lect03

advertisement

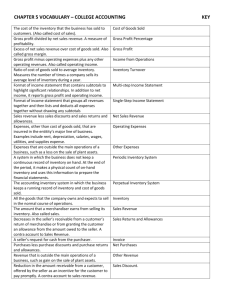

1 Chapter 5 2 • Service business earns fees – Revenues recorded • Merchandising business sells inventory – Revenue from sales – Expense of Inventory Cost • Cost of Goods Sold. 3 • The Cost of Goods Sold – An expense – Treated differently on Income Statement • Sales Revenue - Cost of Goods Sold – Gross Profit or Gross Margin – Reported at the top of an income statement. 4 • Two Inventory Systems – Periodic Inventory System – Perpetual Inventory System 5 • Periodic Inventory System – Company keeps track of Purchases during the period – Calculates COGS at end of year Beginning Inventory + Purchases Goods Available For Sale - Ending Inventory Cost of Goods Sold. 6 • Periodic Inventory System – Assumes anything not there was sold • No information on theft or spoilage - Disadvantage – Company doesn’t know COGS until physical inventory taken - Disadvantage – Easy to maintain - Advantage 7 • Perpetual Inventory System – Company always keeps track of COGS & Inventory – Still need physical inventory • End of year. • Any discrepancy with books - theft and spoilage – Used to be very expensive • With computers & scanners no longer true – Increasing in popularity – Previous class discussion is perpetual system • Will continue to use it in this chapter. 8 • When you purchase inventory with cash: D. Merchandise Inventory Cr. Cash $5,000 $5,000 9 • When you purchase inventory on credit: D. Merchandise Inventory Cr. Accounts Payable $5,000 $5,000 10 • Purchase Returns & Allowances – You return inventory purchased (Purchases Return) • Reverse purchase – Supplier reduces price of merchandise after the sale (Purchases Allowance) • Write down Inventory to amount paid 11 • A return of entire $5,000 purchase: D. Accounts Payable Cr. Merchandise Inventory $5,000 $5,000 12 • The receipt of $1,000 allowance on $5,000 purchase D. Accounts Payable Cr. Merchandise Inventory $1,000 $1,000 13 • Inventory cost includes: – Price paid (less discounts) – freight – insurance in transit – Taxes – Tariffs – Inspection costs – Preparation costs – Everything paid inventory to location & ready to sell 14 • "FOB shipping point“ – Stands for Free On Board – Seller transfers title to inventory at the seller’s location. – Buyer pays shipping costs – E.g. you order car from Ford • • • • Invoice says FOB Detroit You pay shipping costs You own car during shipment. Something goes wrong – Your problem 15 • "FOB destination“ – Seller transfers title to inventory when delivered • At buyer’s place of business – Seller pays shipping costs – E.g., you order car from Ford • • • • Invoice says FOB Los Angeles Ford pays shipping costs Ford owns car during shipment If something goes wrong – Ford’s problem 16 • Transportation Costs on purchases – Part of cost of inventory – Called “Freight in” or “Transportation In” – Under perpetual inventory system – increase cost of the inventory: D. Merchandise Inventory Cr. Accounts Payable/Cash $150 $150 17 • Transportation Costs on sales – An expense • Called “Transportation Out” or “Freight Out”: D. Freight Out Cr. Accounts Payable/Cash $150 $150 18 • Purchases Discounts – We buy inventory – Seller offers credit terms to encourage us to pay quickly – Called purchase discounts. – When we are seller – Called sales discounts 19 • Examples – 2/10 n/30 (“two-ten, net thirty”) • If buyer pays whole invoice within 10 days – Gets 2% off • Otherwise, entire bill due in 30 days – 1/10 EOM • If buyer pays whole invoice during 1st 10 days of next month – Gets 1% off • Otherwise, entire bill due by end of next month. 20 • If seller does not wish to offer discount – Invoice says when payment is due – n/30 • No discount • Entire Invoice due in 30 days – n/10 EOM • Entire invoice due in first 10 days of next month 21 • Passing up purchase discounts is very unwise – Interest cost for delaying payment for a few days is very high – E.g., 2/20 n/30 • Means you are paying 2% for a 20-day loan • Annualized rate of 36.5% per annum. 22 • You buy inventory for $3,500 • Supplier offers you 2/10 n/30 • When you receive inventory – Ignore potential discount D. Merchandise Inventory Cr. Accounts Payable $3,500 $3,500 23 • If payment made during discount period – Show A/P is discharged in full – Show amount paid – Write down Inventory to price actually paid D. Accounts Payable Cr. Cash Merchandise Inventory $3,500 $3,430 70 24 • If payment not made during discount period D. Accounts Payable Cr. Cash $3,500 $3,500 25 • Cash sale - revenue side of transaction: D. Cash Cr. $2,200 Sales Revenue $2,200 • Cash sale - cost side of transaction: D. Cost of Goods Sold Cr. Merchandise Inventory $1,400 $1,400 26 • Credit sale - revenue side of transaction: D. Accounts Receivable Cr. $2,200 Sales Revenue $2,200 • Credit sale - cost side of transaction: D. Cost of Goods Sold Cr. Merchandise Inventory $1,400 $1,400 27 • Customer returns merchandise – you undo sale. – Debit Sales Returns & Allowances • Contra-revenue account • It will be deducted from Sales Revenue – We keep track of this in separate account to gives management important information about company’s returns history • Otherwise, we could have just reduced Sales Revenue 28 • Undo revenue side of transaction: D. Sales Returns & Allowances Cr. $2,200 Accounts Receivable $2,200 • Undo cost side of transaction: D. Merchandise Inventory Cr. Cost of Goods Sold $1,400 $1,400 29 • Sales Discounts – When we are seller – We can offer customers credit terms to encourage quick payment – Same notations as in Purchase Discounts • E.g., 2/10 n/30 – Contra Revenue account • Reduces Sales Revenue 30 • When sale is made – Ignore potential sales discount D. Accounts Receivable Cr. Sales/Sales Revenue $3,500 $3,500 31 • If payment received during discount period – Record the Cash received (reduced price) – Show A/R discharged in full (original price) – The Difference is Sales Discount (difference) D. Cash Sales Discounts Cr. Accounts Receivable $3,430 70 $3,500 32 • If payment received after discount period: D. Cash Cr. Accounts Receivable $3,500 $3,500 33 • Trade Discounts – Offer customers cheaper prices • Not for paying quickly • An After Christmas Sale – E.g, Volume Discounts – If you buy 100, price drops • Record sale at cheaper price – no account for trade discounts. 34 • Net Sales is Sales Revenue reduced by the contra-revenue accounts: Sales Revenue Less: Sales Returns and Allowances Sales Discounts Credit Card Discounts (if treated as a contra-revenue account) Net Sales $480,000 -12,000 -8,000 -6,000 $454,000 35 • Single-step Income Statement – One Revenues section - lists all revenues – One Expenses section - lists all expenses • Multiple-step Income Statement – Contains many subcategories 36 Income Statement For Year Ending December 31, 20XX Net Sales Less: $460,000 Cost of Goods Sold -316,000 Gross Margin/Profit $144,000 Less: -114,000 Operating Expenses Income From Operations Other Revenue & Gains Less: Other Expenses & Losses $30,000 3,600 -2,000 Income Before Income Taxes $31,600 Less: -10,100 Income Tax Expense Net Income $21,500 37 • Gross Profit – Net Sales - Cost of Goods Sold – Also called Gross Margin • Gives you the mark-up on the goods sold – Merchandising profit • Gives information about market place – High gross margins – market isn’t very competitive – E.g., PC market in 1970s & 1980s - high gross margins • During 1990s, the PC market became competitive – Had shrinking gross margins. 38 • Operating Expenses are: – sales expenses and – general & administrative expenses • Direct result of Management activities – Not like Gross Margin • Result from marketplace. – How good is the company in controlling its expenses? 39 • Income From Operations – Gross Margin - Operating Expenses • Considered very important – Represents major operations – Good indication of future performance • Typically viewed as sustainable in the future 40 • Other Revenues and Expenses – Nonoperating revenues & gains • dividends income • interest income • gains from sales of assets – Less nonoperating expenses & losses • interest expense • losses from sales of assets • Follows Income From Operations 41 • Income Before Income Taxes – Income From Operations - Other Revenues and Expenses • Net Income – Income Before Income Taxes - Income Taxes • Earnings Per Share – Reported Below Net Income – Corporation’s Net Income earned for each share of common stock 42 Shafer Auto Parts Corporation Income Statement For the Year Ended December 31, 20XX Revenues from Sales $289,656 Cost of Goods Sold -181,260 Gross Margin from Sales $108,396 Operating Expenses Selling Expenses General and Administrative Expenses $ 54,780 34,504 Total Operating Expenses -89,284 Income from Operations $19,112 43 Shafer Auto Parts Corporation Income Statement For the Year Ended December 31, 20XX Income from Operations $19,112 Other Revenues and Expenses Interest Income $1,400 Less: Interest Expense -2,631 Excess of Other Expenses over Other Revenues Income Before Income Taxes Income Taxes Net Income Earnings per share -1,231 $17,881 -3,381 $14,500 $ 2.90 44 Shafer Auto Parts Corporation Income Statement For the Year Ended December 31, 20XX Revenues Net Sales Interest Income $289,656 $1,400 Total Revenues $291,056 Costs & Expenses Cost of Goods Sold $181,260 Selling Expenses 54,780 General and Administrative Expenses 34,504 Interest Expense 2,631 Income Tax Expense 1,231 Total Costs and Expenses Net Income Earnings per share -276,556 $14,500 $ 2.90 45 • Gross Profit Rate – Also called Gross Profit/Margin Percentage – Gives Gross Profit/Margin in terms that are not influenced by size Gross Profit/Margin ------------------------------------Net Sales 46 • Operating Expenses To Sales Ratio – Focuses on management’s ability to control operating expenses: Operating Expenses ------------------------------------Net Sales