AUDIT PROGRAM

advertisement

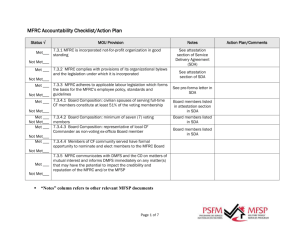

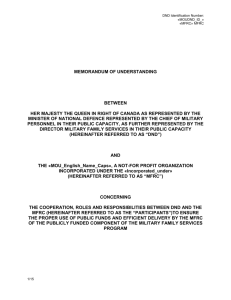

Military Family Services Program Compliance and Assurance Review 2014/2015 Fiscal Year (NAME OF MFRC) (Date of Compliance and Assurance) (Name of MFRC) COMPLIANCE AND ASSURANCE REVIEW PROGRAM – Fiscal Year 2014-2015 Ref MOU 6.3.1 MOU 6.3.2 MOU 6.3.3 2/13 Requirement Method of verification Observation Mode of review Onsite Military Family Resource Centre (MFRC) is a (federally/provincially/territor ially) incorporated, not-forprofit organization in good standing. MFRC complies with the provisions of its own organizational bylaws. Confirm with the province or territory to ensure that MFRC is incorporated in good standing at the time of the audit. Review bylaws. Randomly spot check that Board practices parallel provisions of the bylaws. Cross check with Annual General Meeting (AGM) and Board minutes to verify. Focus on bylaws that are relevant to the Memorandum of Understanding (MOU). (Note observations in Appendix A of audit report.) Onsite MFRC ensures that it adheres to applicable labour legislation, which forms the basis for its employee policy, standards and guidelines. In order for the reviewer to confirm that the MFRC adheres to applicable labour legislation they should be provided with a letter of opinion. This letter would verify adherence to labour legislation and would be signed by an appropriate authority. It would not be appropriate for this letter to be signed by a member of the Board. Onsite (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year MOU 6.3.4 In addition, and subject to the applicable (federal/provincial/territorial) legislation under which it is incorporated, ensure appropriate representation on its Board of Directors consistent with: 1. Civilian family members of serving full-time Canadian Armed Forces (CAF) personnel, constituting at least 51% of the voting membership. Ensure that Military Family Services (MFS) requirements for Board composition are met at the time of the review. Onsite Review bylaws, Board minutes, AGM report and AGM minutes to establish that members of the local CAF community had the formal opportunity to nominate and elect members to the MFRC Board. Onsite 2. A minimum of seven voting members (or in communities of less than 1000 CAF personnel, five voting members is acceptable) MOU 6.3.4 Item 4 3/13 3. A Commanding Officer or a senior member of the command team as a non-voting representative. MFRC must ensure members of the local CAF community have a formal opportunity to nominate and elect members to the MFRC Board of Directors. (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year MOU 6.3.7, 6.3.20 MOU 6.3.10 MOU 6.3.11 MOU 6.3.12 4/13 MFRC develops and submits its Request for Funds, Service Delivery Agreement, Quarterly Financial, Service Level Agreement, Supplemental Agreement and Performance Reports, in the manner prescribed by MFS. MFRC coordinates a minimum of four meetings per year with the local Commanding Officer, the MFRC Board Chair and the MFRC Executive Director MFRC conducts Community Needs Assessment (CNA) at least every three years. MFRC clearly identifies the Military Family Services Program (MFSP) logo on all printed material, signs, website, advertising and promotional material intended to promote the programs and services that fall under the purview of the MFSP. Review applicable documents within the last 12 months Onsite Review minutes of meeting within the last 12 months Onsite Review Community Needs Assessment completed within the last 36 months. Should reflect assessment principles as per 2012 Tool Kit . Revision of at least six promotional pieces, that are in accordance with the MFSP National Graphics Standards Manual (Version July 2011) Onsite (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year Onsite MOU 6.3.13 Privacy Code and Privacy Official language Act and MFSP Parameters for Practice, Sect 3. MFSP Parameters for Practice, Sect 5 5/13 MFRC ensures that formalized procedures are in place to manage personal information as recommended in the MFSP Privacy Code and Base/Wing regulation as applicable. Recommendations from the Commissioner of Canada are also reliable business practices. MFRC provides services in both official languages in accordance with Department of National Defence (DND) standards and the principles of family support MFRCs are expected to report on the expenditure of MFS provided funds; therefore the MFRC chart of accounts must segregate these funds. Verify that Procedures to protect and manage personal information exist Procedures to manage complaints and enquires about adherence to the Code exist Procedures to communicate and train the staff about privacy principle and accompanying procedures exist Onsite (physical filing and storing of information) Revision of at least six communications pieces that reflect that services are provided in both official languages. Onsite Review chart of accounts to ensure that MFS funds are identified and therefore possible to track. Onsite (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year MOU 7.3.1 MFRC uses funds provided by the DND through MFS exclusively for MFSP Mandated Services in accordance with MFSP: Parameters for Practice and its approved Service Delivery Agreement. MFSP Parameters for Practice, Sect 5, Letter Funding Notification (actual year) MFRC uses funds provided by DND through MFS to support mandated services. This may include programming costs. The following items may be reviewed in the MFS compliance review if assistance is deemed appropriate to ensure partnership goals are reached. 6/13 To confirm that MFS funds are being appropriately expended: Verify that MFS funds are segregated and therefore possible to track. Review quarterly expenditure reports and cross reference with financial journal entries, financial records and cancelled cheques. Inspect invoices and receipts. Verify that quarterly reports are in accordance with identified budget items in the Service Delivery Agreement. Monitor that these records clearly indicate purpose for which funds were expended. To confirm that MFS funds are being adequately used in relation to potential Personnel Support Programs (PSP) delivered services and that a collaborative relationship between PSP exists: Verify the membership list of the Community Program Committee (CPC, expand) Verify meeting minutes from the previous two CPC committee meetings Verify the agreed upon Service Delivery Model between the MFRC and local PSP. (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year Onsite Onsite MOU 7.3.1 7/13 Ensure proper control of accountable documents. Verify through sample review that the following acceptable practices are being followed: Proper serially numbered documents are used for processing the following transactions: a. cash receipts from customers; b. disbursement cheques; and c. charitable donation receipts Ask to see sample of records for each. Serial documents are recorded in a master control log that is maintained by someone independent of the bookkeeper. Ask to see log. Daily usage of serial numbered forms are controlled by someone other than the bookkeeper. Ask to see control system. Cash receipts are reconciled to the value of the deposit. Ask how this is being done and ask to see sample. Independent verification of serial numbered forms is conducted semi-annually by the Executive Director (ED). (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year Onsite MOU 7.3.1 Proper internal control over payroll MOU 7.3.1 Invoices, receipts and/or other records that demonstrate the purpose for which the funds were expended will be held on file at the MFRC for a period of six years, and made available to MFS or its representative on request. 8/13 Verify that the following acceptable practices are being followed: If an external payroll service provider is used, time sheets and pay rates must be approved by the Executive Director. Ask to see sample of completed timesheets. If payroll is completed in house, payroll cheques must be signed by the Executive Director who must review and initial the supporting payroll records. Ask to see sample of supporting payroll records. Spot check records. (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year Onsite Onsite MOU 7.3.3 9/13 Follow generally accepted accounting principles and practices, as well as the Canadian Institute of Chartered Accountants guidelines for Not for Profit accounting. Verify by reviewing annual financial audit conducted by Public Accountant. Verify by reviewing management letter that accompanies financial audit. The reviewer will meet with the accountant in person or via phone and discuss the annual audit process with questions such as: did the auditor meet with the ED, Board Chair and Treasurer, who provided all of the documents the auditor required, was the audit done on the premises or completely in the auditor’s own office? Post audit, before the production of final audited statements – did the auditor debrief with the ED, Board Chair and Treasurer? Did the auditor present the financial statements at the AGM? How many years did this company audit the MFRC? (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year Onsite MOU 7.3.3 10/13 Adequate segregation of duties. Management should follow acceptable guidelines for segregation of duties to prevent and detect both intentional and unintentional errors. separation of the custody of assets from accounting; separation of the authorization of transactions from the custody of related assets; separation of duties within the accounting function; and separation of operational responsibility from record-keeping responsibility Verify that the following practices are in place and the following duties are segregated: cheques must be signed by two authorized signing officers; source documents must be attached to or presented with cheques at the time of signature, initialed by those signing the cheques and stamped “paid" to prevent double payment; bank reconciliations must be completed by the Treasurer or third party and must be approved by the ED; ED should have read-only access to online balance and transactions on the bank account. all incoming cheques / mail are received, opened and recorded in a log by someone other than the bookkeeper; incoming cheques are immediately stamped with a “For Deposit Only to MRFC account #”; and bank deposit is taken to the bank by someone other than the individual who prepared it. (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year Onsite MOU 7.3.4 The MFRC will provide to MFS Quarterly Financial and Performance Reports in the format prescribed by MFS, detailing the service provided and funds expended. MOU 7.3.5 Subject to approval from MFS, the MFRC may retain up to a maximum of 10 percent of unexpended funds within a given fiscal year. Funds retained must be expended in such a way that is “in keeping with” the overall goals and objectives of the MFSP. Expenditure of and future reporting on the use of the unexpended funds will be in accordance with MFS provisions. 11/13 Verify with MFS that submissions of quarterly financial reports are up to date at the time of the audit. Review quarterly reports for prescribed format. Ensure that the Board is reviewing these reports at their meetings. For assurance of accuracy in reporting, compare the fourth quarter of most recent fiscal year to the figures reported in the audited financial statement for that year. If applicable: Confirm that approval from MFS was obtained. Track expenditure of funds by cross-referencing with financial journal entries, financial records and cancelled cheques. Monitor that these records clearly indicate purpose for which funds were expended? (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year Onsite Onsite MOU 7.3.8 MFRC will obtain an annual external and independent financial audit conducted by a designated Public Accountant licensed in his/her respective province. MOU 8.1 The MFRC will obtain property, liability, errors and omissions and directors and officer’s liability insurance coverage in accordance with the minimum standards established by MFS. 12/13 Review audit and note any emergent issues. Review management letter that accompanies audit and note salient observations. Verify that credentials of auditor indicate that he/she is licensed in the province. Verify that accountant has no connections other than professional with the MFRC. Ensure that he or she is “independent”. Reviewer to ascertain what the minimum standards established by MFS are at the time of the visit. Confirm with the insurance company used by the MFRC that they have the recommended level of insurance. (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year Onsite Onsite APPENDIX A The reviewer will examine Board bylaws & policies and randomly select five provisions to spot check. The bylaws to be cross checked must be relevant to the provisions of the MOU (i.e. Board composition; AGM requirements; requirement for an annual financial audit; and so on). Using the table below, the reviewer will note five policies or bylaws. The reviewer will then verify the extent to which these are put into practice via analysis of Board and AGM minutes as well as interviews with Board members where appropriate. Board Policy Observation A.1 A.2 A.3 A.4 A.5 13/13 (Name of MFRC) MFSP Compliance and Assurance Review Program: 2014/2015 Fiscal Year Mode of review Onsite Onsite Onsite Onsite Onsite