Use of IT tools in state budget execution audit

advertisement

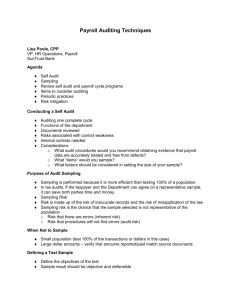

THE NIK REPUBLIC OF POLAND USE OF IT TOOLS IN AUDITING Wiesław Karliński economic adviser Department of Budget & Finance Wieslaw_Karlinski@nik.gov.pl AREAS OF USING IT IN AUDITING - AS SUBJECT OF AUDIT - AS TOOLS AIDING THE AUDITING’S ORGANIZATION AND MANAGEMENT - AS TOOLS AIDING AUDITING PROCESS - AS TOOLS AIDING PREPARATION OF AUDITING’S REPORTS 2 IT TECHNIQUES APPLICATIONS IN AUDITING PROCESS 1. AUDIT STUDY & STATISTICAL SAMPLING STUDYING FAIRNESS OF FINANCIAL AND ACCOUNTING RECORDS & CORRECTNESS OF BUDGET REPORTING 2. ANALYTICAL STUDY OF DATABASES • • STUDYING OF SELECTED INCOMES IN STATE BUDGET STUDYING OF TAX SYSTEM 3 STATE BUDGET AUDIT – CONDITIONS (1) 1. The number of audited institutions (budget entities) ~ 400. 2. About 80-90% entities have applied computer accounting systems which were unfortunately prepared by many different providers. 3. So they do not guarantee full accessibility to data in the electronic form and using typically CAATs tools. 4. The standards of accountancy in budget entities are not sufficiently specified. 4 STATE BUDGET AUDIT – CONDITIONS (2) 5. The differences in size of audited budget entities bring difficulties in forming indiscriminated assumptions . 6. Auditors do not posses enough experience and knowledge in statistical sampling and databases’ transformation. 7. The amount of time for a single audit study is very limited. 5 FAIRNESS OF ACCOUNTING RECORDS : STUDY METHODOLOGICAL ASSUMPTIONS (in 2002) 1. SELECTION OF EVIDENCE SAMPLE RANDOM SELECTION, IRRESPECTIVE OF ACCOUNTING ENTRIES FORMAT (AUTOMATED OR MANUAL) 2. PERFORMING AUDIT STUDY AND DOCUMENTING FINDINGS BASED ON SPECIFIC AUDIT FORM DESIGN 3. EXTRAPOLATION OF FINDINGS BASED ON STATISTICAL METHODS 6 IT TOOL – „AUDITOR’S TOOL KIT (ASSISTANT)” 1 2 3 7 “AUDITOR’S TOOL KIT” - UNIVERSAL FUNCTIONS 1. SAMPLE SIZE CALCULATION: • ATTRIBUTE SAMPLING • VARIABLE SAMPLING • PPS SAMPLING (Poisson’s Distribution) 2. SAMPLING: • RANDOM-NUMBER GENERATOR • SIMPLE RANDOM SELECTION (Excel Input File) • PPS SELECTION (Excel Input File) 3. EXTRAPOLATION: • PROPORTION ESTIMATION (Hypergeometric Distribution) • MEAN-PER-UNIT ESTIMATION (Normal Distribution) • MONETARY UNIT SAMPLING (Poisson’s Distribution) 8 „AUDITOR’S TOOL KIT” - SPECIAL FUNCTIONS: REALIZATION OF STUDY step by step random sample 1. IDENTIFICATON OF POPULATION 2. SAMPLE SIZE & SELECTION intentional selection 3. SAMPLE VERIFICATION sample of expenditure 4. STUDY (QUESTIONNAIRE) 8. SUPPLEMENTARY SELECTION 5. ADDITIONAL DATA 6. FINDINGS & REPORTS 7. EXTRAPOLATION OF FINDINGS FINAL ASSESSMENT assessment ? precision? 9 STUDYING AUDIT EVIDENCE: EXPECTED PROBLEMS (in 2002) 1. AVAILABILITY OF POPULATION TO BE STUDIED IN CHECKLIST FORMAT 2. CONSISTENT RULES AND TECHNIQUES FOR IDENTIFYING ACCOUNTING EVIDENCE 3. VARIED SIZES OF POPULATIONS STUDIED 4. LACK OF KNOWLEDGE OF POTENTIAL IRREGULARITIES’ SCALE 10 STUDYING AUDIT EVIDENCE: SOLUTIONS 1. MANY (9) IDENTIFYING ACCOUNTING EVIDENCE METHODS (including electronic data form) 2. ATTRIBUTE SAMPLING WITH SEQUENTIAL ANALYSIS 3. IDENTICAL RELATIVE MATERIALITY FOR EVERY ENTITY 11 Example Forms (1): Audit Questionnaire 12 Example Forms(2): Estimation & Assessment findings in strata parameters of extrapolation estimation & assessment & error of estimation supplementary selection estimation weighted by value 13 Example Forms (3): Collective Analysis of Findings FAS opinion opinion for budget chapter Detailed Statistics opinion FAS opinion FAS FAS opinion ~ 400 14 STUDY IMPLEMENTATION & SCOPE AUDIT RUN BY 8 DEPARTMENTS & 16 SCC REGIONAL OFFICES AUDITEES IN 2003 : OVER 370 ENTITIES INCLUDING 106 LOCAL GOVERNMENT ENTITIES IN 2004 : 356 ENTITIES INCLUDING 121 LOCAL GOVERNMENT ENTITIES 15 AUDIT RESULTS in 2004 (215 STATE BUDGET ENTITIES) INCORRECT ENTRIES number of entities FORMAL MISTAKES OPINION % number of entities % 173 80,5 POSITIVE 142 66,0 30 14,0 POSITIVE WITH RESERVATION 49 22,8 12 5,6 NEGATIVE 24 11,2 MOST FREQUENT TYPES OF IRREGULARITIES INCORRECT ACCOUNTING MONTH INCORRECT ENTRY TO ACCOUNTS INCORRECT CURRENT CONTROLS OR EVIDENCE REFERRALS INCORRECT AMENDMENTS TO EVIDENCE LACK OF CONSISTENT EVIDENCE IDENTIFICATION 16 IT TECHNIQUES – APPLICATIONS (2) 2. STUDY OF DATABASES SPECIFIC CASE : LOAN PENALTY TICKETS IN VOIVODS’ BUDGETS 17 COLLECTING INCOMES FROM PENALTY TICKETS - GENERAL SCHEME ORGAN AUTHORIZED TO PENALIZE TAX OFFICE VOIVOD > 2mln /year Record penalty ticket Database Payment Execution Title Execution Penalization Payment 7 days ?? (max=1 month) TO ?? (max=2 months) DATABASE AUDITED WITH ANALYTICAL METHODS 18 COLLECTING INCOMES FROM PENALTY TICKETS ORGANIZATION OF STUDY ACL (Audit Command Language) VOIVOD’S ASSESSMENT Excel DB-1 Voivodship databases * Exportation Analysis Findings DB-16 *) total: 16 voivodships, 23 databases, 5 mln tickets Comparative Analysis Excel VOIVOD’S ASSESSMENT 19 TICKETS’ STUDY - EXEMPLARY FINDINGS (1) 317 AVERAGE TIME NEEDED TO RECORD PENALTY TICKET AND ISSUE PAYMENT EXECUTION TITLE IN 2002 300 270 2002 record titles (recorded in 2002) 240 number of days 210 ?? >180 days 180 150 120 90 60 30 0 02 04 06 08 10 12 14 16 18 20 22 24 26 28 30 32 voivodship: chapter 85/02 - 32 20 TICKETS’ STUDY - EXEMPLARY FINDINGS DELAY IN VINDICATION OF INCOMES FROM TICKETS (DISTRIBUTION IN % OVER A NUMBER OF DAYS) 40 35 2002 vindication (In Total) 2002 vindication (without 5 voivodships) percentage of tickets 30 25 20 15 10 5 0 do 30 do 45 do 60 do 90 do 120 do 180 do 270 > 270 DAYS ELAPSED UNTIL PAYMENT, ISSUING EXECUTION TITLE OR CONCLUSION OF STUDY 21 PLANS & PROBLEMS • WIDER ACCESIBILITY TO DATA IN ELECTRONIC FORMAT (outside the NIK influence) • FURTHER REFINEMENT OF THE METHODOLOGY (sampling & analytical methods) • IMPROVEMENT OF APPLIED TOOLS • ADDITIONAL STAFF TRAINING 22 THE NIK REPUBLIC OF POLAND THANK YOU FOR YOUR KIND ATTENTION