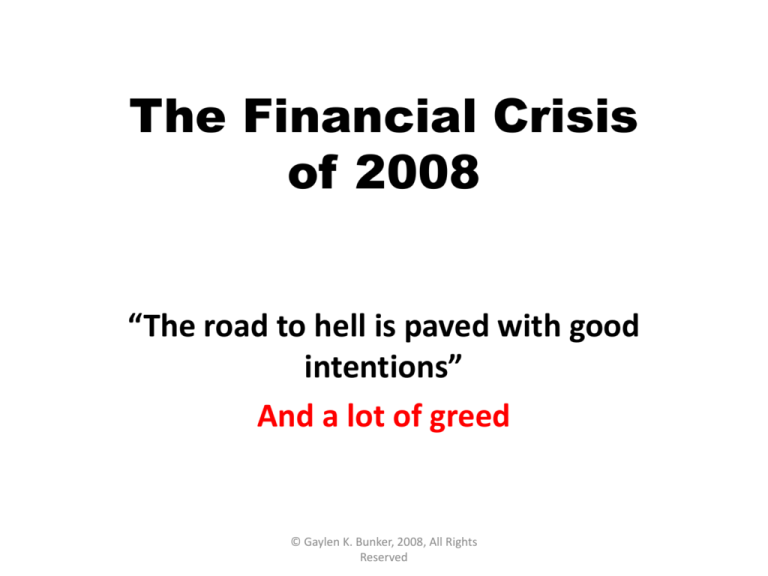

The Financial Crisis

of 2008

“The road to hell is paved with good

intentions”

And a lot of greed

© Gaylen K. Bunker, 2008, All Rights

Reserved

Clinton Administration

1. The Gramm-Leach-Bliley Act of 1999:

–De-regulated the banking industry (competition)

–Sub-prime mortgages (help the poor)

–Complex derivatives (mortgage backed

securities – more options and insurance)

2. The "dot-com bubble“ of the 1990s burst

climaxing in Aug of 2000 when the

S & P 500 peaking above 1500

3. Enron exposed manipulation of accounting--(Sarbanes-Oxley: Fannie and Freddie Excluded)

© Gaylen K. Bunker, 2008, All Rights

Reserved

Distribution of Income: 2006

The poorest 20% of the population makes 3.4% of the income

3.4

8.6

14.5

Lowest Fifth

Second Fifth

50.5

Third Fifth

Fourth Fifth

Highest Fifth

22.9

The richest 20% of the population makes 50.5% of the income

© Gaylen K. Bunker, 2008, All Rights

Reserved

S & P 500 Industrials

1800

1600

1400

1200

1000

800

600

400

200

0

© Gaylen K. Bunker, 2008, All Rights

Reserved

Push for lowering credit standards

In the Winter 2000 edition of the City Journal Howard

Husock reported how Bill Clinton's Administration

forced banks to loan large sums of money to high risk

projects in inner cities. The Democrats in Congress and

the White House forced banks to lower their

investment standards in order to…help poor people.

http://www.parapundit.com/archives/005558.html

© Gaylen K. Bunker, 2008, All Rights

Reserved

Alan Greenspan

Fed Res Chair 1987 to 2006

Greenspan said as chairman at the Federal Reserve System's

Fourth Annual Community Affairs Research Conference,

Washington, D.C. April 8, 2005.

“Innovation has brought about a multitude of new

products, such as subprime loans… Such

developments are representative of the market

responses that have driven the financial services

industry throughout the history of our country. With

these advances in technology, lenders have taken

advantage of credit-scoring models and other

techniques for efficiently extending credit to a broader

spectrum of consumers.”

© Gaylen K. Bunker, 2008, All Rights

Reserved

Alan Greenspan (con’t)

“It was our job to unfreeze the American

banking system if we wanted the economy

to function. This required keeping interest

rates modestly low,”

© Gaylen K. Bunker, 2008, All Rights

Reserved

Alan Greenspan (con’t)

“The development of a broad-based secondary

market for mortgage loans also greatly expanded

consumer access to credit. By reducing the risk of

making long-term, fixed-rate loans and ensuring

liquidity for mortgage lenders, the secondary

market helped stimulate widespread competition

in the mortgage business.”

© Gaylen K. Bunker, 2008, All Rights

Reserved

Alan Greenspan (con’t)

“The mortgage-backed security helped

create a national and even an international

market for mortgages, and market support

for a wider variety of home mortgage loan

products became commonplace,”

© Gaylen K. Bunker, 2008, All Rights

Reserved

Fannie Mae (10K) Dec 31, 2007

The following diagram illustrates the basic process by which we create a typical Fannie Mae MBS

in the case where a lender chooses to sell the Fannie Mae MBS to a third-party investor.

Trying to add liquidity

to the market

© Gaylen K. Bunker, 2008, All Rights

Reserved

Credit Default Swaps

A credit default swap (CDS) is a contract in which

the buyer makes a series of payments to the seller

and, in exchange, receives a payoff if a credit

instrument goes into default. Credit insurance

Credit Default Swaps can be bought by any

investor; it isn’t necessary for the buyer to own the

underlying credit instrument.

© Gaylen K. Bunker, 2008, All Rights

Reserved

The System and AIG

© Gaylen K. Bunker, 2008, All Rights

Reserved

Mortgage Rate History

Interest rates

began a long

decline early in

2001

http://mortgage-x.com/general/historical_rates.asp

© Gaylen K. Bunker, 2008, All Rights

Reserved

Home sales

reached their peak

in 2005

© Gaylen K. Bunker, 2008, All Rights

http://calculatedrisk.blogspot.com/2008/06/existing-home-sales-not-seasonally.html

Reserved

Speculators & Flippers

"Historically, roughly 3 percent of all houses

nationally are bought for investment purposes.

During the 2004-06 period, as much as 25-35

percent of houses in hot real estate markets -such as southern Florida, Las Vegas, and

California -- were bought by investors and

speculators."

Robert F. Wescott, Ph.D.

President, Keybridge Research LLC

© Gaylen K. Bunker, 2008, All Rights

Reserved

© Gaylen K. Bunker, 2008, All Rights

http://mysite.verizon.net/vzeqrguz/housingbubble/

Reserved

Oct 2004

House hearing on Fannie Mae

Ruben Hinojosa: “Over the last 4 years, the United States

has suffered from immense job loss; an increase in the

number of people living in poverty; an incredible and

unsupportable switch from federal budget surplus to an

ever-growing budget deficit; [and] a tremendous increase in

the national debt.

“However, there is one sector of our economy that

has been performing well consistently, and that is the

housing market. It has served as the foundation of the U.S.

economy since the stock market declined. We need to

nurture it [and] ensure that nothing we do…harms it.”

© Gaylen K. Bunker, 2008, All Rights

Reserved

Oct 2004

House hearing on Fannie Mae

Barney Frank: “We have a subset of issues involving

affordable housing, and those are very important to many

of us. What derailed the [regulatory] legislation was an

insistence by the Bush administration on going beyond

safety and soundness and…not do these new products.

“There was an article by Gretchen Morgenson in the

New York Times on Sunday that said the problem is that

they have done too much to bring housing to people who

really cannot afford it and they have overextended by

lending money to people who were below the economic

level that should be there.

© Gaylen K. Bunker, 2008, All Rights

Reserved

William H. Donaldson

SEC Chairman (2003-2005)

“SEC decision allowed [five] firms

to legally violate existing net

capital rules that, in the past 30

years, had limited broker dealers

debt-to-net capital ratio to 12-to1. Instead, the 2004 exemption

allowed them to lever up 30 and

even 40 to 1. "

© Gaylen K. Bunker, 2008, All Rights

Reserved

1959: founded

Donaldson, Lufkin

& Jenrette.

Investment Bank

Grease the

wheels of credit

and growth.

Consumer Debt (pink) and Financial Profits (blue)

as a Percentage of GDP (John Watkins)

Drop Page Fields Here

140.00%

4.50%

4.00%

120.00%

3.50%

100.00%

3.00%

80.00%

2.50%

Data

2.00%

60.00%

1.50%

40.00%

1.00%

20.00%

0.50%

0.00%

1959

1960

1961

1962

1963

1964

1965

1966

1967

1968

1969

1970

1971

1972

1973

1974

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

0.00%

© Gaylen K. Bunker, 2008, All Rights

Year orReserved

quarter

0.00%

1959.

1960.

1961.

1962.

1963.

1964.

1965.

1966.

1967.

1968.

1969.

1970.

1971.

1972.

1973.

1974.

1975.

1976.

1977.

1978.

1979.

1980.

1981.

1982.

1983.

1984.

1985.

1986.

1987.

1988.

1989.

1990.

1991.

1992.

1993.

1994.

1995.

1996.

1997.

1998.

1999.

2000.

2001.

2002.

2003.

2004.

2005.

2006.

2007:III

Financial Profits as a Percentage of GDP

(John

Drop Watkins)

Page Fields Here

4.50%

4.00%

3.50%

3.00%

2.50%

Data

Sum of Other Financial/GDP

2.00%

Sum of Fed Res Banks/GDP

1.50%

1.00%

0.50%

© Gaylen

K. Bunker, 2008, All Rights

Year or quarter

Reserved

Mortgage Rate History

http://mortgage-x.com/general/historical_rates.asp

© Gaylen K. Bunker, 2008, All Rights

Reserved

Hurricane Katrina

Hurricane Katrina was the costliest hurricane, as

well as one of the five deadliest, in the history of the United

States. It formed over the Bahamas on August 23, 2005,

and crossed southern Florida. The most severe loss of life

and property damage occurred in New Orleans, Louisiana.

At least 1,836 people lost their lives in the actual

hurricane and in the subsequent floods.

The storm is estimated to have been responsible for

$81.2 billion (2005 U.S. dollars) in damage, making it the

costliest tropical cyclone in U.S. history.

© Gaylen K. Bunker, 2008, All Rights

Reserved

A decline in building permits was caused by:

1. Mortgage rates have risen steadily over the last

10 weeks, [and] Higher rates tend to depress

demand for housing.

2. In addition, prices for lumber, concrete and other

building materials have jumped in the wake of

Hurricane Katrina.

3. The steady rise in new home prices in recent

years has also helped put the brakes on building.

Prices create their own drag on the market.

http://money.cnn.com/2005/11/17/news/economy/housingstarts/index.htm

© Gaylen K. Bunker, 2008, All Rights

Reserved

Housing Starts

© Gaylen K. Bunker, 2008, All Rights

Reserved

Warren Buffett

"It's only when the tide goes out that

you learn who's been swimming

naked."

© Gaylen K. Bunker, 2008, All Rights

Reserved

Mort Zuckerman

Publisher/owner of the New York Daily News since 1993 and

Editor-in-Chief of U.S. News & World Report since 2007.

“The single greatest contributor to the housing

bubble was Fannie and Freddie. Everybody

knew these were two government sponsored

institutions out of control. They made over 600

billion dollar investment in sub-prime

mortgages in the first six years of this century.

Paulsen, when he said the core of the problem

was the collapse of housing---that’s where it all

started in the sub-prime field.”

McLaughlin Group Sep, 21, 2008

© Gaylen K. Bunker, 2008, All Rights

Reserved

Mort Zuckerman (con’t)

Publisher/owner of the New York Daily News since 1993 and

Editor-in-Chief of U.S. News & World Report since 2007.

Cox, the SEC commissioner was the man who

sat there while they doubled and even tripled

the ability of financial houses to use leverage.

They went from a maximum of twelve to one to

as high as forty to one. This is what happened

on the other side---the over uses of leverage

that compounded the problem in the housing

world and vice versa.”

McLaughlin Group Sep, 21, 2008

© Gaylen K. Bunker, 2008, All Rights

Reserved

© Gaylen K. Bunker, 2008, All Rights

http://mysite.verizon.net/vzeqrguz/housingbubble/

Reserved

Morgan Stanley (10K) Dec 31, 2007

The Company recorded $9.4 billion in mortgagerelated writedowns in the fourth quarter of fiscal

2007 resulting from an unfavorable subprime

mortgage-related trading strategy and the

continued deterioration and lack of market liquidity

for subprime and other mortgage-related

instruments. Included in the $9.4 billion were

writedowns of $7.8 billion related to U.S. subprime

trading positions, principally super senior

derivative positions in CDOs.

© Gaylen K. Bunker, 2008, All Rights

Reserved

S & P 500 Industrials

1800

1600

1400

1200

1000

800

600

400

200

0

© Gaylen K. Bunker, 2008, All Rights

Reserved

Unemployment Rate Nov ‘07 to Nov ’08

(in thousands)

Emp’d

11/07

Occupation

Emp’d

11/08

UnEm

11/07

UnEm

11/08

%

11/07

%

11/08

Total

Chng

% of

Total

Mgmt, Prof & related occupations

52348

53274

963

1786

1.8%

3.4%

823

27.1%

Service occupations

23763

24595

1651

1898

6.9%

7.7%

247

8.1%

Sales and Office occupations

36260

35205

1579

2304

4.4%

6.5%

725

23.9%

Nat'l res, constr & maint. occupations

16011

14480

955

1587

6.0%

11.0%

632

20.8%

Prod'n, transp. & Mat'l occupations

18636

17055

1117

1726

6.0%

10.1%

609

20.1%

147018 144609

6265

9301

4.3%

6.4%

Total

http://www.bls.gov/news.release/empsit.t10.htm

© Gaylen K. Bunker, 2008, All Rights

Reserved

3036 100.0%

The distribution of millionaires in the main regions of the world:

•North America - 2.9 million

•Europe - 2.8 million

•Asia-Pacific - 2.4 million

•Latin America- 0.3 million

•Middle East - 0.3 million

•Africa - 0.1 million

“If all the

national of

the world

are in debt,

where did

the money

go?”

Reader’s Digest,

Jan. ‘09

http://ww-success.com/blog/index.php/2006/10/16/millionaires-in-the-world/

© Gaylen K. Bunker, 2008, All Rights

Reserved

Remedy

“We do not need much more regulation

other than to put a ceiling on leverage by

investment banks and to impose, and

enforce, market-based regulations. Marketbased regulations will do away with

bureaucrats riding a turtle while trying to

catch up to a race horse.”

VALERIANO F. GARCIA (executive director of the World

Bank from 1998 to 2000)

© Gaylen K. Bunker, 2008, All Rights

Reserved

Ludwig von Mises

“Business cycle result from central-bank

generated loose money and cheap credit, and

the cycle can only be made worse by

intervention.

The Causes of the Economic Crisis: And

Other Essays Before and After the Great

Depression, 1931

© Gaylen K. Bunker, 2008, All Rights

Reserved

http://www.opensecrets.org/news/2008/09/update-fannie-mae-and-freddie.html

© Gaylen K. Bunker, 2008, All Rights

Reserved

Lynn E. Turner

We began the decade with names such as

1. Enron and Worldcom,

2. followed by the revelations regarding Wall Street

analysts misleading investors,

3. then on to the mutual fund late trading and market

timing scandal,

4. then the stock option back dating at companies such

as United Health, and

5. now we find ourselves in the midst of the subprime

fiasco.

© Gaylen K. Bunker, 2008, All Rights

Reserved

Lynn E. Turner (con’t)

The problem was:

Subprime loans: A high risk of not being repaid.

Executive Pay: hundreds times average employee.

Credit Rating Agencies compromised independence

Accounting Standards failed to provide transparency.

Due Diligence required of investment banks was

deficient.

“Cheap” debt fueled high levels of liquidity risks.

Regulation was “a turtle chasing a race horse.”

© Gaylen K. Bunker, 2008, All Rights

Reserved

Resets are coming

© Gaylen K. Bunker, 2008, All Rights

Reserved

Freedom versus Equality

“Nature smiles at the union of freedom and

equality in our utopias. For freedom and equality

are sworn and everlasting enemies, and when one

prevails the other dies. Leave men free, and their

natural inequalities will multiply almost

geometrically. Utopias of equality are biologically

doomed, and the best that the amiable philosopher

can hope for is an approximate equality of legal

justice and educational opportunity.”

Will and Ariel Durant, The Lessons of History, pg 20

© Gaylen K. Bunker, 2008, All Rights

Reserved

2006 Data (billions)

Gross Domestic Product:

$13,195

National Health Expenditures 2,105

Private 53% of NHE

1,135

Public 46% of NHE

970

Medicare (65+)

Medicaid (Poor)

VA and Military

Children 0-18

(27% of Population)

© Gaylen K. Bunker, 2008, All Rights

Reserved

100%

16%

The Bunker Curve

(an organic approach)

Vision, Innovation, Creativity

High demand valued service

Benefit greater than Cost

© Gaylen K. Bunker, 2008, All Rights

Reserved

Keep commitments

© Gaylen K. Bunker, 2008, All Rights

Reserved