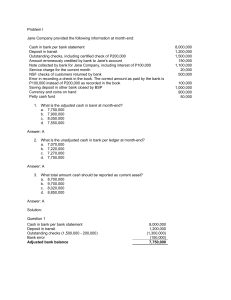

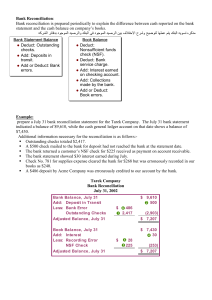

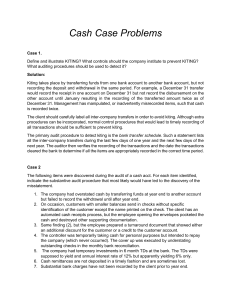

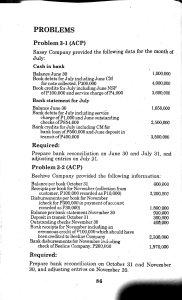

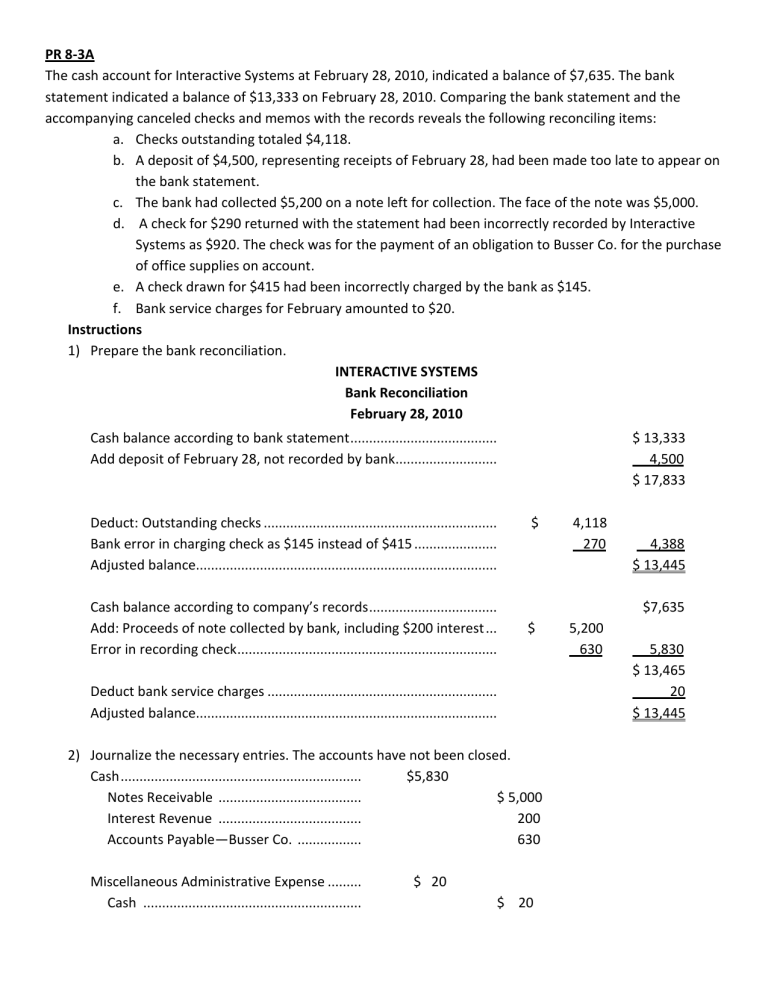

PR 8-3A The cash account for Interactive Systems at February 28, 2010, indicated a balance of $7,635. The bank statement indicated a balance of $13,333 on February 28, 2010. Comparing the bank statement and the accompanying canceled checks and memos with the records reveals the following reconciling items: a. Checks outstanding totaled $4,118. b. A deposit of $4,500, representing receipts of February 28, had been made too late to appear on the bank statement. c. The bank had collected $5,200 on a note left for collection. The face of the note was $5,000. d. A check for $290 returned with the statement had been incorrectly recorded by Interactive Systems as $920. The check was for the payment of an obligation to Busser Co. for the purchase of office supplies on account. e. A check drawn for $415 had been incorrectly charged by the bank as $145. f. Bank service charges for February amounted to $20. Instructions 1) Prepare the bank reconciliation. INTERACTIVE SYSTEMS Bank Reconciliation February 28, 2010 Cash balance according to bank statement ....................................... Add deposit of February 28, not recorded by bank........................... Deduct: Outstanding checks .............................................................. Bank error in charging check as $145 instead of $415 ...................... Adjusted balance................................................................................ Cash balance according to company’s records .................................. Add: Proceeds of note collected by bank, including $200 interest ... Error in recording check ..................................................................... $ 13,333 4,500 $ 17,833 $ 4,388 $ 13,445 $7,635 $ Deduct bank service charges ............................................................. Adjusted balance................................................................................ 2) Journalize the necessary entries. The accounts have not been closed. Cash ................................................................ $5,830 Notes Receivable ...................................... $ 5,000 Interest Revenue ...................................... 200 Accounts Payable—Busser Co. ................. 630 Miscellaneous Administrative Expense ......... Cash .......................................................... 4,118 270 $ 20 $ 20 5,200 630 5,830 $ 13,465 20 $ 13,445 PR 8-5A