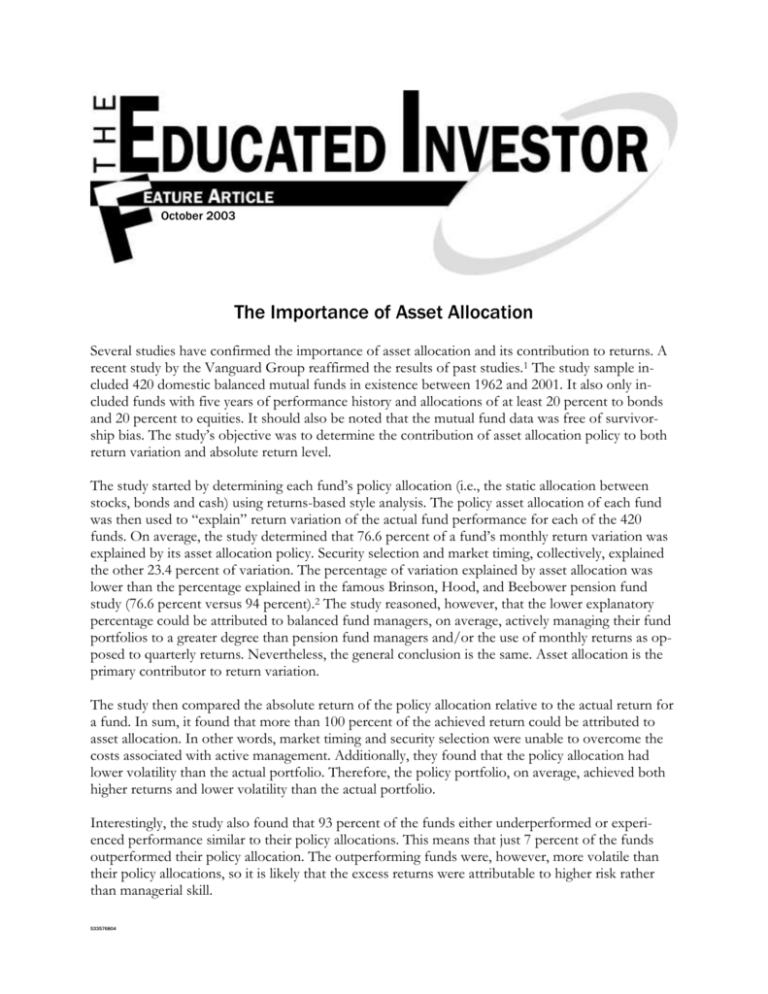

The Importance of Asset Allocation

advertisement

October 2003 The Importance of Asset Allocation Several studies have confirmed the importance of asset allocation and its contribution to returns. A recent study by the Vanguard Group reaffirmed the results of past studies.1 The study sample included 420 domestic balanced mutual funds in existence between 1962 and 2001. It also only included funds with five years of performance history and allocations of at least 20 percent to bonds and 20 percent to equities. It should also be noted that the mutual fund data was free of survivorship bias. The study’s objective was to determine the contribution of asset allocation policy to both return variation and absolute return level. The study started by determining each fund’s policy allocation (i.e., the static allocation between stocks, bonds and cash) using returns-based style analysis. The policy asset allocation of each fund was then used to “explain” return variation of the actual fund performance for each of the 420 funds. On average, the study determined that 76.6 percent of a fund’s monthly return variation was explained by its asset allocation policy. Security selection and market timing, collectively, explained the other 23.4 percent of variation. The percentage of variation explained by asset allocation was lower than the percentage explained in the famous Brinson, Hood, and Beebower pension fund study (76.6 percent versus 94 percent).2 The study reasoned, however, that the lower explanatory percentage could be attributed to balanced fund managers, on average, actively managing their fund portfolios to a greater degree than pension fund managers and/or the use of monthly returns as opposed to quarterly returns. Nevertheless, the general conclusion is the same. Asset allocation is the primary contributor to return variation. The study then compared the absolute return of the policy allocation relative to the actual return for a fund. In sum, it found that more than 100 percent of the achieved return could be attributed to asset allocation. In other words, market timing and security selection were unable to overcome the costs associated with active management. Additionally, they found that the policy allocation had lower volatility than the actual portfolio. Therefore, the policy portfolio, on average, achieved both higher returns and lower volatility than the actual portfolio. Interestingly, the study also found that 93 percent of the funds either underperformed or experienced performance similar to their policy allocations. This means that just 7 percent of the funds outperformed their policy allocation. The outperforming funds were, however, more volatile than their policy allocations, so it is likely that the excess returns were attributable to higher risk rather than managerial skill. 533576804 In summary, the Vanguard study reaffirms the results of prior studies on the importance of asset allocation’s impact on portfolio returns and return variation relative to the contribution from market timing and security selection. Our conclusion is that investors who spend most of their precious time and hard-earned dollars focusing on market timing and security selection issues are highly like to find the efforts not only unproductive, but counterproductive. 1 2 The Vanguard Group. Sources of Portfolio Performance: The Enduring Importance of Asset Allocation. July 2003. Brinson, G.P., L.R. Hood and G.L. Beebower. Determinants of Portfolio Performance. Financial Analysts Journal, July/August 1986. This material is derived from sources believed to be reliable, but its accuracy and the opinions based thereon are not guaranteed. The content of this publication is for general information only and are not intended to serve as specific financial, accounting or tax advice. To be distributed only by a registered investment advisor. Copyright © BAM Advisor Services, 2003. Page 2