Bus 411 assignment three

advertisement

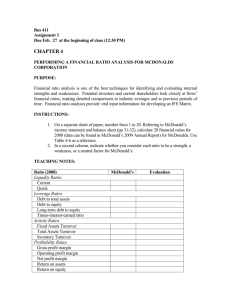

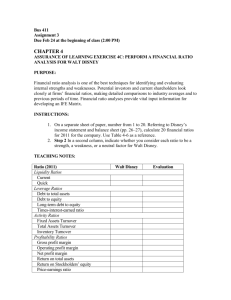

Bus 411 Assignment 3 Due Feb. 28 at the beginning of class (2PM) CHAPTER 4 EXPERIENTIAL EXERCISE 4A: PERFORMING A FINANCIAL RATIO ANALYSIS FOR GOOGLE (GOOG) PURPOSE: Potential investors and current shareholders look closely at firms’ financial ratios, making detailed comparisons to industry averages and to previous periods of time. INSTRUCTIONS: 1. On a separate sheet of paper, number from 1 to 20. Referring to Google’s income statement and balance sheet in the text, calculate 20 financial ratios for the company. 2. Go to http://finance.yahoo.com and find (or calculate) the financial ratios for Yahoo! for the 2004 fiscal year. Record these in the next column. Calculate any you cannot find by hand. 3. In a third column, indicate whether you consider each ratio to be a strength, a weakness, or a neutral factor for Google. Example Chart Ratio Current Quick Fixed assets turnover Total assets turnover Inventory turnover Accounts receivable turnover Debt to total assets Debt to equity Long-term debt to equity Times-interest-earned ratio Return on assets Return on equity Gross profit margin Operating profit margin Net profit margin Revenue per share Price-earnings ratio EPS Net Income Growth Google Yahoo! Evaluation EXPERIENTIAL EXERCISE 4B: CONSTRUCTING AN IFE MATRIX FOR GOOGLE (GOOG) PURPOSE: This exercise will give you experience developing an IFE Matrix. Identifying and prioritizing factors to include in an IFE Matrix fosters communication among functional and divisional managers. Preparing an IFE Matrix allows human resources, marketing, production/operations, finance/accounting, R&D, and computer information systems managers to vocalize their concerns and thoughts regarding the business condition of the firm. This results in an improved collective understanding of the business. INSTRUCTIONS: 1. Develop a IFE Matrix for GOOG 2. What strategies do you think would allow GOOG to capitalize on its major strengths? What strategies would allow GOOG to improve upon its major weaknesses? Refer to the information contained in Table 4-7 when completing this exercise. The steps for completing an IFE Matrix are as follows: 1. List key internal factors as identified in the internal-audit process. Use a total of ten to twenty internal factors, including both strengths and weaknesses. List strengths first and then weaknesses. 2. Assign a weight that ranges from .0 (not important) to 1.0 (all important) to each factor. The weight assigned to a given factor indicates the relative importance of the factor to being successful in the firm’s industry. The sum of all weights must equal 1.0. 3. Assign a 1-4 rating to each factor to indicate whether that factor represents a major weakness (1), a minor weakness (2), minor strength (3), or major strength (4). Strengths must receive a 3 or 4 and weaknesses must receive a 1 or 2. 4. Multiply each factor’s weight by its rating to determine its weighted score for each variable. 5. Sum the weighted scores for each variable to determine the total weighted score for the organization.