Public/InvestEd Additional Materials/Jazzing Up Additions

advertisement

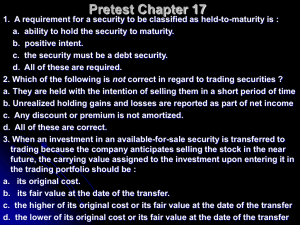

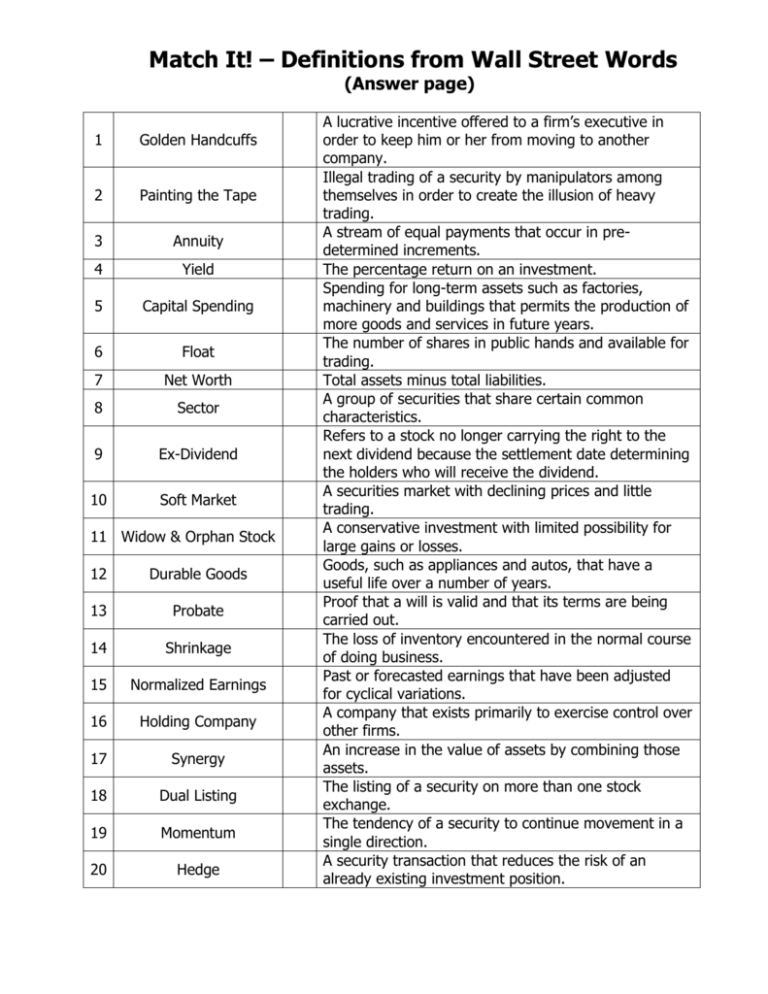

Match It! – Definitions from Wall Street Words (Answer page) 1 Golden Handcuffs 2 Painting the Tape 3 Annuity 4 Yield 5 Capital Spending 6 Float 7 Net Worth 8 Sector 9 Ex-Dividend 10 Soft Market 11 Widow & Orphan Stock 12 Durable Goods 13 Probate 14 Shrinkage 15 Normalized Earnings 16 Holding Company 17 Synergy 18 Dual Listing 19 Momentum 20 Hedge A lucrative incentive offered to a firm’s executive in order to keep him or her from moving to another company. Illegal trading of a security by manipulators among themselves in order to create the illusion of heavy trading. A stream of equal payments that occur in predetermined increments. The percentage return on an investment. Spending for long-term assets such as factories, machinery and buildings that permits the production of more goods and services in future years. The number of shares in public hands and available for trading. Total assets minus total liabilities. A group of securities that share certain common characteristics. Refers to a stock no longer carrying the right to the next dividend because the settlement date determining the holders who will receive the dividend. A securities market with declining prices and little trading. A conservative investment with limited possibility for large gains or losses. Goods, such as appliances and autos, that have a useful life over a number of years. Proof that a will is valid and that its terms are being carried out. The loss of inventory encountered in the normal course of doing business. Past or forecasted earnings that have been adjusted for cyclical variations. A company that exists primarily to exercise control over other firms. An increase in the value of assets by combining those assets. The listing of a security on more than one stock exchange. The tendency of a security to continue movement in a single direction. A security transaction that reduces the risk of an already existing investment position. Match It! – Definitions from Wall Street Words Match the words on the left with the definitions on the right 1 Golden Handcuffs 2 Painting the Tape 3 Annuity 4 Yield 5 Capital Spending 6 Float 7 Net Worth 8 Sector 9 Ex-Dividend 10 Soft Market 11 Widow & Orphan Stock 12 Durable Goods 13 Probate 14 Shrinkage 15 Normalized Earnings 16 Holding Company 17 Synergy 18 Dual Listing 19 Momentum 20 Hedge The number of shares in public hands and available for trading. A group of securities that share certain common characteristics. Spending for long-term assets such as factories, machinery and buildings that permits the production of more goods and services in future years. Goods, such as appliances and autos, that have a useful life over a number of years. A company that exists primarily to exercise control over other firms. A lucrative incentive offered to a firm’s executive in order to keep him or her from moving to another company. Refers to a stock no longer carrying the right to the next dividend because the settlement date determining the holders who will receive the dividend. A stream of equal payments that occur in predetermined increments. A conservative investment with limited possibility for large gains or losses. Proof that a will is valid and that its terms are being carried out. Past or forecasted earnings that have been adjusted for cyclical variations. An increase in the value of assets by combining those assets. The tendency of a security to continue movement in a single direction. The listing of a security on more than one stock exchange. Illegal trading of a security by manipulators among themselves in order to create the illusion of heavy trading. A security transaction that reduces the risk of an already existing investment position. A securities market with declining prices and little trading. Total assets minus total liabilities. The loss of inventory encountered in the normal course of doing business. The percentage return on an investment.