Payroll Auditing Techniques - Charlotte Chapter of the American

advertisement

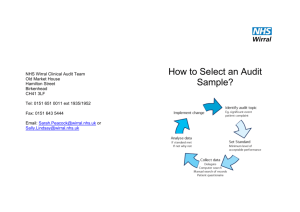

Payroll Auditing Techniques Lisa Poole, CPP VP, HR Operations, Payroll SunTrust Bank Agenda Self Audit Sampling Review self audit and payroll cycle programs Items to consider auditing Periodic practices Risk mitigation Conducting a Self Audit Auditing one complete cycle Functions of the department Documents reviewed Risks associated with control weakness Internal controls needed Considerations o What audit procedures would you recommend obtaining evidence that payroll data are accurately totaled and free from defects? o What “items” would you sample? o What factors should be considered in setting the size of your sample? Purpose of Audit Sampling Sampling is performed because it is more efficient than testing 100% of a population. In tax audits, if the taxpayer and the Department can agree on a representative sample, it can save both parties time and money. Sampling Risk Risk is made up of the risk of inaccurate records and the risk of misapplication of the law Sampling risk is the chance that the sample selected is not representative of the population o Risk that there are errors (inherent risk) o Risk that procedures will not find errors (audit risk) When Not to Sample Small population (test 100% of the transactions or dollars in this case) Large dollar amounts – verify that amounts reported/paid match source documents Defining a Test Sample Define the objectives of the test Sample result should be objective and defensible Defining a Population Decide what period will be covered by the test Define the sampling unit Consider the completeness of the population Consider how the error rate will be measured Selection of the Sample Random number sampling Systematic sampling Other sampling Determine the sample size Perform the sample Evaluate the Sample Results o Interpret results o Reach an overall conclusion about the population Compliance Tests Compliance tests are tests which determine whether controls are being complied with Yes – controls are being followed No – deficiencies in controls Procedural Questions What audit procedures would you recommend to obtain evidence that the pay rates are appropriately assigned and used in figuring gross pay? Review of Self Audit Program Review of Payroll Audit Program Sample listing of audits Items to Consider Auditing SSN – SSNVS/BSO I-9 Forms Garnishments Tax deposits Benefit plan items Unclaimed wages Employee data changes Tax rates Employee tax set up – reciprocity rules Reconciliations Interface data transfers Checks to inactive employees Periodic Practices Data scrubbing – check for data exceptions such as: o o o o Exempt W-4 and state withholding forms for compliance Cost center changes Pay and deduction code usage Retroactive increases and decreases Source Documents Time records Payroll register General ledger balances Wage and tax registers W-2 forms Payroll check clearing account Risk Mitigation Segregation of duties Timely account reconciliations Manual check approvals Review negative liability account balances Job rotation Security of data – storage, passwords, confidentiality agreement Standardized checklists – new dept set up, W-2 corrections, approval authority Questions? Contact Me! Lisa Poole, CPP poolarita@gmail.com 404-813-7847