Chapter 6

Chapter 6 Classwork

6-1. Which one of the following is not considered to be a cash equivalent?

a. Corporate commercial paper due in 90 days after purchase

b. U.S. Treasury bills with an original maturity of six months

c. A money market account with a stock brokerage firm

d. A certificate of deposit with a term of 75 days when acquired

e. Balance in a checking account.

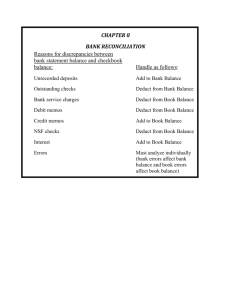

6-2. Which one of the following procedures is not part of preparing a bank reconciliation of a checking account

a. Tracing deposits listed on the bank statement to the books to identify deposits in transit

b. Arranging canceled checks in numerical order and tracing them to the books to identify outstanding checks

c. Identifying items added on the bank statement which have not been recorded as cash receipts by the company

d. Preparing adjustments to reverse the transactions recorded for checks that are still outstanding

6-3. Which one of the following items would be subtracted from the balance per books in a bank reconciliation

a. Outstanding checks

b. Deposit in transit

c. Service charges

d. Interest on customer note

6-4. The accountant for Rogan Corp. was preparing a bank reconciliation as of February 28, 2014. The following items were identified:

Rogan’s book balance

Outstanding checks

Service charge

Customer's NSF check returned by the bank

$15,000

2,500

15

100

What amount will Rogan report as its adjusted cash balance at February 28, 2014?

a. $12,385

b. $12,500

c. $14,885

d. $17,385

Classwork 6-5 Items on a Bank Reconciliation Assume that Seabreez Co. is preparing a bank reconciliation for the month of March. For each of the following items, indicate whether the item is an addition to the bank balance (A-

Bank), an addition to the book balance (A-Book), a deduction from the bank balance (D-Bank), a deduction from the book balance (D-Book), or would not appear on the June reconciliation (NA). Also, place a JE next to your answer for any items that will require a journal entry on the company's books.

_________ 1 Customer's check for $400 is return as NSF (not sufficient funds).

_________ 2 Customer's check for $889 was recorded on the books as $89.

_________ 3 Service charge on the account for $50.

_________ 4 Checks written in March, but not returned to the bank, $8,800

Customer note principal of $10,000 plus $600 in interest collected by the

_________ 5 bank.

_________ 6 Interest on the checking account of $22 for the month.

_________ 7 Deposit of $32,000 made late on March 31 in transit.

_________ 8 Company check for $854 recorded on the books as $584.

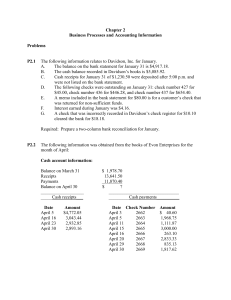

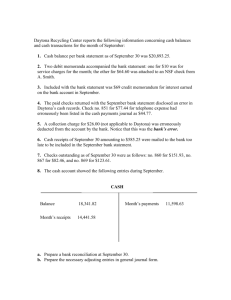

Classwork 6-6 Bank Reconciliation The following information is available to assist you in preparing a bank reconciliation for Pumpkin Center on July 31, 2016: a. The balance on the July 31, 2016, bank statement is $7,398. b. Not included on the bank statement is a $2,450 deposit made by Pumpkin late on July 31. c. A comparison between the canceled checks returned with the bank statement and the company records indicated that the following checks are outstanding at July 31:

No. 12301 $125.50

No. 12307 245.00

No. 12308 410.50

No. 12310 267.00 d. The Cash account on the company's books shows a balance of $17,633. e. The bank acts as a collection agency for interest earned on some municipal bonds held by Pumpkin Center. The

July bank statement indicates interest of $900.00 earned during the month. f. Interest earned on the checking account and added to Pumpkin Center’s account during July was $22.00.

Miscellaneous bank service charges amounted to $40.00. g. A customer's NSF check in the amount of $334.00 was returned with the bank statement. h. A comparison between the deposits listed on the bank statement and the company's books revealed that a customer's check in the amount of $1,200 was recorded on the books during July but was never added to the company's account. The bank erroneously added the check to another company’s account. i. The comparison of deposits per the bank statement with those per the books revealed that another customer's check in the amount of $909 was correctly added to the company's account. In recording the check on the company's books, however, the accountant erroneously increased the Cash account by $9,090.00.

Required

1.

Prepare a bank reconciliation in good form.

2.

Record the necessary journal entries on the company's books resulting from the bank reconciliation prepared in part (1) above.

Classwork 6-7 Working Backward: Bank Reconciliation

Bressner Company's bank reconciliation shows an adjusted cash balance of $30,407. The following items also appear on the reconciliation:

NSF check $907

Deposit in transit 13,004

Interest earned 420

Outstanding checks 3,707

Bank service charges 100

Required

1.

Determine the balance on the bank statement prior to adjustment.

2.

Determine the balance on the books prior to adjustment.