Strengths - BUEC342

advertisement

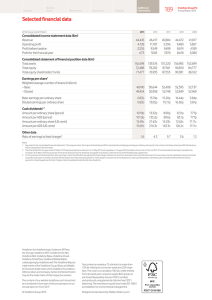

2001 SWAT ANALYSIS Strengths J-Phone brand equity Highly successful parent company J-Phone has 3G license Local knowledge from J-Phone Vodafone has successfully entered other foreign markets Vodafone has well-diversified assets Well developed global supply chain Opportunities Low import tariffs 2nd largest telecom market Explosive growth in mobile market Internet Loyal employees (culture in Japan) Consumers adapt well to new technologies Unattractive to switch cell phone providers Aging, well to do consumer group Weaknesses No experience in East Asian markets Low quality phones/products Lagging in technology New to Japanese culture Weak Japanese wireless infrastructure Threats NTT dominance!!! Non-tariff trade barriers High consumer expectations (welleducated, technology conscious) Non-english consumer base Legal system – businesses settle outside of court Recessionary market Inability to lay-off employees Challenging advertising environment High corporate tax rate (compared to UK +12%) 2005 SWOT ANALYSIS Strengths Improved cash-flow (?) Adoption of international protocols = economies of scale Appropriate communications/advertising Opportunities Still opportunity for growth in market Forging new partnership – bundling with fixed-line (never happened) Economy picking up Weaknesses Unable to compete on price and product Weak 3G infrastructure Hemorrhaging subscribers (declining market share) Poor reputation – people are ostracized if they have Vodafone Not adapting/customizing handsets to market Rapidly declining share price (stock to be delisted) Importing UK management Turnover in senior management Threats Number portability coming in 2006 Entry of new players (3 more licenses) Regulation of pre-paid market Market becoming saturated