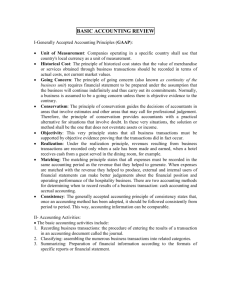

G.A.A.P.

advertisement

G.A.A.P. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES Objectives Identify and describe: ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ Business Entity Conservatism Consistency Cost Full Disclosure Matching Materiality Monetary Unit Time Period Identify revenue recognition methods and their impact on reported net income ◦ Point of Sale ◦ Installment Sales ◦ Percentage of Completion Business Entity Financial accounting is based on the premise that the transactions and balances of a business entity are to be accounted for separately from its owners. The business entity is therefore considered to be distinct from its owners for the purpose of accounting. Therefore, any personal expenses incurred by owners of a business will not appear in the income statement of the entity. Business Entity Similarly, if any personal expenses of owners are paid out of assets of the entity, it would be considered to be drawings for the purpose of accounting much in the same way as cash drawings. Example: ◦ Owner of a business pays the rent on her personal home from her business account. ◦ She should pay back the rent and take away from owner’s equity/withdrawls ◦ Owner of a business buys a new computer system for the business with their personal credit card. ◦ This should be listed as a business expense and be reimbursed by the business. Conservatism The general concept of recognizing expenses and liabilities as soon as possible when there is uncertainty about the outcome, but to only recognize revenues and assets when they are assured of being received. Thus, when given a choice between several outcomes where the probabilities of occurrence are equally likely, you should recognize that transaction resulting in the lower amount of profit, or at least the deferral of a profit. Similarly, if a choice of outcomes with similar probabilities of occurrence will impact the value of an asset, recognize the transaction resulting in a lower recorded asset valuation. Conservatism Under the conservatism principle, if there is uncertainty about incurring a loss, you should tend toward recording the loss. Conversely, if there is uncertainty about recording again, you should not record the gain The conservatism principle can also be applied to recognizing estimates. The conservatism principle is the foundation for the lower of cost or market rule. Consistency Principle The consistency principle states that, once you adopt an accounting principle or method, continue to follow it consistently in future accounting periods. Only change an accounting principle or method if the new version in some way improves reported financial results. If you make such a change, fully document its effects and include this documentation in the notes accompanying the financial statements. Cost Principle The cost principle is the general concept that you should initially record an asset, liability, or equity investment at its original acquisition cost. The principle is widely used to record transactions, partially because it is easiest to use the original purchase price as objective and verifiable evidence of value. A variation on the concept is to allow the recorded cost of an asset to be lower than its original cost, if the market value of the asset is lower than the original cost. Cost Principle However, this variation does not allow the reverse - to revalue an asset upward. Thus, this lower of cost or market concept is a conservative view of the cost principle. Full Disclosure Principle The full disclosure principle states that you should include in an entity's financial statements all information that would affect a reader's understanding of those statements. The interpretation of this principle is highly judgmental, since the amount of information that can be provided is potentially massive. To reduce the amount of disclosure, it is customary to only disclose information about events that are likely to have a material impact on the entity's financial position or financial results. Full Disclosure Principle This disclosure may include items that cannot yet be precisely quantified, such as the presence of a dispute with a government entity over a tax position, or the outcome of an existing lawsuit. Full disclosure also means that you should always report existing accounting policies, as well as any changes to those policies (such as changing an asset valuation method) from the policies stated in the financials for a prior period. Full Disclosure Principle Several examples of full disclosure are: ◦ The nature and justification of a change in accounting principle ◦ The nature of a non-monetary transaction ◦ The nature of a relationship with a related party with which the business has significant transaction volume ◦ The amount of encumbered assets ◦ The amount of material losses caused by the lower of cost or market rule ◦ A description of any asset retirement obligations ◦ The facts and circumstances causing goodwill impairment Matching Principle The matching principle is one of the cornerstones of the accrual basis of accounting. Under the matching principle, when you record revenue, you should also record at the same time any expenses directly related to the revenue. Thus, if there is a cause-and-effect relationship between revenue and the expenses, record them in the same accounting period. Matching Principle Here are several examples of the matching principle: ◦ Commission. A salesman earns a 5% commission on sales shipped and recorded in January. The commission of $5,000 is paid in February. You should record the commission expense in January. ◦ Depreciation. A company acquires production equipment for $100,000 that has a projected useful life of 10 years. It should charge the cost of the equipment to depreciation expense at the rate of $10,000 per year for ten years. ◦ Employee bonuses. Under a bonus plan, an employee earns a $50,000 bonus based on measurable aspects of her performance within a year. The bonus is paid in the following year. You should record the bonus expense within the year when the employee earned it. ◦ Wages. The pay period for hourly employees ends on March 28, but employees continue to earn wages through March 31, which are paid to them on April 4. The employer should record an expense in March for those wages earned from March 29 to March 31. Materiality Principle The materiality principle states that you are allowed to ignore an accounting standard if the net impact of doing so has such a small impact on the financial statements that a reader of the financial statements would not be misled. Under generally accepted accounting principles (GAAP), you do not have to implement the provisions of an accounting standard if an item is immaterial. This definition does not provide definitive guidance in distinguishing material information from immaterial information, so you must exercise judgment in deciding if a transaction is material. (It’s kind of relative) Monetary Unit Principle The monetary unit principle states that you only record business transactions that can be expressed in terms of a currency. Thus, a company cannot record such non-quantifiable items as employee skill levels, the quality of customer service, or the ingenuity of the engineering staff. Time Period Principle The time period principle is the concept that a business should report the financial results of its activities over a standard time period, which is usually monthly, quarterly, or annually. Once the duration of each reporting period is established, use the guidelines of Generally Accepted Accounting Principles or International Financial Reporting Standards to record transactions within each period. You must include in the header of a financial statement the time period covered by the statement. For example, an income statement or statement of cash flows may cover the "Eight Months ended August 31." However, the balance sheet is dated as of a specific date, rather than for a range of dates. Thus, a balance sheet header might state "as of August 31." Point of Sales Collection probability- If it is not possible to make a reasonable estimate of the amount of the allowance for doubtful accounts, then do not recognize a sale until it is possible to do so. ◦ If you are uncertain of the collection of cash from a sale transaction, defer sale recognition until payment has been received. Delivery is complete- Ownership of the goods must have shifted to the buyer, as well as the risks of ownership. ◦ The buyer must also have accepted the goods. ◦ The SEC does not like bill and hold transactions, and only allows them under restricted circumstances. Point of Sales Persuasive evidence of an arrangement- The substance of a transaction (and not just its form) should indicate that a sale transaction has indeed taken place. ◦ For example, the consignment of goods does not constitute a sale until the consignee sells the goods to a third party. ◦ The SEC specifically points out that the transfer of goods solely for demonstration purposes is not an actual sale, nor is a transfer when the "seller" is obligated to take the goods back at a specific price, or when the "buyer" has no obligation to pay for the received items. Point of Sales The price can be determined- The buyer no longer has the contractual right to unilaterally terminate the contract and be paid back for any amounts already paid. ◦ If the price to be paid is contingent on a future event, then you must wait for that event before recognizing the sale. ◦ Also, if it is not possible to reasonably estimate the amount of any customer returns, then you must wait for more certainty regarding this item before recognizing the sale. Installment Sales Many companies allow their credit customers to make periodic payments over several months Under the installment method, only the gross profits on those sales for which cash payment has been received are recognized. All gross profits associated with uncollected receivables are parked on the balance sheet as an offset to receivables, where they remain until customer payments are received Referred to as installment accounts receivable ◦ Amounts owed by customers from credit sales for which payment is required in periodic amounts over an extended time period ◦ Customer is usually charged interest ◦ Example ◦ Buying a car or getting a mortgage Percentage of Completion Involves ongoing recognition of revenue and income related to longer-term projects. By doing so, the seller can recognize some gain or loss related to a project in every accounting period in which the project continues to be active. The method works best when it is reasonably possible to estimate the stages of project completion on an ongoing basis, or at least to estimate the remaining costs to complete a project. Percentage of Completion The percentage of completion method allows you to recognize as income that percentage of total income that matches the percentage of completion of a project