PowerPoint **

advertisement

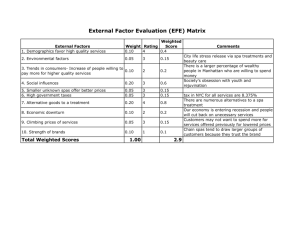

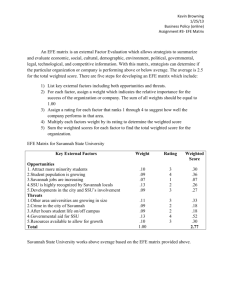

第一組 組長: 陳宜軒 組員: 黃婕昕 林政陸 指導教授:黃光渠 教授 Outline ‧About EE ‧Financial ratios ‧IFE & EFE About EE • History of EE Deutsche Telekom and France Télécom announced plans to merge their respective UK ventures on 8 September 2009. The merger was cleared by the European Commission on 1 March 2010. The joint venture was announced as completed on 1 April 2010, and the name Everything Everywhere was announced on 11 May 2010. 1 About EE • the most advanced digital communications company in UK • Britain’s biggest 3G mobile network • 1st in Britain to offer superfast 4G mobile services • fixed Fiber Broadband service has now reached 15 million households • have lots of conversations with customers 2 About EE • Vision & Mission They believe in giving the UK the best network and best service so our customers trust us with their digital lives. How to achieve this goal 1. Best network 2. Best service 3. Customer trust and relevance https://www.youtube.com/watch?v=UmT8vl2eml8 3 Financial Ratio 4 Financial Structure 0.6 0.48 0.5 0.4 0.36 0.32 0.3 0.24 0.32 0.26 0.25 0.2 0.12 0.1 0.05 0 2010 debt-to-total-assets 2011 debt-to-equity Debt/Asset ratio almost under 50%, which means EE’s financial structure is strong. Note the long-term debt-to-equity rate, it become twice in 2012. Because EE had been issue new bonds. 2012 long term debt-to-equity 5 Debt-Paying Ability 10 8 6 10 TIE ratio jump up to 8.6 in 2012, due to EE started their 4G service and earned a little bit money before other rival enter the market. Second reason is that EE paid off their shareholders’ loans (intersest rate 0.6%)by new Eurbond loan(interest rate 0.25%). 8.6 9 8 7 6 5 4 4 2 2.5 3 2 2 1 0 0 2010 current ratio 2011 quick ratio 2012 time interest earned 6 Operating Ability 100 90 80 88.3 70 74.54 60 50 52.18 40 30 A/R turnover decline form 88.3 to 59.97, it represents that due to more and more short-term prepaid customers. New service provided by 4G attract more customer to use their system, raise their sales and direct raise their inventtory turnover. 36.79 20 10 0 2010 inventory turnover 59.97 53.26 2011 2012 accounts receivable turnover 7 Earning Power 0 -1 2010 2011 2012 -2 -3 -3.82 -3.84 -4 -4.73 -5 -6 -7 -7.67 -8.3 -8 -8.68 -9 -10 EPS price-earnings ratio 8 2010 2011 Revenue 5298 External Purchase 3731 Amortisation &Depreciation 878 25.65% 23.69% 41.11% 2012 6657 4615 1239 1.9% 2.36% 1.21% 6784 4724 1254 單位:(£m) 9 IFE & EFE 10 IFE Weight Rating Weighted Score Internal Strengths 0.15 4 0.6 0.025 4 0.1 1. 0.15 EE's 3G network covers 98%0.6 of the UK 4 population. 4 2. 0.05 EE's 4G coverage is still way 0.2 ahead which 0.10 coverage 4 in 30 of the UK's 0.469 EE offer 3G plan with £32 and £37 cities, Comprehensive Services Portfolio through Vodafone offer 0.10 4 £29 0.4 over 60% of the UK population. 3G & 4GEE networks O2 offer EE cut£32 the. cost of access to its 4G EE:has 30 UK city High service price at 3G 4 EE0.05 has 15 different 4G devices,0.2 including network 02: 13UKcity Low service price at 4G 0.05 3 plan 0.15 the network-exclusive Huawei Ascend P1 EE's cheapest £26. Vodafone: 11 4G UK city was Many 4G device for handsets 0.10 4 LTE. Vodafone's entry-level offer for0.4 a 4G Internal Weaknesses O2 offerplan 13 different handset is £34, devices, Vodafone handsets. O2 offers ahas similar deal at £32. poor bottom-line performance 0.10 113 different 0.1 company's involvement in litigations 0.025 1 0.025 rivals that any attempt to stop its rollout Steady decline in average revenue per user of0.10 fourth-generation mobile services 1 0.1 Wide network coverage Maintain Market Leadership Strong Customer Base Strong brand equity and recognition in Europe Excellent Marketing Capacity (ARPU) Total Weighted Score 3.275 11 EFE Weight Rating Weighted Score Opportunities Increasing mobile data market Growing smart phone market New technology -Fiber Broadband investment Oversea investment in new emerging nations Technology innovation with lower operating cost Trend of globalization for telecom industry 0.15 4 0.6 0.15 4 0.6 It new Fibre Broadband network. gives broadband 0.05you a home 3 0.15 connection typically 10 times faster 0.025 2 0.05 than the UK average. 0.15 3 0.45 0.05 2 0.1 0.05 4 0.2 Threats Weak 4G market Q3 2013 results: 4G rises Regulatory changes from government in fixed line EE0.10 2 0.2in a weak market Competitive pressures from other rival 0.05 2 0.1 Uncertainty of new technology deployment 0.10 3 0.3 No presence in key emerging markets 0.025 1 0.025 Economic slowdown in the European Union 0.10 3 0.3 Total Weighted Score 3.075 12 THE END