Taxes

advertisement

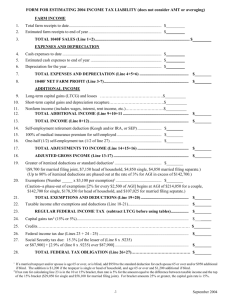

Dealing with Your Federal Income Tax The Definitions AGI = Adjusted Gross Income Taxable Income or Net Income = Income on which tax is computed, or one’s gross income minus deductions and exemptions 3-1 Main Components of Gross Income • Earned income – • Investment income – • Money received in the form of dividends, interest, capital gains or rent from investments (1099 INT’s, 1099 DIV’s, 1099 MISC’s, 1099 B’s) Passive income – • Usually includes wages, salary, commissions, fees, tips or bonuses (W-2’s) (1099 MISC’s) Results from business activities in which you do not directly participate such as a limited partnership (Usually Sched K-1’s) Other income – Alimony, awards, lottery and gambling winnings, and prizes 3-2 Total income is affected by: • Exclusions • Amounts allowed by law to be excluded from gross income • Some items referred to as tax-exempt income; or income not subject to federal income tax – Example = interest on most state and city bonds • Tax-deferred income • Income that will be taxed at a later date, such as earnings from an traditional individual retirement account (IRA) 3-3 Adjusted Gross Income • Adjustments to income – Reduce Gross Income to Adjusted Gross Income – Contributions to a traditional IRA or Keogh – Alimony payments – Interest on a Student Loan – One half of your Self- Employment Tax • Adjusted gross income (AGI) – Gross income reduced by these certain reductions – Becomes the basis for computing various other deductions on Schedule A 3-4 Calculate Taxable Income Tax deduction = Amount subtracted from adjusted gross income (AGI) to arrive at taxable income before one’s exemptions Use the Standard deduction (2011) = Single - $5,800; Joint - $11,600; Head of Household - $8,500 (Most people use the standard deduction) 3-5 Calculate Taxable Income Itemized Deductions • Medical & dental expenses (Greater than 7.5% • • • • • • • of AGI) Taxes (State & Local) Home Interest Charitable Contributions Casualty and theft loses (Greater than 10% of AGI plus $100 for each occurrence) Moving expenses Job-related expenses Other miscellaneous expenses (Most have to be greater than 2% of AGI; some such as gambling losses do not.) 3-6 Calculate Taxable Income Exemptions • Exemptions Subtracted from AGI less deductions – An exemption = a deduction for yourself, your spouse and qualified dependents – The amount of the exemption for the 2011 tax year is $3,700 per person – After deducting exemptions you have arrived at your taxable income 3-7 Calculate Taxes Owed – Tax table rates = Marginal rates • The tax rate paid on the last (or next) dollar of taxable income. – Example: • After deductions and exemptions, a person in the 25% tax bracket pays 25 cents in federal income taxes for every dollar of taxable income in that bracket. 3-8 2011 IRS Tax Brackets at December 2011 Rate on Taxable Income Single Taxpayers Married Taxpayers Filing Jointly Head of Household 10% up to $8,500 up to $17,000 up to $12,150 15% $8,500 - $34,500 $17,000-$69,000 $12,150-$46,250 25% $34,500 - $83,600 $69,000-$139,350 $46,250-$119,400 28% $83,600 - $174,400 $139,350-$212,300 $119,400-$193,350 33% $174,400 - $379,150 $212,300-$379,150 $193,350-$379,150 35% Over $379,150 Over $379,150 Over $379,150 3-9 2011 IRS Tax Example Tax on a single taxpayer’s income of $40,000 Rate on Taxable Income Single Taxpayers Taxable Amount Tax Due 10% up to $8,500 $8,500 $850.00 15% $8,500-$34,500 $26,000 $3,900.00 25% $34,500-$83,600 $5,500 $1,375.00 28% $83,600-$174,400 $40,000 $6,125.00 33% $174,400-$379,150 35% Over $379,150 Average Rate Marginal Rate 15.31% 25.00% = $6,125 / $40,000 3-10 Calculate Taxes Owed The average tax rate = the total tax due divided by taxable income • Average tax rate < marginal tax rate Example: – Taxable income = $40,000 – Total tax bill = $6,125 – Average tax rate = 15.31 or ($6,125 / $40,000) 3-11 Calculate Taxes Owed • Alternative minimum tax (AMT) – Paid by taxpayers with high amounts of certain deductions and various types of income – Designed to ensure that those who receive tax breaks also pay their fair share of taxes 3-12 Calculate Taxes Owed • Tax credits – Amount subtracted directly from the amount of taxes owed – Examples: • • • • • • Earned income credits Foreign tax credits Child and dependent care credits Retirement tax credits Adoption tax credits Hope Scholarship and Lifetime Learning credits 3-13 Tax Credit versus Tax Deduction $100 Tax Credit Reduces Your Taxes by $100 $100 Tax Deduction Amount Your Taxes are Reduced is Based on Your Tax Bracket 3-14 Determining Your Tax Liability 3-15 Making Tax Payments Payroll Withholding Based on the number of exemptions and the expected deductions claimed Estimated Quarterly Payments Estimated tax payments made throughout the year based on income made during the year and reported on various Forms 1099. 3-16 Watching Deadlines Avoiding Penalties • Form 4868 automatic six-month extension – Submit estimated tax due with Form 4868 by April 15 • Penalties & Interest – Underpayment of quarterly estimated taxes may require paying interest on the amount owed – Underpayment due to negligence can result in penalties of 50 to 75 percent 3-17 Prepare a Federal Income Tax Return Every citizen or resident of U.S. and every U.S. citizen who is a resident of Puerto Rico is required to file income tax. • Five filing status categories: – – – – – Single or legally separated Married, filing jointly Married, filing separately Head of household • Unmarried individual or surviving spouse who with a child or dependent relative Qualifying widow or widower (Year of the spouse’s death plus two additional years) 3-18 Which Tax Form Should You Use? • ≈ 400 federal tax forms and schedules • Basically the choice is between 3 forms 1040EZ 1040A 1040 • Which form to use? – Type of income – Amount of income – Number of deductions – Complexity of tax situation 3-19 Completing the Federal Income Tax Return Filing status and exemptions Income Adjustments to income Tax computation Tax credits Other taxes (such as from self-employment) Payments (total withholding and other payments) Refund or amount you owe • • Refunds can be directly deposited to your bank account. Payments may be directly debited from your bank account. Your signature = Most common filing error 3-20 Mississippi State Income Tax • All but 7 states have a state income tax • Mississippi (2010) 1st $5,000 or part of taxable income is taxed at 3% Next $5,000 or part of taxable income is taxed at 4% Remaining Balance of taxable income is taxed at 5% • States usually require income tax returns to be filed when the federal income tax return is due 3-21 How Do I File My Taxes Online? • Tax preparation software – TurboTax and H & R Block At Home are two of the most popular tax preparation software packages • Using software can save 10 or more hours – Tax software allows you to complete needed tax forms • Print and mail the forms or file online – e-filing refunds usually take 3 weeks – Cost for e-filing = $5 - $40 3-22 How Do I File My Taxes Online? • Free File Alliance – Online tax preparation and filing free to many taxpayers – http://www.irs.gov - go to “Free File” – Various qualification criteria to file free; use “Guide Me to a Service” – Connect to selected firm’s website – Use form’s online software to prepare and file tax return 3-23 Available Tax Assistance Sources • IRS Services – Publications and forms • 1-800-TAX-FORM • www.irs.gov – Recorded messages • 1-800-829-4477 – Phone hot line • 1-800-829-1040 – Walk-in service at an IRS office 3-24 Available Tax Assistance Sources • Tax publications – • The Internet – • e.g. Ernst and Young Tax Guide and J.K. Lasser’s Your Income Tax Tax preparation software companies Tax Preparation Services – – Tax preparers charge between $40 and $2,000 depending on the complexity of the return Over 40 million U.S. taxpayers pay someone else to do their taxes 3-25 Types of Tax Preparation Services • One-person, local offices to large firms such as H & R Block • “Enrolled agents” = Government- approved tax preparers • CPA’s • Attorneys 3-26 Evaluating Tax Services Factors to consider: • • • • Training and experience of the tax professional? Fee for preparing taxes and how determined? Questionable deductions suggested? If return is audited will the preparer represent the client? • Is tax preparation the main business activity or is it a front for other financial (or non-financial) products? (I have seen signs advertising tax services at barber shops and men’s wear stores.) 3-27 Tax Service Warnings • Ultimately you are responsible for providing complete and accurate information – If your professional tax preparer makes a mistake, you are still responsible for paying the correct amount, plus any interest and penalties. A good preparer will reimburse any penalties and interest you pay. (I paid one in 2010!) • Hiring a tax preparer does not guarantee that you will pay the correct amount • Beware of tax preparers that offer refunds in advance • “Refund anticipation loans” can charge interest rates in excess of 300% 3-28 What Tax Records to Keep • • • • • • • • Current tax forms and instruction booklets Social security numbers Copy of previous year’s returns W-2 forms from employers 1099 forms (interest, self employment) 1098 (mortgage interest paid) Receipts and documentation for expenses Investment & business expense documents 3-29 What if Your Return is Audited? ≈ 0.6% of all returns are audited • If you claim large or unusual deductions you are more likely to be audited. • Three types of audits: – Correspondence audit for minor questions – Office audit takes place at an IRS office – Field audit is the most complex, with an IRS agent visiting you at your home, your business or your accountant’s office 3-30 What if Your Return is Audited? • Audit Rights – Request time to prepare – Clarification of items being questioned – Right to appeal audit results • When Audited: – Decide whether to bring you tax preparer, accountant or lawyer – Be on time for you’re appointment; bring only relevant documents – Present evidence in a logical, calm and confident manner; maintain a positive attitude – Make sure your information is consistent with tax law – Keep your answers aimed at the auditor’s questions 3-31 Objective 4 Select Appropriate Tax Strategies Tax Planning Strategies • Practice tax avoidance – Legitimate methods to reduce your tax obligation to your fair share but no more – Financial decisions related to purchasing, investing, and retirement planning are the most heavily affected by tax laws • Tax Evasion – Illegally not paying all the taxes you owe, by purposely not reporting all income 3-32 Tax Planning Strategies Minimizing Taxes If you expect Then you should Because The same or a Accelerate Greater benefit to lower tax rate deductions into higher rate next year this year The same tax rate Delay income into Delay paying taxes next year next year Delay deductions Greater benefit A higher tax rate Accelerate income Taxed at lower rate next year 3-33 Tax-Planning Strategies Consumer Purchasing • • Home ownership – One of the best tax shelters – Deduct mortgage loan interest property taxes – Reduces your taxable income and Use home equity line of credit to buy a car or consolidate debt – Interest deductible – Be careful; the loan has to be paid back one of these days 3-34 Tax-Planning Strategies Consumer Purchasing • Job-related expenses may be allowed as itemized deductions – – – • Union dues Business tools Job search costs Health care expenses FSA’s (Flexible Spending Accounts) allow you to reduce your taxable income when paying for health related expenses 3-35 Tax-Planning Strategies Investment Decisions Tax Exempt Investments – Interest income from municipal bonds are exempt from federal and some state taxes Tax Deferred Investments – Tax deferred annuities – Section 529 education savings plans – Retirement Plans -IRA, Keogh or 401(k) • A type of tax shelter 3-36 Tax-Planning Strategies Investment Decisions Capital Gains – – Profits from the sale of stocks, bonds or real estate Long-term capital gains (held more than one year) taxed at a lower rate Self Employment Advantage: Owning your own business can have tax advantages Disadvantage: Business owners have to pay additional taxes 3-37 Tax-Planning Strategies Investment Decisions Children’s Investments Children with investment income of more than $1500 are taxed at parent’s top rate Retirement Plans (These have different contribution limits depending on the situation. One should consult their financial advisor.) – Traditional IRA – Roth IRA – Education IRA – Keogh Plan – 401 (K) Plan 3-38 Changing Tax Strategies • IRS Changes: – IRS modifies tax filing procedures each year – Congress passes legislation to change the tax code each year. – Take advantage of these changes for personal financial planning • Personal Changes: – Consider changes in your personal situation and income – Monitor your tax strategies to best serve your daily needs and long-term financial goals 3-39