Chapter 20

Appendix

•Cash and Liquidity

Management - Appendix

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.

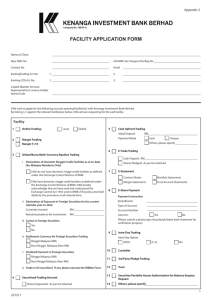

Target Cash Balances

• Target cash balance – desired cash level

determined by trade-off between carrying

costs and shortage costs

• Flexible policy - if a firm maintains a

marketable securities account, the primary

shortage cost is the trading cost from

buying and selling securities

• Restrictive policy – generally borrow shortterm, so the shortage costs will be the fees

and interest associated with arranging a

loan

20A-1

Figure 20A.1

20A-2

BAT Model

• Assumptions

• Cash is spent at the same rate every day

• Cash expenditures are known with certainty

• Optimal cash balance is where opportunity cost of

holding cash = trading cost

• Opportunity cost = (C/2)*R

• Trading cost = (T/C)*F

• Total cost = (C/2)*R + (T/C)*F

C*

2TF

R

20A-3

Example: BAT Model

• Your firm will have $5 million in cash

expenditures over the next year. The

interest rate is 4% and the fixed trading

cost is $25 per transaction.

•

•

•

•

•

What is the optimal cash balance?

What is the average cash balance?

What is the opportunity cost?

What is the shortage cost?

What is the total cost?

20A-4

Miller-Orr Model

• Model for cash inflows and outflows that

fluctuate randomly

• Define an upper limit, a lower limit and a

target balance

•

•

•

•

Management sets lower limit, L

C* = L + [(3/4)F2/R]1/3 (target balance)

U* = 3C* - 2L

(upper limit)

Average cash balance = (4C* - L)/3

20A-5

Figure 20A.3

20A-6

Example: Miller-Orr Model

• Suppose that we wish to maintain a

minimum cash balance of $50,000. Our

fixed trading cost is $250 per trade, the

interest rate is .5% per month and the

standard deviation of monthly cash flows is

$10,000.

• What is the target cash balance?

• What is the upper limit?

• What is the average cash balance?

20A-7

Conclusions

• The greater the interest rate, the lower the

target cash balance

• The greater the fixed order cost, the higher

the target cash balance

• It is generally more expensive to borrow

needed funds than it is to sell marketable

securities

• Trading costs are usually very small

relative to opportunity costs for large firms

20A-8

Chapter 20

Appendix

•End of Chapter

McGraw-Hill/Irwin

Copyright © 2006 by The McGraw-Hill Companies, Inc. All rights reserved.