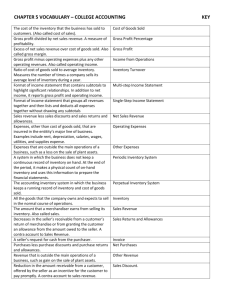

CHAPTER 5

advertisement

CHAPTER STUDY OBJECTIVES 1. Identify the differences between a service enterprise and a merchandising company. Because of the presence of inventory, a merchandising company has sales revenue, cost of goods sold, and gross profit. To account for inventory, a merchandising company must choose between a perpetual inventory system and a periodic inventory system. 2. Explain the recording of purchases under a perpetual inventory system. The Merchandise Inventory account is debited for all purchases of merchandise and for freight costs, and it is credited for purchase discounts and purchase returns and allowances. 3. Explain the recording of sales revenues under a perpetual inventory system. When inventory is sold, Accounts Receivable (or Cash) is debited and Sales is credited for the selling price of the merchandise. At the same time, Cost of Goods Sold is debited and Merchandise Inventory is credited for the cost of inventory items sold. Subsequent entries are required for (a) sales returns and allowances and (b) sales discounts. 4. Distinguish between a single-step and a multiple-step income statement. In a singlestep income statement, companies classify all data under two categories, revenues or expenses, and net income is determined in one step. A multiple-step income statement shows numerous steps in determining net income, including results of non-operating activities. 5. Determine cost of goods sold under a periodic system. The periodic system uses multiple accounts to keep track of transactions that affect inventory. To determine cost of goods sold, first calculate cost of goods purchased by adjusting purchases for returns, allowances, discounts, and freight-in. Then calculate cost of goods sold by adding cost of goods purchased to beginning inventory and subtracting ending inventory. 6. Explain the factors of affecting profitability. Profitability is affected by gross profit, as measured by the gross profit, as measured by the gross profit rate, and by management’s ability to control costs, as measured by the profit margin ratio. *7. Explain the recording of purchases and sales of inventory under a periodic inventory system. To record purchases, entries are required for (a) cash and credit purchases, (b) purchase returns and allowances, (c) purchase discounts, and (d) freight costs. To record sales, entries are required for (a) cash and credit sales, (b) sales returns and allowances, and (c) sales discounts. TRUE-FALSE STATEMENTS 1.______ The operating cycle of a merchandising company ordinarily is shorter than that of a service company. 2.______ Under a perpetual inventory system, the cost of goods sold is determined each time a sale occurs. 3.______ Under the periodic inventory system, cost of goods sold is treated as an account. 4.______ The periodic inventory system provides an up to date amount of inventory on hand. 5______. A very small business most likely would have to use the perpetual inventory system. 6.______ Cost of Goods Sold is considered an expense of a merchandising firm. 7.______ Net sales minus cost of goods sold is called gross profit. 8.______ The terms 2/10, net/30 mean that a 2 percent discount is allowed on payments made within the 10 days discount period. 9.______ Discounts taken by the buyer for early payment of an invoice are called sales discounts by the buyer. 10.______ Sales revenues are only earned during the period cash is collected from the buyer. 11.______ Cash register tapes provide evidence of credit sales. 12.______ Sales Allowances and Sales Discounts are both designed to encourage customers to pay their accounts promptly. 13.______ The normal balance of Sales Returns and Allowances is a credit. 14.______ The multiple-step income statement is considered more useful than the single-step income statement because it highlights the components of net income. 15.______ General and administrative expenses are a category of operating expense. 16.______ Income from operations appears on both the single-step and multiple-step forms of an income statement. 17.______ Sales revenues, cost of goods sold, and gross profit are amounts on a merchandising company's income statement not commonly found on the income statement of a service company. 18.______ Gross profit is a measure of the overall profit of a company. 19.______ If net sales are $750,000 and cost of goods sold is $600,000, the gross profit rate is 20%. 20.______ Under the periodic inventory system, acquisitions of merchandise are not recorded in the merchandise inventory account. MULTIPLE CHOICE QUESTIONS 21.______ Merchandising companies that sell to retailers are known as a. brokers. b. corporations. c. wholesalers. d. service firms. 22.______ Gross profit equals the difference between a. net income and operating expenses. b. net sales revenues and cost of goods sold. c. net sales revenues and operating expenses. d. net sales revenues and cost of goods sold plus operating expenses. 23._______ Net income will result if gross profit exceeds a. cost of goods sold. b. operating expenses. c. purchases. d. cost of goods sold plus operating expenses. 24.______ A merchandiser that sells directly to consumers is a a. retailer. b. wholesaler. c. broker. d. service enterprise. 25.______ Two categories of expenses in merchandising companies are a. cost of goods sold and financing expenses. b. operating expenses and financing expenses. c. cost of goods sold and operating expenses. d. sales and cost of goods sold. 26.______ The primary source of revenue for a wholesaler is a. investment income. b. service revenue. c. the sale of merchandise. d. the sale of plant assets the company owns. 27.______ Generally, the revenue account for a merchandising enterprise is called a. Sales Revenue or Sales. b. Investment Income. c. Gross Profit. d. Net Sales. 28.______ The operating cycle of a merchandising company is a. always one year in length. b. ordinarily longer than that of a service company. c. about the same as that of a service company. d. ordinarily shorter than that of a service company. 29.______ Which of the following expressions is incorrect? a. Gross profit - operating expenses = net income b. Sales - cost of goods sold - operating expenses = net income c. Net income + operating expenses = gross profit d. Operating expenses - cost of goods sold = gross profit 30.______ In a perpetual inventory system, cost of goods sold is recorded a. on a daily basis. b. on a monthly basis. c. on an annual basis. d. each time a sale occurs. 30.______ When using the periodic system the physical inventory count is used to determine a. only the sales value of goods in the ending inventory. b. both the cost of the goods in ending inventory and the sales value of goods sold during the period. c. both the cost of the goods sold and the cost of ending inventory. d. only the cost of merchandise sold during the period. 32.______ The periodic inventory system is used most commonly by companies that sell a. low-priced, high-volume merchandise. b. high-priced, high-volume merchandise. c. high-priced, low-volume merchandise. d. high-priced, low and high-volume merchandise. 33 ______ What is a difference between merchandising companies and service enterprises? a. Merchandising companies must prepare multiple-step income statements and service enterprises must prepare single-step income statements. b. Merchandising companies generally have a longer operating cycle than service enterprises. c. Cost of goods sold is an expense for service enterprises but not for merchandising companies. d. All are differences. 34.______ The journal entry to record a return of merchandise purchased on account under a perpetual inventory system would credit a. Accounts Payable. b. Purchase Returns and Allowances. c. Sales. d. Merchandise Inventory 35.______ Which of the following items does not result in an adjustment in the merchandise inventory account under a perpetual system? a. A purchase of merchandise. b. A return of merchandise inventory to the supplier c. Payment of freight costs for goods shipped to a customer d. Payment of freight costs for goods received from a supplier 36.______ If a purchaser using a perpetual inventory system pays the transportation costs, then the a. Merchandise Inventory account is increased. b. Merchandise Inventory account is not affected. c. Freight-out account is increased. d. Delivery Expense account is increased. 37.______ Freight costs incurred by a seller on merchandise sold to customers will cause an increase a. in the selling expenses of the buyer. b. in operating expenses for the seller. c. to the cost of goods sold of the seller. d. to a contra-revenue account of the seller. 38.______ Hunter Company purchased merchandise inventory with an invoice price of $6,000 and credit terms of 2/10, n/30. What is the net cost of the goods if Hunter Company pays within the discount period? a. $6,000 b. $5,880 c. $5,400 d. $5,520 39.______ A buyer borrows money at 12% interest to pay a $4,000 invoice with terms 1/10, n/30 on the 10th day of the discount period. The loan is repaid on the 30th day of the invoice. What is the buyer’s net savings for this total event? a. $0 b. $13.33 c. $13.60 d. $26.67 40.______ In the credit terms of 1/10, n/30, the “1” represents the a. number of days in the discount period. b. full amount of the invoice. c. number of days when the entire amount is due. d. percent of the cash discount. 41.______ Stanton Company purchased merchandise with an invoice price of $2,000 and credit terms of 2/10, n/30. Assuming a 360 day year, what is the implied annual interest rate inherent in the credit terms? a. 4% b. 24% c. 36% d. 72% 42.______ If a company is given credit terms of 2/10, n/30, it should a. hold off paying the bill until the end of the credit period, while investing the money at 10% annual interest during this time. b. pay within the discount period and recognize a savings. c. pay within the credit period but don't take the trouble to invest the cash while waiting to pay the bill. d. recognize that the supplier is desperate for cash and withhold payment until the end of the credit period while negotiating a lower sales price. 43.______ A purchase invoice is a document that a. provides support for goods purchased for cash. b. provides evidence of incurred operating expenses. c. provides evidence of credit purchases. d. serves only as a customer receipt. 44.______ When using a perpetual inventory system, why are discounts credited to merchandise inventory? a. The discounts are debited to discount expense and thus the credit has to be made to merchandise inventory. b. The discounts reduce the cost of the merchandise inventory. c. The discounts are a reduction of business expenses. d. None of the answers is correct. 45.______ Jake’s Market recorded the following events involving a recent purchase of merchandise: Received goods for $20,000, terms 2/10, n/30. Returned $400 of the shipment for credit. Paid $100 freight on the shipment. Paid the invoice within the discount period. As a result of these events, the company’s merchandise inventory a. increased by $19,208. b. increased by $19,700. c. increased by $19,306. d. increased by $19,308. 46.______ Sales revenues are usually considered earned when a. cash is received from credit sales. b. an order is received. c. goods have been transferred from the seller to the buyer. d. adjusting entries are made. 47.______ A sales invoice is prepared when goods a. are sold for cash. b. are sold on credit. c. sold on credit are returned. d. are sold on credit or for cash. 48.______ The Sales Returns and Allowances account is classified as a(n) a. asset account. b. contra asset account. c. expense account. d. contra revenue account. 49.______ If a customer agrees to retain merchandise that is defective because the seller is willing to reduce the selling price, this transaction is known as a sales a. discount. b. return. c. contra asset. d. allowance. 50.______ The Sales Returns and Allowances account does not provide information to management about a. possible inferior merchandise. b. the percentage of credit sales versus cash sales. c. inefficiencies in filling orders. d. errors in filling customers. 51.______ Which sales accounts normally have a debit balance? a. Sales discounts b. Sales returns and allowances. c. both (a) and (b). d. Neither (a) and (b). 52.______ Which of the following would not be classified as a contra account? a. Sales b. Sales Returns and Allowances c. Accumulated Depreciation d. Sales Discounts 53.______ With respect to the income statement a. contra revenue accounts do not appear on the income statement. b. sales discounts increase the amount of sales. c. contra revenue accounts increase the amount of operating expenses. d. sales discounts are included in the calculation of gross profit. 54.______ Indicate which one of the following would not appear on both a single-step income statement and a multiple-step income statement. a. Gross profit b. Operating expenses c. Sales revenues d. Cost of goods sold 55.______ Gross profit equals the difference between sales and a. operating expenses. b. cost of goods sold. c. net income. d. cost of goods sold plus operating expenses. 56.______ Positive operating income will result if gross profit exceeds a. costs of goods sold. b. selling expenses. c. cost of goods sold plus operating expenses. d. operating expenses. 57______. An advantage of the single-step income statement over the multiple-step form is a. the amount of information it provides. b. its comprehensiveness. c. its simplicity. d. its use in computing ratios. 58.______ Interest expense would be classified on a multiple-step income statement under the heading a. Other expenses and losses b. Other revenues and gains c. Selling expenses d. Cost of goods sold Use the following information to answer questions 59 through 61 Financial information is presented below: Operating Expenses Sales Cost of Goods Sold $ 45,000 150,000 77,000 59.______ Gross Profit would be a. $105,000. b. $ 28,000. c. $ 73,000. d. $150,000. 60.______ The gross profit rate would be a. .700. b. .187 c. .300. d. .487. 61.______ The profit margin ratio would be a. .360. b. .187. c. .300. d. .487. ______Use the following information to answer questions 62 through 65 Financial information is presented below: Operating Expenses Sales Returns and Allowances Sales Discount Sales Cost of Goods Sold $ 45,000 13,000 6,000 160,000 77,000 62.______ The amount of net sales on the income statement would be a. $154,000. b. $141,000. c. $160,000. d. $166,000. 63.______ Gross Profit would be a. $77,000. b. $70,000. c. $64,000. d. $83,000. 64.______ The gross profit rate would be a. .454. b. .546. c. .500. d. .538. 65.______ The profit margin ratio would be a. .454. b. .119. c. .238. d. .135. 66.______ For a jewelry retailer, which is an example of Other Revenues and Gains? a. repair revenue b. unearned revenue c. gain on sale of display cases d. discount received for paying for merchandise inventory within the discount period 67.______ At the beginning of the year, Midtown Athletic had an inventory of $400,000. During the year, the company purchased goods costing $1,600,000. If Midtown Athletic reported ending inventory of $600,000 and sales of $2,000,000, their cost of goods sold and gross profit rate must be a. $1,000,000 and 50% b. $1,400,000 and 30% c. $1,000,000 and 30% d. $1,400,000 and 70% 68.______ During the year, Darla’s Pet Shop’s merchandise inventory decreased by $20,000. If the company’s cost of goods sold for the year was $300,000, purchases must have been a. $320,000. b. $280,000. c. $260,000. d. Unable to determine. 69.______ The amount of cost of good available for sale during the year depends on the amounts of a. beginning merchandise inventory and cost of goods sold. b. beginning merchandise inventory, net cost of purchases, and ending merchandise inventory. c. beginning merchandise inventory, cost of goods sold, and ending merchandise inventory. d. beginning merchandise inventory and net costs of purchases. 70.______ A company shows the following balances: Sales Sales Returns and Allowances Sales Discounts Cost of Goods Sold $ 800,000 125,000 25,000 481,000 What is the gross profit rate? a. 60% b. 36% c. 26% d. 20% 71.______ What is a difference between the profit margin ratio and the gross profit rate? a. None, these are interchangeable terms. b. The gross profit rate is computed by dividing net sales by gross profit and the profit margin ratio is computed by dividing net sales by net income. c. The gross profit rate will normally be higher than the profit margin ratio. d. A profit margin ratio of 7% means that 7 cents of each net sales dollar ends up in net income and a gross profit rate of 7% means that the cost of the goods were 7% of the selling price. 72.______ Karen’s Fashions sold merchandise for $57,000 cash during the month of July. Returns that month totaled $1,200. If the company’s gross profit rate is 40%, Karen will report monthly net sales revenue and cost of goods sold of: a. $57,000 and $34,200. b. $55,800 and $22,320. c. $55,800 and $33,480. d. $57,000 and $33,480. BRIEF EXERCISES Be.73 Assume that Guardian Company uses a periodic inventory system and has these account balances: Purchases $500,000; Purchase Returns and Allowances $14,000; Purchases Discounts $9,000; and Freight-in $15,000. Determine net purchases and cost of goods purchased. EXERCISES Ex.74 June 4 Brown Company purchased $5,000 worth of merchandise, terms n/30 from Johns Company. The cost of the merchandise was $3,500. 12 Brown returned $500 worth of goods to Johns for full credit. The goods had a cost of $350 to Johns. 12 Brown paid the account in full. Instructions Prepare the journal entries to record these transactions in (a) Brown’s records and (b) Johns’ records. Assume use of the perpetual inventory system for both companies. Ex. 75 On October 1, the Mace Bicycle Store had an inventory of 20 ten speed bicycles at a cost of $175 each. During the month of October the following transactions occurred. Assume Mace uses a perpetual inventory system. Oct. 4 Purchased 200 bicycles at a cost of $175 each from the Lyons Bicycle Company, terms 2/10, n/30. 5 Paid freight of $900 on the October 4 purchase. 6 Sold 8 bicycles from the October 1 inventory to Team America for $250 each, terms 2/10, n/30. 7 Received credit from the Lyons Bicycle Company for the return of 12 defective bicycles. 13 Issued a credit memo to Team America for the return of a defective bicycle. 14 Paid Lyons Bicycle Company in full, less discount. Instructions Prepare the journal entries to record the transactions assuming the company uses a perpetual inventory system. Ex.75 The following information is available for Partin Company: Sales Sales Returns and Allowances Cost of Goods Sold Selling Expense Administrative Expense Interest Expense Interest Revenue $598,000 20,000 398,000 69,000 25,000 19,000 20,000 Instructions 1. Use the above information to prepare a multiple-step income statement for the year ended December 31, 2007. 2. Compute the profit margin ratio and return on assets ratio. Partin Company’s assets at the beginning of the year were $770,000 and were $830,000 at the end of the year. Ex.76 The following information is available from the annual reports of Gregg Company and Stine Inc. Sales Cost of goods sold Operating expenses Income before taxes Net income (Amounts in millions) Gregg Stine $32,622 $39,457 20,739 24,431 10,928 13,188 955 1,838 594 1,072 Instructions 1. Calculate the profit margin ratio and gross profit rate for each company. 2. What conclusion concerning the relative profitability of the two companies can be drawn from these data?