Homework Quiz 12

advertisement

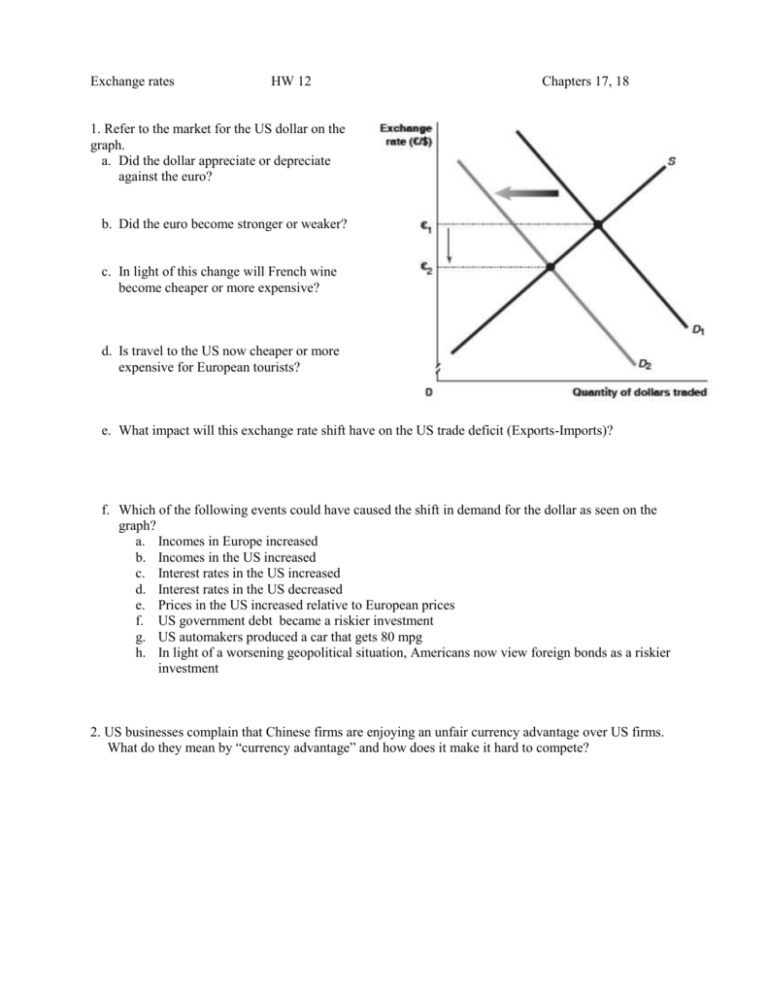

Exchange rates HW 12 Chapters 17, 18 1. Refer to the market for the US dollar on the graph. a. Did the dollar appreciate or depreciate against the euro? b. Did the euro become stronger or weaker? c. In light of this change will French wine become cheaper or more expensive? d. Is travel to the US now cheaper or more expensive for European tourists? e. What impact will this exchange rate shift have on the US trade deficit (Exports-Imports)? f. Which of the following events could have caused the shift in demand for the dollar as seen on the graph? a. Incomes in Europe increased b. Incomes in the US increased c. Interest rates in the US increased d. Interest rates in the US decreased e. Prices in the US increased relative to European prices f. US government debt became a riskier investment g. US automakers produced a car that gets 80 mpg h. In light of a worsening geopolitical situation, Americans now view foreign bonds as a riskier investment 2. US businesses complain that Chinese firms are enjoying an unfair currency advantage over US firms. What do they mean by “currency advantage” and how does it make it hard to compete? 3. If $1 = 0.7 Euros, then 1Euro = ? Compute. 4. Suppose that the yen-dollar exchange rate changes from 100 yen per dollar to 80 yen per dollar. One can say that the: a. Yen has appreciated against the dollar and the dollar has depreciated against the yen b. Yen has depreciated against the dollar and the dollar has appreciated against the yen c. Yen has appreciated against the dollar and the dollar has appreciated against the yen d. Yen has depreciated against the dollar and the dollar has depreciated against the yen 5. If wheat costs $4 per bushel in the United States and 2 pounds per bushel in Great Britain, then in the presence of purchasing-power parity the exchange rate should be: a. $.50 per pound b. $1.00 per pound c. $2.00 per pound d. $8.00 per pound 6. Given a system of floating exchange rates, rising income in the United States would trigger: a. An increase in the demand for imports and an increase in the demand for foreign currency b. An increase in the demand for imports and a decrease in the demand for foreign currency c. A decrease in the demand for imports and an increase in the demand for foreign currency d. A decrease in the demand for imports and a decrease in the demand for foreign currency 7. Starting at the point of equilibrium between the money supply and the money demand, an increase in the domestic money supply causes the value of the home currency to: a. Depreciate relative to other currencies b. Appreciate relative to other currencies c. Not change relative to other currencies d. None of the above 8. Small nations (e.g., the Ivory Coast) whose trade and financial relationships are mainly with a single partner tend to utilize: a. Pegged exchange rates b. Freely floating exchange rates c. Managed floating exchange rates d. Crawling pegged exchange rates 9. The central bank of the United Kingdom could prevent the pound from appreciating by: a. Selling pounds on the foreign exchange market b. Buying pounds on the foreign exchange market c. Reducing its inflation rate relative to its trading partners d. Promoting domestic investment and technological development 10. To defend a pegged exchange rate that overvalues its currency, a country could: a. Discourage commodity exports b. Encourage commodity imports c. Purchase its own currency in international markets d. Sell its own currency in international markets