Review of aggregate production function

advertisement

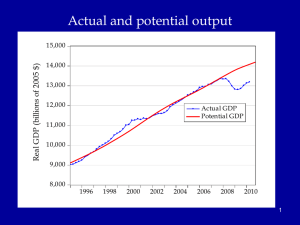

Actual and potential output Real GDP (billions of 2005 $) 15,000 14,000 13,000 12,000 Actual GDP Potential GDP 11,000 10,000 9,000 8,000 1996 1998 2000 2002 2004 2006 2008 2010 1 Agenda • • • • • • Introductory background Essential aspects of economic growth Aggregate production functions Neoclassical growth model Simulation of increased saving experiment Then in the last week: deficits, debt, and economic growth 2 Great divide of macroeconomics Aggregate supply and “economic growth” Aggregate demand and business cycles How do they fit together? Examples of why Keynesian Classical In long run, prices and wages are flexible. In long run, expectations are accurate. In long run, entry and exit make economy more competitive. All these make long-run look more classical than short run. 4 AS-AD in short, medium, long run AS long run π AS medium run AS short run πt AD Yt* = potential output Y Review of aggregate production function Yt = At F(Kt, Lt) Kt = capital services (like rentals as apartment-years) Lt = labor services (hours worked) At = level of technology gx = growth rate of x = (1/xt) dxt/dt = Δ xt/xt-1 = d[ln(xt))]/dt gA = growth of technology = rate of technological change = Δ At/At-1 Constant returns to scale: λYt = At F(λKt, λLt), or all inputs increased by λ means output increased by λ Perfect competition in factor and product markets (for p = 1): MPK = ∂Y/∂K = R = rental price of capital; ∂Y/∂L = w = wage rate Exhaustion of product with CRTS: MPK x K + MPL x L = RK + wL = Y Alternative measures of productivity: Labor productivity = Yt/Lt Total factor productivity (TFP) = At = Yt /F(Kt, Lt) 6 Review: Cobb-Douglas aggregate production function Remember Cobb-Douglas production function: or Yt = At Kt α Lt 1-α ln(Yt)= ln(At) + α ln(Kt) +(1-α) ln(Lt) Here α = ∂ln(Yt)/∂ln(Kt) = elasticity of output w.r.t. capital; (1-α ) = elasticity of output w.r.t. labor MPK = Rt = α At Kt α-1 Lt 1-α = α Yt/Kt Share of capital in national income = Rt Kt /Yt = α = constant. Ditto for share of labor. 7 The MIT School of Economics Robert Solow (1924 - ) Paul Samuelson (1915-2009) 8 Basic neoclassical growth model Major assumptions: 1. Basic setup: - full employment - flexible wages and prices - perfect competition - closed economy 2. Capital accumulation: ΔK/K = sY – δK; s = investment rate = constant 3. Labor supply: Δ L/L = n = exogenous 4. Production function - constant returns to scale - two factors (K, L) - single output used for both C and I: Y = C + I - no technological change to begin with - in next model, labor-augmenting technological change 5. Change of variable to transform to one-equation model: k = K/L = capital-labor ratio Y = F(K, L) = LF(K/L,1) y = Y/L = F(K/L,1) = f(k), where f(k) is per capita production fn. 9 Major variables: Y = output (GDP) L = labor inputs K = capital stock or services I = gross investment w = real wage rate r = real rate of return on capital (rate of profit) E = efficiency units = level of labor-augmenting technology (growth of E is technological change = ΔE/E) ~ ~ L = efficiency labor inputs = EL = similarly for other variables with “ ”notation) Further notational conventions Δ x = dx/dt gx = growth rate of x = (1/x) dx/dt = Δxt/xt-1=dln(xt)/dt s = I/Y = savings and investment rate k = capital-labor ratio = K/L c = consumption per capita = C/L i = investment per worker = I/L δ = depreciation rate on capital y = output per worker = Y/L n = rate of growth of population (or labor force) = gL = Δ L/L v = capital-output ratio = K/Y h = rate of labor-augmenting technological change 10 We want to derive “laws of motion” of the economy. To do this, start with: 5. Δ k/k = Δ K/K - Δ L/L With some algebra, this becomes: 5’. Δ k/k = Δ K/K - n Y Δ k = sf(k) - (n + δ) k which in steady state is: 6. sf(k*) = (n + δ) k* In steady state, y, k, w, and r are constant. No growth in real wages, real incomes, per capita output, etc. ΔK/K = (sY – δK)/K = s(Y/L)(L/K) – δ Δk/k = ΔK/K – n = s(Y/L)(L/K) – δ – n Δk = k [ s(Y/L)(L/K) – δ – n] = sy – (δ + n)k = sf(k) – (δ + n)k 11 Mathematical note We will use the following math fact: Define z = y/x Then (1) (Growth rate of z) = (growth rate of y) – (growth rate of x) Or gz = gy - gx Proof: Using logs: ln(zt) = ln(yt – ln(xt) Taking time derivative: [dzt/dt]/zt = [dyt/dt]/yt - [dxt/dt]/xt which is the desired result. Note that we sometimes use the discrete version of (1), as we did in the last slide. This has a small error that is in the order of the size of the time step or the growth rates. For example, if gy = 5 % and gx = 3 %, then by the formula gz = 2 %, while the exact calculation is that gz = 1.9417 %. This is close enough for most purposes. 12 y = Y/L y* y = f(k) (n+δ)k i = sf(k) i* = (I/Y)* k* k 13 Results of neoclassical model without TC y = Y/L Predictions of basic model: – “Steady state” – constant y, w, k, and r – gY = n Uniqueness and stability of equilibrium. – Equilibrium is unique – Equilibrium is stable (meaning k → k* as t → ∞ for all initial k0). y* y = f(k) (n+δ)k i = sf(k) i* = (I/Y)* k* k 26 14 Historical Trends in Economic Growth in the US since 1800 1. Strong growth in Y 2. Strong growth in productivity (both Y/L and TFP) 3. Steady “capital deepening” (increase in K/L) 4. Strong growth in real wages since early 19th C; g(w/p) ~ g(X/L) 5. Real interest rate and profit rate basically trendless 15 Share of compensation in national income .70 Fringe benefits: (health, retirement, social insurance) Labor share of national income in US .65 - Slow increase over most of century - Tiny decline in recent years as profits rose - Big rise in fringe benefit share (and decline in wage share) .60 .55 .50 Compensation/National income Wages & salaries/National income .45 1930 1940 1950 1960 1970 1980 1990 2000 16 Growth trend, US, 1948-2008 2.0 gX = xxx/60; ln(K) ln(Y) ln(hours) 1.6 So: gY = 3.3% 1.2 gK = 2.9% gH=1.5% 0.8 0.4 0.0 50 55 60 65 70 75 80 85 90 95 00 05 17 Problem with neoclassical model without TC Simplest model misses major trends of growth in y, w, and k. Missing element is technological change 18 Further thoughts on growth 1. Growth involves potential output (not business cycles) 2. Growth theories deal with dynamic version of fullemployment, “classical”-type economy 3. Economic growth involves: - increase in quantity (tons of coal) - improved quality (safer cars) - new goods and services (computer replaces typewriter) 19 The greatest technological change in history Thomas arithmometer, 1870 (10-16 petaflops) China’s Tianhe-1A (2.5 petaflops) [petaflop = 1015 floating point operations per second] Mining in rich and poor countries D.R. Congo Canada 21 Farming the rocks, Morocco, 2001 Capital deepening in agriculture 23 Technological change in medicine Scan for lung cancer African medicine man 24 Introducing technological change First model omits technological change (TC). Let’s see if we can fix up the problems by introducing TC. What is TC? - New processes that increase TFP (assembly line, fiber optics) - Improvements in quality of goods (plasma TV) - New goods and services (automobile, telephone, iPod) Analytically, TC is - Shift in production function. y = Y/L new f(k) old f(k) k* k 25 Introducing technological change We take specific form which is “labor-augmenting technological change” at rate h. For this, we need new variable called “efficiency labor units” denoted as E ~ where E = efficiency units of labor and indicates efficiency units. L=EL New production function is then y = Y/L new f(k) Y F K , EL F(K , L ) old f(k) F K , L L F K/L , 1 L f ( k ), where k K / L y k* k Y / L f (k) Note: Redefining labor units in efficiency terms is a specific way of representing TC that makes everything work out easily. Other forms will give slightly different results. 26 T.C. for the Cobb-Douglas In C-D case, labor-augmenting TC is very simple: Set A 0 E 0 1 for simplicity. Y t K t ( e ht Lt )1 y t Y t / L t K t ( e ht Lt )1 / L t Kt L t1 / L t y t Kt L t = k t 27 Results of neoclassical model with labor-augmenting TC For C-D case, sk * (n h )k * k * s / (n h ) 1/(1 ) y * f (k *) s / (n h ) /(1 ) Unique and stable equilibrium under standard assumptions: Predictions of basic model: – Steady state: constant y, w, k, and r – Here output per capita, capital per capita, and wage rate grow at h. – Labor’s share of output is constant. – Hence, capture the basic trends! 28 y Y/L Impact with labor-augmenting TC y f (k) y* (n )k i*=I*/Y* i sf ( k ) k* 29 k=K/L ln (Y), etc. Time profiles of major variables with TC ln (Y) ln (K) ln(L) ln (L) time 30 Sources of TC Technological change is in some deep sense “endogenous.” But very difficult to model Subject of “new growth theory”: – explains TC as return to investment in research and human capital. – Major difference from conventional investment is “public goods” nature of knowledge – I.e., social return to research >> private return because of spillovers (externalities) Major policy questions: - research and development policy - intellectual property rights (such as patents for drugs) - big $ and big economic stakes involved 31 Several “comparative dynamics” experiments • Change growth in labor force (immigration or retirement policy) • Change in rate of TC • Change in national savings and investment rate (tax changes, savings changes, demographic changes) Here we will investigate only a change in the national savings rate. 32 Two faces of saving 33 The major non-cycle economic issue of today: The federal budget deficit and debt Important documents: National Academy Sciences, Our Fiscal Choices National Commission on Fiscal Responsibility and Reform, Co-Chairs’ Proposal Both will be studied in coming weeks. Issue for us: Since reduced deficit is lower government savings, what is the effect on output: - short run - long run 34 http://www.fiscalcommission.gov/sites/fiscalcommission.gov/files/ documents/CoChair_Draft.pdf 35 Why you can’t get anywhere without Econ 122: An example from the Co-chairs’ proposal 36 Government debt and deficits and the economy: What is the effect of deficit reduction on the economy? 1. A. In short run: • Higher savings is contractionary • Mechanism: lower S, lower AD, lower Y, inflation (straight Keynesian effect in dynamic AS-AD analysis that we did last week) 2. In long-run, neoclassical growth model • Higher savings leads to higher potential output • Mechanism: higher I, K, Y, w, etc. (through neoclassical growth model) 37 Basics of the deficit and growth Assume a closed economy I = T– G + [Y – T – C(Y-T, r)] = Budget surplus + Sp At full employment and assuming that private C does not respond significantly to r, for deficits that reduce G: ΔI = ΔS = Δ (Budget surplus) So this is the motivation of deficit reduction for long-run growth. Question: what is the effect? 38 y** Impact of Higher National Saving y = f(k) y* i = s2f(k) i = s1f(k) (I/Y)* (n+δ)k k k* k** 39 Numerical Example of Deficit Reduction Assumptions: 1. Production is by Cobb-Douglas with CRTS 2. Labor plus labor-augmenting TC: 1. n = 1.5 % p.a.; h = 1.5 % p.a. 3. Full employment; constant labor force participation rate. 4. Savings assumption: a. Private savings rate = 22% of GDP b. Initial govt. savings rate = minus 6 % of GDP c. In 2012, govt. changes fiscal policy to a deficit of minus 2 % of GDP. d. All of higher govt. S goes into national S (i.e., constant private savings rate) and closed economy 5. “Calibrate” to U.S. economy 40 Impact of Lower Govt Deficit on Major Variables 2010 2015 2020 2025 2030 35% Consumption per capita Percent change from baseline 30% GDP per capita Capital per capita 25% 20% NNP per capita - Note that takes 10 years to increase C -Political implications - Must C increase? - No if k>kgoldenrule 15% 10% 5% 0% -5% -10% 41 Conclusions on Fiscal Policy and Economic Growth • Fiscal policy affects economic growth through impact of government surplus through national savings rate • Increases potential output through: – higher capital stock for domestic investment – higher income on foreign assets for foreign investment • Consumption decreases at first then catches up after a decade or so 42 Promoting Technological Change Much more difficult conceptually and for policy: - TC depends upon invention and innovation - Market failure: big gap between social MP and private MP of inventive activity - No formula for discovery analogous to increased saving Major instruments: - Intellectual property rights (create monopoly to reduce MP gap): patents, copyrights - Government subsidy of research (direct to Yale; indirect through R&D tax credit) - Rivalry but not perfect competition in markets (between Windows and Farmer Jones) - For open economy, openness to foreign technologies and management 43