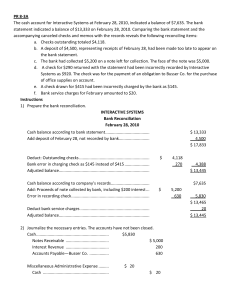

Bank Reconciliation: Bank reconciliation is prepared periodically to explain the difference between cash reported on the bank statement and the cash balance on company’s books. مذكره تسويه البنك يتم عملها لتوضيح وشرح االختالف بين الرصيد الموجود فى البنك والرصيد الموجود بدفاتر الشركه Bank Bank Statement Statement Balance Balance Deduct: Outstanding Deduct: Outstanding checks. checks. Add: Add: Deposits Deposits in in transit. transit. Add Add or or Deduct: Deduct: Bank Bank errors. errors. Book Book Balance Balance Deduct: Deduct: Nonsufficient Nonsufficient funds funds check check (NSF). (NSF). Deduct: Deduct: Bank Bank service service charge. charge. Add: Add: Interest Interest earned earned on on checking checking account. account. Add: Add: Collections Collections made made by by the the bank. bank. Add Add or or Deduct: Deduct: Book Book errors. errors. Example: prepare a July 31 bank reconciliation statement for the Tarek Company. The July 31 bank statement indicated a balance of $9,610, while the cash general ledger account on that date shows a balance of $7,430. Additional information necessary for the reconciliation is as follows: Outstanding checks totaled $2,417. A $500 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer’s NSF check for $225 received as payment on account receivable. The bank statement showed $30 interest earned during July. Check No. 781 for supplies expense cleared the bank for $268 but was erroneously recorded in our books as $240. A $486 deposit by Acme Company was erroneously credited to our account by the bank. Tarek Company Bank Reconciliation July 31, 2002 Bank Balance, July 31 Add: Deposit in Transit Less: Bank Error Outstanding Checks Adjusted Balance, July 31 Book Balance, July 31 Add: Interest Less: Recording Error NSF Check Adjusted Balance, July 31 $ 9,610 500 $ 486 2,417 $ 28 225 (2,903) $ 7,207 $ 7,430 30 (253) $ 7,207 On January 1, a machine costing $230,000 with a 4-year useful life and an estimated $3,000 salvage value was purchased. It was also estimated that the machine would produce 500,000 units during its life. The actual units produced during its first year of operation were 90,000. Determine the amount of depreciation expense for the first year under each of the following assumptions: 1. The company uses the straight-line method of depreciation. ($230,000 - $3,000) / 4 = $56,750 2. The company uses the units-of-production method of depreciation. ($230,000 - $3,000) / 500,000 = $0.454/unit 90,000 x $0.454 = $40,860 3. The company uses the double-declining-balance method of depreciation. 100% / 4 = 25% x 2 = 50% = Double-declining-balance rate $230,000 x 50% = $115,000