Consumer Education * Final Exam Study Guide

advertisement

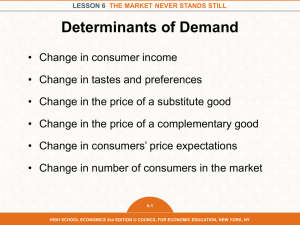

Name __________________ Consumer Education – Final Exam Study Guide The Consumer Education Final Exam will be taken by all students not earning a 90% ‘A’ average or higher by the end of the first 18 weeks of the semester. The final class assignment will be completion of the final exam study guide. All students, regardless of their current class average or exemption status, must complete the final exam study guide. The final exam will cover the following topics: 1. Budgeting 2. Savings & Investment options 3. Banking and Checking accounts 4. Interviewing & working skills 5. Credit & Bankruptcy 6. Government Consumer Protection Agencies 7. Car buying and leasing 8. Property rental and home buying 9. Auto, Property, Life & Health Insurance 10. Economics: forms of economy, supply & demand topics The final exam review packet will be due at the end of the class period on Wednesday, May 29. We will have one class period to work on the packet. The study guide packet is worth 25 points Consumer Ed-Pitcher Final Exam Review - 1 Directions: Fill in all blanks and circle the correct underlined word(s) for each statement. Budgeting 1. A budget should be based on gross/net income. 2. Your monthly rent would be considered a variable/fixed expense. 3. Groceries and gas for your car are variable/fixed expenses. 4. You have more/less control over your variable expense than your fixed expense. 5. A personal budget should be planned for a specific period of time, such as one _______. 6. As a consumer what 3 things protect you from unexpected expenses? 7. You need to learn how to live and spend ________ _________ _________. 8. Do not have a mortgage more than ______ _______ your _______ ________. 9. It is suggested that _____ % of your net income be devoted to savings and no more than ____% should be spent on total car-related expenses (payment, gas, maintenance & insurance). 10. The millionaires interviewed believed that ___________ independence is more important than displaying high social status. 11. Parents of most millionaires did/did not provide economic outpatient care. 12. Parents tend to give more/less money to children with poor financial skills than to children with strong financial skills. Stock Market 13. NYSE stands for: _____________________; NASDAQ stands for __________________. 14. Each stock has a _________, which is a few letters used to research prices and information. 15. ___________ indicates the number of shares traded. 16. The ___________ is the highest point the stock has reached in the last 52 weeks. The ___________ is the lowest point the stock has reached in the last 52 weeks. 17. The simple philosophy to make money in the stock market is: buy ______, sell _______. 18. A ______ order will purchase an indicated number of shares of stock at a set price that you specify. 19. A ______ order purchases the indicated number of shares of stock at the market price. 20. The P/E ratio stands for ______ to ______. The lower/higher the better. 21. Market capitalization indicates how large a company is and is determined by ____________ X Stock Price. 22. To be a publicly traded company you must first issue an IPO, which stands for ___________________. 23. To _______ sell a stock means you are predicting the price will go down. Consumer Ed-Pitcher Final Exam Review - 2 24. To buy on _________ means you are borrowing money to purchase a stock. You will then have to repay the broker plus commission when you sell the stock. Banking/Savings 25. APY stands for __________ _______________ __________. 26. Most banks charge a _____ for stopping payment on a check. 27. Entries in a checkbook should/should not be made regularly at the time money is deposited and checks written out. 28. If there is a disagreement as the amount of the check written in words and the amount in figures, legally the amount written in words/numbers governs. 29. __________ checks are checks that have been paid by the bank. 30. In reconciling a bank statement, ______________ checks should be subtracted from the checkbook balance. 31. Compound interest will earn an investor more/less money than simple interest. 32. The most common retirement account for employees in corporate America is a ________. 33. A Roth IRA, in which IRA stands for _______________________, was set up by Senator William Roth and provides a tax-free savings option that cannot be withdrawn until age ______. 34. Checks over ___ months old may not be honored by a bank. 35. The more _____ you take with your money, the greater the potential ______ on your money. 36. A certified or cashier’s check is an example of a ___________ form of ___________ whereas a personal check is/is not a guaranteed form of payment. 37. The only way to really make money is to ________ _________ on _______ __________. 38. How has the banking industry changed significantly from the 1980’s to today? 39. What does FDIC stand for and what is its purpose? 40. How much money does the FDIC insure deposits for? if and when will that be changing? Credit/Bankruptcy 41. APR stands for __________ ____________ __________. 42. APR for credit cards generally has a much higher/lower interest rate than any other type of loan. 43. The ideal customer to the credit card industry is a person willing to make the _______ payments _________. 44. If a credit card holder only makes the minimum monthly payments they will never pay off their credit card because the minimum payment is calculated as ____% of the ___________ ___________. 45. Credit card companies tend to target high school grads attending college more/less than those of the same age working and living on their own. 46. One of the most vulnerable groups of credit-using Americans are military personnel/tradesmen whose credit card debt and ______________ rates are twice the national average. 47. The 3 C’s of credit are: _____________, _____________ and _______________. 48. Inquiring and pursuing additional credit would _______ your credit rating. Consumer Ed-Pitcher Final Exam Review - 3 49. Paying bills in full and in a timely manner would ______ your credit rating. 50. If an individual can afford to make only one payment, either their mortgage, car payment or credit card bill, for the purposes of their credit rating they should pay their ________________. 51. If an individual fails to pay their home loan it is referred to as ____________ on the loan and the home becomes ______________. 52. 700 would be considered a good/bad credit score. 53. The Chase Freedom and United Mileage credit card are examples of _______ cards. 54. What are the 4 main reasons people file for bankruptcy? 55. Filing for bankruptcy will remain on your credit report for _____ years. Interviewing & working skills 56. A resume should be how long? 57. List at least 5 major categories on a resume (in order): 58. A job application should be filled out with a _______ or _______ ______. 59. Any section of a job application that is not filled out should have the words ______ written. 60. The __________ ____________ ____________ is a publication and website that provides career information such as description, growth projection & salary. 61. A ___ is what is sent to all employees at the end of each year and is used in preparing their income taxes. 62. The _____ is filled out by all employees prior to their first day for tax purposes in which you list your number of ___________. 63. Describe the difference between claiming ‘1’ or claiming ‘0.’ 64. List at least 5 tips for interviewing: 65. Explain the difference between a signing bonus and severance pay: 66. Explain the difference between being fired and being laid off: Housing-Buying & Renting 67. The greatest advantage of home ownership is building __________. 68. List 3 different types of homes one could buy? 69. List one advantage and one disadvantage of owning a single-family home? Consumer Ed-Pitcher Final Exam Review - 4 70. _________ tax and _________ paid on a mortgage are tax-deductible items. 71. ARM stands for _________ _________ __________. The opposite of an ARM is: 72. List 2 items that can appreciate a home’s value and 2 separate items that can depreciate it’s value: 73. The ________ and _________ are the two most important rooms in improving a home’s value. 74. When renting a tenant does/does not need any renter’s insurance. 75. The legal document signed between a landlord and renter is called a ______. 76. A ___________ is considered good debt while ________ ______ debt is considered bad debt. 77. To avoid PMI, which stands for __________ _______________ _____________, a home buyer should make a down payment of at least ____ %. 78. Many new homeowners were not able to afford to purchase the homes they were buying so they got a 125% loan which means: 79. Many buyers of homes were not purchasing them with their #1 intention of living in the home but more so looking at the real estate as an ____________. Cars – Buying and Leasing 80. The MSRP must be stated on all new/used cars. 81. In almost all cases cars appreciate/depreciate in value. 82. List 3 items that cause depreciation in cars. 83. The Lemon Law applies to _____ cars that are in repair ____ or more times or for a total of _____ days within ___ year. 84. List at least 3 items other than the cost of the car must a buyer have to pay when initially buying the car? 85. People lease cars so they can drive a _____ car ______ often. 86. When leasing a car you may make a down payment to lower the monthly lease payments. This is amount is called ____-___ ________ __________. 87. List 2 disadvantages of leasing: 88. List 2 advantages of leasing: 89. What is the difference between an open-ended and closed-ended lease? Insurance – Auto, Home, Life, Health 90. The purpose of any type of insurance is to protect against ___________ loss. 91. The amount paid each month by the policyholder is called the _____________. Consumer Ed-Pitcher Final Exam Review - 5 92. In the event of an accident if the insured makes a claim they may still need to pay a portion of the loss, which is called the _________. 93. In the event of hail damage or vandalism an insured would use __________ coverage but if your car is struck by another moving vehicle you would use __________ coverage. 94. The terms 50/100/80 for bodily injury & property damage coverage refer to: 95. State law requires drivers to carry what two auto insurance coverages? 96. If a policyholder lowers their deductible it will cause their premium to increase/decrease. 97. Life insurance exists for three reasons: if you live too _____, if you die too _____ or if you become ___________ and can no longer work. 98. Smokers and/or those with a history of medical problems are a greater/lesser risk and will have a higher/lower life insurance premium than those who do not. 99. List 4 items that can lower your automobile insurance premium: 100. For health insurance a ______ policy is cheaper than an individual policy. 101. HMO stands for ____________ ______________ __________________. 102. PPO stands for _____________ ______________ __________________ and will generally cost more/less. 103. In an HMO policy you must see your ___________ _______ ___________ first then they will refer you to a specialist, whereas with a PPP policy you aren’t required to chose a primary care physician. With a PPO, when seeing doctors within the plan you will have to make a small ___ - _____, which in most cases is $______. 104. _______ life insurance is expensive: You're paying not only for insurance but also for the investment portion. 105. Purchased for only a stated period of time, such as 20 years, ______ life insurance does not build up cash value and the premium normally increases as the insured gets older. 106. Insurance companies often advertise ______ life as a forced ________ option for retirement planning, although there are many better ways to plan for retirement. Economics/Business info 107. According to the law of demand, if the price of a good rises: 108. According to the law of supply, when the price of a product rises: 109. Competition causes prices to go _______ and product quality to go ______. 110. Price fixing and monopolies are legal/illegal. 111. Tax deductions such as donations to charity and interest paid on student loans and a mortgage will lower your __________ ___________. 112. The U.S. form of economy is one of capitalism/command. Consumer Ed-Pitcher Final Exam Review - 6 113. _____________ refers to how quickly an asset can be turned into cash. 114. Opportunity cost deals with the best ________ given up when making a decision. Government Agencies 116. The FDA stands for ________________________________. 117. The Government agency that monitors the stock market and practices of publicly traded companies is list acronym and what it stands for):________________________________________________________. 118. What government agency monitors the airline industry? 119. What government agency enforces economic policies that prohibit monopolies and price-fixing? 120. The supply of _________ and the raising or lowering of __________ rates are determined by the Federal Reserve as part of their fiscal/monetary policy. This is in contrast to the actions of government spending and taxation which are a part of the fiscal/monetary policy.