File - Michael Bullock

advertisement

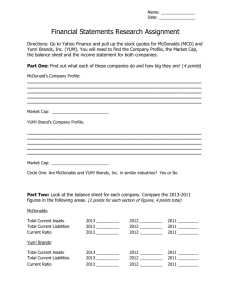

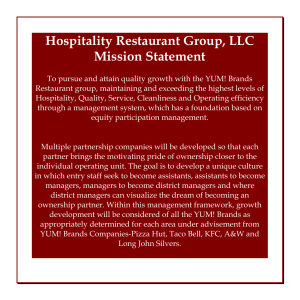

Are we lovin’ it? McDonald’s Company Analysis Submitted by: William Enroughty Adam Senholzi Michael Bullock Alison Thomas November 17, 2012 1 TABLE OF CONTENTS I. CURRENT SITUATION…………………………………………………3 BRIEF FIRM HISTORY…………………………………………………….3 STRATEGIC POSTURE…………………………………………………….3 II. EXTERNAL ENVIRONMENT…………………………………………4 SOCIO-CULTURAL ENVIRONMENT………………………………..4 TASK ENVIRONMENT……………………………………………………5 III. INTERNAL ENVIRONMENT…………………………………………6 MANAGEMENT………………………………………………….6 MARKETING………………………………………………………15 OPERATIONS/PRODUCTION……………………………..20 FINANCE……………………………………………………………22 2 Current Situation BRIEF FIRM HISTORY The story of our beloved golden arches started in 1948 in San Bernardino, California at the hands of Dick and Mac McDonald who was selling 15 cent hamburgers at a drive in. In 1954 the McDonald’s signed their first franchising agreement with a 52 year old malt machine sales man by the name of Ray Kroc, who was trying to sell a machine to the McDonalds, but ended up having an epiphany when seeing the operation and decided he was destined to sell burgers. Kroc’s epiphany landed him operating fourteen McDonald’s by 1957 and by 1961 he bought out the McDonald brothers for a mere $2.7 million (Hoovers). To put the $2.7 million price of McDonalds in perspective it is just .01% of the current McDonalds sales of $27 billion, 55 years later. In 1967 McDonalds went international, as of today McDonalds operates in 119 countries serving 68 million customers daily. McDonalds is and has always been in the fast food industry, more specifically in the burger segment which they dominate with Burger King. The focus of this paper will be to demonstrate and explain why McDonald’s is the current leader of fast food restaurants and how they will remain the trailblazer even in this economic recession. McDonalds is relevant in several cultures because of their presence in many different countries where they offer a fast and low cost food choice to consumers. B. Strategic Posture. 1. McDonalds currently operates by the mission “to be our customers' favorite place and way to eat”. With this broad mission statement they are somewhat stating what they do, but nothing about why they are in the business or where they are going. They are stating their commitment to being the best by the reference of “favorite place and way to eat”(Farfan). They are also adding an experience factor with the “way to eat”, eluding that consumers associate each restaurant with a certain type of environment and feeling and stating they want McDonalds to be their favorite. McDonalds does go into detail in a list of values that are all centered on the experience they want you to have every time you walk in a McDonalds. The five key points of the McDonalds experience are people, products, place, price, and promotion. 2. The current Porter’s strategy McDonalds is implementing is one driven by differentiation. This is consistent with their current global strategy of “Play to Win” which is centralized around consistently impressing customers with their experience at McDonalds as well as being appropriate for their environmental context. McDonalds recognizes that consumers can choose from a plethora of fast food restaurants similar to theirs and aims to differentiate themselves. They implemented this strategy by cutting customer wait time to a minute and thirty seconds and adding a fifty cent toy to a meal and calling it a “happy meal”. They have also used marketing strategies like “have you had your break today?” targeting the working market to make them associate their valued break time with McDonalds. On top of that McDonalds has recently invested capital into renovating restaurants into what is now a modern sleeker “McCafe”. All of these efforts are focused at improving the experience a customer has at McDonalds and making it stand out to them, thus retaining customers. 3 Socio-Economic Relevant Political Factors As many people might think, the majority of political influence on the fast food industry is related to obesity and excessive weight gain. But, that is not all of the governance that has affected the fast food industry. Animal rights activists have been protesting against fast food restaurants for years and now have started to gain political influence. McDonald’s launched a campaign to have slaughterhouses handle their work with the animals in a more humane way. McDonald’s has pressured the food industry to consider the “animal welfare” (americanradioworks.publicradio.org). One of the major laws passed that we all might remember was the ban on “super-sized” meals. When pulling through a restaurant such as McDonalds and knowing you could have almost twice as many fries and soft drink for only around twenty five cents more, you would have been a fool not to take that offer. What most consumers did not realize is in fact how many more calories and fat they were ingesting with the upgrade. In March 2004 McDonalds had completely done away with the “Supersized” meals due to heavy political pressure (msnbc.msn.com). Currently many states are trying to outlaw super-sized drinks. According to Greenvilleonline.com the New York Board of Health has approved the ban on drinks that have more than 25 calories per 8 ounces. It would not affect 100 percent juice or beverages with more than 50 percent milk or milk substitute. The ban will apply in fast food restaurants, movie concession stands, workplace cafeterias and most places that sell prepared food (foxnews.com). The ban was originally proposed by NYC mayor Michael Bloomberg. A heavy burden has been placed on the shoulders of the Food and Drug Administration these last couple of year with obesity rates sky rocketing. In 2010, no state in the country had an obesity rate of less than 20% (Fuller, Policymic.com). The FDA began its discussions on requiring fast food restaurants to include calorie and fat labels on its products in the early parts of 2011(tucsoncitizen.com). Since then there has been many emergence as to what you are actually consuming when you eat fast food. Effective very soon, McDonald’s will now list the calorie count of all its items on the menu both inside and on the drive thru (tauntongazette.com). The fast food market is not only affected by political decisions made in regards to the presentation of their food, but also how they can treat their workers. With many fast food restaurants striving for high efficiency, fast turnover, and minimal expenses, employment can tend to take a back seat. The standard pay for a regular fast food employee is minimum wage. The annual salary of the average McDonalds employee is as follows: Cashier: $15,000; Fry Cook: $15,000; Shift Manger: $16,000; Manager: $28,000 (careerleak.com). While these rates are going up with as minimum wage and the cost of living increase, this shows that the payment of fast food employees would be much worse if the government did not set work minimums. Economic Factors 4 Although economic times are rough, fast food restaurants have not taking the grunt that other businesses did. With times worsening and people not spending as much as they used to a value menu at a fast food restaurant began to attract more attention. If you needed to get something to eat but did not have much money to spend, why not get a $1 double cheeseburger form McDonalds. It is fast and cheap. In the heart of the recession in May 2008, McDonald’s sales rose 4.3%. Along with cheap process this was also aided by the launch of their Southern Style Chicken sandwich and biscuit (Associated Press, msnbc.msn.com). Another way to look at all of the success of fast food restaurants during this time period is that people need to eat. They are not just going to cut eating out of their budget to save some money. When you can offer a cheap eat you can attract many customers, especially in the growing lower-middle class market. However, for the majority of the fast food industry, over the five years to 2012, revenue is expected to have declined at an average rate of 0.7% per year (IBIS World Fast Food Restaurant). In the recent year to come not many changes are expected within the fast food restaurant industry, however, S& P expects sales to increase 3.5% to $174 billion. This increase can be attributed to a price increase of only 2.5% and with only a 1.0% increase in customer traffic (S & P, netadvantage.standardandpoors.com). While these statistics do not seem large at all you have to think of the industry as a whole. Think in any given town in the country how many fast food restaurants there are. Any restaurant that is inexpensive and fast can be considered fast food, with most of these restaurants not even requiring you to leave the confines of your vehicle. If you consider the mass number of restaurants like this across the country the amount of profit to be made on only a 3.5% increase in sales is exponential for these chains. Social Factors One of the most major social factors that affect the fast food industry is personal appearance. With today’s society placing so much pressure on individuals to look like super models, it is hard for most to grasp a healthy lifestyle without going to the extremes. If society is demanding you to look perfect and thin, you most likely will not want to go grab a Big Mac from McDonalds or a taco from Taco Bell. Since all the new number have been coming forward about the calorie and fat content of fast food restaurant society has place a negative connotation with a meal at a fast food joint. In 2004, Morgan Spurlock filmed an unprecedented documentary looking directly at the affects fast food has on the human body. Supersize Me, is a documentary in which Morgan Spurlock ate nothing but McDonalds for an entire month and the results were astonishing (imdb.com). This played a major social role in how Americans viewed fast food from that point on. This was the first real hard evidence that proved fast food can cause some serious harm to your body and physical image. This did not scared people away from fast food but rather opened their eyes to the potential threats. While many fast food places have begun to disclose the nutritional value of their foods they have also taken other steps to try and maintain a steady customer base. While the actual food has taken a heavy social hit, the drinks they serve have not. One of the most profitable sections of a fast food restaurant is its café like drinks. McDonalds and others have opened up new divisions within their restaurants devoted only to drinks. They make anything from a standard coffee to fruit smoothies and 5 cappuccinos. This has opened up a whole new market for these restaurants and has achieved a new customer base who is only interested in the drinks (nrn.com). Technological Factors The main function of new technology systems within the fast food industry is to provide maximum efficiency and increase speed. Drive-thru restaurants have begun to use an advanced point of sale system in which as soon as your order is placed at the cash register, it then is immediately transferred, electronically, to kitchen where your food can begin being made on the spot, known as the Till System and POS (computing.co.uk) This cuts out the time of running orders to the kitchen or communicating them through a microphone. This also allows for more accuracy in that orders stand a better chance of being completed correctly if the order pops up on a screen instead of being delivered through word of mouth. Another technology that has emerged and is helpful to customers and the restaurant is the use of LED screens in the drive thru. This allows for the customer to view their order as it is place to insure accuracy. This also will show them the price they owe for their purchase so they can have it ready at the window. This also increases the speed and turnover rate (delphidisplay.com). Internal Environment MANAGEMENT McDonald’s Corporation has been a fast-food industry leader since its public debut in 1965. They owe much of their success to product innovation and brand identity. McDonalds’ 33,000 and counting stores have helped the corporation’s rankings improve to #4 most valuable global brand in 2012. (marketline) McDonalds’ management has ensured long-term survival of the corporation, and is continuing to adapt to consumer preferences and changes in the market. The corporation’s brand equity is the driving factor in its ability to survive. Product introductions and extensions have been successful because of the strong brand recognition. When a company consists of over 33,000 restaurants and 400,000 employees, consistency is a key to maintaining your status in the market. In 1961, Fred Turner (former senior chairman) and Ray Kroc (1st grillman) founded Hamburger University which is a training program for McDonalds employees. “If we are going to go anywhere, we’ve got to have talent. And, I’m going to put my money in talent.”(Ray Kroc) McDonalds’ Hamburger University lives by this philosophy and its graduate numbers are increasing every year. Today over 80,000 owners, operators, and managers have graduated from this program. (McDonalds) BOARD OF DIRECTORS The objective of the board is to provide oversight of the firm with the goal of making the company more prosperous and competitive in the industry. McDonalds’ board has continued to govern 6 the golden arch family in the right direction, and they are a large factor in the success of the company. The board consists of 14 members, including the CEO, with a composition of 87% being independent. Andrew J. McKenna is the active Chairman of the Board since 2004. He is in charge of the overall effective performance of McDonalds’ Board of Directors. (marketline) After 41 years of active support, Jim Skinner (former CEO) retired from McDonalds in June 2012. He was succeeded by former McDonalds Co. USA president Don Thompson, who himself has been with the corporation for over 20 years. Thompson has held many positions including director, President, and Chief Operating Officer. He is the only internal member on the board at this time. The governance committee is responsible for selecting board membership, and extending invitations to join. At this point the board believes the necessary membership quantity to fall between 11 and 15 members. (McDonald’s) At this time 50% of directors are women or minorities. All directors attended over 90% of all Board and Committee meetings in 2011. Often times many directors serve on board for multiple companies making it difficult at times. There is limited membership on other public company boards making members focus their attention solely on McDonald’s. Regular Board self-assessments and Director peer reviews hold members accountable. (DEF 14a) McDonalds requires all of its senior managers own a percentage of stock including the CEO. McDonald’s theory states that, “Directors more effectively represent McDonald’s shareholders, whose interests they are charged with protecting, if they are shareholders themselves.” Beginning in 2008, McDonald’s requires that all board members should own McDonald’s Common Stock equal in value to the lesser of five times the annual cash Board retainer or ten thousand shares within five years of joining the Board. (McDonald’s) The minimum number of shares to be held by a director is calculated on the first day of trading each calendar year based on their fair market value. McDonald’s states that in the event the cash retainer increases, the Directors will have five years from the time of the increase to acquire any additional shares needed to meet these guidelines. (marketline) The CEO Don Thompson is required to own stock equal in value to at least 6 times his salary. There are many important aspects is McDonald’s Executive Compensation Program. They believe the program provides incentives for executive level positions to push the business forward. Currently 85% of Don Thompson’s direct compensation is performance based. He is evaluated annually on factors such as competitive benchmarks and individual performance in the company. Other best practices include clawback provisions, capped incentive payments, and no employment agreements. Yum Brands has a different philosophy; in fact, they do not require any stock ownership by their directors. They believe that the number of shares owned should be a personal decision made by the directors themselves. They do encourage the fact that directors should own a number of shares, and also the fact that they shouldn’t sell them until 12 months prior to retirement but there is nothing in the by-laws that prevent them from doing so. (Yum Brands PDF) Both companies have been successful in addressing the issues of agency theory. Compensation, stock ownership, and membership in general is aligned with the company’s by-laws, the long-term survival of the company always comes first. 7 All committee members, except for the executive committee, are independent. The Audit Committee is composed of 5 board members, 60% of them being financial experts (Enrique Hernandez, Jr., Cary D. McMillan, and Roger W. Stone) The Committee oversees McDonald’s financial reporting process and internal control structure on behalf of the Board of Directors. They meet regularly with the independent auditor which is currently Ernst & Young. (DEF14a) The Compensation Committee consists of 5 members including: Robert A. Eckert (chairman), Susan E. Arnold, Richard H. Lenny, John W. Rogers, Jr., and Miles D. White. The responsibility of this committee is to review and approve compensations of the CEO and other senior managers. The Committee is also in charge of administering incentive and equity compensation plans, and reviewing executive compensation disclosure. (DEF14a) The Governance Committee (Andrew J. McKenna, Robert A Eckert, Enrique Hernandez, Jeanne P. Jackson, Roger W. Stone, & Miles D. White) are responsible for monitoring the activities of the board itself. They set criteria for board membership; evaluate performance and corporate governance process. They recommend non-management compensation and also recommend resignation by directors who fail to be re-elected running unopposed. (DEF14a) Sustainability & Corporate Responsibility Committee (Walter E. Massey -chairman, Susan E. Arnold, Richard H. Lenny, Sheila A Penrose, & John W. Rogers, Jr.) is responsible for advising management about the Company’s global sustainability strategies and reporting, reviewing social trends and stakeholder activities that may impact the Company’s brand reputation, and reviewing the Company’s diversity activities, corporate political contributions and philanthropy efforts.(DEF14a) The Finance committee (Jeanne P. Jackson-chair, Richard H. Lenny, Cary D. McMillan, John W. Rogers Jr, & Roger W. Stone) oversees certain material financial matters such as derivatives commodities, equity, and debt. They are also in charge of reviewing the company’s banking arrangements annually. Most importantly they reviews the Company’s dividend policy and share repurchase program in light of the Company’s strategy and performance.(DEF14a) Lastly is the Executive Committee (James A skinner- chair, Robert A. Eckert, Enrique Hernandez Jr, & Andrew J. McKenna) can exercise most board powers during periods between board meetings. They are the last resort.(DEF14a) When it comes to the Board of Directors, it is important to have all four functions of business being represented. It is crucial to have every function of business accounted for in the decision process, and McDonald’s leads by example with their board composition In looking at Yum! Brands, McDonalds’ biggest competitor, their board is made up of 11 members. Like McDonalds the majority of the board members are independent. Nine of the current 11 are independent under the rules of the New York Stock Exchange. The Board of Directors met 6 times in 2011 and the each board member attended at least 75% of the meetings compared to McDonalds 90%. Yum Brands Corporate Governance principals state that the CEO may also serve as Chairman of the Board. David Novak (Yum Brands CEO) is currently serving as chairman. Yum Brands believes that 8 allowing Novak to hold both positions brings leadership and experience within the industry to the board. They also feel that shareholders, business partners, employees, customers, and franchises benefit from hearing the company’s message and strategy from a unified voice. (DEF14A) As stated before, Yum Brands does not require stock ownership by board members. They have, however; established ownership guidelines for their top 600 employees. David Novak (Yum CEO) is required to own 336,000 shares of YUM stock or stock equivalents (approximately thirteen times his base salary at the end of fiscal 2011). NEO’s (excluding Novak) are expected to meet ownership targets, equal in value to 2 to 3 times their current annual base salary depending upon their positions, within 5 years from the time the established targets become applicable. If an NEO or other employee does not meet his or her ownership guideline, they are not eligible for a grant under the LTI Plan. In 2011, all NEO’s and other top employees met their ownership guidelines. Yum’s Board of Directors Committee structure is different than that of McDonalds. There are 4 main committees including Audit, Management/Planning, Nominating and Governance, and Executive/Finance. The Audit Committee (Mirian M. Graddick-Weir, J. David Grissom, Bonnie Hill, Jonathan Linen, & Thomas C. Nelson-chair) oversees the integrity of financial statements within the company. They meet and work alongside the efforts of the independent auditor (KPMG) The Management Planning & Development Committee (David Dorman, Massimo Ferragamo, Thomas M. Ryan, & Robert D Walter-chair) is very similar to that of McDonald’s compensation committee. They are responsible for reviewing all policies on which compensations is paid. The also monitor the performance of the CEO and other senior managers. The Nominating and Governance Committee (David Dorman, Massimo Ferragamo, Robert D. Walter, & Thomas M. Ryan –chair) is responsible for assisting the board in selecting qualified members to join and to determine the composition and compensation of the board members themselves. Yum Brands combines their Executive and Finance Committee (Thomas C. Nelson, Thomas M. Ryan, Robert D. Walter, & CEO David Novak) this committee can exercise all powers of the board and management of the business when the board is not in session. Committees of the Board of Directors (2011) Table # 2: Lists the committees for each company and the frequency they meet/year McDonald’s Frequency/Yr. Yum Brands Frequency/Yr. Audit 9 Audit 9 Compensation 8 Management Planning & 5 9 Development Governance 7 Executive Exercises All Power 0 2 Finance Nomination & Governance Executive/Finance 3 Exercises All Power 0 Sustainability & 4 Corporate Responsibility (McDonalds, Yum Brands) (DEF 14a) CONCLUSION Both McDonald’s and Yum Brands Board of Directors are providing oversight to their respective companies. Management, Marketing, Finance, and Operations are all represented in committees that are functioning at a high level. McDonald’s Corporation has a stronger structure and board composition. It is important to hold committee meetings frequently even if there are no problems. The composition of 6 committees has allowed McDonald’s Board of Directors to establish strong awareness of their roles and responsibilities. Yum Brands has 4 committees which I believe would be difficult to divide work and concentrate on the task at hand with so much responsibility within the committees. The fact that Yum Brands committees met no more than 5 times in 2011 (with the exception of audit) is concerning from an outside point of view. I also feel that McDonald’s holds the CEO Thompson to higher standards and he doesn’t have as much power as Novak. With 85% of his compensation being performance based there is an incentive, which most companies don’t have, to motivate their CEO to push their companies to new heights. TOP MANAGEMENT As mentioned previously Don Thompson is the active CEO of McDonald’s Corporation. Thompson has been with McDonalds for over 20 years driving results in every sector of the company. Since joining in 1990, as an engineer, Thompson has held the following positions Regional Vice President, Division President and Chief Operating Officer, and President of McDonalds USA. Thompson is well known for his contribution to leadership and global growth priorities as COO. These priorities are to optimize their menu, modernize their customer experience, and to broaden restaurant accessibility. These priorities are still very relevant to McDonald’s “Plan to Win” today. (McDonald’s) With this vision in mind McDonalds is the #1 global fast-food chain in the World. Thompson currently owns 31,869 shares of McDonald’s stock. His current total compensation is $4,073,748.(Forbes.com) 10 Don Thompson followed in the footsteps of McDonald’s Legend James A. Skinner who retired at age 67. Skinner was the last surviving author of the “Plan to Win” which is a turnaround program designed to address an unprofitable period. With this plan in place McDonald’s stock prices tripled during Skinner’s term. With two rapid losses of former CEO’s, McDonalds implemented a new strategy to plan ahead. Jim Skinner and McDonalds were sure that if they hired an outsider, instead of Thompson, there was a good chance the “Plan to Win” would have been abandoned. Having executives in house during those unexpected losses was vital for company success. The process for grooming these candidates takes about two years. McDonald’s refuses to send employees to off campus leadership sites or institutions. The combining of leadership and business strategy was done right there in house.(Forbes.com) Don Thompson is not afraid to tell listeners where he comes from. Growing up in 1300 block North Cleveland projects is not a pleasant childhood. “The proof is in how many people know his story.” "I know all about it," said Andrew McKenna, McDonald's chairman. "How he grew up near Cabrini-Green, how his grandmother raised him and moved him to Indianapolis in the sixth grade. I know all of it. He's the real thing." (Chicago Tribune) When Thompson’s grandmother moved him to Indianapolis because of growth of gang activity on the North Side, he began to realize how lucky he was to have someone care about him so much and that he was going to have a shot at a better life. Thompson exceled in math and science and was recruited by the Minority Engineering Advancement Program at Purdue University's School of Engineering and Technology. "My grandmother gave everything she had to get me into and through Purdue," Thompson told Black Enterprise. People that have met Thompson say that he is a very grounded person, and that his routes have made him a very humble yet elite member of the business world. Thompson is a very knowledgeable man, and his track record proves his determination and influence on the people that surround him. When he was hired as an engineer designing robotics for food transport and control circuits in cooking equipment, McDonald’s recognized his work ethic and promoted him a year later. What many people don’t know about the CEO of McDonalds is that he took part in a training program when he was promoted to operations. To learn the basics Thompson began his operations career making french-fries. In a short time he was then promoted to shift manager, then assistant manager and, then co manager of the facility. His first management position was of the San Diego region which was ranked 39 out of 40. Within just a year the now CEO brought the area’s ranking up to #2. "I remember him being so dynamic and interested in what he was doing. I thought to myself, 'God, I gotta keep an eye on that guy.'"(McKenna Chicago Tribune) Thompson knows what it takes to be successful, and has been a part of almost every branch on his vertical ride to the top of the largest fast food chain in the world. As CEO, employees know what to expect every day from Don Thompson. He has seen the worst and the best, but he remains level headed and up to the task. (Chicago Tribune). 11 David C. Novak is the chairman of the board and chief executive officer of Yum since 2001. Novak brings with him to Yum a very experienced business background. He has served as the Chief Operating Officer of Pepsi-Cola, and is also currently an independent director of JP Morgan Chase Co. and a director of Bank One Corporation. Novak was named 2012 Chief Executive of the Year by Chief Executive Magazine. He currently owns 236,830 shares of stock and his total compensation is $20,411,852. (Taking People with You) Novak attended the University of Missouri where he graduated with a B.A. degree in 1974. He has established a clear vision throughout the company. He has shaped the company’s strategic direction with 4 principal growth strategies. 1. 2. 3. 4. build leading brands across China in every significant category drive aggressive international expansion and build strong brands everywhere dramatically improve U.S. brand positions, consistency and returns drive industry-leading, long-term shareholder and franchisee value People admire Novak for his contributions to company leadership, and to leadership in the everyday business world. “David Novak is a hard-driving CEO with a great heart and soul—and that gives him unique insight into both your own personal development and how to bring out the best in others.” (Jamie Dimon, chairman and CEO, JPMorgan Chase) Taking People with You, is a book written by Novak that focusses on getting your people aligned, passionate about what they do, and focused on living their mission statement. Many books written on leadership today do not relate to every type of employee. Novak’s book reaches out to a wide spectrum, from CEO’s to shift managers. Novak preaches that the most important business skill is getting people behind you and on your side. By leading by example, He has definitely accomplished this within Yum Brands, the largest restaurant company in the world. (Taking People with You) CONCLUSION I feel that Don Thompson, CEO of McDonald’s, is a better leader for his respective company. He has worked his way through the organization, and has experience at all levels. I feel that he is well respected for that fact that he is an internal CEO who takes a lot of pride in the outcome of his work because he has worked under men like himself before. I think it’s important to have had experience within the corporation you are running. Both Men are good leaders, but employees are more likely to respond better to someone who has done the work themselves. In this case is Don Thompson. ORGANIZATIONAL STRUCTURE 12 McDonald’s Corporation has a centralized organization structure. Even though many of their 30,000 and counting restaurants are franchises, all restaurants receive the same products and packaging from the same vendors. This is a reason for the consistency of their restaurants in all parts of the world. There are 4 positions with regard to structure that cover different demographic areas. There are broken up into the following. So, perhaps the organizational structure is centralized with divisions focused on geographic areas? 1. 2. 3. 4. USA: East Division President: Rick Colón West Division President: Steve Plotkin Latin America: Edgardo Navarro Asia, Pacific, Middle East and Africa: Dave Hoffmann Europe: Doug Goare These relationships allow them to establish a local connection, and incorporate the McDonald’s brand into different cultures around the world. This structure is appropriate for the competitive environment and is consistent with McDonald’s Corporation strategy and mission. (McDonald’s) Yum Brands is divisional among its three companies (KFC, Taco Bell, & Pizza Hut). It also operates a centralized organizational structure. Much like McDonalds, Yum has restaurants in over 120 countries. The key to being successful is to make local connections and relationships to establish global brand identity. They create a competitive edge by adapting to different cultures, and making sure that their products are consistent. (Yum Brands) In Conclusion, McDonald’s has been a great example and leader in the global fast food industry. Their structure has allowed them competitively control their market by managing their company in a way where consistency and brand identity prevails above all else. CULTURE McDonald’s culture and values are what guides them on a day to day basis. Welcoming employees to McDonald’s is just as important and welcoming customers. They are very proud of the 85,000 jobs they create. Their ability to serve customers allows them to grow and ultimately please shareholders and investors. They support their system, and value each and every person is the process. “The person who runs the restaurant is equally important as the person who delivers the buns.” (McDonald’s) McDonald’s recognizes that it is a leader and makes a point to give back to the community in every way it can. They believe that it is their duty to help their customers make this world a better place. It is their goal to leverage their size, scope, and resources to make the communities in which they operate a better place now and for the future. McDonald’s is committed to sustainable business practices and will not operate in any fashion to prevent future generations from meeting their needs. 13 McDonald’s has a well-defined culture visible in over 120 countries today. Their goal is to be aware and sensitive to the differences around the world. When it comes to product innovation in foreign countries McDonald’s is the leading competitor. Although not always easy, they strive to establish target markets in every way of life by spending money on research to appeal to all types of people. Their culture supports their mission statement and strategy and allows them to be a competitive corporation. Yum Brands culture is based on Leadership and recognition. They celebrate achievements big and small, and strive to let everyone know how important their role is in the company. Appreciation is key to making people happy, and a happy staff is more motivated at work. They take pride in the fact that their customers experience will never exceed that of their team members because they are the reason for success. Novak has established many awards and recognitions throughout Yum Brands and has helped thousands become leaders in the business world. Yum Brands is committed to, not only developing work skills, but to help those develop life skills as well. Problem solving, communication, positive energy, and the ability to work in a team are just a few of the many things Novak has instilled in his management teams. (Yum Brands) The health and nutritional needs of consumers is something that Yum strongly values. Three critical responsibilities of Yum to its customers are: 1. The health and nutritional needs of our consumers 2. Feeding the world's hungry 3. Understanding and respecting the sensitive environmental and agricultural resources on which our business depends Yum believes that giving back to less fortunate is a privilege. Yum Brands participates actively in partnership with the U.N. World Food Programme in a program called World Hunger Relief. Since the launch in 2007, over 1 million people from Yum have volunteered their time and money feeding millions of people and saving lives around the world. Their culture aligns with the mission statement and vision and under CEO Chris Novak they have climbed to the top of the restaurant company standings. CONCLUSION Management in both companies has ensured long term survival of their companies. The leadership in these companies has made sure to teach employees how to focus on their values and mission. However, I feel that McDonald’s has a brighter future due to the fact of experience in the executive positions. Their Board of Directors is very fair and compensation for their CEO is based on performance. It is difficult to relate to an employee in the industry if you have no job experience at any of the levels below you. Don Thompson has worked almost every position in McDonald’s Corporation, and he is a very understanding person. 14 The composition and structure within the corporation is very well organized and it ensures productivity. Yum Brands is doing well now, but they need to make changes as they continue to grow. At this point they need to think of new strategies and organizational structures to prepare them for the future. With Having Novak has the CEO and chairman of the board, I feel board lacks a difference of opinion. They need to make adequate changes to make their board more effective as they continue to expand into larger markets. DECISION MATRIX Board of Directors Top Management Organizational Structure Culture McDonald’s Strength Strength Strength strength Yum Brands strength Needs Improvement Weakness Strength Marketing In any industry maximizing a company’s market share is critical. The marketing department of a company is responsible for increasing the firm’s market share. McDonald’s Corporation is the market leader in the fast food industry. They have been successfully growing their market share since 1955 (McDonalds.com). A major competitor to McDonald’s is Yum! Brands Incorporated, which is made up of Taco Bell, Kentucky Fried Chicken and Pizza Hut (yum.com). The chart above shows how McDonald’s and Yum! Brands market share has fluctuated over a five year span. McDonald’s, once the powerhouse in the fast food industry, has lost market share to the others in the industry. On the contrary, Yum! Brands has increased its market share. McDonalds had a net decrease of 0.5% over the 2005 to 2010 period and Yum! Brands had a net increase of 0.2% (IBISworld.com). 15 In today’s world of social media, have a strong marketing scheme on the internet is important to the success of the overall marketing strategy. From the graph below, one can see the number of fans the major players in the fast food industry have on the leading social media site, Facebook. The top two are McDonald’s and Taco Bell with both over 7 million fans and rising. Since this chart was made in 2011 McDonalds fan base has grown significantly to 25,442,932 fans on Facebook. Taco Bell has grown as well to their new fan base of 9,444,465 fans (facebook.com). Product McDonalds offers a wide variety of different products. They place high priority on developing a menu that has what the customers want. McDonalds offers new products when different opportunities present themselves. They introduce new items onto to their menu with the change of the seasons, such as when they introduce frozen smoothies in the summer and spices hot drinks during the colder months. Their product mix appeals to people of all ages. The classic hamburger appeals to the older generations that were around for the original fast food burger boom and the happy meal selections appeal to young children with is offering of smaller portions and a toy. McDonalds has diversified its menu to accommodate more customers and attract new potential customers to the restaurant. They have been successful with this in offering a new “diet” menu. This helped McDonalds gain and regain customers that were lost when the health concerns of eating fast food were raised. (marketing91.com) Taco Bell is the leading Mexican-Style fast food restaurant in the country. They offer a variety of different styles of Mexican cuisine. Most of their items are sold in some form of a tortilla shell, whether it be a taco, quesadilla, burrito or nacho. Taco Bell has also launch a “healthy” menu in which they are 16 trying to show that their food can be quick, tasty, and healthy. They call it the “Fresco Menu” with all of the items on the menu being less than nine grams of fat. (Summer Course Group) Price Both McDonalds and Taco Bell use a value pricing method when selling their products. Both companies have a value menu separate from their regular menu. McDonalds Dollar menu offers customers a variety of single products for the price of only one US Dollar ($1). Taco Bell’s Value menu offers the customers a variety of products separated into three different price ranges. The 79 cent menu offers the customer very basic menu items such as the cheese roll up which is simply a tortilla and cheese melted together and rolled. The next section is the 89 cent category which has item a step up from the 79 cent range. Finally the 99 cent selection is where all of the items begin to consistently contain meat. This has items such as the ½ lb. Cheesy Bean and Rice Burrito. With everything in today’s market revolving around quick food for less money, the fast food industry has had to quick adapt to changing their menu in order to accommodate the ever changing market. In June 2011, McDonalds reported higher than expected sales figures. Many attest this growth in sales revenue is attributable to their ability to have stable and low pricing at the McDonalds restaurants. As inflation affects any business it proposes challenges to McDonalds to remain competitively priced while still creating a profit. McDonalds was forced to raise some of its prices on premium food items in order to offset other food costs. McDonalds wants customers to keep coming in so they are trying to hide the increases in cost has effectively as they can. (reuters.com) From the chart above one can see that while food costs increase the McDonalds tries to keep the price of their signature items relatively stable. As seen above, the Big Mac burger, McDonalds most popular item, the price has increased less than a dollar in the US since 2007. (aacesubajou.wordpress.com) 17 Place The place at which McDonalds and Taco Bell can deliver their product to the customers is simple. Both companies conduct their business at a store front where their food can be purchased by the customer. The restaurants can be easily spotted and recognized. From the golden arches to the bell there are many restaurants in almost every town in the country. There are 12,804 McDonalds in the United States of America and 5,896 Taco Bells. That is approximately 256 and 118 locations per state in the US respectively. (nationmaster.com)(entrepreneur.com) Promotion In an ongoing attempt to grow the company’s market share, both McDonalds and Taco Bell consistently use a heavy advertising scheme. Both companies use many different forms of advertising and spend a large dollar amount on advertising each year. 2011 Advertising Expenses McDonalds Network TV Spot TV Cable TV Span Lang Net TV Outdoor Local Radio Syndication Magazines US Internet - Display Sunday Magazines Natl Spot Radio Newspapers Natl Newspapers Network Radio US Internet - Search Hispanic Newspapers Hispanic Magazines Local Magazines B-to-B Magazines The chart above shows the distribution of how McDonalds spent its $996,762,940 in advertising expenses in 2011. The majority of its money went to the promotion on network television. McDonalds advertising expense is proportionate to 4% of their total sales in 2011. (Advertising RedBooks). 18 McDonalds also does advertising through sponsorship. Recently in 2012, McDonalds sponsored the Olympic Games which were help in London. Their logo appeared on everything along with Coca Cola and the Olympic Rings. McDonalds Receives a lot of scrutiny about sponsoring the Olympics. Many say that it is a bad image to have an unhealthy fast food restaurant sponsor an event that is supposed to symbolize fitness and athleticism. (Adweek). Taco Bell has a similar approach in advertising with the use of Sponsorships. Taco Bell recently sponsored the Major League Baseball (MLB) World Series. In one of their biggest promotional moves ever, Taco Bell agreed to give a free Dorito Loco Taco to everyone in the nation for every time a base was successfully stolen in the World Series. As the promised, once a based was stolen they agreed to give away the free tacos. On Tuesday October 30 between the hours of two and six pm, taco bell gave out free tacos to anyone who came in and got one. (latimes.com) 2011 Advertising Expenses Taco Bell Cable TV Network TV Spot TV Local Radio Natl Spot Radio Outdoor Natl Newspapers US Internet - Display Newspapers Syndication US Internet - Search Magazines Hispanic Newspapers Span Lang Net TV Network Radio B-to-B Magazines Similar to McDonalds, Taco Bell also uses a wide variety of advertising methods. However, unlike McDonalds, Taco Bell spends the majority of their $258,585,621 advertising expenses on cable television as opposed to network television like McDonalds. Taco Bell’s advertising expenses are proportionate to 5% of their sales. (Advertising RedBooks) Marketing Effectiveness In analyzing the effectiveness of McDonalds and Taco Bell’s marketing ploy, it can be determined that both companies rely on a heavy advertising approach in order to maintain their competitive edge in the market and to increase their market share. McDonalds and Taco Bell both rely on brand loyalty. While attracting new customers is very important to both companies success 19 maintaining a loyal following and keeping present customers satisfied is equally important in their overall marketing objective. Both companies are at the mature life cycle phase. They both have established names and customer base. There has not been a significant shift in either company’s market share over the last five years and both are trying to maintain their competitive edge. While McDonalds is by far the industry leader, Taco Bell, along with Yum! Brands, is making strides in order to try and close the distance in market share. Despite the recent allegations against Taco Bell and the quality of their meat, they have been able to promote and show that they are still a good company and provide quality products to their customers. (Fox News) Conclusion The objective of marketing is to maximize market share. McDonalds Corporation maintains the largest market share in the fast food industry. Taco Bell with its partners in Yum! Brands are promoting effectively promoting to close the gap in overall market share in the fast food industry. Yum! Brands is the leader in the non-burger fast food industry with its offering of chicken, Mexican, and pizza. McDonalds may be at risk with their market share due solely to the fact that Yum! Brands have a large diversification in products they can offer to their customer base. Product Price Place Promotion Marketing Effectiveness McDonalds Strength Strength Strength Strength Strength Taco Bell Strength Neutral Neutral Strength Strength Operation/production Productivity & Reinvestment McDonalds had happy investors last year when they returned $6 billion to shareholders through share repurchases and dividends paid. McDonalds has maintained a pledge to develop sales in existing restaurants that you can see in the below figures provided from the 10-k. Capital expenditures rose 28% in 2011 because of increased reinvestment in existing restaurants and new restaurants. For the upcoming year McDonalds expects capital expenditures to be approximately $2.9 billion; half will go to opening new restaurants in foreign markets and the other half, $1.45 billion, will be used to reinvest in existing restaurants. In 2011 alone the company opened (net of closings) 872 traditional restaurants compared to the 551 opened in the year before; of these closing 400 were in Japan due to strategic review of the markets 20 restaurants. McDonalds is proactive in identifying their weaknesses or under performers and assessing what to do with them, they close for reasons such as existing sales and profit performance or loss of real estate tenure. Mcdonalds Capital Expenditures 2012 10-k in millions 2011 2010 2009 new restaurants 1,193 968 809 existing restaurants 1,432 1,089 1,070 other 105 78 73 total capital expenditures 2,730 2,135 1,952 total assets 32,990 31,975 30,225 To paint a better picture a graph of capital expenditures to net income has been attached. As you can see in 2007 McDonalds invested 80% of revenues into the company but then double its net income the next year. You can also see that the company is committed to reinvesting in themselves through improvements as the capital expenditures average around half of the net income each year. Capital Expenditures/ Net Income 2007 Capital Expenditure 1,947 Net Income 2,395 % of net income reinvested in the 81% company 2008 2,136 4,313 2009 2010 2011 1,952 2,135 2,730 4,551 4,946.30 5,503.10 50% 43% 43% 50% As you can see from the table below its not that the revenues were deviating from the norm very much so the lack in net income in 2007 must have been from an increase in expenses. Capital Expenditures/ Total Revenues *total revenues= company-operated sales (+) franchised revenues 2007 2008 2009 2010 Capital Expenditure 1947 2136 1952 2135 Total Revenues 22,787 23,522 22,745 24,075 % of revenues reinvested 9% 9% 9% 9% 2011 2730 27,006 10% Operations and Marketing aligned: According to the QSR reported first quarter earnings of McDonald's U.S. generated comparable sales of 8.9% driven by a focus on core items such as the Big Mac, new offerings such as Chicken McBites, reimaged restaurants, technology and labor investments and favorable weather. Operating income for the quarter rose 10 percent. As stated above in 2012 the company expects $1.45 billion of capital expenditures to be reinvested in existing restaurants; of that about half ($725million) will be 21 used to reimage 2,400 locations worldwide, with the other half to invest in marketing campaigns and other earnings generating activities. As you can see in the table in the above section in 2007 McDonalds used 81% of its net income on capital expenditures at this time Jim Skinner had just became CEO and was following the strategy of “being better, not just bigger”(restaurant magazine). This framework started the revitalization that McDonalds needed to be the best by increasing the menu variety, reimaging restaurants to be sleek and modern, and indorsing a healthy lifestyle, all funded by capital expenditures invested within itself. Operating leverage: As you can tell from the table below McDonalds has done a good job of keeping the fixed costs and variable costs in a close range. Though they should explore ways to decrease the fixed costs it is not increasing so is not an immediate threat. Fixed Cost Variable Cost Operating Cost Operating Leverage 2011 7,703 10,773 18,476 42% 2010 7,180 9,421.50 16,602 43% 2009 6,760.10 9,143.60 15,904 43% R&D: Research and Development costs are not available on the financial statements or any other form because the company claims that these expenditures are “not material”. Though McDonalds does operate research and development facilities in the U.S. Europe and Asia the costs are unknown. Conclusion: McDonalds has been around the block when it comes to operations and being productive. They are a high turnover, low profit margin, number one fast food restaurant not by mistake but by perfecting the operation. They understand that they need to continually invest in themselves and market it to keep their customers attracted, which they have been doing at increasing rates with greater outcomes. FINANCE The objective of finance functioning is to maximize shareholder wealth. This can be measured by a company’s total returns to investors over time. Total returns are equal to stock appreciation plus dividend yield. Below illustrates returns between McDonalds and Yum brands on a year by year basis since 2006. As you can see, McDonalds has outperformed Yum Brands in total returns to shareholders. McDonalds shows positive returns for the entire five years while Yum brands had a negative return from 2007-08. Although Yum brands showed strong growth in the years following their negative return McDonalds value is still significantly higher overall. 22 In the appendix is the DuPont Model for the McDonalds Corporation and Yum Brands. This also shows if McDonalds has been maximizing shareholders wealth. According to Forbes.com, McDonalds has had an impressive ROE average of 30.3% over the last five years. However, Yum brands have outperformed McDonalds in this segment with an ROE of 99.3%. This contradicts the returns shown above saying that McDonalds is not maximizing shareholder wealth when compared to Yum Brands. McDonalds has also shown 18.1% of net profit margin over the last five years, which means that it retains 18.1 cents per every dollar sold. This is an impressive fact as well especially when comparing Yum brands 9.6%. This goes to show that McDonalds has acquired better economies of scale than Yum brands. With a higher profit margin McDonalds is expected to also show a better asset turnover ratio than Yum brands, however, it is just the opposite. Yum brands five year average is 1.54 and McDonalds is only .79 which means that McDonalds could show some improvement. Reasoning why McDonalds asset turnover is so much lower than Yum brands is because Yum brands has had more revenues to their assets than McDonalds. The most important aspect of these two companies when comparing their financials is their equity multiplier. McDonalds latest quarters equity multiplier is 2.43 with Yum brands at 4.08 recognizing that Yum brands is about 1.25 times that of McDonalds. This represents that Yum brands is taking advantage of more leverage than McDonalds in order to produce a higher return. As we have looked at these companies’ financial ratios and trends we have compared them to the industry average (composed of McDonalds, Yum brands, Wendy’s, Burger King, Subway, etc.). A firm’s liquidity represents their ability to meet their short term obligations. Currently in McDonalds and Yum brands latest quarter both companies show a ratio of 1.01. This ratio is a good sign because both companies have ratios over 1, meaning that the company’s current assets are more than their current liabilities. According to the chart and the statistics pulled from Morningstar, McDonalds has had a better current ratio than Yum brands throughout the past five years. Although, their ratios in the latest quarter show that they are the same reflects that McDonalds has been taking on more liabilities or less assets and vice versa for Yum brands. This means that McDonald’s liquidity is not yet a weakness nor is it strength. This is a position that McDonalds could take in order to increase their competitive advantage against Yum brands. 23 Current Ratio 2 Ratio 1.5 yum 1 mcdonalds 0.5 0 2007 2008 2009 2010 2011 McDonald’s inventory turnover ratio is higher than Yum brands and the spread between the two has been consistently increasing. McDonald’s ratio has increased while Yum brands have decreased over the five years. This implies that McDonalds has done everything in order to keep their inventory ratio as high and competitive as possible as well as maintaining the advantage. Inventory Turnover Turnover 200 150 100 yum 50 mcd 0 2007 2008 2009 2010 2011 Receivable turnover ratios for McDonald’s and Yum brands are just the opposite of inventory turnover ratios because the positions are reversed. Yum brands hold a higher receivable turnover ratio than McDonald’s and the spread between the two remains consistent throughout the five year period. Both company ratio’s show an overall five year decrease in performance. McDonald’s low ratio “implies the company should re-assess its credit policies in order to ensure the timely collection of imparted credit that is not earning interest for the firm” (Investopedia). This is an area that management should focus more closely on. 24 Receivable Turnover 60 Turnover 50 40 30 yum 20 mcd 10 0 2007 2008 2009 2010 2011 McDonald’s average collection period has also been significantly higher than Yum brands over the past five years. This is considered a weakness for McDonald’s since it takes them longer to collect revenue after a sale has been made. This is an area that McDonald’s needs to improve on in order to increase efficiencies against Yum brands. Average Collection Period 20 Days 15 yum 10 mcd 5 0 2007 2008 2009 2010 2011 Total asset turnover is another area of concern for McDonald’s. As you can see, McDonald’s asset turnover is also being outperformed by Yum brands. Although Yum brands has decreased their turnover ratio and McDonalds has increased theirs overall in the past years, Yum brands has about double the asset turnover ratio than McDonalds does. 25 Asset Turnover Turnover Ratio 2 1.5 Yum 1 Mcdonalds 0.5 0 2007 2008 2009 2010 2011 Another set of ratios to consider are the leverage ratios. McDonald’s is Long-term Debt to Equity 3.5 3 D/E 2.5 2 yum 1.5 mcd 1 0.5 0 2007 2008 2009 2010 2011 The Capital Asset Pricing Model (CAPM) is used to calculate the expected rate of return for investing in a particular stock. McDonald’s expected rate of return is 7.19% as calculated below. McDonald’s CAPM = RF + βMCD [E (RM) – RF] = 2.31% + 0.40 [14.49% – 2.31%] = 7.19% The difference between McDonald’s required rate of return and the market rate (14.49%) adequately reflects the stability of McDonald’s as compared to the industry. Because of McDonald’s lower risk they are more competitive because they have a lower cost to borrow money. Because of this they will want to reinvest more in themselves. The question following is the form of financing. The capital structure decision is very important to the survival of the firm. It can significantly affect company returns. For example, when looking at McDonald’s returns on Morningstar you can notice that return on equity is 40.01% while return on Assets is 16.48%. If McDonald’s was purely equity financed, then return on equity would equal return on assets (no debt: assets = equity). By taking on long-term debt, McDonald’s can benefit from a lower cost of capital of debt through debt rather than equity because of tax advantages. This would allow McDonald’s to produce a higher return on equity 26 resulting in a rise in their stock price. Capital structure at an optimal level balances risk and return in order to maximize a firm’s stock price. In conclusion, McDonald’s has provided better returns to their investors then their competitors. McDonald’s leads in profit margin but has a low return on assets. McDonald’s has had a steady debt to equity ratio that has increased in the past five years. This leads to fact that McDonald’s can increase their debt to equity ratio in order to produce higher returns and operate with more leverage since they have higher current ratio than their competitors and can meet their obligations if necessary. Overall, McDonald’s is a strong organization with good profitability and improvements in asset management and capital structure. McDonald’s Corporation SWOT Analysis Strengths Weaknesses Brand Identity Loyal Partnerships with suppliers Industry leader in social responsibility Nutritional Facts Cleanliness Cultural awareness Opportunities Poor turnover rate Age biased advertisements (happy meals) Health complaints Quality (exists industry wide) Threats E commerce capability Discounts Joint-ventures Recyclable packing 27 Emerging competition Health issues Currency fluctuation Local food outlets Recession/economy Works Cited McDonald. (2012). McDonald. Retrieved from http://www.mcdonalds.com/us/en/our_story/our_history.html Yum! brands. (2012, March 22). Retrieved from http://www.yum.com/brands/ Samadi, N. (2012, July). fast food restaurants in the us. Retrieved from http://clients1.ibisworld.com.jproxy.lib.ecu.edu/reports/us/industry/default.aspx?entid=1980 Bina, K. (2011, June 09). Franchise help. [0]. Retrieved from http://www.franchisehelp.com/blog/franchisehelp-franchise-facebook-rankings-for-april-2011 McDonalds. (2012, November 04). McDonalds. Retrieved from https://www.facebook.com/McDonalds Taco Bell. (2012, November 04). Taco bell. Retrieved from https://www.facebook.com/tacobell Stegwee, L. (2008, August 01). Taco bell marketing mix. Retrieved from http://summercoursegroupnine.blogspot.com/2008/08/marketing-mix.html Bashin, H. (2010, June 13). Marketing91. Retrieved from http://www.marketing91.com/marketing-mixmcdonalds/ Taco bell value menu. (2008, September 02). Retrieved from http://news.foodfacts.info/2008/09/tacobell-value-meal.html Baertlein, L. (2011, July 22). Low prices help mcdonald's beat profit expectations. Retrieved from http://www.reuters.com/article/2011/07/22/us-mcdonalds-idUSTRE76L28Y20110722 Wasitova, L. (2011, July 15). The purchasing power parity. Retrieved from http://aacesubajou.wordpress.com/2011/07/15/w-13_lilly-wasitova_the-purchasing-power-parity/ Nation master. (2011, October 9). Retrieved from http://www.nationmaster.com/graph/foo_mcd_resfood-mcdonalds-restaurants www.entrepreneur.com. (n.d.). Retrieved from http://www.entrepreneur.com/franchises/tacobellcorp/282858-0.html Thielman, S. (2012, August 06). mcdonald's deal makes health advocates sick the controversy behind junk food brands sponsoring the olympics. Retrieved from http://www.adweek.com/news/advertisingbranding/mcdonalds-deal-makes-health-advocates-sick-142504 28 Foxnews.com. (2011, February 3). Retrieved from http://www.foxnews.com/health/2011/01/25/wheres-beef-taco-bell-sued-ingredients/ Hsu, T. (2012, October 30). Taco bell gives away free doritos locos tacos after world series. Retrieved from http://www.latimes.com/business/money/la-fi-mo-taco-bell-doritos-locos-world-series20121030,0,5034537.story Jacobs, D. (2012, March 22). Mcdonald. Retrieved from http://www.forbes.com/sites/deborahljacobs/2012/03/22/mcdonalds-recipe-for-success-brought-newceo-to-the-table/ MattAlden. (2011, October 17). Retrieved from http://dividendmonk.com/mcdonalds-corporation-mcddividend-stock-analysis-2011/ (http://retailindustry.about.com/od/retailbestpractices/ig/Company-Mission-Statements/McDonald-sRestaurants-Mission-Statement.htm) McLellan, Michael. "History ." McDonald's Corporation(2012): n.pag. Hoovers . Web. 14 Nov 2012. <http://subscriber.hoovers.com/H/company360/history.html?companyId=10974000000000>. Farfan, Barbara. "McDonald's Restaurants Mission Statement - A Common Mission With Branded Values." About. N.p., n.d. Web. 14 Nov 2012. <http://retailindustry.about.com/od/retailbestpractices/ig/Company-MissionStatements/McDonald-s-Restaurants-Mission-Statement.htm>. 29