Robert N. West

advertisement

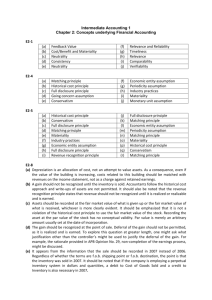

Basic Accounting Concepts: The Income Statement Part One: Financial Accounting Robert N. West © The VEMBA McGraw-Hill Accounting Companies, Inc., 1999 Basic Business Financial Flows Collection activities Cash Accounts receivable Slide 3-1 Purchasing or production activities Inventories Earnings activities Robert N. West © VEMBA Accounting Basic Concepts • Money • • • • Robert N. West measurement Entity Going concern Cost Dual aspect Slide 3-2 • Accounting period • Conservatism • Realization • Matching • Consistency • Materiality © VEMBA Accounting Basic Concepts Let’s take a look at our summer camps income statement for a few summer months. Slide 3-3 Revenues $122,400 Less expenses: Food $42,756 Wages 46,935 Rental 12,000 Other costs 5,472 Total exp. 107,163 Net income $ 15,237 Accounting Period Concept Robert N. West © VEMBA Accounting Basic Concepts Slide 3-4 Revenues $122,400 The accounting period concept allows us to find Less expenses: out how we did for a specific Food $42,756 period of time. Wages 46,935 Rental 12,000 Other costs 5,472 Total exp. 107,163 Net income $ 15,237 Accounting Period Concept Robert N. West © VEMBA Accounting Basic Concepts • Money • • • • Robert N. West measurement Entity Going concern Cost Dual aspect Slide 3-5 • Accounting period • Conservatism • Realization • Matching • Consistency • Materiality © VEMBA Accounting Basic Concepts Slide 3-6 Aspects of the conservatism concept: Recognize revenues (increases in retained earnings) only when they are reasonably certain. Recognize expenses (decreases in retained earnings) as soon as they are reasonably possible. Robert N. West © VEMBA Accounting Basic Concepts In December, customers pay for a year’s subscription to a magazine that they will begin receiving in January. Slide 3-7 When should the revenue be recognized? Conservatism Concept Robert N. West © VEMBA Accounting Basic Concepts In December, customers pay for a year’s subscription to a magazine that they will begin receiving in January. Slide 3-8 Revenue is recognized when the service is performed--thus in the year the magazine service is provided. Conservatism Concept Robert N. West © VEMBA Accounting Basic Concepts • Money • • • • Robert N. West measurement Entity Going concern Cost Dual aspect Slide 3-9 • Accounting period • Conservatism • Realization • Matching • Consistency • Materiality © VEMBA Accounting Basic Concepts Slide 3-10 Joe makes credit sales of merchandise amounting to $100,000. Realization Concept Robert N. West © VEMBA Accounting Basic Concepts Slide 3-11 If experience indicates that 3 percent of credit sales will eventually become bad debts, then revenue for the period is $97,000. Sorry Joe, I can’t pay. Realization Concept Robert N. West © VEMBA Accounting Basic Concepts • Money • • • • Robert N. West measurement Entity Going concern Cost Dual aspect Slide 3-12 • Accounting period • Conservatism • Realization • Matching • Consistency • Materiality © VEMBA Accounting Basic Concepts Today is March 19 Slide 3-13 On March 19, an item of inventory costing $1,000 is received. Matching Concept Robert N. West © VEMBA Accounting Basic Concepts Today is April Slide 3-14 On April 16, the vendor is paid in full. 16 Matching Concept Robert N. West © VEMBA Accounting Basic Concepts Today is May 9 Slide 3-15 On May 9, the item of merchandise is sold for $1,500. When should the merchandise be an expense to the firm? Matching Concept Robert N. West © VEMBA Accounting Basic Concepts Today is May 9 Slide 3-16 On May 9, the item of merchandise is sold for $1,500. In May, when the merchandise is sold. Matching Concept Robert N. West © VEMBA Accounting Basic Concepts Slide 3-17 Types of transactions that need to be considered in distinguishing between amounts that are properly considered as expenses of a given accounting period and the expenditures made in connection with the item. Expenditures that are also expenses Beginning assets that become expenses Expenditures that are not yet expenses Expenses not yet paid Robert N. West © VEMBA Accounting Basic Concepts • Money • • • • Robert N. West measurement Entity Going concern Cost Dual aspect Slide 3-18 • Accounting period • Conservatism • Realization • Matching • Consistency • Materiality © VEMBA Accounting Basic Concepts LIFO Robert N. West Slide 3-19 The consistency concept: Once an entity has decided on one accounting method, it should use the same method for all subsequent events of the same character (unless it has a sound reason to change methods). © VEMBA Accounting Basic Concepts • Money • • • • Robert N. West measurement Entity Going concern Cost Dual aspect Slide 3-20 • Accounting period • Conservatism • Realization • Matching • Consistency • Materiality © VEMBA Accounting Basic Concepts Slide 3-21 A dozen pencils were purchased for the office secretary. These pencils are assets to the firm and technically should be expensed each time one is used. Materiality allows the firm to expense the pencil either at the time of purchase or when an inventory is taken of office supplies at period-end. Materiality Robert N. West © VEMBA Accounting Income Statement Slide 3-22 GARDEN CORPORATION Income Statement For the Year Ended December 31, 1998 Net sales Cost of sales Gross margin Research and development expense Selling, general, and administrative expenses Operating income Other revenues (expenses): Interest expense Interest and dividend revenues Royalty revenues Income before income taxes Provision for income taxes Net income Robert N. West $75,478,221 52,227,004 23,251,217 2,158,677 8,726,696 12,356,844 (363,000 ) 43,533 420,010 12,466,387 4,986,555 $ 7,479,832 © VEMBA Accounting Statement of Retained Earnings Slide 3-23 Statement of Retained Earnings Retained earnings at the beginning of year Add: Net income Deduct: Dividends ($4 per common share) Retained earnings at end of year Robert N. West $16,027,144 7,479,832 (4,390,000 $19,116,976 © VEMBA Accounting Chapter 3 The End Robert N. West © VEMBA Accounting