Defining Marketing for the 21st Century

advertisement

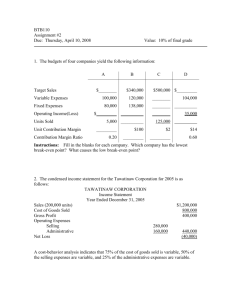

Financial Aspects of Marketing Management Part 1: Variable Cost 1) Variable Costs 2) Fixed Costs Part 2:Relevant Sunk Cost 1) Relevant Costs 2) Sunk Costs Part 3: Gross Margin 1) Trade Margin 2) Net Profit Margin (before Taxes) Part 4: Contribution Analysis 1) Break-Even Analysis 2) Sensitivity Analysis 3) Contribution Analysis and Market Size 4) Assessment of Cannibalization Part 5: Liquidity Part 6: Operating Leverage Part 7: Discounted Cash Flow Part 8: Customer Lifetime Value Part 9: Preparing A Pro Form Income Statement Strategic Marketing MKT470 Part 1: Variable and fixed Cost Marketing managers are accountable for the impact of their actions on profit and cash flow. Therefore, they need a working knowledge of basic accounting and finance concepts Part 1: Variable and fixed Cost Variable Cost: are expenses that are uniform per unit Of output within a relevant time period. As volume increases, total variable costs increases: Variable costs are Divided into two categories: 1) Cost of goods sold applied directly to Production 2) Expenses that are not directly tied to production (sales commissions, discounts and delivery expenses Part 1: Variable and fixed Cost Fixed Cost are expenses that do not fluctuate with output within a relevant time period of time, but become smaller per unit as the output increases Two categories: 1) 2) Programmed Costs (result from attempts to generate sales (marketing expenditure is considered programmed Costs) Committed Costs: Required to maintain the organization (such Rent and administration cost) Total Fixed costs do not change during a budget year Selling expenses can be fixed or variable costs Part 2: Relevant and Sunk Costs Relevant Costs are expenditure that: -Expected to occur in the future as a result of some marketing actions (such as adding a product to the marketing). -Sunk Costs are past expenditures (such as past research and test marketing) Part 3: Margins Margin refers to the difference between the selling price and the cost of a product or service. Margins are expressed on a total volume basis or on an individual unit basis. 1) Gross Margin or Gross Profit 2) Trade Margin 3) Net Profit Margin Part 3: Margins (Kerin, page 35) Gross Margin is the difference between total sales revenue and total cost of goods sold or on per unit basis. Total Gross Margins $ % Net Sales $10 0 100 % Cost of goods sold -40 -40 Gross Profit Margin 60 60 Part 3: Margins (Kerin, page 35) Trade Margin is the difference between unit sales price and unit cost at each level of marketing channels for example: Factory Wholesaler 2.88-2.0=88/2.00=30 Unit cost of goods sold Unit selling Gross Margin Manuf. $2.00 $2.88 30.6% Wholesaler 2.88 3.60 20 Retailer 3.60 6.00 40 Consumer 6.0 Retailer Part 3: Margins (Kerin, page 36) Net Profit Margin (before taxes) Is the remainder after cost of goods sold, other variable costs and fixed costs have been subtracted from sales revenue (Income Statement of an Organization) Dollar Amount Percentage Net sales $100.000 100% Cost of goods sold -30.000 -30 Gross profit margin $70.000 70% Selling expenses -20.000 -20 Fixed expenses -40.000 -40 Net Profit Margin $10.000 10% Part 4: Contribution Analysis (Kerin, page 37) Contribution analysis is the difference between total revenue sales and total variable costs Contribution analysis is useful in assessing relationships among costs, prices and volumes of products and services with respect to profit. 1) Break-Even analysis: identifies the unit or dollar sales volume at which the organization neither makes a profit nor incurs a loss. Total revenue= total variable costs + total fixed costs Part 4: Contribution Analysis (Kerin, page 37) Break-Even analysis requires three pieces of information: 1) An estimate of the unit variable costs 2) An estimate of the total dollar fixed costs 3) The selling price for each product Total dollar fixed costs Unit break-even volume= Unit selling price – unit variable costs Plan to sell a product for $5.00. the unit variable costs are $2.00, Total Fixed costs are $30.000. How many units must be sold to break even? Fixed costs=$30.000 Contribution unit = $5.00-$2.00=$3 = $30.000/$3.00=10.000 units Part 4: Contribution Analysis (Kerin, page 37) Break-Even Analysis Dollar Amount Percentage Net sales $100.000 100% Cost of goods sold -30.000 -30 Gross profit margin $70.000 70% Selling expenses -20.000 -20 Fixed expenses -40.000 -40 Net Profit Margin $10.000 10% Liquidity Liquidity refers to an organization’s ability to meet short-term (one year budget) financial obligations. Working Capital is the dollar value of an organization’s current assets (such as cash, accounts receivable, prepaid expenses, inventory) Operating Leverage Operating leverage refers to the extent to which fixed costs and variable costs are used in the production and marketing of products and services. More fixed cost = high operating leverage. Examples: airlines and heavy equipments Less fixed cost compared to variable cost= low operating leverage The higher a firm’s operating leverage, the faster its total profit will increase. Discounted Cash Flow A dollar received this year is not equivalent to a dollar received today because of risk, inflation, and opportunity cost. Discounted cash flow are future cash flows expressed in terms of their present value. Customer lifetime value Customer lifetime value requires three pieces of information: 1) The per-period (month or year) cash margin by customer ($M)= sales revenue - variable cost and other traceable cash. 2) The retention rate (r) the per-period the customer will be retained 3) The interest rate (i). CLV= $M 1 1+ i-r Preparing a Pro Forma Income statement Pro Forma Income Statement for 12-Months Period Ended Dec. 31, 2006 Display projected revenues, budgeted expenses, estimated net profit for a year. Sales 1,000,000 Cost goods sold 500,000 Gross Margin 500,000 Marketing expenses 170,000 Advertising expenses 90,000 Delivery expenses 40,000 Admin Salaries 120,000 Depreciation Building 20,000 Interest expenses 5,000 Tax & Insurance 5,000 Other admin expenses 5,000 Net Profit before income tax 300,000 155,000 45,000