Ten Sound Money Management Principles for Students

advertisement

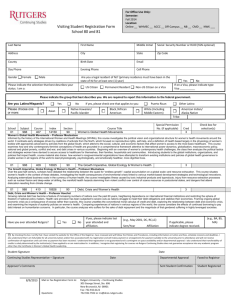

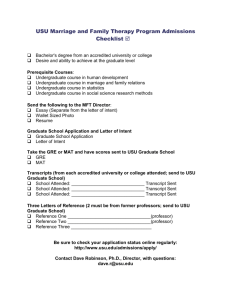

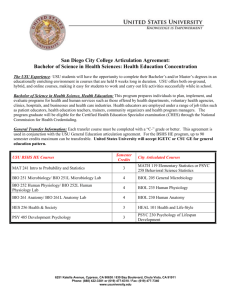

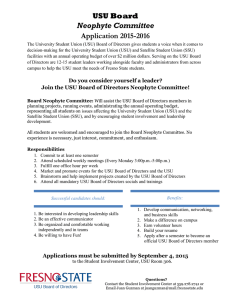

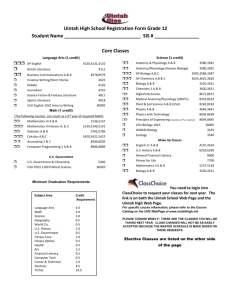

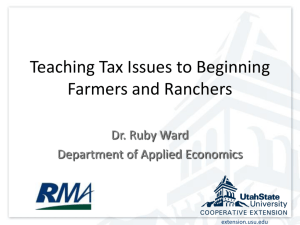

Ten Sound Money Management Principles for Students PPT Developed by Barbara O’Neill, Ph.D., CFP Revised & presented by Jean Lown, Ph.D., Family, Consumer & Human Development, USU Jean.lown@usu.edu What are Your $ Questions? I can’t promise to answer all of them but by knowing your questions before we start I can adjust my presentation How many parents? – Single parents? Utah Savers? – Sign up for drawing PPT on FPW website 2 Money Management Principles Are timeless and time-tested Apply to everyone Work well in up & down economies Help people grow wealthy over time Need to be taught in school 3 1. Go For The Goal Goals provide a “why” for saving Use goals to develop action plans Break goals into benchmarks Make your goals SMART – Specific – Measurable – Attainable – Realistic – Time-Related 4 Invest in your Human Capital Get a solid education – For career satisfaction – For better health – For higher lifetime earnings It’s OK to borrow for education – There is an opportunity cost to taking too long to earn degree – Student loans are better than credit cards 5 2. Time Is Your Friend Time: a young person’s biggest asset Compound interest is awesome For every decade that savings is delayed, the required investment triples Example: $500,000 at 65; 10% yield – Age 25: $ 79 per month – Age 35: $ 219 per month – Age 45: $ 653 per month – Age 55: $ 2,141 per month 6 More About Time Time diversification reduces investment volatility The Rule of 72 – 72/interest rate = doubling period – 72/doubling period = interest rate Advantage calulators 7 3. Live Below Your Means Spend less than you earn Create a spending plan – Income = Fixed Exp (including savings) + Flexible Exp + 1/12 of Occasional Expense Distinguish needs from wants “Step-down principle” Automate savings so money isn’t spent 8 4. Establish Emergency Fund Aka contingency fund – Online savings accounts • • • • No minimum FDIC insured 4.5% (varies) Linked to checking account – HSBC – Emigrant – ING & many others 9 Pay Yourself First: Automate Your Savings Tax-deferred employer plans – Get full 401(k) match from employer Employer credit unions Savings bond purchase plans Mutual fund Automatic Investment Plan Direct stock purchase plans 10 Utah Saves http://www.utahsaves.org/ Build wealth, not debt Saver Strategies Get out of debt Earned income tax credit Free income tax preparation Individual Development Accounts 11 5. Buy Insurance According to “The Large Loss Principle” Magnitude- not frequency- of losses Increase deductible to save $ Spend premium dollars on large potential losses: – Liability – Disability – Destruction of home – Large medical expenses – Loss of household earner’s income 12 6. Low Income Saver’s Credit Refundable tax credit up to $1,000/person Contribution to retirement account: IRA, 401(k), 403(b), or SEP Couple filing jointly AGI: $50k or less Single with AGI: $25,000 or less Sliding scale: 10-50% of contribution 13 7. Repay Debt Quickly and Borrow For Less Consumer debt ratio < 15% of net pay Consumer debt + housing < 50% of net High debt makes other problems worse Negotiate lower interest rates Always pay more than the minimum Avoid “perma-debt” Pay promptly to avoid late fees 14 Family Life Center PowerPay analysis 8. Earned Income Tax Credit Refundable tax credit for workers 15 9. Vita tax prep Provided by USU accounting students in Business building- starts Feb. AVOID instant tax refunds – High cost loans (similar to payday loans) Auto deposit Split your refund – Save a portion, pay debt, spend 16 9. Buying House/Vehicle Don’t buy more house than you can afford (Subprime mortgage meltdown) – Don’t’ trust mortgage broker Don’t buy before you are really ready for the financial commitment Buy new cars every 8-10 years or buy “new used” 17 Check Your Financial Health Take the Financial Fitness Quiz – http://njaes.rutgers.edu/money/ffquiz/ Least common practices – Not having a will – No written financial goals – No written budget – No net worth calculation 18 Financial Education Resources Investing For Your Future – Home study course – http://www.investing.rutgers.edu/ Money 2000 & Beyond – http://www.rce.rutgers.edu/money2000 RU-FIT financial independence training – http://www.rce.rutgers.edu/ru-fit/ USU Extension – http://extension.usu.edu/ 19 Spend Less, Enjoy the Holidays More http://extension.usu.edu/htm/news/articl eID=2361 Start a UESP account for your kids Spend time with important people Avoid gift cards – High fees, money can’t be saved Pay cash! Avoid debt. 20 Small Steps to Health & Wealth http://njaes.rutgers.edu/sshw/ “This program is designed to motivate consumers to implement behavior change strategies that simultaneously improve their health and personal finances.” 21 Personal Finance Magazines Kiplinger’s Personal Finance Magazine – Kiplingers.com Money Magazine – Money.com – Money 101 on-line financial mgmt course • http://money.cnn.com/pf/101/ • 23 lessons 22 FCHD 3350 Family Finance Personal Financial Management DSS general education Fall & Spring semesters – Live and on-line Don’t leave campus without this class! 23 The Financial Checkup by Alena Johnson 24 USU Family Life Center Very low cost financial & housing counseling PowerPay Debt reduction computer analysis https://powerpay.org/ First time homebuyer workshops 797-7224; 495 North 700 East, Logan 25 Financial Planning for Women http://www.usu.edu/fpw For women of all ages & knowledge Second Wednesday (except December) – 12:30-1:30 in Family Life room 318 – 7-8:30 pm in Family Life Center Email list: jean.lown@usu.edu – Monthly e-news & program info Sign up sheet for FPW PPT will be posted on the website 26 Avoid Common Mistakes of Young Adults Buying a house before you are ready Buying too much house Putting too much $ into vehicles Keeping a balance on your credit cards Waiting to invest for retirement until… Not considering the cost of kids Spending too much on eating out 27 Closing Thought “If it is to be, it is up to me” Comments? Questions? Experiences? 28