UFCW & Kroger Health Plan: Benefits & Eligibility

advertisement

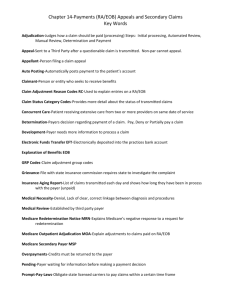

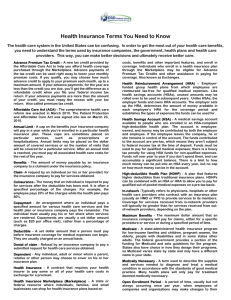

UFCW LOCAL 1000 & KROGER DALLAS HEALTH AND WELFARE PLAN December 15, 2015 Presentation to UFCW Local 1000 Shop Stewards AGENDA I. Introduction II. Administrative Manager’s Presentation III. Consultant’s Presentation IV.Cigna Presentation V. MedExpert Presentation ADMINISTRATIVE MANAGER’S PRESENTATION WHO IS NEBA? NEBA stands for “National Employee Benefits Administrators, Inc.”. NEBA is a Third Party Administrator (TPA) that specializes in administering benefit plans that cover employees working under Collective Bargaining Agreements (CBAs) with various Unions across the United States. NEBA has been in business for over twenty (20) years and employs approximately eighty (80) union members covered under a Collective Bargaining Agreement with the United Food and Commercial Workers Local Union 1625. WHAT DOES NEBA DO FOR THE MED-1000 PLAN? NEBA… Collects contributions from Kroger & Participants Determines who is eligible for benefits and which plan they may qualify for Sends eligibility information to other parties that provide benefits, such as: Dental Insurance Provider Vision Insurance Provider Life Insurance Provider Provider Network and Medical Management Program Provider Kroger - Pharmacy Program Provider MedExpert – Employee Assistance with Individual Medical Decisions Program Provider Administers COBRA when Participants lose coverage WHAT DOES NEBA DO FOR THE MED-1000 PLAN? (continued) NEBA… Processes self insured claims Medical claims Life insurance claims Short Term Disability / “Loss of Time” claims Provides Member Services to Participants Provides general Administration Services to the Trustees Accounting Compliance Etc. ELIGIBILITY: HOW IS IT DETERMINED? Employees may qualify for the Med-1000 plans based on: • length of employment; • number of hours worked; and • status as either Full Time or Variable Hour employees. Hire Date Hours Worked Employee Status ELIGIBILITY: HOW IS IT DETERMINED? • Kroger submits a monthly report of hours worked by each employee in the bargaining unit • The report includes hire dates and other information that is used to determine eligibility • NEBA credits each employee with their hours worked • NEBA applies the Med-1000 Plan’s eligibility rules to determine who is eligible WHEN DOES ELIGIBILITY BEGIN? WORK, ADMINISTRATIVE LAG AND COVERAGE PERIODS Work, Administrative Lag and Coverage Periods Fixed “Standard” Measurement Periods for earning initial or continuing coverage for all Plans other than Plan C Standard Measurement Period in Which Administrative Lag Period Coverage Period Minimum Hours are Accumulated May - October November - December January - June November – April May - June July - December Work, Administrative Lag and Coverage Periods Each Calendar Month is a Measurement Period for earning initial or continuing coverage for Plan C Measurement Period in Which Minimum Hours are Accumulated Administrative Lag Period Coverage Period January February-March April February March-April May Etc… WHAT PLANS ARE AVAILABLE TO VARIABLE HOUR EMPLOYEES? Plan C – Employee Only 4th Month Plan E – Employee/Child 9th Month Plan D-Family 13th Month Plan B-Employee Only 25th Month Plan A - Family 25th Month •60 Hours per Month •780 Hours in 6 Months • 720 Hours in 6 Months or • 1,200 Hours in 12 Months •192 Hours in 6 Months •720 Hours in 6 Months WHAT PLANS ARE AVAILABLE TO FULL TIME EMPLOYEES? Plan E – Employee/Child 1st Month After 60 Days Plan D - Family 13th Month Plan A - Family 25th Month •No Minimum Hours Required • 720 Hours in 6 Months or • 1,200 Hours in 12 months •720 Hours in 6 Months WHAT BENEFITS ARE AVAILABLE UNDER EACH PLAN? Major Benefit Provisions as of 1/1/2016 Coinsurance PCP & Specialist Copay 70% $25 70% $25 75% $25 Plan Deductible Out of Pocket Max C $400 $4,000 E $400 Individual $1,200 Family D $400 Individual $1,200 Family B $400 Individual $4,000 Individual 75% A $400 Individual $1,200 Family $2,500 Individual $5,000 Family 80% $4,000 Individual $8,000 Family $4,000 Individual $8,000 Family Vision & Dental Benefits Dependent Coverage Spouse Child N N N Y Dental & Vision Y Y $15 Dental & Vision N N $15 Dental & Vision Y Y Vision 13th Month Vision 13th Month HOW DO PARTICIPANTS ENROLL? • New Hires are sent enrollment instructions upon hire and again when they first qualify for coverage • Open Enrollment is held annually during the last quarter of the year • Special Enrollment is available if Participants have a life event • The enrollment website is www.mybenefitplaninfo.com Cycle of a Claim HOW DO CLAIMS GET PAID? Healthcare Provider Visit NEBA Issues Explanation of Benefits to Participant Healthcare Provider Submits Claim to Cigna NEBA Issues Payment or Denial to Provider Cigna Reprices Claim and Submits to NEBA NEBA Processes the Claim CYCLE OF A CLAIM: HEALTHCARE PROVIDER VISIT • Patient Visits Healthcare Provider • Patient Presents their Cigna ID Card • Healthcare Provider Calls NEBA to Verify Eligibility and Benefits • NEBA Provides Eligibility Verification • NEBA Provides a Summary of Benefits Available • Patient Receives Healthcare Services CYCLE OF A CLAIM: HEALTHCARE CLAIM SUBMISSION & REPRICING • Healthcare Provider Submits a Claim to Cigna Which Includes Details Regarding the Healthcare Services Provided • Cigna Reviews the Claim and Applies a Discount Based on the Agreement They Have with the Healthcare Provider • Cigna Discounts in 2015 Have Been in Excess of 50% CYCLE OF A CLAIM: HEALTHCARE CLAIM ADJUDICATION • Cigna Submits “Repriced” Claim Reflecting Discounts to NEBA for Adjudication • NEBA Reviews the Claim and Determines if the Claim is Payable • • Is the Patient Eligible? Are the Services Covered? • NEBA Applies the Med-1000 Benefits, such as Copays, Deductibles, etc. • NEBA Calculates the Amount Due to the Provider or Participant EXPLANATION OF BENEFITS: WHAT DOES IT MEAN? • The Explanation of Benefits (EOB) Provides Details Regarding how a Claim was Adjudicated • The EOB shows if the claim was approved or denied. • If the claim was denied, the EOB shows the reason and refers the Participant to the correct pages in the Summary Plan Description to learn more about the reason for the denial • The EOB shows the amount applied towards the Patient’s Deductible • The EOB shows the amount of copay the healthcare provider should have collected during the patient’s visit • The EOB tells the patient and the healthcare provider how much the patient owes • The EOB tells the healthcare provider how much the Patient’s bill should be discounted • The Patient should always confirm that the healthcare provider is billing them correctly by comparing the bill to their EOB EXPLANATION OF BENEFITS: WHAT DOES IT MEAN? • The Explanation of Benefits (EOB) Provides Details Regarding how a Claim was Adjudicated • The EOB shows if the claim was approved or denied. • If the claim was denied, the EOB shows the reason and refers the Participant to the correct pages in the Summary Plan Description to learn more about the reason for the denial • The EOB shows the amount applied towards the Patient’s Deductible • The EOB shows the amount of copay the healthcare provider should have collected during the patient’s visit • The EOB tells the patient and the healthcare provider how much the patient owes • The EOB tells the healthcare provider how much the Patient’s bill should be discounted • The Patient should always confirm that the healthcare provider is billing them correctly by comparing the bill to their EOB EXPLANATION OF BENEFITS: WHAT DOES IT MEAN? • The Explanation of Benefits (EOB) Provides Details Regarding how a Claim was Adjudicated • The EOB shows if the claim was approved or denied. • If the claim was denied, the EOB shows the reason and refers the Participant to the correct pages in the Summary Plan Description to learn more about the reason for the denial • The EOB shows the amount applied towards the Patient’s Deductible • The EOB shows the amount of copay the healthcare provider should have collected during the patient’s visit • The EOB tells the patient and the healthcare provider how much the patient owes • The EOB tells the healthcare provider how much the Patient’s bill should be discounted • The Patient should always confirm that the healthcare provider is billing them correctly by comparing the bill to their EOB EXPLANATION OF BENEFITS: WHAT DOES IT MEAN? • The Explanation of Benefits (EOB) Provides Details Regarding how a Claim was Adjudicated • The EOB shows if the claim was approved or denied. • If the claim was denied, the EOB shows the reason and refers the Participant to the correct pages in the Summary Plan Description to learn more about the reason for the denial • The EOB shows the amount applied towards the Patient’s Deductible • The EOB shows the amount of copay the healthcare provider should have collected during the patient’s visit • The EOB tells the patient and the healthcare provider how much the patient owes • The EOB tells the healthcare provider how much the Patient’s bill should be discounted • The Patient should always confirm that the healthcare provider is billing them correctly by comparing the bill to their EOB EXPLANATION OF BENEFITS: WHAT DOES IT MEAN? • The Explanation of Benefits (EOB) Provides Details Regarding how a Claim was Adjudicated • The EOB shows if the claim was approved or denied. • If the claim was denied, the EOB shows the reason and refers the Participant to the correct pages in the Summary Plan Description to learn more about the reason for the denial • The EOB shows the amount applied towards the Patient’s Deductible • The EOB shows the amount of copay the healthcare provider should have collected during the patient’s visit • The EOB tells the patient and the healthcare provider how much the patient owes • The EOB tells the healthcare provider how much the Patient’s bill should be discounted • The Patient should always confirm that the healthcare provider is billing them correctly by comparing the bill to their EOB EXPLANATION OF BENEFITS: WHAT DOES IT MEAN? • The Explanation of Benefits (EOB) Provides Details Regarding how a Claim was Adjudicated • The EOB shows if the claim was approved or denied. • If the claim was denied, the EOB shows the reason and refers the Participant to the correct pages in the Summary Plan Description to learn more about the reason for the denial • The EOB shows the amount applied towards the Patient’s Deductible • The EOB shows the amount of copay the healthcare provider should have collected during the patient’s visit • The EOB tells the patient and the healthcare provider how much the patient owes • The EOB tells the healthcare provider how much the Patient’s bill should be discounted • The Patient should always confirm that the healthcare provider is billing them correctly by comparing the bill to their EOB FUND CONSULTANT’S PRESENTATION Jim Crump UFCW LOCAL 1000 The new Patient Protection and Affordable Care Act (ACA) contains provisions that impact health plans such as MED 1000 and UFCW Local 1000 Oklahoma Health and Welfare Plan. 24 ACA PLAN PROVISIONS • No Lifetime or Annual Limits 2010 Annual Maximum Plan A Plan B Plan C Plan D $100,000 $ 30,000 $ 20,000 $ 50,000 2014 Annual Maximum Unlimited Unlimited Unlimited Unlimited 25 ACA PLAN PROVISIONS (continued) • Minimum Essential Coverage • • • • • • • • • • Ambulatory patient services, Emergency Services, Hospitalization, Maternity and newborn care, Mental health and substance use, Prescription drugs – Kroger Plan Rehabilitative services, Laboratory services, Preventive and wellness service and chronic disease management, Pediatric services, including oral and vision care. 26 ACA PLAN PROVISIONS (continued) • Coverage of Adult Children Up to Age 26. • Emergency services without prior authorization and covered at InNetwork rates. (non-grandfathered plans). • Plans may not impose a waiting period of more than 90 days. • Plans may not impose pre-existing condition exclusions on any participants. • Plans do not have to offer coverage for Spouses. 27 INCREASED BENEFIT COST MED 1000 Medical Claims Per Employee Per Year (All Plans) – Does not include Dental, Vision, Disability, Administration, PPO fees, or Stop Loss Insurance. 2010 $3,059 2011 $3,577 2012 $4,489 2013 $4,906 2014 $5,480 2015 $6,664 Medical Claim Cost has more than doubled since ACA was enacted! 28 MED 1000 FINANCIAL SUMMARY 12 Months Ending September 30, 2015 Additions Kroger Contributions Employee Contributions Investment Income Deductions Benefits Paid Other Benefit Expenses Administrative Expenses Change in Fund Equity $31.8 million $ 2.3 million $ .9 million $35.0 million $38.7 million $ 2.7 million $ 2.0 million $43.4 million ($8.4 million) 29 NEW TAXES, FEES and STOP LOSS PREMIUMS ACA has imposed fees, taxes and premiums that did not previously exist. Reinsurance Fee Payable by Self-Insured Plans to subsidize the Individual Health Insurance market. 2014 $63 per covered life 2015 $44 per covered life 2016 $27 per covered life Patient-Centered Outcomes Research Institute Fee (PCORI Fee) 2014 $2 per covered life 2015 $2.08 per covered life 2016 $TBD MED 1000 paid or will pay more than $466,000 in 2014 and $365,000 in 2015 for the Reinsurance and PCORI Fees. 30 NEW TAXES, FEES and STOP LOSS PREMIUMS (continued) Health Insurer Fee Payable by Health Insurance Companies, based on market share and intended to generate substantial revenue to help pay for ACA. This fee is passed on to consumers in the form of higher premiums. Cadillac Plan Tax • Effective 2018 • 40% of the value above $10,200 31 NEW TAXES, FEES and STOP LOSS PREMIUMS (continued) Stop Loss Premiums Self-insured plans like MED 1000 and CARE 1000 purchase Stop Loss Insurance to cover large claims. Because Annual Limits are not permitted, the cost of Stop Loss Insurance has increased significantly. Claims in excess of $1 million are now occurring regularly. MED 1000 will pay more than $700,000 in 2016 for Stop Loss Insurance. 32 MANDATES AND PENALTIES Individual Mandate and Penalty Penalties to Employees for Not Maintaining ‘Minimum Essential Coverage’ with either Medicare, Medicaid, Individual Insurance Policies, Employer or Taft-Hartley Sponsored Plans. 2014 $95 per adult and $47.50 per child 2015 $325 per adult and $162.50 per child 2016 $695 per adult and $347.50 per child 33 MANDATES AND PENALTIES (continued) Employer Mandate Employers with 50+ full-time employees must offer medical coverage that is “affordable” and provides “minimum value” or else be subject to Employer Penalties (below). Coverage is “affordable” if employee contributions are less than 9.5% of Employees W-2 wages. A plan must pay 60% of the cost of covered health services to be considered “minimum value.” 34 MANDATES AND PENALTIES (continued) Employer Penalties If employer does not provide “affordable” “minimum value” coverage the penalty will be the lesser of: • $2,000 for each employee, minus the first 30; or • $3,000 for each employee who receives a subsidy for coverage on an exchange. 35 CIGNA WELLBEING PARTNERSHIP UFCW “Med 1000” Kroger Dallas Stewards December 15th, 2015 Jodi Berry Dawn Godard Thank You! – We appreciate the opportunity to work together with everyone here today, to support providing educational communications to the members! Drive Member Engagement • Provide the packet today, with copies of the key member communications . Custom one page member flyer. • Educate on Emergency Room alternatives. Provide a member letter or e-mail sample and UC/CC In-Network directories for the Dallas, TX area. • Provide helpful focus topics quarterly, in PDF’s to post to local websites and provide newsletter content. • Provide step by step instructional on online provider look-up guide. Promote PCP and Cigna Designated Specialty provider selection. Confidential, unpublished property of Cigna. Do not duplicate or distribute. Use and distribution limited solely to authorized personnel. © 2015 Cigna 37 Goals and Objectives Objectives Goal 1 Increase health awareness • We want to ask for your partnership to Drive member awareness in Cigna toll free support lines, online website wellness tools and programs and to help members and their dependents be empowered to make better health decisions. • Partner today, with the Trustees, Stewards and NEBA, to coordinate quarterly periodic member communications, on key topics and provide healthy recipes and nutritional and fitness tips. Please help us promote this member engagement! Goal 2 Increase health and wellness events onsite • Promote the members to get their Preventive Care screenings with biometrics and knowing personal health numbers to address any identified risk. • Increase group.MyCareallies.com personal website user awareness, utilization and taking the Health Assessment. • Educate membership to call the Cigna 24 hour health information nurse line for decision support on health decisions and steerage in choosing a Participating Provider • MedExpert vendor also available, for additional medical inquiry information Goal 3 Implement a robust communication campaign to create awareness of… • Partner to help educate the members on alternatives to the ER. Encourage members to choose participating UC/CC when appropriate, for cost savings and a better quality of care. • Key focus on Maternity Health. Provide support and education on having a healthy pregnancy, to support healthy babies • Increase member awareness in Cigna Care Allies Case Managers. Encourage members to Take the call and Make the call, to utilize the Case Management. Goal 4 Improve plan utilization • Educate and create awareness on the Healthy Rewards member discounts and cost savings program on health care items for fitness, weight management and quitting tobacco. Support healthy pregnancies and help address chronic conditions. Confidential, unpublished property of Cigna. Do not duplicate or distribute. Use and distribution limited solely to authorized personnel. © 2015 Cigna 38 Introduction to MedExpert December 15, 2015 (c) 2015 MedExpert International, Inc. | Confidential Independent Experienced Vetted CA-based 30+ years to build CMS Health Care Innovations Award No Compromising Affiliations 10+ years with UFCW Funds 5 year longitudinal study with Harvard, Stanford, and MIT On-staff physicians and nurses Over 125,000 UFCW lives covered (c) 2015 MedExpert International, Inc. | Confidential 40 Mission Statement MedExpert’s mission is to improve lives of UFCW members through the timely exchange, understanding, and implementation of current, unbiased, and accurate medical and health information. MedExpert believes that every UFCW member, regardless of language, education, or station in life, deserves today’s finest medical knowledge delivered in a prompt, honest, clear, and respectful manner. This mission is possible through a robust knowledge system that identifies EBM quality information within 4 to 8 minutes and exchanges that knowledge through MedExpert’s knowledge transfer platform. (c) 2015 MedExpert International, Inc. | Confidential 41 MICOMM™ Advanced Telecomm System UFCW Members will always be automatically routed to their MedExpert case manager. <0.025 Seconds <1.00 <1.00 Second Second <2.00 Seconds MICOMM™ Features: Fully integrated with knowledge (FAME ™) and EHR system (MILS™) Phone number identified in <0.025 seconds Call routed to Member’s Personal Case Manager in < 1.00 seconds EHR loads with member information in <2.00 seconds No phone trees No voice mail Current engineered capacity 3,000,000 calls every 4 hours (c) 2015 MedExpert International, Inc. | Confidential 42 TM MedExpert QMMS Products & Services MedExpert QMMS™ Products & Services MISP1 MISP2 MISP3 MISP4 MISP5 MISP6 MISP7 (Quality Medical Management System) MISP8 MISP9 MISP10 MISP11 MISP12 MISP13 MISP14 MISP15 MISP16 MISP17 MISP18 MISP19 MISP20 MISP21 MISP22 MISP23 MISP24 MISP25 MISP26 Medical Decision Support IMDS ™ (Individual Medical Decision Systems) Biometric Body Composition | BMI | Waist | BPF Glucose | Fasting Glucose | A1c Lipid | Cholesterol | HDL/LDL | Triglyceride Blood Pressure Assessment Execution Health Risk | HRQ | LLL Health Plan | CAHPS Provider | VSQ9 Disease Risk | Asthma + >75 assessments Screening & Toxicology Nicotine | Cotinine FIT Schedule C Drugs Utilization | Case Management Informed ™ (Prospective Utilization/Case Management) Independent Utilization Review Medical Management Health Coaching Chronic Disease Management Directly Observed Therapy (DOT) Wellness Smoking Cessation Nutrition Fundamentals™ Exercise On! Sleep Soundly Stress Less Data Management MICore™ MI Data Analytics QMMS™ Incentive Management Member Program Agreement Fulfillment (c) 2015 MedExpert International, Inc. | Confidential IMDS™ (Individual Medical Decision Systems) is based on artificial intelligence that required over a decade to develop. IMDS™ covers all 22,000+ conditions; 16,000+ pharmaceuticals; all wellness issues and 300,000+ co-morbidities. 43 Co-Branding to Provide Numerous Modes of Engagement (c) 2015 MedExpert International, Inc. | Confidential 44 (c) 2015 MedExpert International, Inc. | Confidential 45