ch03

advertisement

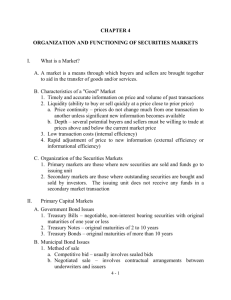

CHAPTER THREE THE MARKETPLACE © 2001 South-Western College Publishing Outline The Role of the Capital Markets Economic Function Continuous Pricing Function Fair Pricing Function The Exchanges National Exchanges Regional Exchanges Trading Systems Circuit Breakers and Trading Curbs 2 Outline The Nasdaq Stock Market The National Market System Tiers of the Nasdaq Market Third and Fourth Markets Regulation The Exchanges The NASD The SEC SIPC Ethics Illegal vs. Unethical The Chartered Financial Analyst Program AIMR Standards of Professional Conduct 3 The Role of the Capital Markets An exchange serves three principal functions. Economic Function Continuous Pricing Function Fair Pricing Function 4 Economic Function Capital markets facilitate the flow of capital from savers to borrowers. Capital Savers Borrowers Capital Market 5 Economic Function: An Example Mortgage $ Banks offer home mortgages so that home buyers who are short of cash can borrow money to buy houses. Home Buyer Home Ownership Bank $ Home Seller 6 Economic Function: An Example Mortgage Bank Facilitated by government agencies such as the Federal National Mortgage Association, banks sell the mortgages to investors with surplus cash. $ Gov’t Agency $ Mortgagebacked securities Investors 7 Economic Function: An Example Mortgage Mortgage $ Home Buyer Home Ownership Bank $ Cyclic Flow of Capital Gov’t Agency $ $ Mortgagebacked securities Home Seller Investors 8 Economic Function The primary market is the “new securities” market where securities are sold to the public for the first time. The secondary market is the “used securities” market, where previously issued securities are traded among security holders. 9 Continuous Pricing Function Capital markets enable market participants to get accurate, up-to-date price information. 10 Fair Pricing Function Capital markets remove the fear that people have of buying or selling at a rip-off price. The greater the number of participants and the more formal the marketplace, the “fairer” the price. 11 The Exchanges United States National Exchanges New York Stock Exchange (NYSE) Nasdaq Stock Market Regional Exchanges e.g. Philadelphia Stock Exchange International Exchanges e.g. England, France, Japan, Thailand Trading Systems Specialists are charged with making a fair and orderly market in one or more assigned securities at posts on the exchange floor. Marketmakers are groups of competing individuals who maintain a fair and orderly market by open outcry trading in pits on the exchange floor. SuperDot is an electronic system enabling NYSE firms to send orders directly to the specialists’ posts. 13 Circuit Breakers and Trading Curbs Both trading curbs and circuit breakers are designed to reduce temporary volatility in the market. At the NYSE, when the Dow Jones Industrial Average fluctuates by more than 2%, the circuit breaker is activated and computerized trading becomes restricted. Trading curbs halt all trading at the exchange. 14 The Nasdaq Stock Market The Nasdaq (National Association of Securities Dealers Automated Quotations) stock market is sometimes called the over-the-counter (OTC) market. It is a worldwide computerized linkup of brokerage firms, investment houses and large commercial banks. Bids and offers are posted to an electronic bulletin board called the National Market System. 15 The Nasdaq Stock Market Market Tiers - national market issues: issues by large and established firms e.g. Intel, Microsoft - small-cap issues: issues with a low level of capitalization - pink sheet issues: the smallest and most speculative Nasdaq stocks The trading of listed securities in the Nasdaq market is known as the third market. Direct trades between large institutional investors comprise the fourth market. 16 The “Markets” Primary Market Company via investment bankers Public Secondary Market via stock exchanges or Nasdaq Public Public Third Market listed securities via Nasdaq Public Public Fourth Market via telephone or Instinet Institution Institution Regulation The Exchanges have rules regarding... - the financial capacity of members serving as stock specialists - the financial & market activity, as well as the disclosure & annual reporting of listed firms The Securities and Exchange Commission (SEC) was established… - to ensure that investors have adequate information to make an informed investment decision - so as to help prevent price manipulation and abuses like the Ponzi scheme 18 Regulation The National Association of Security Dealers - is a self-regulatory body that licenses brokers and generally oversees the trading practices of OTC securities The Securities Investor Protection Corporation - protects investors from loss due to brokerage firm failure, fraud, natural disaster, or theft 19 Ethics Illegal vs. Unethical A wide range of investment activities may be legal, but these activities carry substantial ethical baggage. The Chartered Financial Analyst Program - promotes investment education and ethical behavior among those involved in the investment business AIMR Standards of Professional Conduct - a strict set of ethical guidelines 20 Review The Role of the Capital Markets Economic Function Continuous Pricing Function Fair Pricing Function The Exchanges National Exchanges Regional Exchanges Trading Systems Circuit Breakers and Trading Curbs 21 Review The Nasdaq Stock Market The National Market System Tiers of the Nasdaq Market Third and Fourth Markets Regulation The Exchanges The NASD The SEC SIPC Ethics Illegal vs. Unethical The Chartered Financial Analyst Program AIMR Standards of Professional Conduct 22