Lafayette Investment Club

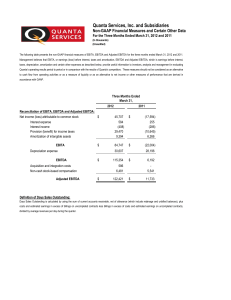

advertisement

Lafayette Investment Club Oct 14, 2011 Agenda • • • • Club News Education – Valuation Ratios Renewable Energy – overview How to invest in renewable energy? Club News • Morgan Stanley – Fri, Oct 28th Sebastian Crapanzano, MD, Risk Management • Barclays – Wed, Nov 2nd Jim Glascott, MD, Investment Banking • Rabobank – November Andrew Cooper Ratios and Stock Valuation Understanding How Stocks Are Compared And Valued Types of Valuation • Fundamental Analysis – “A method of evaluating a security that entails attempting to measure its intrinsic value by examining related economic, financial and other qualitative and quantitative factors.” – Investopedia • In other words you have to look at the big picture when fundamentally looking at a company. • You have to consider things like; Industry (Competitors, Market), Earnings, Income, Cash Flow etc. • Essentially you need to find out the Companies DNA. How do we do this? • 1) Balance Sheet - A statement of the assets, liabilities, and capital of a business or other organization at a particular point in time. (Loans/ Short term/long term Debt) • 2) Income Statement - a financial statement that gives operating results for a specific period. (expenses/ COG’s) • 3) Cash Flow - The total amount of money being transferred into and out of a business, esp. as affecting liquidity. (solvency, the cash health) • All three things can publically be viewed online, these statements are released Quarterly, and Annually. What's Next? • Once you have considered “The Big Picture”, you have an understanding of the companies fiscal figures, the next question I always ask myself, is where the hell is this stock going and how does it compare to its market and competitors? • A great tool to use are ratios that you can use to valuate these companies and see how they match up. • Most of these ratios point out if the stock is “cheap” or “expensive” or “undervalued” or overvalued”. • Once you understand where the company stands in comparison to the market, you can see if these are the right “levels” to get in. Ratio’s • • • • Here are some of the Ratio’s used to valuate companies. P/E – Price Earnings PEG – Price Earnings Growth EBITDA - Earnings before interest, taxes, depreciation, and amorization • EV/EBITDA – Enterprise Value to EBITDA Price/Earnings • This valuation ratio compares the company's current share price to its per-share earnings. • This can be a valuable tool in valuating companies within the same industry. • P/E is often used as a multiple when noting how much an investor/trader is willing to pay per dollar of earnings. • You will often hear analysts or traders say, “Its trading 10 times earnings” or “At a multiple of 14 the stock seems cheap”. • Formula: Market Value per Share / Earnings per Share (EPS) PEG (Price Earnings Growth) Ratio • A huge valuation tool for estimating potential earnings growth. • A company with a low PEG ratio closer to 0 is most likely undervalued. • However, just like P/E it has its limits. • These are projected numbers, so of course are subject to change. • This is still a great tool to see how it compares to industry leaders, also a huge tool used by Growth Investors. • Formula: Price/Earnings / Annual EPS growth EBITDA • A measurement of a company's operating profitability. It is equal to earnings before interest, tax, depreciation and amortization (EBITDA) divided by total revenue. • In essence you have a look at the company’s total profitability outlook. Enterprise Value/ EBITDA • First Enterprise Value is not to be mistaken with market cap. • Market Cap only deals with is limited to common equity. • Enterprise Value sums up everything and gives you the market value of the whole business. • EV/EBITDA is important because it can compare any company to another. • It ignores tax structures of other countries, and it also can be a great tool for potential takeover targets. • A company with a low ev/ebitda multiple is considered by some as undervauled. DCF – Discounted Cash Flow • This valuation tool, seemingly complicated, but if your good at math. • This a great method for valuating what your investment may be down the road. • In essence, THE DCF is = the money you would receive from an investment and adjusts for the time value of money. Done More Renewable Energy Greg Allis Solar (PV) Panels Radiation Hotspots Wind Turbines Global Wind Energy Production • Source: GWEC, Global Wind Report Annual Market Update 2010 Geothermal Other forms • • • • Biofuels Biomass Hydroelectric Tidal “I’m Going to Work on Wall Street, Why Do I Care?” • New and developing technologies • Huge political, social, and economic impacts • Money to be made Success Indicators • Government/financial support • Energy potential • Social attitude towards green energy Where/How to Invest in Clean Energy &Risks of Clean Energy Renewable Energy Companies Alternate Energy Stocks • First Solar Inc. (NASDAQ: FSLR) -solar • Tesla Motors Inc. (NASDAQ: TSLA) -electrical(vehicles) • FuelCell Energy Inc. (NASDAQ: FCEL) -electrical Renixx –Renewable Energy Industrial Index Green ETF’s • A green ETF is ultimately a basket of alternative energy stocks or stocks of green companies • Bought and sold on the stock market • Not subject to the same fees as an alternate investment fund(lower expense ratio) • Buying ETF’s is less risky than individual stocks Alternate Energy ETF’s • Market Vectors Global Alternative Energy ETF (NYSE: GEX) • PowerShares Clean Energy ETF (NYSE:PBW) • Market Vectors Solar Energy ETF (NYSE: KWT). Funds • iShares S&P Global Clean Energy Index Fund (ICLN) • New Alternatives Fund(NALFX) Risks of Clean Energy • Rapidly developing technologies • Industries prospects rely on Government help(subsidies) • Alternative-energy stocks tend to fall in and out of favor depending on the price of crude • So many clean energy companies emerging its hard to pick which one will stand the test of time • (Investor emotional Involvement for the wrong reasons)