Citrus), Traction (Grape) & Elevation (Berry) SoBe Adrenaline Rush SoBe No Fear (with a new product called ‘Motherload’) SoBe Essential Energy RockStar International – Launched Rockstar Roasted recently • • – Coffee & Energy with 50% more cafeeine than original Rockstar 3 Flavors – Mocha, Latte, & Light Vanilla Launch of Rockstar Punched in past year • Energy + Punch Key Players in Market (Cont.) • Full Throttle – – – – • Products Throttle Fury and Blue Demon targeted to Hispanics Launch of Full Throttle Hydration this past April • First energy drink with electrolytes to halt dehydration • Non-carbonated Product Targeted towards blue-collared workers Skewed towards older demographic, rarely even considered by teens Tab Energy – Launched Tab Energy for Women titled “HER” – Healthy, Energy, Revitalizer • First energy drink targeting woman • Pink Lemonade Flavor Consumer Insight – Who Drinks Energy Drinks? • Adult Consumer – – – – • 31.6M adult energy drink users (14% of adults) • Grew by 14.3M during 2002-2006 Male Skewed • 1 in 6 males (25M men); 1 in 10 females (15M women) • However, number of women using energy drinks has nearly doubled during 2002-2006 18-24 – 34% of respondents (9.9M) – largest adult age group Race • Hispanics (27%) & Blacks (21%) more likely to drink energy drinks vs. Asians (16%) and Whites (12%) – 2006 data • Figures have doubled from 2002 – Hispanics (13%) and Blacks (12%) Teen Consumer – – – 33% respondents are likely to use energy drinks (rebellious image with being legal) Increase consumption from 2002-2006 – From 1 in 5 teens, to now 1 in 3 Twice as likely to use other brands compared to adults – Teens deriving higher consumption through other brands • Either because of affordability issue, or experimentation with a range of brands before becoming brand loyal • More influenced by price, different taste and different positioning than adults Consumer Insight - Where, When, and How Loyal • Where are energy drinks purchased? – 59% – 38% – 15% – 13% – 11% – 11% from both supermarkets & convenience stores from a Wal-Mart drug stores bar club store mass merchandiser • When are energy drinks consumed? – 63% – 38% – 28% – 22% – 20% – 11% in the afternoon (to fight fatigue) morning early evening with lunch late evening with dinner • Loyalty – 33% stick to one brand – 38% use 2 to 3 brands altering between them – 33% no preference Consumer Insight – The Reasons for and against Energy Drinks • What is the purpose energy drinks are consumed? – 76% – 35% – 21% – 18% – 12% – 34% – 32% – 18% energy boost mental alertness hydration health & nutrition weight management as a refreshment for taste to mix with other beverages • Why don’t the “non-drinkers” drink energy drinks? – 33% – 33% – 25% – 25% – 20% – 17% high price high amount of caffeine poor taste don’t think about them find unsafe to drink not knowledgeable about ingredients