Answers Chapter 5 Quiz.s13

advertisement

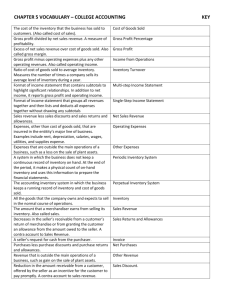

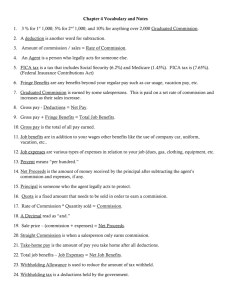

Name: __________________________ ACG 201 Quiz Chapter 5 Spring 2013 Multiple Choice: Show all work for full credit. 1. Net income will result if gross profit exceeds A) cost of goods sold. B) operating expenses. C) purchases. D) cost of goods sold plus operating expenses. 2. Two categories of expenses in merchandising companies are A) cost of goods sold and financing expenses. B) operating expenses and financing expenses. C) cost of goods sold and operating expenses. D) sales and cost of goods sold. 3. Under a perpetual inventory system A) accounting records continuously disclose the amount of inventory. B) increases in inventory resulting from purchases are debited to purchases. C) there is no need for a year-end physical count. D) the account purchase returns and allowances is credited when goods are returned to vendors. 4. In a perpetual inventory system, cost of goods sold is recorded A) on a daily basis. B) on a monthly basis. C) on an annual basis. D) each time a sale occurs. 5. Under the perpetual inventory system, which of the following accounts would not be used? A) Sales Revenue B) Purchases C) Cost of Goods Sold D) Inventory 6. A credit sale of $1,600 is made on April 25, terms 2/10, net/30, on which a return of $100 is granted on April 28. What amount is received as payment in full on May 4? SHOW YOUR WORK A) $1,470 B) $1,568 C) $1,600 D) $1,500 ($1,600 – 100)*2% = $30 discount for early payment ($1,600- 100 [Return]) – 30 = $1,470 cash paid on May 4 Page 1 of 2 7. Financial information is presented below: Operating Expenses $ 21,000 Sales Returns and Allowances 7,000 Sales Discounts 3,000 Sales Revenue 150,000 Cost of Goods Sold 105,000 Gross profit would be (SHOW YOUR WORK): A) $42,000. B) $35,000. C) $38,000. D) $45,000. Net Sales = ($150,000 – 7,000 – 3,000) = $140,000 Gross Profit = Net Sales – COGS; $140,000 – 105,000 = $35,000 8. The entry to record the return of goods from a customer would include a A) debit to Sales Revenue. B) credit to Sales Revenue. C) debit to Sales Returns and Allowances. D) credit to Sales Returns and Allowances. 9. Multiple-step income statements show A) gross profit but not income from operations. B) neither gross profit nor income from operations. C) both income from operations and gross profit. D) income from operations but not gross profit. 10. The sales revenues section of an income statement for a retailer would not include A) Sales discounts. B) Sales. C) Net sales. D) Cost of goods sold. Page 2 of 2