Problem & Solution

advertisement

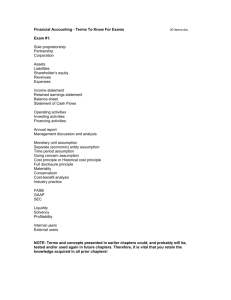

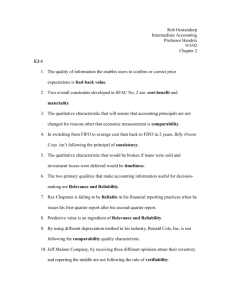

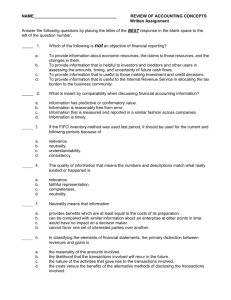

Intermediate Accounting 1 Chapter 2: Concepts underlying Financial Accounting E2-1 (a) (b) (c) (d) (e) Feedback Value Cost/Benefit and Materiality Neutrality Consistency Neutrality (f) (g) (h) (i) (j) Relevance and Reliability Timeliness Relevance Comparability Verifiability (a) (b) (c) (d) (e) Matching principle Historical cost principle Full disclosure principle Going concern assumption Conservatism (f) (g) (h) (i) (j) Economic entity assumption Periodicity assumption Industry practices Materiality Monetary unit assumption (a) (b) (c) (d) (e) (f) (g) (h) (i) Historical cost principle Conservatism Full disclosure principle Matching principle Materiality Industry practices Economic entity assumption Full disclosure principle Revenue recognition principle (j) (k) (l) (m) (n) (o) (p) (q) (r) Full disclosure principle Matching principle Economic entity assumption Periodicity assumption Matching principle Materiality Historical cost principle Conservatism Matching principle E2-4 E2-5 E2-8 (a) Depreciation is an allocation of cost, not an attempt to value assets. As a consequence, even if the value of the building is increasing, costs related to this building should be matched with revenues on the income statement, not as a charge against retained earnings. (b) A gain should not be recognized until the inventory is sold. Accountants follow the historical cost approach and write-ups of assets are not permitted. It should also be noted that the revenue recognition principle states that revenue should not be recognized until it is realized or realizable and is earned. (c) Assets should be recorded at the fair market value of what is given up or the fair market value of what is received, whichever is more clearly evident. It should be emphasized that it is not a violation of the historical cost principle to use the fair market value of the stock. Recording the asset at the par value of the stock has no conceptual validity. Par value is merely an arbitrary amount usually set at the date of incorporation. (d) The gain should be recognized at the point of sale. Deferral of the gain should not be permitted, as it is realized and is earned. To explore this question at greater length, one might ask what justification other than the controller’s might be used to justify the deferral of the gain. For example, the rationale provided in APB Opinion No. 29, non-completion of the earnings process, might be discussed. (e) It appears from the information that the sale should be recorded in 2007 instead of 2006. Regardless of whether the terms are f.o.b. shipping point or f.o.b. destination, the point is that the inventory was sold in 2007. It should be noted that if the company is employing a perpetual inventory system in dollars and quantities, a debit to Cost of Goods Sold and a credit to Inventory is also necessary in 2007.