Review of aggregate production function

Economics 122

Macroeconomics in the long run:

Economic growth

1

Agenda

• Introductory background

• Essential aspects of economic growth

• Aggregate production functions

• Neoclassical growth model

• Simulation of increased saving experiment

• Debt, deficits, and growth

2

Great divide of macroeconomics

Aggregate demand and business cycles

Aggregate supply and “economic growth”

Review of aggregate production function

Y t

= A t

F(K t

, L t

)

K t

L t

= capital services (like rentals as apartment-years)

= labor services (hours worked)

A t g x

= level of technology

= growth rate of x = (1/x t

) dx t

/dt = Δ x t

/x t-1

= d[ln(x t)

)]/dt g

A

= growth of technology = rate of technological change = Δ A t

/A t-1

Constant returns to scale: λY t

= A means output increased by λ t

F(λK t

, λL t

), or all inputs increased by λ

Perfect competition in factor and product markets (for p = 1):

MPK = ∂Y/∂K = R = rental price of capital; ∂Y/∂L = w = wage rate

Exhaustion of product with CRTS:

MPK x K + MPL x L = RK + wL = Y

Alternative measures of productivity:

Labor productivity = Y t

/L t

Total factor productivity (TFP) = A t

= Y t

/F(K t

, L t

)

4

Review: Cobb-Douglas aggregate production function

Remember Cobb-Douglas production function: or

Y t

= A t

K t

α L t

1-α ln(Y t

)= ln(A t

) + α ln(K t

) +(1-α) ln(L t

)

Here α = ∂ln(Y t

)/∂ln(K t

) = elasticity of output w.r.t. capital;

(1-α ) = elasticity of output w.r.t. labor

MPK = R t

= α A t

K t

α-1 1-α = α Y t

/K t

Share of capital in national income = R t for share of labor.

L t

K t

/Y t

= α = constant. Ditto

5

Note 1. Cobb-Douglas p. f. implies that factor shares in national income are constant.

Note 2. Cobb-Douglas p. f. implies that growth in wages = growth in labor productivity (g w

= g

Y/L

)

6

The MIT School of Economics

Robert Solow

Paul Samuelson

7

Basic neoclassical growth model

Major assumptions:

1. Basic setup:

- full employment

- flexible wages and prices

- perfect competition

- closed economy

2. Capital accumulation: ΔK/K = sY – δK; s = investment rate = constant

3. Labor supply: Δ L/L = n = exogenous

4. Production function

- constant returns to scale

- two factors (K, L)

- single output used for both C and I: Y = C + I

- no technological change to begin with

- in next model, labor-augmenting technological change

5. Change of variable to transform to one-equation model: k = K/L = capital-labor ratio

Y = F(K, L) = LF(K/L,1) y = Y/L = F(K/L,1) = f(k), where f(k) is per capita production fn.

8

Major variables:

Y = output (GDP)

L = labor inputs

K = capital stock or services

I = gross investment w = real wage rate r = real rate of return on capital (rate of profit)

E = efficiency units = level of labor-augmenting technology (growth of E is technological

L

~ change = ΔE/E)

= efficiency labor inputs = EL = similarly for other variables with “

~

”notation)

Further notational conventions

Δ x = dx/dt g x

= growth rate of x = (1/x) dx/dt = Δx s = I/Y = savings and investment rate k = capital-labor ratio = K/L c = consumption per capita = C/L t

/x t-1

=dln(x i = investment per worker = I/L

δ = depreciation rate on capital y = output per worker = Y/L n = rate of growth of population (or labor force)

= g

L

= Δ L/L v = capital-output ratio = K/Y h = rate of labor-augmenting technological change t

)/dt

9

We want to derive “laws of motion” of the economy. To do this, start with:

5. Δ k/k = Δ K/K - Δ L/L

With some algebra, this becomes:

5’. Δ k/k = Δ K/K - n Y Δ k = sf(k) - (n + δ) k which in steady state is:

6. sf(k*) = (n + δ) k*

In steady state, y, k, w, and r are constant. No growth in real wages, real incomes, per capita output, etc.

ΔK/K = (sY – δK)/K = s(Y/L)(L/K) – δ

Δk/k = ΔK/K – n = s(Y/L)(L/K) – δ – n

Δk = k [ s(Y/L)(L/K) – δ – n]

= sy – (δ + n)k = sf(k) – (δ + n)k

10

y* y = Y/L i* =

(I/Y)* y = f(k)

(n+δ)k i = sf(k) k* k

11

Results of neoclassical model without TC

y* y = Y/L

Predictions of basic model:

– “Steady state”

– constant y, w, k, and r

– g

Y

= n i* =

(I/Y)* y = f(k)

(n+δ)k i = sf(k)

Uniqueness and stability of equilibrium.

– Equilibrium is unique

– Equilibrium is stable

(meaning k → k* as t → ∞ for all initial k

0

).

k* k

26

12

Now let’s step back a moment to consider the meaning of economic growth in the broader context.

13

General concepts

1. Growth involves potential output

Potential GDP = output if unemployment rate at NAIRU

Distinguish from business cycles, which is utilization of potential

Implicit assumption about business cycle: policy keeps economy near full employment

2. Most growth theories deal with dynamic version of full-employment, “classical”-type economy

This is closest thing to “consensus macroeconomics”

14

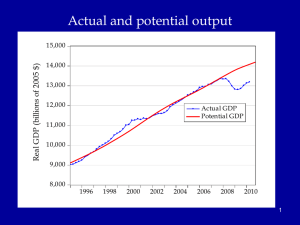

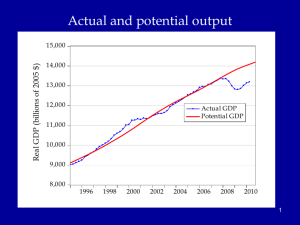

Actual and potential output

14,000

13,000

12,000

11,000

10,000

9,000

8,000

Actual GDP

Potential GDP (CBO)

7,000

90 92 94 96 98 00 02 04 06 08 10

15

General concepts

3. “Productivity isn't everything, but in the long run it is almost everything.”

- As we will see, in the long run, real wages and per capita income grow (almost) proportionally with labor productivity (= GDP per hour worked).

16

Growth in per capita income

(average, percent per year)

1.5

1.0

0.5

0.0

Data for Western Europe from Angus Maddison up to 1700

1700-1830

1830 to present

3.5

U.S. Productivity Growth in the 20 th Century

3

2.5

2

1.5

1

0.5

0

1899-2005 1899-1948 1948-1973 1973-1995 1995-2008

General concepts

4. Economic growth involves:

- increase in quantity (bushels of wheat)

- improved quality of goods and services

- new goods and services

19

Mining in rich and poor countries

D.R. Congo

Canada

20

Farming the rocks, Morocco, 2001

Medicine in rich and poor countries

Scan for lung cancer

African medicine man

22

Economic growth and improved health status:

Eradication of polio

Health: Disappearance of polio:

A benefit of growth that is not captured in the GDP statistics!

Historical Trends in Economic Growth in the US since 1800

1. Strong growth in Y

2. Strong growth in productivity (both Y/L and TFP)

3. Steady “capital deepening” (increase in K/L)

4. Strong growth in real wages since early 19 th C; g(w/p) ~ g(X/L)

5. Real interest rate and profit rate basically trendless

25

Share of compensation in national income

.70

.65

.60

.55

Fringe benefits:

(health, retirement, social insurance)

.50

Compensation/National income

Wages & salaries/National income

.45

1930 1940 1950 1960 1970 1980 1990 2000

Labor share of national income in US

- Slow increase over most of century

- Tiny decline in recent years as profits rose

- Big rise in fringe benefit share (and decline in wage share)

26

Growth trend, US, 1948-2008

2.0

1.6

1.2

0.8

ln(K) ln(Y) ln(hours)

0.4

0.0

50 55 60 65 70 75 80 85 90 95 00 05 g

X

= xxx/60;

So: g

Y

= 3.3% g

K

= 2.9% g

H

=1.5%

27

Results of neoclassical model without TC

Predictions of basic model without TC:

– “Steady state” property misses major trends of growth in y, w, and k.

– Missing element is technological change

28

First model omits technological change (TC).

Let’s see if we can fix up the problems by introducing TC.

What is TC?

- New processes that increase TFP (assembly line, fiber optics)

- Improvements in quality of goods (plasma TV)

- New goods and services (automobile, telephone, iPod)

Analytically, TC is

- Shift in production function. y = Y/L new f(k) old f(k) k* k

The greatest technological change in history

Thomas arithmometer, 1870 IBM/LANL Roadrunner

(10 -16 petaflops) (1.10 petaflops)

[petaflop = 10 15 floating point operations per second]

We take specific form which is “labor-augmenting technological change” at rate h.

For this, we need new variable called “efficiency labor units” denoted as E where E = efficiency units of labor and

~ indicates efficiency units.

L = E L

New production function is then y = Y/L new f(k)

Y , ( , )

,

where k / y / ( ) k*

Note: Redefining labor units in efficiency terms is a specific way of representing TC that makes everything work out easily. Other forms will give slightly different results. old f(k) k

T.C. for the Cobb-Douglas

In C-D case, labor-augmenting TC is very simple:

Y t

A

0 t

1

L = E L = E

0 e ht L t

Y t

A

0

K t

( E L t

) 1

Y t

A h (1 ) t K t

L t

1

So for C-D, labor augmenting is “output-augmenting” with a scalar adjustment of the labor elasticity.

32

y* i*=I*/Y*

Impact with labor-augmenting TC y ( )

( n ) k i ( ) k* k=K/L

Results of neoclassical model with labor-augmenting TC

For C-D case,

*

Set A 1 for simplicity, sk * ( n h k * s / ( ) 1/(1 ) y * ( *) s / ( ) /(1 )

Unique and stable equilibrium under standard assumptions:

Predictions of basic model:

– Steady state: constant y, w, k, and r

– Here output per capita, capital per capita, and wage rate grow at h.

– Labor’s share of output is constant.

– Hence, capture the basic trends!

34

ln (Y), etc.

Time profiles of major variables with TC ln (Y) ln (K) ln (L) time

35

Sources of TC

Technological change is in some deep sense “endogenous.”

But very difficult to model

Subject of “new growth theory”:

– explains TC as return to investment in research and human capital.

– Major difference from conventional investment is “public goods” nature of knowledge

– I.e., social return to research >> private return because of spillovers (externalities)

Major policy questions:

- research and development policy

- intellectual property rights (such as patents for drugs)

- big $ and big economic stakes involved

36

20,000

2,000

200

Now let’s move on to applications of economic growth theory

20

2

75 00 25 50 75 00 25 50 75 00 25 50

37

Several “comparative dynamics” experiments

• Change growth in labor force (immigration or retirement policy)

• Change in rate of TC

• Change in national savings and investment rate (tax changes, savings changes, demographic changes)

Here we will investigate only a change in the national savings rate.

38

Two faces of saving

39

Government debt and deficits and the economy:

What is the effect of deficit reduction on the economy?

1. A. In short run, with constant real interest rate:

• contractionary (straight Keynesian effect in IS-LM analysis)

B. In short run, with full monetary response:

(neoclassical synthesis, Samuelson-Tobin policy)

• first have fiscal tightening

• then have monetary response with output/inflation targets that offsets fiscal contraction

• no impact on U or short-run Q

• have higher public and national savings rate

3. In long-run, neoclassical growth model

- higher s rate leads to a higher trajectory for K, Y, w, etc.

- numerical example with Cobb-Douglas

40

y** y*

Impact of Higher National Saving y = f(k) i = s

2 f(k) i = s

1 f(k)

(I/Y)*

(n+ δ)k k* k** k

41

Numerical Example of 1993 Budget Act in

Neoclassical Growth Model

Assumptions:

1. Production is by Cobb-Douglas with CRTS

2. Labor plus labor-augmenting TC:

1. n = 1.5 % p.a.; h = 1.5 % p.a.

3. Full employment; constant labor force participation rate.

4. Savings assumption: a. Private savings rate = 18 % of GDP b. Initial govt. savings rate = minus 2 % of GDP c. In 1992, govt. changes fiscal policy and runs a surplus of 2 % of GDP d. All of higher govt. S goes into national S (i.e., constant private savings rate)

5. “Calibrate” to U.S. economy

42

Impact of Increased Government Saving on Major Variables

1990 1995 2000 2005 2010

35%

30%

25%

Consumption per capita

GDP per capita

Capital per capita

NNP per capita

20%

15%

- Note that takes 10 years to increase C

-Political implications

- Must C increase?

- No if k>k goldenrule

10%

5%

0%

-5%

-10%

43

Results on Growth Rates:

Growth rates of Potential

NNP

NNP per GDP per Consumption capita capita per capita

1982-1992

1992-2002

2002-2012

2012-2052

2052-2092

3.02%

3.28%

3.11%

3.03%

3.02%

1.50%

1.75%

1.59%

1.51%

1.50%

1.50%

1.97%

1.69%

1.53%

1.50%

- Modest impact on growth in short run

- Consumption down then up

- No impact on growth in long run

- GDP v NNP (remember that GDP excludes earnings on foreign assets)

1.50%

1.47%

1.69%

1.53%

1.50%

44

What if savings in an open economy?

• For small open economy

– What happens if savings rate increases?

– In this case the marginal investment is abroad!

– Therefore, same result, but impact is upon net foreign assets, investment earnings, and not on domestic capital stock and domestic income.

– No diminishing returns to investment (fixed r)

– Will show up in NNP not in GDP!

(Most macro models get this wrong.)

• Large open economy like US:

– Somewhere in between small open and closed.

– I.e., some increase in domestic I and some in increase net foreign assets

45

Open economy with mobile financial capital ( r = world r = r w )

NX = S - I

S r = real interest rate r = r w

NX deficit

I(r)

I, S, NX

46

With higher saving in small open economy r = real interest rate

S

0

S

1

Higher saving:

1. No change I

2. No change GDP

3. Higher foreign saving

4. Increase GNP, NNP

Final NX surplus r = r w

Original

NX deficit

I(r)

0 I, S, NX

47

Conclusions on Fiscal Policy and Economic

Growth

• Fiscal policy affects economic growth through impact of government surplus through national savings rate

• Increases potential output through:

– higher capital stock for domestic investment

– higher income on foreign assets for foreign investment

• Consumption decreases at first then catches up after a decade or so

48

Growth Accounting

Growth accounting is a widely used technique used to separate out the sources of growth in a country relies on the neoclassical growth model

Derivation

Start with production function and competitive assumptions. For simplicity, assume a Cobb-Douglas production function with laboraugmenting technological change:

(1) Y t

= A t

K t

α L

Take logarithms: t

1-α

(2) ln(Y t

) = ln(A t

)+ α ln(K t

) + (1 - α) ln(L t

)

Now take the time derivative. Note that ∂ln(x)/∂x=1/x and use chain rule:

(3) ∂ln(Y t

)/∂t= g[Y t

] = g[A t

] )+ α g[K t

] + (1 - α) g[L t

]

In the C-D production function (see above), ) α is the competitive share of K sh(K); and (1 - α) the competitive share of labor sh(L).

(4) g[Y t

] = g[A t

] + sh(K) g[K t

] + (1 – sh(L)) g[L t

]

From this, we estimate the rate of TC as:

(5) g[A t

] = g[Y t

] –{sh(K) g[K t

] + (1 – sh(L)) g[L t

]}

50

(1) Y t

= A t

K t

α L

Take logarithms: t

1-α

(2) ln(Y t

) = ln(A t

)+ α ln(K t

) + (1 - α) ln(L t

)

Now take the time derivative. Note that ∂ln(x)/∂x=1/x and use chain rule:

(3) ∂ln(Y t

)/∂t= g[Y t

] = g[A t

] )+ α g[K t

] + (1 - α) g[L t

]

In the C-D production function (see above), ) α is the competitive share of K sh(K); and (1 - α) the competitive share of labor sh(L).

(4) g[Y t

] = g[A t

] + sh(K) g[K t

] + (1 – sh(L)) g[L t

] while growth in per capita output is:

(5) g[Y t

/L t

] = g[A t

] + sh(K) (g[K t

] - g[L t

])

From this, we estimate the rate of TC as:

(5) g[A t

] = g[Y t

] –{sh(K) g[K t

] + (1 – sh(L)) g[L t

]}

Note that this is a very practical formula. All terms except h are observable.

Can be used to understand the sources of growth in different times and places.

51

Some applications

1. Clinton’s growth policy (see above)

2. U.S. growth since 1948

3. China in central planning and reform period

4. Soviet Union growth, 1929 - 1965

The very rapid (measured) growth in the Soviet economy came primarily from growth in inputs, not from TFP growth.

5. Japanese growth, 1950-75

Japan had very large TFP growth after WWII. Wide variety of sources, including adoption of foreign

6. Supply-side economics (Reagan 1981-89; Bush II 2001-2009)

- To follow

52

Business sector of US

Growth in:

Output

Output per hour

Total factor productivity

Period

1948-73 1973-95 1995-2002

4.01

3.30

2.10

3.08

1.50

0.55

3.74

2.96

1.21

Source: BLS, http://www.bls.gov/news.release/prod3.t01.htm

53

GDP: China

Growth in:

Output

Capital

Labor

Combined inputs

Total factor productivity

Period:

1952-78 1978-98

5.82

9.27

7.13

2.54

4.38

1.44

9.02

2.78

5.27

3.99

Source: Source: G. Chow, Accounting for Growth in Taiwan and Mainland

China. Assumes Cobb-Douglas aggregate production function with elasticity of K = 0.4.

54

TFP, Soviet Union

Source: William Easterly and Stanley Fischer,”The Soviet economic decline : historical and republican data,” World Bank Research Working Paper no. 1284, 1994.

55

Promoting Technological Change

Much more difficult conceptually and for policy:

- TC depends upon invention and innovation

- Market failure: big gap between social MP and private MP of inventive activity

- No formula for discovery analogous to increased saving

Major instruments:

- Intellectual property rights (create monopoly to reduce MP gap): patents, copyrights

- Government subsidy of research (direct to Yale; indirect through

R&D tax credit)

- Rivalry but not perfect competition in markets (between

Windows and Farmer Jones)

- For open economy, openness to foreign technologies and management

56