SWOT Analysis

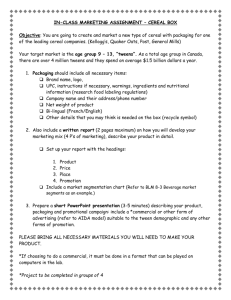

advertisement

General Mills (NYSE: GIS) Ruonan Ding Meiling Liu Jinglin Pan Prateek Sharma Date: 30-Nov-2010 Agenda Industry Analysis Company Analysis SWOT Financial Analysis DCF Model Comparable Recommendations Industry Overview Food Processing Industry Annual production estimated at around $1tn (2004) Key drivers Population growth rate Per capita disposable income Price of grains/ raw materials Health consciousness Source: U.S. Department of Commerce Industry Report Food Manufacturing NAICS 311 (2008) www.trade.gov/td/ocg/report08_processedfoods.pdf Porters Five Forces SUPPLIER POWER – MEDIUM - Most suppliers i.e. agricultural/meat producers enter into long-term contracts with companies BARRIERS TO ENTRY – HIGH - High Capital Expenditure - Difficult to replace existing brands (Brand Loyalty) - Access to distribution channels Porters Forces Contd. THREAT OF SUBSTITUTES – LOW - Substitutes to processed foods are fresh foods or eating-out. Time constraint or money constraint BUYER POWER- HIGH - Most buyers ( Wal-Mart etc.) make up a large percentage of sales RIVALRY- HIGH - Firms compete on innovation, product differentiation and marketing/ advertising - Compete not only among themselves but also with private labels Competitor- Kraft Foods Inc. Kraft Foods Inc. is the largest food and beverage company in North America and the second largest in the world. In 2007, Kraft discontinued the cereal production divesture. It only competes in snack segment with GIS. Following its January 2010 acquisition of Cadbury, Kraft has had strong quarterly earnings, both in revenue and operating profit across all candy and snack segments. Competitor- Kellogg The Kellogg Company, headquartered in Michigan, manufactures and markets ready to eat cereal and convenience foods. Kellogg holds 34.2% of the cereal market in the U.S. Kellogg’s has managed to consistently post increases in sales revenue and net profits since 2005. Competitor- PepsiCo PepsiCo Americas Food is the division most applicable to this industry. Within this division, is Quaker Foods North America (QFNA). QFNA holds about 8.0% of cereal market in the U.S. QFNA operates four manufacturing plants in the United States. QFNA grew at an annual rate of 2.2% in the five years to 2010 The Company Overview General Mills is a global food manufacturer and marketer of consumer foods sold through retail stores. They are also a supplier of food products to the food service and commercial baking industries Manufactures its products in 15 countries and markets them in more than 100 countries Their brands include Cheerio's,Yoplait, Nature Valley, Betty Crocker, Pillsbury, Green Giant, Old El Paso, Progresso, Cascadian Farm, Muir Glen and more The Company Profile Headquarters in Minneapolis, MN Global workforce of 33,000 FY2010 Net Sales: $14.8 Billion Primary Customers Grocery Stores, mass merchandisers, membership stores, natural food chains, drug, dollar and discount chains, commercial and non-commercial food service distributors and operators, restaurants and convenience stores The Company Brand Portfolio Major Product Categories Ready-to-eat cereal, yogurt, super-premium ice cream, ready-to-serve soup, dry dinners, shelf stable and frozen vegetables, refrigerated and frozen dough products, dessert and baking mixes, flour, frozen pizza and pizza snacks, grain, fruit and savory snacks, and a wide variety of organic products like soup granola bars and cereal. The Company Sales Segments Their sales can be categorized into 4 segments: U.S Retail $10.3 Billion business International $2.7 Billion business Wholly-owned companies Joint-ventures o Cereal Partners Worldwide (CPW): 50-50 partnership with Nestle that markets breakfast cereals in 130 countries outside of U.S o Haagen-Dazs Japan: Operates their ice cream business in Japan Bakeries & Foodservice $1.8 Billion business Source: General Mills Inc. Corporate Brochure 2010 http://www.generalmills.com/~/media/Files/CorporateBrochure_090110_LowRez.ashx The Company Sales Breakdown Source: General Mills Inc, Annual Report 2010 http://generalmills.com/~/media/Files/annual_report_2010.ashx The Company Growth Model 5 Key Business Drivers: Innovation Brand Building Customer Growth International Expansion Margin Expansion Executed through: Holistic Margin Management (HMM) Cost cutting measure which ranges from consolidating purchases to give them more bargaining power to change of packaging for more efficient loading and unloading Increased media and multicultural advertising Recognizes the growing Hispanic population and the sales potential R&D and Product innovations New products like chocolate and multigrain varieties of Cheerio's The Company Growth Opportunities Economic conditions favoring At-home Meals Aligning products with growing US consumer groups Baby boomers, millenials, and multicultural population Emerging market expansion Expanding operations in China, Brazil, India The Company The Future Increase CapEx to ~$700 million in FY2011 Increase manufacturing capacity for cereals and Yoplait yogurt Expand International production capacity for Wanchai and Haagen Daz products Continue HMM throughout supply chain Targeting $1 Billion in savings through HMM in the next 3 years Expects increase in energy and commodity prices Makes use of hedging instruments to manage the fluctuation in input costs Expects cost savings from HMM to offset rising COGS Share repurchase program Reduce outstanding shares by 2% every year Recent Events PAI is selling its 50% stake in Yoplait and GIS is the front runner GIS has had franchise agreements with Yoplait since 1977 which is one of their top businesses General Mills buys Mountain High Yogurt Faces the risk of losing Yoplait because French Dairy Sodima (50% owner of Yoplait) wants to severe their licensing by 2012 Rising food costs are pressuring food makers and retailers to pass on the costs to consumers GIS expects input costs to rise 4%-5% in FY2011 Recently raised prices on some cereal brands and baking products The Company Management Assessment Regular dividends without reduction for 112 years Dividend rate has been growing at 9% compound rate over past 4 years • Strength in efficiency and productivity – HMM discipline helps to keep COGS down even in times of inflation 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% -10.0% F2006 F2007 F2008 F2009 Input Cost Inflation F2010 F2011 Gross Margin *Figures from General Mills Inc. 10-K FY 2010 Source: (1) General Mills Inc, Corporate Fact Sheet http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9NjA4NzN8Q2hpbGRJRD0tMXxUeXBlPTM=&t=1 SWOT Analysis Strength: Strong brand equity on key brands Growing international operations Product development skills Innovators Brand management skills Weakness: Dependent on the US market for revenue Rising SG&A expenses SWOT Analysis Opportunities: Growing health consciousness Higher penetration with smaller retailer customers in the U.S. Rising demand for cereals Threats: Commodity price increases Competitive market Private label growth STOCK PRICE CHART Source: Yahoo Finance Key Ratios For the Fiscal Period Ending Profitability Return on Assets % Return on Equity % Margin Analysis Gross Margin % EBITDA Margin % EBITA Margin % Asset Turnover Accounts Receivable Turnover Inventory Turnover Short Term Liquidity Quick Ratio 12 months May-28-2006 12 months May-27-2007 12 months May-25-2008 12 months May-31-2009 12 months May-30-2010 6.9% 19.0% 7.2% 20.6% 7.6% 22.4% 7.6% 22.9% 9.3% 28.9% 35.6% 20.6% 17.0% 36.1% 20.2% 16.9% 35.8% 20.0% 16.6% 35.6% 18.3% 15.2% 39.7% 20.9% 17.8% 13.0x 7.2x 13.3x 7.1x 13.4x 6.9x 14.4x 7.0x 14.8x 6.6x 0.3x 0.3x 0.4x 0.5x 0.5x Source: Capital IQ Company Financials DuPont Analysis Discount Rate Weighted Average Cost of Capital Adjusted Rate of Return on Equity 22.80% 19.50% 5.58% 4.50% Equity/Total capital 48.17% 50.77% Debt/ Total Capital 51.83% 49.2% 12.86% 11.34% Rate of Return on Debt WACC 2010 Return on average total capital ◊ Return on Equity % ◦ 2009 2008 2007 2006 13.80% 12.30% 11.70% 11.00% 10.40% 28.95% 22.91% 22.45% 20.63% 19.05% Source: ◊ General Mills Inc. 10-K ; ◦ Capital IQ Company Financials Discounted Cash Flows Sensitivity Chart Terminal Growth Rate Discount Rate #### 10.00% 11.00% 11.34% 11.50% 12.00% 2% 40.44 34.29 32.51 31.71 29.39 2.50% 42.82 36.06 34.12 33.25 30.74 3% 45.55 38.06 35.93 34.98 32.25 3.50% 48.70 40.32 37.97 36.92 33.93 4% 52.37 42.90 40.28 39.12 35.82 Comparable Analysis Estimated Value Per Share Based on Multiples Trailing P/E P/S P/EBITDA Minimum $22.10 $9.96 $32.45 Median $23.90 $32.05 $36.05 Maximum $26.18 $46.13 $36.41 Average $24.06 $29.88 $34.96 Price Per Share Low $21.50 Median $30.67 High $36.24 Mean $29.63 *Figures of comparables obtained from competing firms previously mentioned, and data is obtained from Capital IQ. Recommendation Basis Current Price: $35.45 (Nov-29-2010) DCF Valuation: $26.17 (Negative) $35.93 (Base) $41.29 (Positive) Relative Valuation: $21.50 - $36.24 On Watch-List Since Dec 2009 - Underperformed both DJIA and S&P 500 - Underperformed relative to peers Recommendation We DO NOT recommend investing at this time Keep in watch list. Look for other companies within the sector that match our investment policy It’s a good company but not a great stock.