Chapter 14 MONEY AND THE BANKING SYSTEM

advertisement

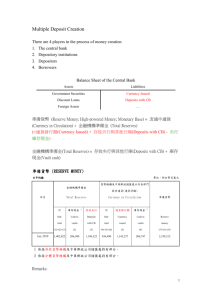

Chapter 14 MONEY AND THE BANKING SYSTEM Chapter in a Nutshell 1. Money is the set of assets in the economy that people regularly use to purchase goods and services from other people. Money has three functions in the economy: It is a medium of exchange, a unit of account, and a store of value. These functions distinguish money from other assets such as stocks and bonds, real estate, and the like. 2. Are credit cards money? Not at all! If you use your credit card to make a purchase, you obtain a short-term loan from the financial institution that issued the card. Credit cards are thus a method of postponing payment for a brief period. In shopping for a credit card, a person should want to consider features such as the credit card’s annual percentage rate, the grace period, whether the issuer may charge an over-limit fee or a late-payment fee, and the annual cost of the card. 3. The basic money supply (M1) consists of coins, paper money, checking accounts, and traveler’s checks. Under federal law, only the U.S. Treasury issues coin and the Federal Reserve System issues paper currency. Checking account money is created by the banking system. 4. The check collection system in the United States is efficient, but the collection process that a check goes through may be complicated. The check processing system is conducted by local clearinghouses, correspondent banks, and the Federal Reserve System=s check collection network. 5. The U.S. economy has an array of banks, including commercial banks, savings and loan associations, mutual savings banks, and credit unions. We call these institutions depository institutions because they accept deposits from people and provide checking accounts that are part of the money supply. 6. If you save money in a bank, you have alternatives such as money market deposit accounts, savings accounts, and certificates of deposit. In shopping for an account, it is important to look at features such as the interest rate, the method of interest compounding, the annual percentage yield, the timing of interest earned, and fees. 7. A commercial bank is a corporation that seeks to make a profit for its stockholders. Among the most important assets of a bank are its reserves, loans, and government securities. Deposits and borrowings are a bank’s major liabilities. 8. Most of our money comes from checking accounts issued by banks, rather than currency. Through the process of lending reserves, banks create money. The money multiplier is used to calculate the maximum amount of money the banking system generates with each dollar of reserves. The money multiplier is the reciprocal of the required reserve ratio. 137 138 Chapter 14: Money and the Banking System 9. The FDIC has insured deposits and promoted safe and sound banking practices since 1934. The FDIC insures deposits up to $100,000 in virtually all U.S. banks and S & Ls. Since the start of FDIC insurance, not one depositor has lost a cent of insured funds because of bank failure. Chapter Objectives After reading this chapter, you should be able to: 1. Define money and identify the functions of money. 2. Identify the components of our basic money supply. 3. Describe the collection process a check goes through. 4. Distinguish between the major depository institutions in our economy. 5. Compare the various types of savings accounts which banks offer to their customers. 6. Explain how banks attempt to make a profit for their stockholders. 7. Discuss the process of money creation by the banking system. 8. Identify the purposes of the Federal Deposit Insurance Corporation. Knowledge Check Chapter 14: Money and the Banking System Key Concept Quiz 1. demand deposit 2. share draft account 3. local clearing house 4. near monies 5. M3 money supply 6. depository institutions 7. money-market deposit accounts 8. required-reserve ratio 9. money multiplier 10. bank run 11. deposit-payoff approach 12. purchase-and-assumption approach _____ a. provides a quick and efficient way of collecting and processing locally drawn checks _____ b. the reciprocal of the required reserve ratio _____ c. includes components of M2 plus large time deposits _____ d. is specified by the Federal Reserve Bank _____ e. a regular checking account that does not pay interest _____ f. when depositors rapidly withdraw funds from a bank _____ g. they accept deposits from people and provide checking accounts _____ h. withdrawing funds from this account is usually not as convenient as doing so from a checking account _____ i. the most commonly used strategy used by FDIC in dealing with failed institutions _____ j. accounts maintained by credit union members _____ k. interest paying deposits that can be easily converted into spendable money _____ l. when the FDIC makes payments to each depositor up to the insurance limit of $100,000 Multiple Choice Questions 1. All of the following distinguish money from other assets, except a. b. c. d. it is a medium of exchange it is a unit of account it is a store of value it is supported by gold reserves 2. All of the paper money in the United States consists of a. b. c. d. Federal Reserve notes Treasury securities U.S. government securities commercial notes 3. A regular checking account that doesn’t pay interest is also known as a a. b. c. d. demand deposit account NOW account certified account automated teller account 139 140 Chapter 14: Money and the Banking System 4. All U.S. currency a. b. c. d. is designated as legal tender is mostly backed by gold reserves is partially backed by silver reserves is printed by the U.S. Treasury 5. The M1 money supply consists of all of the following except a. b. c. d. currency in the hands of the public demand deposits traveler’s checks small time deposits 6. Near monies a. b. c. d. are interest-paying deposits are broader measures of money supply include money-market deposit accounts all of the above 7. All of the following are true for commercial banks except a. b. c. d. they are private corporations they are not owned by the stockholders they are often referred to as full-service banks they were originally formed to make loans to businesses 8. Savings and loan associations a. b. c. d. first appeared in the United States in the 1930s mainly make capital-equipment-purchase loans to businesses are the largest provider of residential mortgage loans obtain most of their funds by issuing money market deposit accounts 9. Excess reserves a. b. c. d. can be used to make loans can be used to purchase government securities equal actual reserves minus required reserves all of the above 10. The required reserve ratio a. b. c. d. is specified by the Federal Reserve is specified by the U.S. Congress is specified by the U.S. President is specified by the U.S. Treasury 11. The maximum amount of money the banking system generates with each dollar of reserves a. is equal to 1/required reserve ratio b. is called the money multiplier c. is determined by the percentage of checking deposits banks are required to hold on reserve d. all of the above Chapter 14: Money and the Banking System 141 12. The greater are currency holdings a. b. c. d. the larger the required reserve ratio the smaller the actual money expansion multiplier the higher the rate of inflation the higher the interest rate 13. The FDIC attempts to accomplish all of these goals except a. b. c. d. promote safety through examination and audits insure deposits up to $100,000 in virtually all U.S. banks and S & Ls arrange disposition of the assets and deposit liabilities of all insured banks that fail limit investor losses in the stock market 14. The most common strategy used by the FDIC to deal with a failed institution is a. b. c. d. the purchase and assumption approach deposit payoff approach total liquidation approach the zero cost approach 15. The liabilities of a bank include all of the following except a. b. c. d. savings deposits deposits at the Federal Reserve demand deposits large time deposits 16. Which component of the M1 money supply is “legal tender”? a. b. c. d. money market mutual funds bank credit cards coin and paper currency passbook savings accounts 17. Which of the following is not a function of the FDIC? a. b. c. d. issues paper currency and coin examines and audits commercial banks insures deposits of commercial banks arranges mergers between sound banks and failing banks The next three questions are based on the hypothetical balance sheet of U.S. Bank, shown in the following table. Balance Sheet of the U. S. Bank Assets Liabilities 142 Chapter 14: Money and the Banking System Reserves Loans $200,000 60,000 Securities 140,000 Property 100,000 Deposits Borrowings from other banks $400,000 100,000 18. If the required reserve ratio is 10 percent, U.S. Bank has excess reserves of a. b. c. d. $40,000 $80,000 $120,000 $160,000 19. U.S. Bank can make new loans of up to a. b. c. d. $120,000 $160,000 $200,000 $240,000 20. If this balance sheet was for the commercial banking system, instead of U.S. Bank, loans and deposits could expand by a maximum of a. b. c. d. $1.2 million $1.4 million $1.6 million $1.8 million 21. All of the following monies are legal tender except a. b. c. d. nickels, dimes, and quarters Federal Reserve notes paper currency demand deposits 22. According to the concept of compound interest, a saving deposit a. b. c. d. loses purchasing power due to inflation earns interest on interest pays increasing amounts of interest to wealthy depositors pays interest during all four quarters of the year 23. What type of check refers to the situation where U.S. Bank signs Mary Smith’s check and thus guarantees payment on it? a. money order Chapter 14: Money and the Banking System 143 b. traveler’s check c. cashier’s check d. certified check 24. To Wells Fargo Bank, your checking account is a. b. c. d. a liability an asset legal tender a reserve requirement 25. The main emphasis of the M1 money supply is the role of money as a a. b. c. d. standard of debt unit of inflation store of value medium of exchange 26. In the United States, coins are issued by a. b. c. d. the U.S. Treasury the Federal Reserve commercial banks savings and loan associations True-False Questions 1. T F M2, and M3 are identical measures. 2. T F The difference between M1, M2 and M3 is that M2 and M3 includes currency, while M1 does not. 3. T F Most of our money is held in the form of currency. 4. T F Banks create money by lending. 5. T F The larger the currency holdings, the smaller is the money multiplier. 6. T F The larger the required reserve ratio, the smaller is the money multiplier. 7. T F Required reserve ratios are determined by the Treasury Department of the U.S. government. 8. T F Required reserves can only be held in the form of vault cash by the banks. 9. T F The largest source of the M1 money supply is the Federal Reserve System. 10. T F Actual reserves equal excess reserves minus required reserves. 11. T F Traveler’s checks are part of the M1 money supply, but not the M2 money supply. 12. T F All of our paper currency comes from the U.S. Treasury. 13. T F The money supply in the United States is backed by gold reserves. 144 Chapter 14: Money and the Banking System 14. T F The Federal Deposit Insurance Corporation insures bank deposits up to $1 million. 15. T F Under federal law, only the U.S. Treasury issues coins. 16. T F A credit union is a non-profit institution. 17. T F Savings and loan associations are the largest provider of residential mortgage loans. 18. T F Near monies are interest-paying deposits that can be easily converted into spendable money. 19. T F Negotiable order of withdrawal accounts do not pay interest and require a minimum balance. 20. T F The Federal Reserve is the largest nationwide processor of transit checks. 21. T F Credit cards are a major component of the M1 money supply in the United States. 22. T F Concerning the calculation of finance charges for credit cards, most banks use the previous balance method. 23. T F Traveler’s checks, cashier’s checks, and certified checks are legal tender in the United States. 24. T F Demand deposits are essentially interest-paying checking accounts issued by commercial banks. 25. T F Certified checks and cashier’s checks have better guarantees of payment than personal checks. 26. T F The future value of money increases by a greater amount when interest is compounded on an annual basis rather than a quarterly basis. 27. T F Federal Reserve notes make up all of the paper money issued in the United States today. 28. T F Rather than issuing checking accounts, credit unions issue share draft accounts. 29. T F Gold and silver currently provide important sources of “backing” for the U.S. money supply. Chapter 14: Money and the Banking System 145 Application Questions 1. Consider the balance sheet of a commercial bank on the Isle of Thrift. This being the only bank on this island, it constitutes the entire banking system. Balance Sheet of the Isle of Thrift Bank Assets Reserves Liabilities $30,000,000 Loans 70,000,000 Total 100,000,000 Deposits $100,000,000 Total $100,000,000 If the required reserve ratio on deposits is 20 percent, how much must the bank maintain in required reserves? How much excess reserves does the bank have? What is the total amount of the deposits that the bank can loan out? What is the value of the money multiplier? 2. Consider another bank that has the same balance sheet as described in question 1. However, this bank is located on the Isle of Flush, and its reserves requirement is set by a different central bank. This being the only bank on this island, it constitutes the entire banking system. a. If the required reserves-to-deposits ratio is 10 percent, how much must this bank maintain in required reserves? b. How much excess reserves does this bank have? c. How much of the excess reserves can this bank loan out? 146 Chapter 14: Money and the Banking System d. What is the money multiplier on the Isle of Flush? 3. Which island will create more money? Explain. Answers to Knowledge Check Questions Key Concept Answers 1. e 5. c 2. j 6. g 3. a 7. h 4. k 8. d 9. 10. 11. 12. Multiple Choice Answers 1. d 6. d 2. a 7. b 3. a 8. c 4. a 9. d 5. d 10. a 11. 12. 13. 14. 15. b f l i d b d a b 16. 17. 18. 19. 20. c a d b c 21. 22. 23. 24. 25. d b d a d 26. a Chapter 14: Money and the Banking System True-False Answers 1. F 6. T 2. F 7. F 3. F 8. F 4. T 9. F 5. T 10. F 11. 12. 13. 14. 15. F F F F T 16. 17. 18. 19. 20. T T T F T 21. 22. 23. 24. 25. F F F T T 26. 27. 28. 29. 147 F T T F Application Question Answers 1. a. The bank must maintain $20 million in required reserves. b. The bank has $10 million in excess reserves. c. The bank can loan out $80 million of its deposits. d. The value of the money multiplier on the Isle of Thrift is 5. 2. a. The bank must maintain $10 million dollars in required reserves. b. The bank has $20 million in excess reserves. c. The bank can loan out all of its excess reserves. d. The money multiplier on the Isle of Flush is 10. 3. The bank in the Isle of Flush can create more money because the money multiplier is higher.