report - WordPress.com

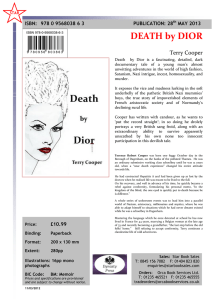

advertisement