F410 LN #5 Ratio Analysis and Free Cash Flow

advertisement

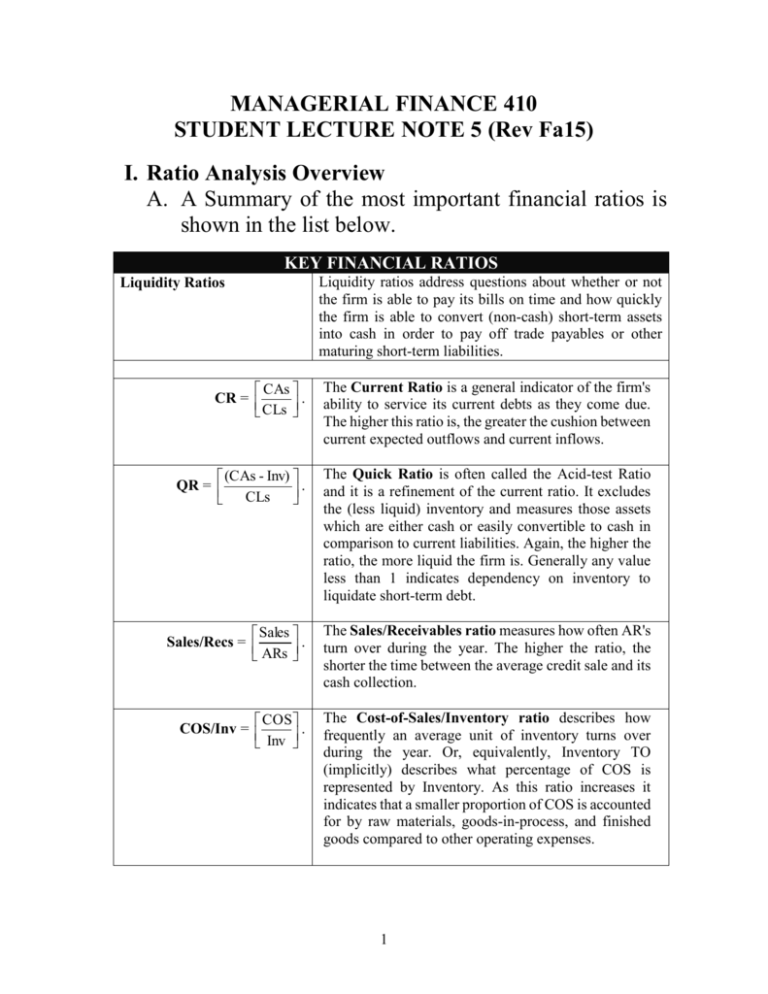

MANAGERIAL FINANCE 410 STUDENT LECTURE NOTE 5 (Rev Fa15) I. Ratio Analysis Overview A. A Summary of the most important financial ratios is shown in the list below. KEY FINANCIAL RATIOS Liquidity Ratios Liquidity ratios address questions about whether or not the firm is able to pay its bills on time and how quickly the firm is able to convert (non-cash) short-term assets into cash in order to pay off trade payables or other maturing short-term liabilities. CAs CR = . CLs The Current Ratio is a general indicator of the firm's ability to service its current debts as they come due. The higher this ratio is, the greater the cushion between current expected outflows and current inflows. (CAs - Inv) QR = . CLs The Quick Ratio is often called the Acid-test Ratio and it is a refinement of the current ratio. It excludes the (less liquid) inventory and measures those assets which are either cash or easily convertible to cash in comparison to current liabilities. Again, the higher the ratio, the more liquid the firm is. Generally any value less than 1 indicates dependency on inventory to liquidate short-term debt. Sales Sales/Recs = . ARs The Sales/Receivables ratio measures how often AR's turn over during the year. The higher the ratio, the shorter the time between the average credit sale and its cash collection. COS COS/Inv = . Inv The Cost-of-Sales/Inventory ratio describes how frequently an average unit of inventory turns over during the year. Or, equivalently, Inventory TO (implicitly) describes what percentage of COS is represented by Inventory. As this ratio increases it indicates that a smaller proportion of COS is accounted for by raw materials, goods-in-process, and finished goods compared to other operating expenses. 1 COS COS/Payables = . APs Efficiency Ratios The Cost-of-Sales/Payables ratio shows how often trade payables turn over during the year. As this ratio increases it indicates a shorter time period between credit purchases and cash payment. These ratios describe how effectively the firm utilizes its assets and employs its net working capital. Sales Total Asset Turnover is a very general measure of a TATO = . TAs firm's ability to generate sales in relation to total assets. TATO should be used only to compare firms within industry groups and in conjunction with other efficiency ratios in developing specific conclusions. Sales FATO = . FAs Fixed Asset Turnover is a more specific measure of asset efficiency than TATO in that it focuses explicitly on fixed assets. Highly depreciated fixed assets (net of accumulated depreciation) or a very labor-intensive operation may cause distortion of this ratio. 365 ACP = . Sales/ARs Average Collection Period tells how long it takes the firm on average to collect a credit sale. ACP, described in RMA Reports as Days’ Receivables can be found from the Sales/Recs. ratio. It is printed in bold type directly to the left of the Sales/Recs. ratio. 365 Inventory Conversion Period tells how long it takes the ICP = . COS/Inv firm on average to produce a unit of production, and how long before the inventory is sold. ICP, described in the RMA Reports as Days' Inventory is printed in bold type directly to the left of the COS/Inv. ratio. 365 APP = . COS/APs Average Payment Period tells how long in days it takes the firm on average to pay for its credit purchases. APP is shown in RMA Reports as Days' Payables. It can be found from the COS/AP ratio. Days' Payables are shown in bold type directly to the left of the COS/AP ratio. CCC = ACP + ICP – APP. Cash Conversion Cycle is an aggregate measure of net working capital efficiency. It measures the time in days between when productive inputs are paid for and when the cash inflow from a sale is actually received. The longer the CCC is, the more the firm has tied up in working capital. 2 Coverage/Leverage Ratios These ratios show the firm's ability to service its debt and the extent to which the firm relies on debt vs. stock financing. EBIT TIE = . LT Debt Int Times Interest Earned indicates how many times the firm is able to pay its long-term debt interest out of earnings from operations. A high ratio generally indicates that the firm has little difficulty in meeting debt service obligations and may show that the firm has additional ability to take on more debt. FAs FA/NW = . TE The Fixed Asset/Net Worth ratio is a leverage measure indicating the extent to which owner's equity has been invested in plant and equipment (fixed assets). A lower ratio indicates a relatively smaller investment in fixed assets relative to net worth, and that there's a greater "cushion" for creditors in case of bankruptcy. Thus, a higher ratio indicates greater risk for the creditors. TLs Debt/NW = . TE The Debt/Net Worth ratio shows the relationship between capital contributed by creditors and that provided by owners of the firm. It is an indication of the degree of protection afforded the creditors by stockholders' investment. Obviously, as this number grows it shows an increasing proportion of total investment by creditors relative to owners. Firms with a low Debt/NW ratio will generally have greater access to future borrowing. TLs Debt Ratio = . TAs The Debt Ratio describes the proportion of capital provided by creditors versus owners. It is closely related to the Debt/NW ratio. Although the Debt Ratio can not be directly found from the RMA Studies it can be found using the common-size equity ratio. Profitability Ratios EBIT OPM = . Sales The ratios express a given type of earnings as a percentage of either output or return on investment. Operating Profit Margin relates earnings from operations to the sales generating those earnings. Since this measure includes interest costs it provides a measure of return in relation to financial risk. This measure is shown in RMA Studies in the CommonSize ratios under "Operating Profit". 3 EBT B-T PM = . Sales Before-Tax Profit Margin describes the amount of earnings before taxes generated by sales. This measure is shown in RMA Studies in the Common-Size ratios under "Profit-before Taxes" as a percentage of Sales. EAC A-T PM = . Sales Due to major differences in Tax Liability for firms with similar before-tax earnings caused by tax rules, the RMA Studies utilize only Earnings Before Taxes in calculating profitability ratios. Thus, all industry profit ratios are determined before taxes. The three after-tax (A-T) versions are provided here because although these numbers may be less comparable to other firms, they are more relevant for stockholders. The after-tax measures use Earnings Available to Common Stockholders (EAC) in place of EBT. The Before-Tax (A-T) Return on Asset ratio measures EBT B-T ROA = . TAs the pre-tax (after-tax) return on total assets and measures the effectiveness of management in employing the resources provided to it by total investment in the firm. A EAC heavily depreciated plant and/or a large amount of A-T ROA = . TAs intangible assets may distort ROA. EBT B-T ROE = . TE EAC A-T ROE = . TE Return on Equity measures the before-tax (after-tax) return on the funds provided by the owners of the firm. This ratio is THE one best indicator of shareholder welfare maximization. However, ROE needs to be viewed with caution since a relatively high ROE is usually a positive indicator, but may also show that the firm uses high levels of debt. Whereas, a low ROE may be due to a largely equity-financed, conservative firm. II. The After-Tax DuPont Formula and Its Uses A. The Effect of Leverage: Developed by an analyst at DuPont (big shock), the approach shows how a given ROA is translated into a relatively ______ ROE through use of leverage (gearing) by the firm. 1. Consider first the calculation of ROA: 4 EAC EAC Sales . ROA = * TA's Sales TA's (5.1) = Profit Margin TATO. This formulation makes sense because a company's ROA is determined by a combination of profit and volume. They either make money on mark-up or sales volume. 2. How is ROA translated into ROE? EAC EAC TA' s ROE = * TA' s Common Equity . (5.2) Common Equity = ROA Equity Multiplier. 3. Call the quantity [1/Equity Multiplier] the Equity Ratio. It can be found from knowledge of the debt ratio. Recall that the debt ratio was given above as follows: Total Liabilities Debt Ratio = . Total Assets The Equity Ratio can then be determined as follows since TAs = TLs + TEs: 5 Equity Total Assets Total Liabilities Total Equity = ; TA' s TA' s Ratio Total Assets = 1 - Debt Ratio . Similarly the Equity Ratio can also be re-expressed in terms of the Equity Multiplier (EM) as its reciprocal. Thus, the linkage is as follows. Total Equity Equity Ratio = ; TA's TA' s Equity Multiplier = . Total Equity ROA TA ROE = ROA * ROA * EM . Equity Ratio TE (5.3) Notice, that the lower the amount of equity employed by the firm, the lower the divisor (in the equity multiplier), the higher the resulting ROE. Thus, if two firms have _____ ROA's, the firm which uses the ______ degree of leverage will have the ______ ROE. 4. An Example on the Use of Leverage Ex. 5.1 – Leverage and Returns Rasmus Astrand (F381 Fa’09, F382 Sp’10) is demonstrating the effect of leverage on firm ROAs vs. ROEs. He 6 has developed the following example. Assume there are two firms, Firm L and Firm U which are identical in terms of their operating incomes (i.e. EBITL = EBITU = $200k). However, their capital structures are quite different as is shown in the figure below. Firm L Debt @ 8% Equity Total Assets Amt $500k $500k $1000k Firm U Debt Equity Total Assets Amt $0k $1000k $1000k Assume that both firms have sales of $2,500k and a flat tax rate of 40%. Calculate: a) Earnings after taxes (EAT) for both firms, and b) Use the DuPont formula to find both ROA and ROE for the two firms. c) What can you conclude about the effect of leverage on returns to stockholders? A5.1 Firm L(evered) EBIT $200k -Interest $40k EBT $160k -Taxes $64k $96k a) EAT Firm U(unlevered) EBIT $200k -Interest $0k EBT $200k -Taxes $80k EAT $120k A5.1b) Use the DuPont formulas to find ROA and ROE. $2,500k $96k * ROAL = = 2.5 * 0.0384 = _____ = $1,000k $2,500k 7 . $2,500k $120k ROAU = = 2.5 * 0.048 = _____ = * $1,000k $2,500k . $1,000k ROEL = 0.096 * = 0.096 * 2 = _____ = $500k $1,000k ROEU = 0.12 * = 0.12 * 1 = _____ = $1,000k . . A5.1c) The ROAL < ROAU, but ROEL > ROEU. This illustrates the fact that the presence of debt in the levered firm’s capital _________ the return to its shareholders. Note also that for the unlevered firm that ROA = ROE, since stockholders are providing 100% of the financing. III. Financial Statement Analysis A. Cross Sectional Analysis compares a firm's financial data at a point in time to the same numbers from the relevant industry B. Time-Series Analysis examines a firm's operating results over time, eg. a five-year period. C. The best source of comparative industry data for U.S. companies is the Annual Statement Studies published by Robert Morris Associates. D. The Industries, SIC (Standard Industrial Classification) and NAICS (North American Industry Classification System) numbers covered in the RMA Annual Statement Studies are detailed in pages 1946, and 16-18, respectively, of the (2001-02) report. 8 E. The SEC 10-K forms currently provide the firm’s 4digit SIC code, however, the RMA Reports are now (since 2005) coded solely on the basis of the 6-digit NAICS. F. A website link to the U.S. Census Department’s “Correspondence Tables: 2002 NAICS Matched to 1987 SIC” is given below: http://www.census.gov/epcd/naics02/N02TOS87.HTM G. The breakdown by industry is as follows: Part I - Manufacturing Industries; Part II - Wholesaling Industries; Part III - Retailing, Services and Not Elsewhere Classified Industries; Part IV - Contractor Industries; Part V - Finance Industry Supplement. The comparative numbers provided by the RMA Reports cover both the common-size balance sheet and the income statement data, as well as (more than) the 21 key financial ratios in Figure 5.1 below. FIGURE 5.1 Liquidity Ratios: Coverage/Leverage Ratios: Current Ratio Times Interest Earned Quick Ratio Fixed Assets/Net Worth Sales/Receivables Debt/Net Worth Cost of Sales/Inventory Debt/Total Assets Cost of Sales/Payables Profitability Ratios: Efficiency Ratios: Operating Profit Margin Total Asset Turnover Before-Tax Profit Margin 9 Fixed Asset Turnover Average Collection Period Inventory Conversion Period Average Payment Period Cash Conversion Cycle After-Tax Profit Margin Before-Tax ROA After-Tax ROA Before-Tax ROE After-Tax ROE H. 2008 10-K Financial Statements for Lance, Inc. Item 8. Financial Statements and Supplementary Data Consolidated Statements of Income LANCE, INC. AND SUBSIDIARIES For the Fiscal Years Ended December 27, 2008, December 29, 2007, and December 30, 2006 (in thousands, except share and per share data) 2008 2007 2006 852,468 $ 531,528 320,940 762,736 $ 444,487 318,249 730,116 415,576 314,540 Selling, general and administrative Other (income)/expense, net 290,826 Income from continuing operations before interest and income taxes 291,680 (854) 30,114 277,317 2,390 38,542 283,006 191 31,343 Interest expense, net Income from continuing operations before income taxes 3,041 27,073 2,222 36,320 3,156 28,187 Income tax expense Net income from continuing operations 9,367 17,706 12,511 23,809 9,809 18,378 — — — 44 15 29 153 53 100 Net sales and other operating revenue Cost of sales Gross margin $ Income from discontinued operations, before income taxes Income tax expense Net income from discontinued operations Net income $ Basic earnings per share: From continuing operations From discontinued operations Basic earnings per share Weighted average shares outstanding — basic Diluted earnings per share: From continuing operations From discontinued operations Diluted earnings per share Weighted average shares outstanding — diluted See Notes to Consolidated Financial Statements. 10 17,706 $ 23,838 $ 18,478 0.77 $ 0.61 0.57 $ — — — 0.77 $ 0.61 $ 0.57 $ 31,202,000 30,961,000 30,467,000 $ 0.76 $ 0.60 0.56 $ — — — 0.76 $ 0.60 $ 0.56 $ 31,803,000 31,373,000 30,844,000 $ Consolidated Balance Sheets LANCE, INC. AND SUBSIDIARIES December 27, 2008 and December 29, 2007 (in thousands, except share data) 2007 2008 Assets Current assets Cash and cash equivalents Accounts receivable Inventories Deferred income taxes Prepaid expenses and other current assets Total current assets Fixed assets, net Goodwill, net Other intangible assets, net Other assets Total assets 22,711 28,915 Liabilities and Stockholders’ Equity Current liabilities Accounts payable Accrued compensation Accrued profit-sharing retirement plan Accrual for casualty insurance claims 58,630 Accrued selling costs Other payables and accrued liabilities Short-term debt Total current liabilities Long-term debt Deferred income taxes Accrual for casualty insurance claims 48,070 Other long-term liabilities Total liabilities Commitments and contingencies Stockholders’ equity Common stock, 31,522,953 and 31,214,743 shares outstanding, respectively Preferred stock, no shares outstanding Retained earnings Additional paid-in capital Accumulated other comprehensive income 48,301 Total stockholders’ equity Total liabilities and stockholders’ equity See Notes to Consolidated Financial Statements. $ 807 74,406 43,112 9,778 12,933 141,036 216,085 80,110 23,966 4,949 $466,146 $ 8,647 64,081 38,659 9,335 12,367 133,089 205,075 55,956 13,171 5,712 $413,003 $ 25,939 26,312 5,592 5,581 5,162 15,983 7,000 91,569 91,000 31,241 8,459 8,370 230,639 $ 21,169 20,564 5,383 8,163 4,511 14,847 — 74,637 50,000 26,874 7,428 6,967 165,906 26,268 — 160,938 49,138 (837) 235,507 $466,146 26,011 — 163,356 41,430 16,300 247,097 $413,003 I. RMA Report for NAICS Industry 311821: Cookie and Cracker Manufacturing, 4/1/08 – 3/31/09 11 Comparative Historical Data 5 6 6 2 8 4/1/06-3/31/07 ALL 27 % 7.1 18.7 14.2 1.9 41.9 38.9 11.6 7.5 100.0 5 4 3 9 4/1/07-3/31/08 ALL 21 % 6.6 19.8 17.3 1.1 44.8 38.4 12.3 4.5 100.0 13.2 4.3 12.7 0.1 7.8 38.0 24.8 0.6 5.5 31.0 100.0 10.8 2.8 13.7 0.1 7.9 35.4 18.9 0.8 10.7 34.2 100.0 MANUFACTURING – Cookie and Cracker Manufacturing NAICS 311821 Type of Statement Current Data Sorted by Sales 8 1 6 3 12 4/1/08-3/31/09 ALL 30 % 13.6 18.5 18.9 3.5 54.6 36.5 4.2 4.6 100.0 Unqualified Reviewed Compiled Tax Returns Other 1 1 1 1 2 NUMBER OF STATEMENTS 0-1MM 3 % ASSETS 3(4/1-9/30/08) 1-3MM 1 % 3-5MM 2 % 2 1 3 5-10MM 6 % Cash & Equivalents Trade Receivables (net) Inventory All Other Current Total Current Fixed Assets (net) Intangibles (net) All Other Non-Current Total 3 1 2 5 4 3 27 (10/1/08-3/31/09) 10-25MM 25MM & OVER 10 8 % % 12.4 17.3 21.8 4.3 55.8 38.7 2.9 2.6 100.0 LIABILITIES 3.7 5.6 16.3 0.0 10.7 36.3 22.0 0.8 4.1 37.0 100.0 Notes Payable-Short Term Cur.Mat. - L/T/D Trade Payables Income Taxes Payable All Other Current Total Current Long Term Debt Deferred Taxes All Other Non-Current Net Worth Total Liabilities & Net Worth 2.3 3.8 14.3 0.0 9.2 29.6 21.2 0.8 3.9 44.5 100.0 INCOME DATA 22 28 41 19 36 51 22 28 43 (23) (21) 100.0 32.7 27.8 5.0 1.6 3.4 1.9 1.3 0.7 1.2 0.8 0.4 16.7 13.0 9.0 18.8 10.2 7.2 16.9 12.9 8.5 6.2 1.4 0.5 0.7 1.2 4.1 0.8 2.3 327.3 49.8 10.4 -2.1 16.3 2.8 -1.3 12.2 5.6 3.4 3.0 2.1 1.5 1433029M 757365M 24 29 38 23 42 55 17 30 38 (20) (18) 100.0 28.6 22.3 6.2 0.9 5.4 1.8 1.3 0.9 1.2 0.7 0.4 14.9 12.4 9.6 16.2 8.6 6.6 21.8 12.3 9.5 14.3 4.0 1.4 0.5 1.1 2.0 0.8 1.4 NM 47.2 25.5 7.0 15.8 9.5 2.0 12.3 6.7 3.0 3.0 2.4 1.4 1517108M 681787M 100.0 33.5 27.1 6.5 1.0 5.5 3.8 1.9 0.9 2.1 1.2 0.4 18 20.4 25 14.6 33 11.2 18 20.0 30 12.0 59 6.2 17 22.0 22 16.7 37 9.8 17.3 (23) 4.4 2.0 0.4 0.7 3.7 0.5 1.1 5.0 62.0 (24) 29.1 8.6 27.0 14.8 1.7 23.8 7.5 3.9 4.0 2.8 1.8 1311106M 443329M Net Sales Gross Profit Operating Expenses Operating Profit All Other Expenses (net) Profit Before Taxes RATIOS Current Quick 17 29 43 36 52 69 13 35 47 Sales/Receivables Cost of Sales/Inventory Cost of Sales/Payables 100.0 32.8 23.9 8.9 1.0 7.9 3.8 1.5 1.2 1.9 1.0 0.4 21.4 12.7 8.5 10.0 7.1 5.3 27.9 10.3 7.8 EBIT/Interest 0.3 0.7 3.0 0.6 1.2 3.5 Fixed/Worth Debt/Worth % Profit Before Taxes/ Tangible Net Worth % Profit Before Taxes/ Total Assets Sales/Net Fixed Assets Sales/Total Assets Net Sales ($) Total Assets ($) M = $ thousand MM $ million 12 782M 300M 1274M 297M 7563M 5244M 46797M 16518M 25.5 14.2 1.7 27.3 4.8 1.9 3.5 1.9 1.1 166845M 95183M 1087845M 325787M J. Conducting Cross-Sectional Analysis 1. Common-size Statements a. Income Statement: take _____ as 100%, replace each dollar amount with its relative proportion of Sales. b. Balance Sheet: take _____ ______ (or Total Liabs. + Total Equities) as 100% and find proportion which each asset or liability account represents. 2. An Example using the Datasets for Lance, Inc. provided above is next. Ex. 5.2 1. Brody Howes (F382 Fa’07) is going to help you in developing a spreadsheet which will perform the following calculations for Lance, Inc. for the fiscal year ended December 27, 2008. a) Calculate the Common-Size Balance Sheet Ratios; b) Calculate Common-Size Income Statement Ratios; c) Determine the specific financial ratios given above in FIGURE 5.1. d) Determine the appropriate industry numbers from the RMA Annual Statement Studies and incorporate them, insofar as possible, into the spreadsheet. The specific format for certain of the cell locations are as follows: ASSETS LIABILITIES Total CA's: C10 Total CL's:H8 Total FA's:C16 Total Liabs.: H12 Total Assets: C17 Total Equity: H21 TL's + TE: H22 13 INC STMT Net Sales: G25 COS:G26 EBIT: G32 EBT: G34 EAT=EAC: G36 2. Conduct Cross-Sectional Analysis for Lance, Inc. versus the Industry for the most recent year. For the 18 ratios which correspond between the firm and RMA discuss whether each ratio is a positive or negative indicator for Lance. Explain carefully how each negative ratio is influenced, or influences, other ratios. In one or two sentences each, summarize how the four ratio groups (i.e., Liquidity, Efficiency, Leverage and Profitability) compare, as a whole, to the industry. A5.2. See the spreadsheet at the end of this lecture note: “COMPARATIVE ANALYSIS OF FINANCIAL POSITION”. Note: The RMA Studies Industry judged to most closely represent Lance, Inc. is “Cookies and Crackers”; SIC# = 2052. A5.2.2. Liquidity Ratios: Industry CAs $141,036 Current Ratio: = = _____ vs. 1.90. CLs $91,569 Lance's Current Ratio is (18.9%)1 _____ than that of the industry suggesting that either CAs are relatively low or that CLs are high. The Quick Ratio and leverage ratios need to be examined to decide if this presents a potential problem before making a more 1 Calculated as (1.54 -1.90)/1.90 = -0.189, or generally (Firm Ratio minus Industry Ratio)/Industry Ratio. 14 specific conclusion-although Lance's lower ratio is a slightly ________ indicator. $97,924 CAs Inv Quick Ratio: = $91,569 = CLs ____. Industry vs. 1.20. The Quick Ratio for Lance is slightly _____ than the industry's ratio which is also a ________ indicator for the firm. Given that Lance’s QR dropped less (compared to the CR) than the Industry’s did this indicates that Lance's inventory is lower than that of the Industry. This conclusion is verified by comparing the firm's common-size Inventory ratio (=9.25%) to the industry's ratio (=18.9%). Sales Sales/Recs: = ARs ______ $852,468 $74,406 = Industry Vs. 14.6 The Lance Sales/Receivables Ratio is a ________ indicator of liquidity since it is _____ than that of the Industry. This ratio shows Lance has more uncollected sales compared to all sales than the Industry. (Note: this result seems counterintuitive given the comparison of common-size AR ratios. How can this be explained?) Industry 15 vs. 12.0 COS $531,528 COS/Inv: = = ______ Inv $43,112 The COS/Inventory ratio for Lance is a slightly _______ indicator for the firm. Compared to all costs of production, Lance’s inventory is a bit lower than the Industry’s, although the difference is marginal. COS $531,528 COS/Payables: = = APs $ 25 , 939 ______ Industry vs. 16.70 The COS/Payables Ratio for Lance is a ________ indicator for the firm. It suggests that Lance’s trade credit (unpaid credit purchases) is smaller compared to the costs of production than that for the Industry. Efficiency Ratios: Sales $852,468 Total Asset TO: = =______. TAs $466,146 Industry vs. 2.80 TATO for Lance is a ________ measure compared to the Industry suggesting that the firm generates fewer dollars in sales per dollar of TAs. Industry Sales $852,468 Fixed Asset TO: = = ______. vs. 7.50 FAs $ 325 , 110 16 Compared to the Industry's ratio, Lance's FATO is also a _______ figure indicating that the firm utilizes its FAs less efficiently. Or, equivalently that the firm requires proportionately more FA's to generate the same amount of sales. This conclusion is not surprising in view of the firm's comparatively lower current ratio (less CAs means more FAs). The same finding is shown by comparing Lance's common-size FA ratio (=69.7%) to the Industry's FA ratio (=45.4%). Industry 365 365 ACP: = = _____. vs. 25 days (Sales/ARs ) ($852,468 / $74,406) Lance's ACP is a ________ efficiency measure for the firm indicating that, on average, it takes almost six days longer, on average, to collect its ARs as does the industry. Industry 365 365 ICP: = ($531,528 / $43,112) = ______. vs. 30 days (COS/Inv) The Inventory Conversion Period for Lance shows that the firm converts its production inputs into finished inventory marginally ______ than does the industry. This slightly positive efficiency measure is not surprising given the firm's relatively lower inventory level. Industry 17 vs. 22 days 365 365 APP: = = ______. (COS/APs) ($531,528 / $25,939) The Average Payables Period for Lance is ____ (19.04% lower) than that for the Industry. This shows that the firm pays for its credit purchases about four days more quickly (on average) than does the Industry. CCC: = = ______ days = 31.858 + 29.605 – 17.812 Industry vs. 33 days The Cash Conversion Cycle which describes the time (in days) between when the production inputs are paid for and the cash from a sale is received. The CCC for Lance is 10.65 days ______ than that for the Industry. This ________ indicator shows that Lance does not manage cash as well as the average Industry firm. Coverage/Leverage Ratios: Industry EBIT $30,114 TIE: = = _____x vs. 4.4x LT Debt Int $3,041 The TIE measure is a very ________ indicator for Lance showing that the firm is more than twice (2.25)2 as capable of affording its interest costs from operating profits. This comparison shows the firm is 2 Based on the wording used here, the comparison is calculated as Firm/Industry = 9.9027/4.4 = 2.2506. 18 either more profitable than the Industry, has less debt, or both. Since the firm’s common-size EBIT (its OPM) of 3.53% is less than the Industry’s (6.50%) it must be the case that Lance uses less debt. Industry FAs $325,110 Fixed/Worth: = = ______ vs. 0.70 TE $ 235 , 507 Comparison of the FA/NW ratio for Lance and the Industry shows the firm’s ratio to be almost two (1.972) times ______. This indicator would technically be negative for the firm. However, it may be showing relatively more FAs, (we knew that), or more equity/less debt (shown next), or both (true for Lance) which are not negative when considered in combination. TLs $230,639 Debt/NW: = = ______ TE $235,507 Industry vs. 1.1 Lance’s D/E ratio indicates that the firm uses ____ debt than does the Industry. Lance’s Debt/NW ratio is 11.25% lower than the Industry’s. This lower debt level for the firm is also shown using the Debt Ratio, below. TLs $230,639 Debt Ratio: = = ______ TAs $466,146 Industry vs. 63.0% Note: Industry Debt Ratio = 1- RMA Common-Size Equity Ratio 19 = 1- 0.370 = 0.630 = 63.0%. As is further emphasized by the Debt Ratio, Lance utilizes ____ debt (about 21.5% less) than the Industry. This ratio and the Debt/Worth ratio will also show one reason why Lance’s ROE is markedly lower in comparison to the Industry. Profitability Ratios: EBIT $30,114 OPM: = = ______ Sales $ 852 , 468 Industry vs. 6.50% The Operating Profit Margin for the Industry is 1.84 times3 that of Lance. This ___________ comparison indicates that the firm keeps a smaller share of each dollar from operations. This ratio is given for both Lance and the Industry in the common-size Income Statement ratios. Industry EBT $27,073 Before-Tax PM: = = ______. vs. 5.50% Sales $ 852 , 468 Lance's Before-Tax Profit Margin is exceeded by the Industry’s B-T PM by a slightly smaller amount than was its OPM (1.73 times). This is consistent with Lance having ____ debt and therefore less debt interest. 3 This comparison, as worded here is calculated as Industry/Firm, i.e., 0.065/0.0353 = 1.8414 times. 20 Industry EAC $17,706 After-Tax PM: = = ______. vs. NC Sales $852,468 Although the Industry A-T PM is not available because RMA provides no after-tax ratios it seems probable that Lance's A-T PM would be _____ than the Industry's average. EBT $27,073 Before-Tax ROA: = = _____. TAs $ 466 , 146 Industry vs. 14.80% EAC $17,706 After-Tax ROA: = = _____. TAs $466,146 Industry vs. NC Lance's B-T ROA is markedly _____ (60.74%) than that of the Industry. Again this is not surprising given the firm's much lower profit margins. Lance's A-T ROA is not directly comparable to a similar Industry ratio but most assuredly must be at least somewhat lower. Industry EBT $27,073 Before-Tax ROE: = = ______. vs. 29.10% TE $ 235 , 507 Industry EAC $17,706 After-Tax ROE: = = _____. vs. NC TE $ 235 , 507 As was true with the B-T ROA, B-T ROE for the Industry is seriously ______ (2.53 times) than that of 21 Lance. It is also clear that A-T ROE must be much lower for Lance than for the Industry as well. Overall Conclusions: Liquidity Ratios: Lance is generally ____ liquid than its Industry. The main reason that working capital is relatively low is that Lance’s cash level is very low. On the positive side, inventory and accounts payable are found to be somewhat lower than the Industry. Efficiency Ratios: Lance seems to utilize its total and fixed assets somewhat ____ effectively than its Industry based on its turnover ratios. Generally the firm's management of short-term assets is inferior to the Industry. However, Lance’s default risk is probably viewed as relatively lower than average since it pays its trade payables more quickly. Coverage/Leverage Ratios: Lance’s TIE ratio is very ________ because of the firm's relatively lower debt interest. The three leverage ratios also clearly show that the firm employs less debt than the Industry. Thus, Lance’s lower default risk is further reinforced. Profitability Ratios: Lance's (B-T) profit margins are all relatively _____ than those for the Industry. Both Before-Tax return on investment measures (ROA and ROE) suggest Lance is relatively less profitable than the average firm in the Industry. IV. Financial Statements & Free Cash Flow 22 FIN 410: Comparative Analysis of Financial Position Lance, Inc. ASSETS: 27-Dec-08 ComSize Industry LIABILITIES: 27_Dec-08 ComSize Industry Current Assets Current Liabilities Cash $807 0.17% 13.6% Accounts Payable $25,939 5.56% 16.3% MarketableSecs $0 0.00% Accrued and other $58,630 12.58% 20.0% Accounts Rec'ble $74,406 15.96% 18.5% Short-term debt $7,000 1.50% Total CL's Inventories $43,112 9.25% 18.9% $91,569 19.64% 36.3% Long-Term Liabilities Other $22,711 4.87% Total CA's $141,036 30.26% 54.6% L-T Debt $91,000 19.52% 22.0% Other Liabilities $48,070 10.31% 4.9% Fixed Assets Total Liabs. $230,639 49.48% 63.0% Fixed Assets, net $216,085 46.36% 36.5% Stockholder's Equity Goodwill, net $80,110 17.19% 4.2% Preferred Stock $0 0.00% Other Assets $28,915 6.20% 4.6% Common Stock $26,268 5.64% Total FA's $325,110 69.74% 45.4% Treasury Stock $0 0.00% Total Assets $466,146 100.00% 100.0% Retained Earnings $160,938 34.53% Add’l Paid-In Cap $49,138 10.54% Prefd. Shs. Out: 0 Other ($837) -0.18% Total Equity Com Shs. Out: 31522.953 $235,507 50.52% 37.0% TLiabs + TEquity Earnings/Share $0.56 $466,146 100.00% 100.0% INCOME STATEMENT 27-Dec-08 ComSize Industry Net Sales $852,468 100.00% 100.0% Cost of Sales $531,528 62.35% 66.5% Gross Margin $320,940 37.65% 33.5% Administrative & Selling Expenses $291,680 34.22% Research & Development Expenses $0 0.00% Other (income)/expense, net ($854) ($854) -0.10% Total Operating Expenses $290,826 $290,826 34.12% 27.1% Operating Income (EBIT) $30,114 $30,114 3.53% 6.5% Debt Interest and other income (loss) $3,041 0.36% Earnings Before Taxes (EBT) $27,073 3.18% 5.5% Provision for Income Taxes $9,367 $9,367 1.10% Net Income (EAC) $17,706 $17,706 2.08% CALCULATION OF FINANCIAL RATIOS Liquidity Ratios: Lance Industry Coverage/Leverage Lance Industry Current Ratio Times Int. Earned 1.54 1.90 9.90 4.4 Quick Ratio Fixed/Worth 1.07 1.20 1.38 0.70 Sales/Recs. TLiab/Worth 11.46 14.60 0.98 1.1 COS/Inventory TLiab/TA's 12.33 12 49.5% 63.0% COS/Payables Profitability Ratios (%): 20.49 16.70 Efficiency Ratios: Oper.Profit Margin 3.53% 6.50% Total Asset TO BT-Profit Margin 1.83 2.80 3.18% 5.50% Fixed Asset TO AT-Profit Margin 2.62 7.50 2.08% Avg. Coll. Period BT-Retrn on Assets 31.86 25.00 5.81% 14.80% Inv. Conv. Period AT-Retrn on Assets 29.60 30.00 3.80% Avg. Pmt. Period BT-Retrn on Equity 17.81 22.00 11.50% 29.10% Cash Conv. Cycle AT-Retrn on Equity 43.65 33.00 7.52% 23 A. Traditional Accounting Statements and Measures of Profitability are designed primarily for creditors and tax collectors. B. Alternative Measures make the data more useful for financial analysis. C. Modifications for Managers and Equity Analysts 1. Operating Current Assets (OperCA) are the assets necessary to operate the business. OperCA = Cash + ARs + Inventory. (5.4) 2. Operating Current Liabilities (OperCL) are the funds obtained from non-investors, like suppliers (APs), employees (accrued wages) and the taxman (accrued taxes). OperCL = APs + Accruals. (5.5) 3. Net Operating Working Capital (NOWC) represents the working capital acquired with investorsupplied funds. NOWC = (Cash + ARs + Inv) – (APs + Accruals). (5.6) 4. Operating Capital (OperCap) represents all assets (both short- and long-term) required to operate the business. OperCap = NOWC + Net FA (Fixed Assets). 24 (5.7) • Note: These measures exclude nonoperating items such as marketable securities and notes payable, and fixed assets not directly tied to production 5. Net Operating Profit after Taxes (NOPAT) is the amount of profit a company would generate if it had no debt and held (owned) no financial (nonproductive) assets. It is considered to be a better measure of management performance than net income. NOPAT = EBIT * (1- t). (5.8) 6. Free Cash Flow (FCF) is the cash flow available to investors after investments (in fixed assets and working capital) needed to sustain operations have been made. FCF = NOPAT - OperCap, (5.9) where: OperCap is based on Net FA. • If the OperCap were found using FAGross, then FCF would be: FCF = NOPAT + Dep - OperCap(Gross). (5.9a) Note: (5.9) and (5.9a) yield the same result because the difference between Gross and Net Fixed Assets is Depreciation. Question: Is negative FCF always a bad sign? 25 Answer: Not if NOPAT is positive FCF < 0 could be due to large investments in operating assets. 7. Return on Invested Capital (ROIC) is a measure that can be used to assess whether a firm’s growth is profitable. NOPAT ROIC = . Operating Capital (5.10) If a firm’s ROIC is greater than the rate of return investors require, i.e., WACC, then the firm is adding value. 8. Market Value Added (MVA) is calculated as the difference between the market value of equity and the book value of equity (i.e., the total amount of investorsupplied equity). MVA = MV of Equity – BV of Equity. (5.11) 9. Economic Value Added (EVA) is a measure of how much value (true economic profit) has been added to the firm over the course of a particular year. It differs from accounting profit because it represents residual income after all costs of capital (debt and equity) have been deducted. EVA = NOPAT – kWACC*(OperCap) (5.12) EVA = (OperCap)*(ROIC – WACC). (5.12a) 26 Notes to Consolidated Financial Statements. NOTE 5. FIXED ASSETS Fixed assets at December 27, 2008 and December 29, 2007 consisted of the following: (in thousands) 2008 Land and land improvements Buildings and building improvements Machinery, equipment and computer systems Trucks and automobiles Furniture and fixtures Construction in progress 2007 $ 14,670 15,209 84,118 87,067 287,821 305,007 59,490 61,967 2,304 2,334 10,909 12,341 459,312 483,925 Accumulated depreciation and amortization (253,732) (267,456) $ 205,580 $ 216,469 Assets held for sale (505) (384) Fixed assets, net $ 205,075 $ 216,085 The increase in fixed assets during 2008 was primarily due to purchases of fixed assets for existing facilities and $11.0 million from business acquisitions. Depreciation expense related to fixed assets was $32.0 million during 2008, $29.3 million during 2007, and $26.8 million during 2006. During 2008, we capitalized $0.3 million of interest expense into fixed assets as part of our ERP system implementation. There are two facilities in Canada that accounted for $17.5 million and $24.2 million of the total net fixed assets in 2008 and 2007, respectively. At December 27, 2008, and December 29, 2007, assets held for sale consisted of land and buildings related to certain properties in Columbus, Georgia. $ Addendum: See page 28 for WACC (presumably). Including the effects of the interest rate swap agreements, the weighted average interest rate for 2008 and 2007 was 3.6% and 5.3%, respectively. Ex. 5.3 Danielle Baker (F382 Sp’06) has provided you with the supplemental information from Lance’s 10-K report on fixed assets and depreciation. Danielle has also supplied the Balance Sheet and Income Statement data for Lance for 2007 and 2008. Use the Income Statement information to determine the firm’s average tax rate for both 2007 and 2008 (use round function and round tax rate to four decimal places in SS). Use the Lance_FCF Worksheet in Spreadsheet 3 to calculate all of the relevant values given in equations (5.4) 27 through (5.12). Skip equations (5.9a) and (5.12a) in this analysis. From Bloomberg the firm’s WACC = 10.5143% in 2007 and 7.9466% in 2008. a) Was the firm able to fund expansion needs internally? b) Based on ROIC was the firm adding value in 2007 or 2008? c) Determine MVA in 2007 and 2008 using the information provided previously in the firm’s 10-K reports. LANCE Inc. Cash & equiv. S-Term Inv. Accts Rec Inventories Other Current Total Curr As Net Fixed As Goodwill Other Assets Total FAs Total Assets 2008 $807 $0 $74,406 $43,112 $22,711 $141,036 $216,085 $80,110 $28,915 $325,110 $466,146 2007 $8,647 $0 $64,081 $38,659 $21,702 $133,089 $205,075 $55,956 $18,883 $279,914 $413,003 Sales COS Gross Margin Selling, general and admin exp Other (income)/expense Total Oper. Costs EBIT Interest exp. EBT Avg. Rate Taxes ? Net Inc fr. Cont Opers. EBT fr. Discnt'd Opers. Tax Expense Net Income 28 Accts payable Accruals & Other S-T Debt & Other Total Curr Liabs Long-term debt Other L-T Liabs Total Liabs 2008 $25,939 $58,630 $7,000 $91,569 $91,000 $48,070 $230,639 2007 $21,169 $53,468 $0 $74,637 $50,000 $41,269 $165,906 Preferred Stock Common stock Retained earnings Add’l Paid-In & Other Total equity Total L&E $0 $26,268 $160,938 $48,301 $235,507 $466,146 $0 $26,011 $163,356 $57,730 $247,097 $413,003 2008 $852,468 $531,528 $320,940 $291,680 ($854) $290,826 $30,114 $3,041 $27,073 $9367 $17,706 $0 $0 $17,706 Avg. Rate ? 2007 $762,736 $444,487 $318,249 $277,317 $2,390 $279,707 $38,542 $2,222 $36,320 $12,511 $23,809 $44 ($15) $23,838 A5.3. Avg Tax Rate = Tax Liab/Taxable Income. Avg Tax Rate08 = $9,367/$27,073 = ______. Avg Tax Rate07 = $12,511/$36,320 = ______. OperCA = (Cash + AR + Inv + Other CAs). OperCA08 = ($807 + $74,406 + $43,112 + $22,711) = _____ ___. OperCA07 = _____ ___. OperCL = (AP + Accruals & Other CLs). OperCL08 = ($25,939 + $58,630) = ____ ___. OperCL07 = ____ ___. NOWC = OperCA – OperCL. NOWC08 = $141,036 – $84,569 = ___ ____. NOWC07 = _____ __. OperCap = NOWC + Net FA + Other LT Assets. OperCap08 = $56,467 + $216,085 + $109,025 = _____ ___. OperCap07 = ___ _____. NOPAT = EBIT * (1 – t). NOPAT08 = $30,114 * (1 – 0.346) = __ _____. NOPAT07 = $38,542 * (1 – 0.3445) = _ ______. FCF08 = NOPAT - Net capital investment = NOPAT – (OperCap08 – OperCap07) = $19,695 – ($381,577 – $338,366) 29 = $19,695 – $43,211 = _____ ___. A5.3a) Since NOPAT is less than the change in OperCap and FCF is negative the firm is not able to fund its expansion needs internally. ROIC = NOPAT/OperCap. ROIC08 = $19,695/$381,577 = __ ___. ROIC07 = $25,264/$338,366 = __ ___. A5.3b) ROIC08 (=5.16%) < WACC08 (=7.9466%), and ROIC07 (=7.47%) < WACC07 (=10.5143%), so the firm was losing value in both 2007 and 2008. EVA08 = NOPAT- (WACC * OperCap08) = $19,695 - (0.079466)*($381,577) = $19,695 - $30,322 = -$10,627. EVA07 = $25,264 - (0.105143)*($338,366) = $25,264 - $35,577 = -$10,313. A5.3c) Using “Close” prices (12/29/08 & 12/27/07) MVA = MVEquity – BVEquity. MVA08 = (31522.953)*($22.02) – $235,507 = $458,628. MVA07 = (31214.743)*($21.03) – $247,097 = $409,349. 30 Strangely even though EVA was negative in both 2007 and 2008, the firm’s performance was positive and the stock price (and MVA) increased from 2007 to 2008. Note: Retained Earnings and Add’l Paid-In decreased, (management draining the reserves?) so BVE declined. This would account for the increase in MVA. Further, the share price increasing suggests the market did not perceive possible management duplicity. 10. MVA vs. EVA a. MVA measures the effect of managerial actions on shareholder wealth since the firm’s inception. b. EVA measures managerial effectiveness in a given year. c. The relationship between MVA and EVA is not necessarily direct, although firms with a history of positive (negative) EVA’s will probably have a positive (negative) MVA. However, MVA reflects expected future prospects, so MVA could still be positive in the face of a series of negative EVAs if investors expect a turnaround. d. In choosing MVA vs. EVA to evaluate management performance for incentive-based compensation, firms typically use EVA. Why? 31