Problem set #2

advertisement

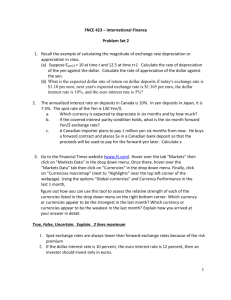

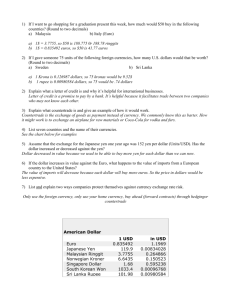

FNCE 423 – International Finance Problem Set 2 Due: In class, on Monday 1. Recall the example of calculating the magnitude of exchange rate depreciation or appreciation in class. (a) Suppose Eyen|$ = 100 at time t and 135 at time t+1. Calculate the rate of depreciation of the yen against the dollar. Calculate the rate of appreciation of the dollar against the yen. 2. Consider the U.S. and its major trading partners: Canada, Mexico, China, and Japan. For simplicity, assume these are the only four countries with which the U.S. trades. Trade shares and exchange rates for these four countries are as follows: Country (currency) Canada (Dollar) Mexico (Peso) China (Renminbi) Japan (Yen) Share of trade 36% 28% 20% 16% $ per FX in 2002 0.641 0.098 0.121 0.008 $ per FX in 2003 0.763 0.089 0.121 0.009 a. Compute the percentage change from 2002 to 2003 in the four U.S. bilateral exchange rates (defined as U.S. dollars per units of foreign exchange FX) in the table provided. Round up your percentages to the nearest whole number. b. Use the trade shares as weights to compute the percentage change in the nominal effective exchange rate for the U.S. between 2002 and 2003 (in U.S. dollars per foreign currency basket). Round up the percentage change to the nearest whole number. c. Based on your answer to b, what happened to the value of the U.S. dollar against this basket between 2002 and 2003? How does this compare with the change in the value of the U.S. dollar relative to the Mexican peso? Explain your answer carefully. 3. The annualized interest rate on deposits in Canada is 10%. In yen deposits in Japan, it is 7.5%. The spot rate of the Yen is 130 Yen/$. a. Which currency is expected to depreciate in a year and by how much? b. If the covered interest parity condition holds, what is the one year forward Yen/$ exchange rate? c. A Canadian importer plans to pay 1 million yen a year from now. He buys a forward contract and places $x in a Canadian bank deposit so that the proceeds will be used to pay for the forward yen later. Calculate x 1 4. Go to the Financial Times website (www.ft.com). Hover over the tab “Markets” then click on “Markets Data” in the drop down menu. Once there, hover over the “Markets Data” tab then click on “Currencies” in the drop down menu. Finally, click on “Currencies macromap” (next to “Highlights” near the top left corner of the webpage). Using the options “Global currencies” and Currency Performance in the last 1 month, figure out how you can use this tool to assess the relative strength of each of the currencies listed in the drop down menu on the right bottom corner. Which currency or currencies appear to be the strongest in the last month? Which currency or currencies appear to be the weakest in the last month? Explain how you arrived at your answer in detail. True, False, Uncertain. Explain. 2 lines maximum 1. Spot exchange rates are always lower than forward exchange rates 2. Needing to pay 9,000 yen per radio to its suppliers in a month, Radio Shack buys yen at a spot-exchange 1 month from now. This is an example of Radio Shack hedging its foreign currency risk 3. If the dollar interest rate is 10 percent, the euro interest rate is 12 percent, then an investor should invest only in euros. Short Answers: 5 lines maximum 1. Discuss the effects of a rise in the dollar interest rate on the exchange rate. 2. Why might you prefer an option over a futures or forward contract? 2