File

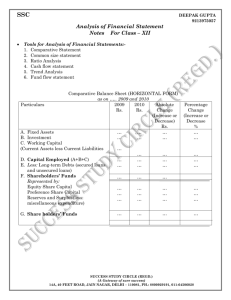

SSC

DEEPAK GUPTA

9213975057

ACCOUNTIG PRINCIPLES

Class – XI

Chapter – 3

Accounting Principles :- Principles of accounting are the general law Or rules which are adopted by accountants universally while recording accounting transactions.

Features of Accounting Principles :-

1.

Accounting Principles are man – made .

2.

Accounting Principles are flexible.

3.

Accounting Principles are generally/universally accepted.

The Principles are classified into two categories:

(1)Accounting concepts

(2)Accounting conventions

Accounting Concepts :

1.

The Business Entity – concept :- Accounting entity/Business entity/seprate entity concept means that a business unit is considered a distinct entity from its owners and all other entities. Therefore, All the transactions of the business are recorded in the book of accounts from the business point of view.

2.

Money Measurement concept :- Money measurement assumption means that only those transactions and events or facts which can be expressed in terms of money are recorded in the books of accounts. In the other words, we can say that those events and transactions which can’t be expressed in terms of money, do not find a place in the book of accounts.

3.

Going Concern Concept :- The going concern concept holds that a business shall continue for an indefinite period and there is no intention to close the business. It means that business will continue to exist in the for seeable future. It is because of this concept that, fixed assets are recorded at their original cost and depreciated in a systematic manner

4.

The Accounting Period Concept :- Accounting period assumption is linked with going

concern Assumption. On the basis of going concern concept profit of the business can be truly ascertained after the closure of the business. But it is not possible. So , Accounting period concept is applied, According to this concept the life of an enterprise be broken into smaller

periods so that its performance is measured at regular intervals.

5.

The Dual Aspect Concept :- Dual aspect concept means that every business transaction has

two aspect .If one account is debited, any other account must be credited. Thus we can say that

Asset = Capital + Liability

(owner‘s equity ) (outsider’s equity)

SUCCESS STUDY CIRCLE (REGD.)

(A Gateway of sure success)

14A, 40 FEET ROAD, JAIN NAGAR, DELHI – 110081, PH. 8800929191, 01164506028

1

SSC

DEEPAK GUPTA

9213975057

In other words accounting equation demonstrates the fact that for every debit there is an equivalent credit.

6.

The cost Concept (Historical Cost Concept) :- The cost concept holds that an assets is recorded in the books of accounts at the price paid to acquire it (Purchase it). The cost is the basis for all subsequent accounting of the assets. Assets is recorded at the cost at the time of its purchase but is systematically reduced in value by charging depreciation.

7.

The Revenue Recognitions Concept:- According to this concept revenue is considered to have been realized when a transaction has been entered into and the obligation to receive the amount has been established. It helps in ascertaining the amount and time of recognizing the revenues.

8.

Matching Concept :- Matching Principle means that the expenses should be matched with the

revenues generated in the relevant period. Matching Principle implies the matching of expenses of an accounting period against related revenues.

9.

The accrual concept :- Accruals concept holds that a transaction is recorded in the books of

Accounts at the time when it takes place and not when the settlement is take place. Under this concept , Profit is regarded as earned at the time the goods or services are sold to a customers.

10.

The Verifiable Concept :- According to this concept accounting is free from personal bias. It means all accounting transactions should be evidenced and supported by business documents . for e.g. cash , memo, invoices, sales, bills etc.

Accounting Conventions :-

1.

Conventions of full disclosure :- The Principle of full disclosure means that financial statement should disclose all significant information relating to the economic affairs of the firm. For this purpose facts or items which do not find a place in financial Statements are shown as foot notes, schedules etc. for example : contingent liability appearing a foot note .

2.

Convention of consistency :- Consistency Principle means that accounting procedures and policies used once in the business should be continuously followed. Accounting rules and

Principle should not be changed from year to year. This concept helps in better understanding of accounting information and makes it comparable.

3.

Convention of Prudence or conservation :- According to Principles, an accountant while recording business transactions in the book of accounts, should take all possible losses into account and should leave all anticipated profits.

4.

Materiality Concept :- According to materiality principle, an accountant should disclose all material information in the books of accounts. There is unlimited amount of financial information’s which can be provided for any business. But in order to make financial information more meaningful accountant should record only those informations which are material.

SUCCESS STUDY CIRCLE (REGD.)

(A Gateway of sure success)

14A, 40 FEET ROAD, JAIN NAGAR, DELHI – 110081, PH. 8800929191, 01164506028

2