US Retail - Beedie School of Business

advertisement

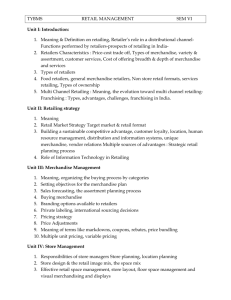

US Retailers Present by Karen Lin & Haoying Guo Industry Analysis Retail Sector • Establishments engaged in retailing merchandise • Generally without transformation • Final step in the distribution of merchandise Retail Sector • Highly Competitive Industry • Common Factors influence the industry: – – – – – – – Cost of goods Consumer debt level Economic condition Customer preference Inflation Employment Weather Pattern Retailers In the U.S. Economy • Retailer trade takes up: – 11.7% of national employment – 12.9% of all establishments • In 2003, the average retail trade employment is 14,911,500 • In 2003,nonsupervisory workers' average hourly earnings were $11.90 Monthly Sales For Retail In Millions 2005 Jan 2004 Dec 2004 Nov 2004 Oct 313,730 315,078 311,555 292,856 Estimated Annual Sales: 3.6 Trillions Value Retailing • Definition: – The business of retailing famous-name, quality merchandise at prices at least 25% below the regular retail price. • Most large retailers are belong to this catalog. (Such as Wal-Mart and Home Dept) • The value retailing sector’s share of total retail sales is 7.5% Wal-Mart Wal-Mart at a Glance Wal-Mart Stores, Inc. is the world's largest retailer The company employs more than 1.5 million associates worldwide More than 138 million customers per week visit Wal-Mart stores worldwide Senior Officers H. Lee Scott --- President and CEO Named in January 2000 25-year veteran Other Senior Officers Promoted internally Operations Wal-Mart Stores Includes: Discount Stores, Supercenters and Neighborhood Markets SAM’S CLUB International comprised of wholly owned operations in Argentina, Canada, Germany, South Korea, Puerto Rico and the U,K, the operations of joint ventures in China and operations of majority-owned subsidiaries in Brazil and Mexico. U.S. Domestic Competitors Key Success Factors Do the same things as other retailers but Better "Every Day Low Prices" Technology Sales data sharing with major suppliers Lasting Relationships with Suppliers One-to-one relationship with medium and small suppliers. How Wal-Mart Grows Building new stores and Clubs in the attractive sites. Recent Strategy: move towards grocery side Adding more “Neighborhood Markets” Expansion of 2004 Domestic 139 new Wal-Mart Stores 130 conversions and/or relocations from Discount Stores to Supercenters 13 SAM’S CLUBs opened International Square footage increased approximately 46 million square feet (or 8%) Negative Impact of New Stores Additional stores take sales away from existing units. The comparative store sales will be reduced by approximately 1%. Performance of 2004 Total Company net sales increased 11.6% from fiscal 2003 to $256.3 billion. Total Assets increased 10.7% to $104.9 billion International segment had an operating profit increase of 18.6% and a sales increase of 16.6% 4 billion tax paid takes up 1/446 of the total U.S. Federal taxes Income Statement (millions) Ratios 2004 2003 2002 Gross Margin 22.5% 22.3% 22.0% (SG&A)/(Net Sales) 17.5% 17.4% 17.2% (Interest costs)/(Net Sales) (Net Income)/(Net Sales) 0.32% 0.42% 0.58% 3.53% 3.46% 3.23% Segments Ratios Balance Sheet Cash Flow Statement Stocks Initial Public Offering in 1970 200,000 shares for $16.5 per share Up to March 14, 2005 4,234,866,944 shares outstanding (11 Stock splits) $51.60 per share Annual rate of return from 1970 to 2005 29.56% per year Dividend Began paying dividends in 1974 Increased the annual dividend payment every year Paid out more than $11 billion to shareholders 2004, the annual dividend payment increased by 44% Share Repurchase Wal-Mart also has a share-repurchase program Since beginning the program, Wal-Mart has repurchased more than $13 billion in shares. In 2004, Board of Directors authorized the repurchase of another $7 billion Options 1-year Stock Chart 1-years Comparison Some Measures Total Cash Per Share (mrq):1.3 Return on Assets (ttm):9.36% Return on Equity (ttm):22.99% Book Value Per Share (mrq):11.621 Dividend Yield:1.16% 5-years Stock Chart 5-year Comparison Stock Chart Since Beginning Can Wal-Mart Still Grow? There is definitely room for growth: In U.S., Wal-Mart sales are less than 10 percent of the retail market. Even smaller market share outside US. Problems: The same business model works everywhere? Intensive competitions in international market. Recommendation No one can beat Wal-Mart Owns lots resource and quite experienced in Retailing Takes time to expand internationally In one year time zone, the Stock price is lowest. Buy For Long Term Investment Retail Industry in Home Improvement Home centers, lumberyard, and hardware stores were primary retail outlets. US Retail Sales of Home Improvement Products, by Type of Store, 1998: Industry Overview Traditional retailers: lumberyards & hardware stores. Home centre A combination of the two Size, concentration on the homeowner, one-stop shopping, self-service, customer convenience Warehouse-type Home Centre Created markets by making DIY materials affordable and accessible Competition leads to acquisition & consolidation (1) Home Depot (1/3 market share, 12.9%) Competitors: Lowe’s Companies, Menard, Hechinger, Payless Cashways Consumer Professional builder Contractor DIYer Boomers are key in home improvement market New market: Female homeowner About The Home Depot Second largest retailer in the U.S. Funded in 1978 in Atlanta, Georgia. Co-founder: Arthur Blank & Bernard Marcus The world’s largest home improvement retailer. Operates more than 1,800 stores across North America. Also in Mexico, the District of Columbia, and Puerto Rico. Brisk pace in store expansion from less than 100 stores in 1989 to almost 800 in 1999. Owns 82% of real estate. Leadership Robert (Bob) L. Nardelli Chairman, President and CEO Joined HD in December 2000. Former president and CEO of GE Power Systems. Strategy: Enhancing the core retail network through distinctive and innovative merchandise, store modernization and technology investment; extending its business through new store formats, online sales and installation services; and by expanding to new geographies and professional customer segments. Leadership – Exec. VP Francis Blake Business Development and Corporate Operations. (2002) John Costello Merchandising & Marketing. (November 2002) Robert DeRodes Executive Vice President & Chief Information Officer. (2002) Dennis Donovan Human Resources (April 2001) Frank Fernandez Secretary and General Counsel (April 2001) Tom Taylor Home Depot Stores (1984) Carol B. Tomé Executive Vice President & Chief Financial Officer (1995) 3 Business Segments Home Depot Flagship Stores First three stores opened in Atlanta in 1979. U.S. and Canadian stores range in size from 45,000 square feet to 165,000 square feet (avg. 106,000 sq. feet of enclosed space + 22,000 sq. feet in the outside garden area.) Sells 40,000 to 50,000 different kinds of home improvement supplies, building materials, and lawn and garden products. How-To Clinics, At-Home ServicesSM, Tool Rental Centers, Truck Rental. National brands account 88%+ of the merchandise in the stores. Exclusive brands EXPO Design Center Over 50 stores in major markets in 16 states and growing Cater to design professionals with home decorating products & services. Full design and installation services with project superintendents to oversee complete job Other Home Depot Stores Supply stores for commercial & industrial customers. Landscape Supply stores for landscape & garden pros. Merchandise Selection & Sales Stores’ merchandise selection is based on particular customer and climate need, and on local building code requirements. Different stores don’t carry the same products, due to different merchandise demands in different geographical areas. 34% building materials, lumber, floor & wall coverings 27% plumbing, heating, lighting, electrical supplies 15% seasonal & specialty items 14% hardware & tools 10% paint and other products Key Success Factors Economies of scale Low price Level of customer service Wide array of products “We are credited with having revolutionized the home improvement industry by offering an unparalleled selection of products and services under one roof.” 3 Sources of Future Growth Open new stores. 24-hour Home Depot outlets Smaller villager’s hardware stores Urban format stores Cater to professional customers. Female Homeowners News - Summary Over past 4 years, The Home Depot has increased sales by 60% and earnings per share by 105%. Increase in cash dividends & share repurchase program. 2002 2003 2004 2005 Annual increase in Cash Dividend 20% 24% 25% 23% Share Repurchase Program + $2 billion + $1 billion Reach $7 billion + $2 billion Acquisition of home centres, supply companies, and distributors. Oct 10, 2002 - The Home Depot announce to open two sourcing offices in Shanghai and Shenzhen Recent Awards & Recognition 10 Best Boards in the United States, BusinessWeek (2002) No. 13 Ranking, Fortune 500 (2003) No. 22 Ranking in Profit, Forbes listing of America’s 500 Top Companies (2003) Top 20 Companies for Leaders, CEO Magazine (2002) Excellence in Employee Development, Retail Council of Canada (2002) Best Friend Award for work with local communities & youth, LA’s Best (2002) Flex Your Power Energy Conservation Award, Governor of California (2002) Operational Highlights 2003 Store count Average ticket Weighted avg. weekly sales per store Weighted avg. sales per sq. foot 1,707 % chg 11.4 2 2002 1,532 % chg 14.9 3 2001 1,333 $ $ $ 3.48 1.62 51.15 49.43 48.64 $763,00 (1.17) $772,00 (4.93) $812,00 0 0 0 $ 370.87 •By Oct. 31, 2004: 1754 stores. 0.18 $ 370.21 (4.57) $ 387.93 Financial Statements Financial Highlights – Income Statement USD$ (in million) 2003 % of Sales 2002 % of Sales $ 58,247 2001 Net Sales $ 64,816 $ 53,553 Gross Profit $ 20,580 31.75% $ 18,108 31.11% $ 16,147 Total Operating Expenses $ 13,734 21.19% $ 12,278 21.08% $ 11,215 Interest Expense $ (62) 0.096% $ (37) 0.064% $ 4,957 Net Income $ 4,304 6.64% $ 3,664 6.29% $ 3,044 2003 2003 vs. 2002 2002 2002 vs. 2001 2001 Basic Earning per Share $ 1.88 19.7% $ 1.57 20.77% $ 1.30 Diluted Earning per Share $ 1.88 20.5% $ 1.56 20.93% $ 1.29 # of Outstanding Shares 2,275,220 K (2.51%) 2,333,740 K # of Outstanding Shares (Jan 31, 2005): 2,195,960 K (0.52%) 2,345,888 K Financial Highlights – Balance Sheet 2003 $ 2,826 M $ 1.24 2002 $ 2,188 M $ 0.94 2001 $ 2,477 M $ 1.06 26.36% 27.78% 25.48% 58.26% 57.21% 58.25% $ 34,437 M $ 22,407 M $ 30,011 M $ 19,802 M $ 26,394 M $ 18,082 M ROA 12.50% 12.21% 11.53% ROE 19.21% 18.50% 16.83% Book Value per Share $ 11.041 Cash Cash / #of Shares Merchandise Inventories/Total Asset Net Property & Equip. / Total Asset Total Assets Stockholders’ Equity Financial Highlights – Statement of Cash Flows USD$ (in million) Net Cash from Operations Capital Expenditures Net Cash Used in Financing Activities Repurchase of Common Stocks Cash Dividends Paid to Stockholders 2003 2002 2001 $ 6,545 $ 4,802 $ 5,963 (3,508) (2,749) (3,393) (1,931) (2,165) (173) (1,554) (2,000) – (595) (492) (396) Free Cash Flow = CFO – Cap Exp – Preferred Div – Debt Repayment + New Debt Issues = $ 3,028 M Option – Exec. Compensation Option - continue Option - continue The Percent of Class column indicates beneficial ownership of less than 1%, based on 2,241,907,929 shares of common stock outstanding as of April 1, 2004 Derivatives Objective: to decrease the volatility of earnings and cash flow associated with fluctuations in interest rates. Several interest rate swaps with a total notional amount of $475M that swap fixed rate interest on our $500M 53/8% Senior Notes for variable interest rates equal to LIBOR plus 30 to 245 basis points and expire on April 1, 2006. At February 1, 2004, the fair market value of these agreements was $19 million. Direct Competitor Comparison Company HD Home Depot LOW Lowe’s Companies Retail Industry (Home Improve) Market Cap Employees Revenue Growth (ttm) Revenue (ttm) Gross Margin (ttm) EBITDA (ttm) Operating Margin (ttm) Net Income (ttm) EPS (ttm) P/E Ratio (ttm) 83.42B 299,000 11.30% 73.09B 33.42% 7.93B 10.84% 5.00B 2.258 16.82 43.78B 116,000 16.40% 36.46B 33.73% 4.61B 9.70% 2.18B 2.70 20.95 133.97M 5,190 K 13.10% 1.20B 25.23% 1.56M 2.48% 31.00M 1.58 16.49 Stock Quote – Summary Traded on the NYSE Included in the Dow Jones Industrial Average and Standard & Poor's 500 Index. Symbol: Current Price: 52-week Range: EPS (ttm): P/E Ratio (ttm): Dividend & Yield: Price/Sales (ttm): Price/Book (mrq): Beta: 1.279 HD $37.99 $32.34 - 44.30 $2.26 16.82 $0.40 (1.03%) 1.17 3.52 Stock Price – 1 Year Chart 1 Year Chart: Home Depot vs. Dow and S&P Stock Price – 5 Year Chart 5 Year Chart: Home Depot vs. Dow and S&P Stock Price – Since 1984 Recommendation Expansion opportunity in foreign market Canada & Mexico Pay out cash dividends Good return HD’s 1.03% vs. Lowe’s 0.28% BUY for long term investment