Chapter 5 - Accounting Theory

advertisement

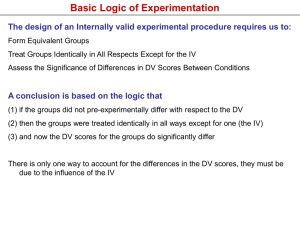

5-1 CHAPTER 5 ACCOUNTING THEORY UNDERLYING FINANCIAL ACCOUNTING 5-2 Accounting Theory Defined “. . . a set of basic concepts and assumptions and related principles that explain and guide the accountant’s actions in identifying, measuring, and communicating economic information.” 173 5-3 Structure of Accounting Theory Formal Approach Accounting theory provides a logical framework for accounting practice. 5-4 Structure of Accounting Theory Formal Approach Accounting theory provides a logical framework for accounting practice. ASSUMPTIONS 5-5 Structure of Accounting Theory Formal Approach Accounting theory provides a logical framework for accounting practice. PRINCIPLES ASSUMPTIONS 5-6 Structure of Accounting Theory Formal Approach Accounting theory provides a logical framework for accounting practice. RULES PRINCIPLES ASSUMPTIONS 5-7 Structure of Accounting Theory Informal Approach Accounting Theory Accounting theory is somewhat like a cloud, i.e. not well-defined. 5-8 Structure of Accounting Theory Informal Approach The terms "assumptions", "principles", "rules", "concepts", "postulates", "standards", etc. are used many different ways in the profession. Therefore, the authors' classification of these terms is not important to us in this course. i.e., you do not have to understand the authors’ theory structure - just know the meaning and relevance of the items/“ideas” on the following slides. 5-9 Business Entity “Idea” Each business has an identity separate from its owners. The business is the accounting entity. Financial statements report only the activities, resources, and obligations of that business. 5-10 Going-Concern In the absence of evidence to the contrary, we assume that a business will continue to exist indefinitely. For example, a company is more likely to acquire long-term assets if it can assume that the company will continue to exist indefinitely. It is fundamental to the matching principle. 5-11 MONEY MEASUREMENT Business entities measure economic events and transactions in monetary units. In the United States, the unit of measurement is the dollar. 5-12 Stable Dollar or Stable Monetary Unit 5-13 Stable Dollar or Stable Monetary Unit Assumes that the dollar maintains a relatively stable value. In countries with high inflation, this assumption may not be valid. 5-14 Stable Dollar or Stable Monetary Unit Assumes that the dollar maintains a relatively stable value. In countries with high inflation, this assumption may not be valid. Accountants do not adjust the accounts for the changing value of the dollar (i.e., inflation) 5-15 Periodicity Continuous business activity is divided into arbitrary time periods as exemplified by this time line. Business activity is best reported in annual, quarterly or monthly periods. 5-16 Other Basic Ideas Substance Over Form The substance of a transaction or economic event is more important than its legal form. 5-17 Other Basic Ideas Substance Over Form The substance of a transaction or economic event is more important than its legal form. e.g., next semester, we will study that even though parent and subsidiary companies are legally separate entities, GAAP says that a set of consolidated financial statements must be prepared as if they were one company, i.e., one economic entity. 5-18 Other Basic Ideas Consistency Requires that a company use the same accounting principles from one period to the next. It does not require that all companies use the same principles. A change from one acceptable accounting principle to another must be disclosed in the notes to the financial statements. 5-19 Other Basic Ideas Double-Entry Bookkeeping Every transaction will have both a debit effect and a credit effect on the primary financial statements. Total debits must equal total credits. Articulation The primary financial statements are fundamentally related to each other as shown on page 19. 5-20 Major Principles/Ideas Exchange-Price or Historical Cost Matching Revenue Recognition Expense Recognition Gain and Loss Recognition Full Disclosure 5-21 Major Principles/Ideas Exchange-Price or Historical Cost Matching Revenue Recognition Expense Recognition Gain and Loss Recognition Full Disclosure All transactions are recorded at their historical cost at the time of the transaction. 5-22 Major Principles/Ideas Exchange-Price or Cost Matching Revenue Recognition Expense Recognition Gain and Loss Recognition Full Disclosure The most important principle. It provides the basis for accrual accounting. 5-23 Major Principles/Ideas Exchange-Price or Historical Cost Matching Revenue Recognition Expense Recognition Gain and Loss Recognition Full Disclosure Revenues are recorded when they are earned (i.e., realized). When does this happen? When title passes. 5-24 Exceptions to Revenue Recognition Principle Cash basis of revenue recognition Installment basis of revenue recognition (Need only know concept, not how to apply) Percentage-of-completion basis of revenue recognition Revenue recognition at completion of production (Need only know concept, not how to apply) 180 181 5-25 Major Principles/Ideas Exchange-Price or Historical Cost Matching Revenue Recognition Expense Recognition Gain and Loss Recognition Full Disclosure Expenses should be recorded as they are incurred in the process of earning revenues. 5-26 Major Principles/Ideas Exchange-Price or Historical Cost Matching Revenue Recognition Expense Recognition Gain and Loss Recognition Full Disclosure The rules are different for recognition of gains and losses. 5-27 Gain and Loss Recognition Gains are recognized/recorded at the time they are realized. For example, an increase in the value of land cannot be recognized as a gain until the land is actually sold. 5-28 Gain and Loss Recognition Gains are recognized/recorded at the time they are realized. For example, an increase in the value of land cannot be recognized as a gain until the land is actually sold. Losses are recognized when they become apparent. For example, a decrease in the value of inventory would be recognized as a loss when it becomes apparent. 5-29 Major Principles/Ideas Exchange-Price or Historical Cost Matching Revenue Recognition Expense Recognition Gain and Loss Recognition Full Disclosure Disclose in the financial statements or related notes, all information important enough to influence a stakeholder. 5-30 Cost-Benefit Consideration Optional information should be included in the primary financial statements only if the benefits of providing it exceed the costs. For example, providing a listing of every sales transaction may be interesting, but the cost of providing that information to every shareholder might bankrupt the company. 5-31 Materiality An item is material if knowledge of the item would affect the decision of an informed user, therefore, this is a somewhat nebulous concept. Material items must be reported. An item can be material either in amount or in nature. Materiality in amount is relative to the size of the amounts on a company’s fin. stmts. (e.g. $50,000,000 may not be material …) 5-32 Conservatism Transactions should be recorded so that net assets and net income are not overstated. Anticipate losses, but do not anticipate gains. 5-33 Summary of Significant Accounting Policies Appears in the notes to the financial statements. Includes a discussion of the major accounting policies. 5-34 Almost Finished A good framework is the best foundation. 5-35 Conclusion Virtual Keypad Questions