ABS Intro & corporate financing choices

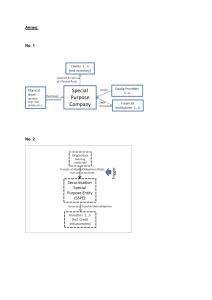

advertisement

SIM/NYU The Job of the CFO Financing with Asset-Backed Securities Prof. Ian Giddy New York University Asset-Backed Securities The technique Legal, tax and accounting issues The economics An application ABS in Asia Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 2 Securitization of Assets Securitization is the transformation of an illiquid asset into a security. For example, a group of consumer loans can be transformed into a publicly-issued debt security. A security is tradable, and therefore more liquid than the underlying loan or receivables. Securitization of assets can lower risk, add liquidity, and improve economic efficiency. Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 3 What is the Technique for Creating Asset-Backed Securities? A lender originates loans, such as to a homeowner or corporation. The securitization structure is added. The bank or firm sells or assigns certain assets, such as consumer receivables, to a special purpose vehicle. The structure is legally insulated from management The SPV issues (usually) high-rated debt. Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 4 Securitization: The Basic Structure SPONSORING COMPANY ACCOUNTS RECEIVABLE SALE OR ASSIGNMENT SPECIAL PURPOSE VEHICLE ACCOUNTS RECEIVABLE Copyright ©2001 Ian H. Giddy giddy.org ISSUES ASSET-BACKED CERTIFICATES Asset Securitization 5 The Process Key features are: pooling of a group of similar non-traded financial assets transfer of those assets to a special-purpose company which issues securities risk reduction by systematic risk assessment, by diversification, by partial guarantees, etc. division of the benefits (and risks) among investors on a pro-rata basis being offered in the form of a security (rather than, for example, as a portfolio of loans or receivables) on-going servicing of the underlying assets' cash flows through to the asset-backed security investors. Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 6 Finance Company Limited Case Study: The Company (Finance Company Limited) Finance company whose growth is constrained Has pool of automobile receivables Has track record Plans to use this as an ongoing source of financing Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 8 Key Decisions Securitize the assets Decisions Form of transfer of asset Copyright ©2001 Ian H. Giddy Form of special purpose vehicle Form of credit enhancement giddy.org Form of Form of cash flow transformation of allocation cash flows Asset Securitization 9 Case Study: Initial Exchanges Finance Co.’s Customers Hire-Purchase Agreement Finance Co. Ltd (Seller) Rating Agency Top Rating Servicing Agreement Proceeds FCL 1997-A (Special Purpose Co.) Sale of Assets Proceeds Investors Asset-Backed Securities Trustee Trust Agreement Copyright ©2001 Ian H. Giddy Guarantee Agreement giddy.org Financial Guarantee Provider (if required) Asset Securitization 14 Case Study: Ongoing Payments Finance Co.’s Customers Hire-Purchase Payments Finance Co. Ltd (Seller) Servicing Fees Monthly HP Payments FCL 1997-A (Special Purpose Co.) Monthly ABS Payments Trustee Trustee Responsibilities Copyright ©2001 Ian H. Giddy Guarantee Responsibilities giddy.org Investors Financial Guarantee Provider Asset Securitization 15 Getting a Rating: The Risks Credit risks Liquidity risk Servicer performance risk Swap counterparty risk Guarantor risk Legal risks Sovereign risk Interest rate and currency risks Prepayment risks Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 16 Risk-Management Techniques in ABS CREDIT ENHANCEMENT SPONSORING COMPANY ACCOUNTS RECEIVABLE SOVEREIGN PROTECTIONS SALE OR ASSIGNMENT SPECIAL PURPOSE VEHICLE ACCOUNTS RECEIVABLE ISSUES ASSET-BACKED CERTIFICATES INTEREST RATE/ CURRENCY HEDGES CASH FLOW REALLOCATION Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 17 Credit Enhancement: An Alternative Approach Rating Agency Top Rating Senior Lower Rating Finance Co. Ltd (Seller) Proceeds FCL 1997-A (Special Purpose Co.) Subordinated Sale of Assets No Rating More Subordinated Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 18 Choose a Structure to Suit the Type of Assets to be Securitized Mortgage Securitization Non-Mortgage ABS Intangibles Infrastructure and Project Financing Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 19 Asset-Backed Securities: Legal and Regulatory Aspects Legal The Transfer The Special-Purpose Vehicle Taxation Accounting Treatment Bank Regulatory Treatment Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 20 Legal Aspects Goal: Credit quality must be solely based on the quality of the assets and the credit enhancement backing the obligation, without any regard to the originator's own creditworthiness Otherwise, quality of the ABS issue would be dependent on the originator's credit, and the whole rationale of the asset-backed security would be undermined. Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 21 Three conditions enable the separation of the assets and the originator The transfer must be a true sale, or its legal equivalent. If originator is only pledging the assets to secure a debt, this would be regarded as collaterized financing in which the originator would stay directly indebted to the investor. The assets must be owned by a specialpurpose corporation, whose ownership of the sold assets is likely to survive bankruptcy of the seller. The special-purpose vehicle that owns the assets must be independent Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 22 What Makes it a Sale? The form and treatment of the transaction The nature and extent of the benefits transferred The irrevocability of the transfer The level and timing of the purchase price, Who possesses the documents Notification when the assets are sold Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 23 What Makes it Likely to be Consolidated? The difficulty of segregating and ascertaining individual assets and liabilities The presence or absence of consolidated financial statements The comingling of assets and business functions The existence of parent and intercorporate guarantees and loans The transfer of assets without strict observance of corporate formalities. Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 24 Taxation Aspects If the SPV or the transfer is subject to normal corporate, withholding, or individual tax rates, investors or borrowers could in principle be subject to additional or double taxation Must avoid double taxation of Seller/servicer Trust or special-purpose corporation Investors Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 25 Accounting Treatment Sale versus financing Consolidation Accounting for loan servicing Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 26 FASB Sale Treatment The transferor relinquishes control of the future economic benefits embodied in the assets being transferred The SPV cannot require the transferor to repurchase the assets except pusuant to certain recourse provisions The transferor's obligation under any recourse provision are confined and can be reasonably estimated Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 27 Consolidation Treatment International accounting standards hold that consolidated financial statements are more meaningful than separate ones "Nonhomogeneous operation" exception Finance, insurance, real estate and leasing subsidiaries can generally be left apart Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 28 Fees Loan-origination fees. These are deferred and recognized over the life of the loan as an adjustment of yield. Commitment fees. These are to be deferred. Syndication fees. These should be recognized when the syndication is complete unless the originator retains a portion of the syndicated loan. Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 29 Bank Regulation and Capital Requirements Goal: Ensure that the substance and not the form of the asset transfer is what governs capital requirements. The regulatory authorities may assess capital or reserve requirements as if the financing was a secured borrowing: Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 30 Bank Regulation: Issues in Asia Avoid excessive bank risk-taking Discourage speculative investments Prevent financial market scandals Prevent circumvention of deposit regs Encourage financing of capital investment Discourage financing of consumption Promote development of capital markets Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 31 Asset Securitization: Cost-Benefit Analysis Separation of Two Businesses: Origination and Lending SPONSORING COMPANY ACCOUNTS RECEIVABLE SALE OR ASSIGNMENT SPECIAL PURPOSE VEHICLE ACCOUNTS RECEIVABLE Copyright ©2001 Ian H. Giddy giddy.org ISSUES ASSET-BACKED CERTIFICATES Asset Securitization 33 Separation of Two Businesses: Origination and Lending SPONSORING COMPANY Asset securitization makes sense when the assets are worth more outside the company than within But what makes them worth more outside? ACCOUNTS RECEIVABLE SALE OR ASSIGNMENT SPECIAL PURPOSE VEHICLE ACCOUNTS RECEIVABLE Copyright ©2001 Ian H. Giddy giddy.org ISSUES ASSET-BACKED CERTIFICATES Asset Securitization 34 For Banks: Capital Requirements In a perfect world, adding good assets would require little additional capital, since creditors would not see any increase in the bank's risk But if regulatory capital requirements penalize banks for holding such assets, they should: securitize the good assets profit from origination and servicing In general, regulatory costs or rigidities create an incentive for banks to shrink their balance sheets by securitizing loans Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 35 A Bank’s Capital Savings Securitization Cost-Benefit Analysis (for a regulated financial institution) Funding cost savings Gain/cost ($ millions) Two-year bank notes vs pass- 1.1 though rate Upfront costs Underwriting SEC filing, legal fees, etc (2.6) Ongoing costs Letter-of-credit fee (0.5) Capital charge Cost of capital at 25% (15% after tax) 7.7 Net benefit Copyright ©2001 Ian H. Giddy 5.7 giddy.org Asset Securitization 36 For Corporations: “Pure Play” Argument Separate the credit of the assets from the credit of the originator: Identify and isolate good assets from a company or financial institution Use those assets as backing for high-quality securities to appeal to investors. Such separation makes the quality of the asset-backed security independent of the creditworthiness of the originator. Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 37 Sears: Asset-Backed Financing? SEARS Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 38 Why Did Chrysler Use ABS in 1992? Downgraded to B+ in early 1992 Lost access to its normal funding sources Needed to continue to fund its car loans Only way to do this was to securitize the loans “Firms that securitize tend to have considerably weaker credit quality than other firms.” Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 39 Costs Associated with Securitization Interest cost of the debt Issuance expenses of the debt Also: Credit enchancement and liquidity support for the assets Structuring fees payable to bankers Legal, accounting and tax advice fees Rating agencies' fees Systems modifications Management time Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 40 Costs Needed to Measure the Annual Pre-Tax Impact of Securitization The interest on the securitized funding The annual costs of credit enhancement/liquidity lines Any guarantees to enhance the credit rating of any interest rate or foreign exchange swap counterparty Amortized front-end fees (debt issuance, credit enhancement, liquidity lines) Amortized transaction costs (legal, accounting, structuring, rating, etc.) Opportunity costs relating to any temporary cash retention in any guaranteed investment contract (GIC) Annual systems/accounting/rating agency costs etc. Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 41 Sample Cost/Benefit Analysis Portfolio yield Funding cost Default rate Amortized upfront issuance costs Amortized upfront securitization costs Annual costs of guarantees and credit lines Annual additional costs (systems, reporting, trustee fees, etc) Effect on sponsor's marginal cost of capital With securitization Without securitization 18.50% 18.50% -7.22% -9.00% -5.00% -5.50% -0.10% -0.05% -0.20% -0.25% -0.25% 0.00% Profits 5.48% Net savings from securitization 1.53% per annum Copyright ©2001 Ian H. Giddy giddy.org 3.95% Asset Securitization 42 The Decision Process Corporation or Financial Institution requires additional funds to give customers financing or to finance a future revenue stream. Are funds freely available from banks ? Yes Borrow from banks No Does the firm/FI have good, self-liquidating assets ? No Issue equity or mezzanine capital Yes Do the assets have a sufficiently high yield to cover servicing and other costs ? Yes Would the assets be worth more (have a cheaper all-in funding cost) if they were isolated from the company/FI ? Yes Copyright ©2001 Ian H. Giddy No No Get out of the financing business Use assets as collateral for on-balance sheet debt Securitize the assets giddy.org Asset Securitization 43 Asset-Backed Securities Project Financing Prof. Ian Giddy Stern School of Business New York University Asset-Backed and Project Financing Collateralized debt Securitized loans Non-recourse project debt Basic question: Why should a company segregate the cash flows from a particular business, and make it selffinancing? Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 45 Project Financing Stand-alone, non-recourse, multi-stake, "production payment financing" Structure? Participants? Funding sources? Risks? Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 46 Project Financing (Summary) Stand-alone, non-recourse "production payment financing" Sponsor's vehicle company structures multi-stake finance Sources: govt development financing, IBRD/IFC, sponsor loans, supplier credits, customer credits, institutional investors, banks, lease financing, equity Risks: resource quantity, input costs, technical, timing, pre-completion, demand, operating, force majeure, political Risk sharing and mitigation Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 47 Project Financing Definition Steps Lending to a single purpose entity for the acquisition and /or construction of a revenuegenerating asset with limited or no recourse to the sponser Repayment of the loan is solely from the revenues generated from operation of the asset owned by the entity Security for the loan the revenue generating asset all shares and interests in the entity real property all contacts, permits authorizations, etc.; and, all other instruments necessary for continuing project operations Copyright ©2001 Ian H. Giddy giddy.org Project Identification & Resource Allocation Risk Allocation & Project Structuring Bidding & Mandating Contracts Due Diligence & Documentation Execution & Monitoring Construction Monitoring Term Loan Conversion & Ongoing Monitoring Asset Securitization 49 Benefits of Project Financing Limitation of Equity Investment to Project’s Economic Requirement Enhanced Returns Risk Sharing and Diversification Accounting Treatment Preserves Corporate Borrowing Capacity Access to Long Term Financing Tax Benefits Political Risk Mitigation Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 50 The Risks Political Resource & input Technical Construction Legal Economic Copyright ©2001 Ian H. Giddy giddy.org Cost overruns Completion delays Mounting interest expenses Asset Securitization 51 Eurotunnel: The Risks and the Remedies Category Nature Remedy Political Nationalization Govt interference Taxes & the like Legal Treaty ratified Technical Process Effect on completion Repairability Use existing technology Construction Delays Overruns Repairability Use top experts Performance bonds Legal Access to control in default Fire, injury, etc liability Security interests Default defn Economic Price competition Rail links Market studies Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 52 Sample Structure Arranging Bank Sponsors / Shareholders SINGLE PURPOSE PROJECT COMPANY Equipment Warranties and Supply Agents Supplier Contractor Turnkey Construction Feed Stock Long Term (e.g., fuel) Agreement Supplier Operator Copyright ©2001 Ian H. Giddy Offtake (e.g, power purchase) Agreement Syndicate Banks Other Project Participants: Purchaser Currency and Interest Rate Hedge Providers Multilaterals and EDA’s Legal Counsel Operations & Maintenance Mgmt Technical Consultants giddy.org Asset Securitization 53 Ras Laffan Who is the issuer? Ras Laffan LNG Co. Ltd. (Qatar) But Security Trustee (IBJ) plays unusually major role What assets does it have? Natural gas reserves; LNG take-or-pay Sale and Purchase Agreement with Korea Gas; Security Trust Agreement; Project Coordination Agreement; loan refund agreement, etc. Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 54 Ras Laffan What are the risks, and how are they handled? Qatar/regional interference Qatar legal system Default on Agreements Completion/timing Operating Economic (LNG market) Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 55 Ras Laffan: Natural Gas Project Finance Ras Laffan Liquified Natural Gas LNG Korea Gas LNG payments Security Trustee Debt service payments Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 56 Mobil QM (Mobil Corp.) Contractors Contractors Contractors Joint venture agreement 30% Qatargas (State of Qatar) 70% Ras Laffan Liquified Natural Gas LNG Contract payments Korea Gas Residual payments LNG payments Security Trustee (New York) Ras Laffan Debt service payments Debt service payments Bondholders Banks Export Credit Agencies asiansecuritization.com Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 58 Ian H. Giddy Stern School of Business New York University 44 West 4th Street, New York, NY 10012, USA Tel 212-998-0332 Fax 917-463-7629 ian.giddy@nyu.edu http://giddy.org Copyright ©2001 Ian H. Giddy giddy.org Asset Securitization 59