Prof. Luigi Franzoni - LL.M. in Intellectual Property

advertisement

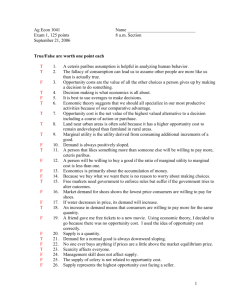

September 13-14, 2011 Lecturer: Professor Luigi Alberto Franzoni ECONOMIC ANALYSIS OF IP OBJECTIVE: Study the economic implications of IP (monopoly power and market competition). Understand how economic tools can be applied for legal aspects? To develop these tools (monopoly), apply to Law and then to analyze IP (patents) impact in the economy. Monopoly is an imperfect market, entails looses and inefficiency and we have to prove why. Suggestion: read Lemley, Merges to understand the debate. Monopoly Patents: just one owner who is able to sell to consumer or bring something to the market so it is important to understand the market behavior. MARKETS: “Any structure that allows buyers and sellers to exchange any type of goods, services and information”. Not talking about financial or stock market, which are focus on one item (treasury bonds for example), for most people there is no explanation where the prices are going but microeconomics tries to explain their behavior. We need to focus on one specific day with two dimensions (or facts): price and quantity traded; and in the graphic we’ll find several combinations of both variables (p,q) which will explain theories of the two forces of the market: demand of consumers (D) or those who buy and supply (S) or those who sell. Assumptions: Sellers are firms Buyers are consumers WHAT ARE PERFECTLY COMPETITIVE MARKETS? Definition: Perfect Competition exists in a market with many independent agents (buys and sellers), none of which are large enough to influence market price. Firms (sellers) hence have no market power and are ‘price-taker’ (as opposed to ‘pricemakers’). In a market, all that is observable is a particular equilibrium point (price and observed quantity traded). This is theoretically where supply and demand are equal to each other. Figure 1: Market Equilibrium Price (P) Supply P* (Equilibriu m Price) Demand Q* (Equilibriu m Quantity) Quantity (Q) Key Concept: Rationality Microeconomics (neo-classical theory) is based on the principle of rationality. All agents (both consumers/buyers and firms/sellers) are assumed to act rationally. Rationality implies that agents have the cognitive ability to foresee the consequences of their actions. The agent then makes a decision after evaluating all the possible consequences of all possible actions. Hence, agents are able to make the decision which best facilitates their self-interests. a) Demand Side Analysis Definition: A Demand Curve (or ‘Demand Function’), shows the quantity of a product that consumers wish to purchase at different prices. It is an expression of consumers’ ‘Willingness to Pay’ to for a good. There is normally an inverse relationship between price and quantity (the ‘Law of Demand’), meaning that at higher prices, consumers tend to demand less (and at lower prices, consumers tend to demand more) utility-maximizers. Demand curve serves then for two purposes: (1) to make predictions and (2) for welfare analysis of specific markets- important for policy definitions. The Basis of Demand Consumers make demand decisions based on a comparison of costs and benefits of consumption. The benefit received from consumption is related to the value the consumer places on the good. There thus exists a ‘benefit function’, which gives total benefits as being dependent on the amount consumed: b(Q). The cost of consumption is the amount spent on a good - price per unit multiplied by the number of units consumed – c(Q) = (PxQ). The net benefit of consumption is the difference between benefit and cost. u(Q) Net Benefit = b(Q) - (P.Q) Equals Total Benefit minus Total Cost As consumers are utility-maximize, it means that consumer would like to maximize the previously given formula: Max u(Q) = b(Q) – p(Q) and for obtaining such maximization we have to work with the marginal analysis. Price (P) c(Q) = PxQ (Total Cost) b(Q) (Total Benefit) Maximum difference between Cost and Benefit [ Max u(q) ] Q* (Optimal Quantity) Quantity (Q) Figure 2: Cost-Benefit Analysis of Consumption (Total Basis) Marginal Analysis: Economists believe that consumers make decisions at the margin; i.e. should one more unit of the good be obtained or not? The consumer will compare the additional (marginal) utility to be achieved by consuming one more unit of the good, to the additional (marginal) utility that must be given up in order to obtain the good. At any particular price, the consumer will continue to buy units of the good as long as the marginal benefit, as expressed by maximum willingness to pay, exceeds the price. The optimal quantity for the consumer (quantity that maximizes net benefit) is where the slope of the Total Cost curve is the same as the slope of the Total Benefit curve. This means that ‘Marginal Cost’ (increase in total cost from consumer one additional unit) is equal to ‘Marginal Benefit’ (increase in total benefit from consumer one additional unit). The Marginal Cost is denoted as c’(Q), which is the price of the good (slope of the total cost curve), while Marginal Benefit is denoted by b’(Q) (slope of the total benefit curve). Mathematically: Goal: to maximize u(Q) | u(Q) = b(Q) – P.Q 0 = b’(Q) – P b’(Q) = P Price (P) b’(Q) (Marginal Benefit) c’(Q) = P P* (Marginal Cost) (Market Price) Q1 Q* Q2 Quantity (Q) Figure 3: Cost-Benefit Analysis of Consumption (Marginal Basis) Note that: If Q1 is consumed, marginal benefit is greater than marginal cost. Therefore rational consumer would increase consumption. If Q2 is consumed, marginal benefit is less than marginal cost. Therefore rational consumer would decrease consumption. Equilibrium is where marginal cost equals marginal benefit (Q*) Observe that b’(Q) (marginal benefit) is downward sloping. This means that as the consumer consumes more units of a good, the value of further units decrease, and hence the consumer’s willingness to pay. This leads to the downward sloping shape of the demand curve. Consumer Surplus The consumer surplus is the difference between what the consumer is willing to pay, and what they actually pay. For any given unit, it is the net benefit. Total consumer surplus is the sum of the net benefit from each unit consumed. Consumer Surplus = ∑i ( = Sum of = Sum of CS Total Benefit from Consumption - P Benefit of each unit minus Cost of each unit = - P* = Q P* Demand Demand Q* Consumer Surplus P P P* ) Net Benefit from all units consumed Total Cost of Consumption - P b(qi) Q* Demand Q Q* Note that as price changes, the consumer surplus changes. A decrease in price results in an increase in consumer surplus, while a decrease in price results in a decrease in consumer surplus. Q Price (P) Original Consumer Surplus Increase in Consumer Surplus P1 P2 Demand Q1 Q2 Quantity (Q) Figure 4: Change in Consumer Surplus from a Decrease in Price We can infer now the General Demand Theory: The quantity of a product demanded by consumer is dependent on the following factors: 1. The Price of the good (Demand is Downward sloping because when price decreases quantity increase). 2. Consumer Tastes 3. Consumer Income (recall ‘normal good’ vs. ‘inferior good’ distinction) 4. Price of Related Goods (recall ‘substitute’ vs. ‘compliment’ distinction) 5. Expectations about future price changes Important concepts to review for better understanding of the downward sloping shape: Price Elasticity Price Elasticity of Demand is a measure of consumer’s responsiveness to changes in price. The law of demand states that as price increases, quantity demanded will decrease; Price elasticity gives a measure for the extent of this decrease. Elasticity is seen in the slope of the demand curve Price-E = [ (% change in Q) / (% change in P) ] – Note that change in P and Q are expressed as percentages, meaning that E is a number (independent of any unit of measurement) Income Elasticity Income elasticity of demand is a measure of how consumer demand changes relative to changes in income. For most goods, quantity demanded increases as income increases (‘normal goods’). For goods known as ‘inferior goods’, quantity demanded decreases as income increases (such as low quality goods (eg: public transport) Income-E = [ (% change in Q) / (% change in Income) ] Income elasticity is positive (>0) for normal goods, and negative (<0) for inferior goods) b) Supply Side Analysis For supply, the agent being analysed is the firm, which produced output for sale. Goods are produced through the transformation of inputs into outputs. It is assumed that the goal of a rational firm is to maximise profits. The Total Revenue a firm makes is equal to the price per unit multiplied by the number of units sold. The total cost incurred is dependent on the amount produced, and is denoted as c(Q). The Firm incurs three types of costs: 1) ‘Fixed Costs’ (FC), which do not depend on the quantity produced 2) ‘Variable Costs’ (VC), which depend on the quantity produced 3) ‘Sunk Costs’, which are on-off costs which are incurred in the past Note that the firm’s cost function considers only Fixed Cost and Variable Cost, as Sunk Costs are not included (since they are only incurred once in the past). [Total Cost = Fixed Cost + Variable Cost] Profit = Total Revenue - Total Cost Π = P.Q - c(Q) Π = P.Q - FC - VC ‘Marginal Cost’ is the change in cost from producing one more unit of output. It is denoted by c’(Q). Price/Cost PxQ Maximum difference between Revenue and Cost [ Max π ] (Total Revenue) c(Q) (Total Cost) Fixed Cost (FC) Q* Quantity (Q) (Optimal Quantity) Figure 4: Output Decision of the Firm (Total Basis) The optimal quantity for the producer (quantity that maximizes net profit) is where the slope of the Total Cost curve is the same as the slope of the Total Revenue curve. This means that ‘Marginal Cost’ is equal to ‘Marginal Revenue’ (increase in total revenue from consumer one additional unit). In the case of perfect competition, the firm cannot influence the market price by producing more output; therefore, ‘Marginal Revenue’ is equal to the market price. Mathematically: Goal: to maximize π | π = P.Q – c(Q) 0 = P – c’(Q) c’(Q) = P Price/Cost C’(Q) (Marginal Cost) P* (Market Price) Q1 Q* Q2 Quantity (Q) Figure 5: Output Decision of the Firm (Marginal Basis) Note that: If Q1 is produced, price is greater than marginal cost. Therefore rational firm would increase production. If Q2 is produced, price is less than marginal cost. Therefore rational consumer would decrease production. Equilibrium is where marginal cost equals price (Q*) Observe that c’(Q) (marginal cost) is upward sloping. This means that as the firm produced more units of a good, the cost of producing further units increases, and hence the price that the firm will charge. This leads to the downward sloping shape of the demand curve. Producer Surplus The producer surplus is the difference between the amount of revenue received by the firm, and the minimum amount that the firm would be willing to receive for sale of that output (sum of marginal costs). Since marginal cost considers only variable cost, the producer surplus is equal to the profit of the firm plus the fixed cost. Producer Surplus = ∑i ( = Sum of = Sum of CS Total Revenue from Production P - - c(qi) Revenue from each unit minus Cost of producing each unit - Sum of Marginal Cost of Production = P* Producer Surplus Supply P Supply = P* y y y Q* ) Net Revenue from all units consumed P Supply P* P Q Q* Q Q* Note that when price increases, the producer surplus increases, and when price decreases, the producer surplus decreases. y y y Q c) Market Equilibrium and Efficiency A market is in equilibrium where quantity demanded is equal to quantity supplied. This equilibrium consists of an observed quantity traded, and a particular price. If price is too high (eq. P1), Supply is greater than demand, leading to excess supply. Competitive forces will push prices downward. If price is too low (eq. P2), Supply is less than demand, leading to excess demand. Competitive forces will push prices upward. Price (P) Supply P1 P* Excess Supply CS PS Excess Demand P2 Demand Q* Quantity (Q) Figure 6: Market Equilibrium Perfect Competition is said to be efficient because it generates the highest surplus possible (sum of the consumer surplus and the producer surplus). Recall that consumer surplus is a measure of welfare for the consumer, while producer surplus represents welfare for the consumer. Efficiency is a matter of maximising the total welfare. The issue of distribution of welfare is delegated to the taxation system. Monopoly Analysis A monopoly exists where there is only one firm/seller in a market. This single firm is thus able to determine the price charged in the market (it is a price-maker as opposed to a price-taker). Since a monopolist can affect price, its decision to maximize profit is also based on analysis of cost and revenue. The firm’s total revenue is still price multiplied by quantity sold; However, as the firm sells more output, it causes the market price to fall (lower point on the demand curve). Hence, as the firm sells one more unit, two things happen: i) The firm makes revenue from selling the new unit at price ‘P’ (positive effect on total revenue) ii) The firm looses revenue as all previously sold units are now sold at the lower price ‘P’ (negative effect on total revenue) The total effect on revenue is the sum of these two effects, and is known as ‘Marginal Revenue’. Marginal Revenue is denoted by r’(Q), and graphically cuts halfway where the demand curve cuts the quantity axis. The monopoly maximizes profit where marginal cost is equal to marginal revenue [c’(Q)=r’(Q)], and price is set corresponding to this quantity. Price/Cost c’(Q) (Marginal Cost) CS P* (profit maximising price) Deadweight Loss PS (π+FC) r’(Q) Demand (Marginal Revenue) Q* Quantity (Q) (profit-maximising quantity) Figure 6: Monopoly Equilibrium Note that the monopolist charges a higher price than the perfectly competitive firm would. Monopoly equilibrium is said to be inefficient because it does not lead to maximum welfare, as there is a ‘deadweight loss’. Deadweight loss is surplus that is not created, and opportunity to create welfare that is lost. Also observe that there are consumers who are wish to consumer the good, but are excluded from the market. These consumers value the good (have a willingness to pay) in excess of the marginal cost of production. Therefore monopoly also leads to a lower quantity produced than in perfect competition. d) Market Failure Competitive markets generally lead to economically efficient outcomes. However, instances when the does not happen are known as ‘Market Failures’. 1. Market Power Market power exists when firms have the ability to influence prices (they are pricemakers). In such circumstances, the price charged in the market is higher than the perfectly competitive price, leading to a dead-weight-loss and inefficient outcomes. Examples include the existence of Monopoly or Oligopoly. 2. Natural Monopoly Natural Monopoly exists when an industry is characterised by very high sunk costs. Because of this, marginal cost may fall as output increases, and it is very difficult for competitors to replicate the investments necessary to compete. Examples of natural monopolies are utility companies. The traditional solution to natural monopoly is the nationalisation of such companies, although the modern trend is one of industry regulation. 3. Externalities Externalities exist when decisions to producer or consume a good indirectly affect other parties, outside of the market mechanism. Externalities may either be negative (e.g. pollution) or positive (e.g. scenic buildings). Because of the existence of externalities, free markets (which are based on private costs and benefits) may not lead to efficient outcomes. 4. Asymmetric Information Asymmetric Information exists where one party has more information about market conditions than the other. This should be contrasted with uncertainty (when neither party have the relevant information). Asymmetric Information may lead to two inefficient outcomes: i) Adverse Selection – When on party has more information on an unobservable variable (e.g. quality of a good), the market may fail due to pre-contractual opportunism (e.g. only low quality goods are traded). Reference is made to the ‘Market for Lemons’ Model. Possible remedies include minimum quality standards, warranties and disclosure requirements. ii) Moral Hazard – The market may fail because of the effects of unobservable variables or behaviour. For example, a person may behave differently (in terms of risks taken) since they are insured, as compared to if they are non-insured. Possible remedies include optimal contracts with rewards, incentives or penalties. 5. Public Goods Public goods are goods that have two properties: i) Non-rivalry – the property that consumption by one individual does not reduce the quantity available for others to consumer ii) Non-excludability – the property that persons are unable to exclude others form consuming the good Examples include street lighting, national defence, and traditional radio waves. Public goods have zero marginal cost, since it does not cost anything to supply to good to one additional consumer. Since there is no mechanism to force consumers to pay for the good, public goods lead to the ‘free-rider problem’. The free market will not supply public goods, and hence the remedy is for the state to provide such goods. IP Rights are very important for analysing public goods, since information is both nonrival and non-excludable. e) Patents and Trade Secret Protection Justification/Theories of Patent Protection 1. Reward Theory This theory is based on the premise that there is a need to provide incentives to inventors in order to encourage innovative activities. Patents give such incentives in the form of temporary monopoly rights, which translate into financial rewards. 2. Disclosure Theory This theory is based on the premise that disclosure of new information is important for social development. The patent system hence exists in order to encourage disclosure of new technologies (in contrast with trade secrets), which develops the knowledge base of society in general. Most academics see Reward Theory and Disclosure Theory as the two most important justifications of the patent system. 3. Prospect Theory Prospect theory was developed in the 1970s, and drew on the analogy of oil prospecting. The concept is that it is best for one entity to research into a particular field, in order to minimize any duplicated efforts. This suggests that patent should be granted in the earliest stages of research, before an invention is developed and commercialized. However, this theory goes against the idea of market-driven innovation and competition. 4. Certification Theory This theory suggests that the patents system serves as a mechanism to ‘certify’ the innovative capabilities of a firm, and hence its success. Investors may use the number of patents granted to a firm as a proxy measure for its level of innovation and hence its profitability. This theory is also called ‘Signaling Theory’ – signaling is the process of using an observable variable as a proxy for a non-observable variable in order to solve existing information-asymmetries. Certification theory should be seen as a side-benefit of the patent system, rather than a full-fledged theory for its justification. 5. Natural-Rights Theory Natural Rights Theory suggests that inventors should be granted patents as they have a natural right to benefit from their creations, and to be credited accordingly. However, this theory may be more appropriate to explain the existence copyright system, as opposed to the patent system. There is also the controversy as to whether such natural rights should apply to corporations (who own most modern patents). f) Denicolo-Franzoni (2009) Model A Model to Analyse the Microeconomics of Patent and Trade Secret Protection The Model analyses the debate between weak (non-exclusive) IP rights and strong (exclusive) IP rights in terms of promoting innovation. The model analyses the structure of the market under (i) patent protection, and (ii) trade secret protection, and compares the results. Under Patent Protection: - A Patent is monopoly power given to a firm for ‘T’ years - During these T years, the firm earns a profit of ‘πm’ and creates a deadweight loss of ‘∆m’ - After T years, the patent expires, and the market changes from monopoly to perfect competition - In perfect competition, no profit is made and no deadweight loss is created Under Trade Secret Protection: - With trade secret protection, other firms can replicate the innovation, either through reverse engineering or independent discovery - The firm enjoys monopoly for ‘S’ years, when replication occurs. ‘S’ is hence the lead time of the original innovator - After S years, the market becomes a duopoly (two firms with equal market share/profit), and competition causes the price to fall - In the duopoly, the innovator earns a profit of ‘πd’, while deadweight loss of ‘∆d’ is created in the market. The key issue for the policy maker is to define the optimal length of patent protection ‘T*’, which will give the same reward regardless of whether the firm chooses patent or trade secret protection. Therefore, the system in neutral in terms of the incentive for firms to disclose their innovations. By comparing rewards (profits) and costs (deadweight loss) under both types of protection, the model concludes the following: - Optimal patent protection length (T*) is equal to S (duplication time) plus some additional margin (ratio of profits) - If competition is so strong upon duplication that the market becomes perfectly competitive (duopoly profits driven to zero), then (T*=S) - Patent protection is preferable (for society) is the ratio of profit to deadweight-loss is less under patent protection [(π m/∆d) < (πd/∆d)] - If competition is weak (prices not driven down by much), then there is a higher deadweight loss. As such, patent protection is likely to be better - If competition is strong (prices are driven down significantly), then the deadweight loss is smaller, and trade secret protection is better for society - In conclusion, the key factor is the intensity of competition after replication of the innovation.