Estimate the cost formula for maintenance cost.

advertisement

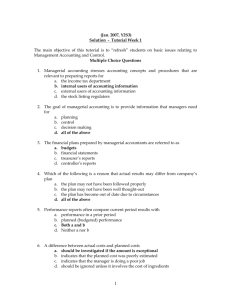

Ch 02: Managerial Accounting and Cost Concepts Managerial-KU Introduction: 1. Many different kind of organization affect our daily lives, like……. [Manufacturing – retailers – services- Nonprofit organization – government] 2. All of these organization have: a. A set of Goals or objectives b. Managers strive to achieve these goals c. To achieve these goals : Managers need information. ( Comes from accounting system) And the day to day work of the management which are: Planning 1. Identify alternatives. 2. Select the best alternative 3. Develop budgets for the selected alternative. Directing and motivating 1. Employee work assignments. 2. Routine problem solving. Controlling 1. The control function ensures that plans are being followed. 2. Controlling is the process of comparing actual results with the budget. 3. Feedbacks in the form of performance reports are an essential part of the control function 3. Accounting System: Is a part of the organization's management information system, which accumulate date for use in both financial and managerial accounting 4. Types of accounting: a. Financial Accounting b. Managerial Accounting Page 1 of 11 By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts Managerial-KU MANAGERIAL VERSUS FINANCIAL ACCOUNTING: Users Reports Time focus Verifiability versus Relevance Precision versus Timeliness Subject GAAP Requirement Financial accounting Managerial External Persons Who make financial decisions Financial Statement Income statement Retained Earning statement Balance sheet Statement of cash flow Historical Perspective Managers (internal) who plan for and control an organization Cost Reports Cost of Goods Sold Cost of Goods Available Cost of Goods Manufactured Emphasis on Verifiability Future emphasis Emphasis on relevance for planning and control Emphasis on Precision Emphasis on Timeliness Primary focus is on the whole organization Must follow GAAP and prescribed formats Mandatory for external reports Focus on segments of an organization Need not follow GAAP or any prescribed format Not Mandatory 5. Preparing of Cost Reports: To prepare the cost reports we have first to understand what meant by cost. Cost: is a sacrifice made by recourses to achieve a particular purpose. Costs can be classified in a number of ways—depending on the purpose of the classification1- Product and period : (Preparing external financial reports. 2- Manufacturing and Non-manufacturing : (Assigning costs to cost objects ). 3- Direct and indirect : ( the relationship between costs and Products) 4- Material, labor and overhead : ( Preparing Cost Budget ) 5- Variable and Fixed : ( the relationship between costs and activity ) 6- Controllable and Non-controllable : ( Making business Decisions ) Now let's look at various calcification of cots. Page 2 of 11 By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts Managerial-KU Cost Classifications: (General Cost Classifications) 1 Product Costs 3 2 Manufacturing Direct Material (V) Cost of goods sold Inventory Direct Prime Cost Direct Labour (V) Conversion Cost Indirect Overhead (V,F,M) Indirect Material Period Costs Non - Manufacturing Marketing (selling) Administrative Page 3 of 11 Indirect Labour Other MOH Rental of Factory. Depreciation on Plant, Equipment. Utilities, Factory Supplies, Factory Insurance on Factory By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts Managerial-KU Cost Classifications: ( 4 types of cost classifications ) 1. Product and period Costs. Product costs include all the costs that are involved in acquiring or making a product, Product costs are also known as Inventorable costs. Period costs include all selling costs and administrative costs, These costs are expensed on the income statement in the period incurred. 2. Manufacturing and Non-Manufacturing Costs. Manufacturing costs: includes a. Direct Material. Raw materials that become an integral part of the product and that can be conveniently traced directly to it. Examples the aircraft engines on a Boeing 777, the Intel processing chip in a personal computer, the blank video cassette in a pre-recorded video, and a radio in an automobile. b. Direct Labor. Those labor costs that can be easily traced to individual units of product. Examples Wages paid to automobile assembly workers c. Manufactory overhead includes all manufacturing costs except direct materials and direct labor, These costs cannot be easily traced to specific units (also called indirect manufacturing cost, factory overhead, and factory burden). Indirect Materials. Materials used to support the production process. Examples lubricants and cleaning supplies used in the automobile assembly plant. Indirect Labor. Wages paid to employees who are not directly involved in production work. Examples maintenance workers, janitors and security guards. Other manufactory overhead. maintenance and repairs on production equipment, heat and light, property taxes, depreciation and insurance on manufacturing facilities, etc. Non-Manufacturing costs: includes a. Selling Costs. include all costs necessary to secure customer orders and get the finished product into the hands of the customer Examples of selling costs include advertising, shipping, sales travel, sales commissions, sales salaries, and costs of finished goods warehouses. Page 4 of 11 By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts b. Managerial-KU Administrative Costs. include all executive, organizational, and clerical costs associated with the general management of an organization. Examples of administrative costs include executive compensation, general accounting, secretarial, public relations, and similar costs involved in the overall general administration of the organization as a whole. 3. Cost Classification for decision making: 1. Opportunity Cost. Is the potential benefit given up when one alternative is selected over another. 2. Differential Cost (Incremental Cost) A difference in Cost between alternatives. 3. Sunk Cost. Is a cost that has already been incurred and cannot be changed by any decision made now or in the future. 4. Variable and Fixed Costs. (for predicting cost behavior) A Variable cost Varies in direct proportion to changes in the level of activity. For example, if you don’t have a texting plan on your cell phone, text messaging costs 5 cents per text. Your total texting bill increases with the number of texts you send. Activity (Messages) 100 200 300 Cost Per Message 5 Cents 5 Cents 5 Cents Total Cost of Messages 500 Cents 1000 Cents 1500 Cents A Fixed cost is constant within the relevant range. In other words, fixed costs do not change for changes in activity that fall within the “relevant range" For example, your monthly contract fee for your cell phone is a fixed amount for a certain number of minutes. The monthly contract fee does not change based on the number of calls you make. Relevant range: The range of activity within which assumptions about variable and fixed cost behavior is valid. Note: if you go over your monthly minutes allotment, you have exceed the relevant range for your monthly contract and will be charged above and beyond your monthly contract fee. Activity (Minutes) 10 20 50 Page 5 of 11 Cost Per Minute $10 $05 $02 Total Cost of Calls $100 $100 $100 By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts Managerial-KU Types of fixed costs: a. Committed fixed cost. Investments in facilities, equipment, and basic organizational structure that can’t be significantly reduced without making fundamental changes. b. Discretionary fixed cost Those fixed costs that arise from annual decision by management to spend on certain fixed cost item, such as advertising and research. Cost Variable Fixed Summary of Variable and Fixed cost Behavior In Total Per Unit Total variable cost changes as Variable cost per unit remains the same activity level changes over wide range of activity Remains the same, within relevant Fixed cost per unit goes down as activity Range level goes up A Mixed cost (Semivariable cost) A cost that contains both variable and fixed cost element Cost Reports 1- Income Statement Sales revenue (-) Cost of goods sold (=) Gross margin (-) Selling and administrative ***** (****) **** (****) (=) Income before taxes **** (-) Income tax expense (***) (=) Net Income (or net loss) ***** Page 6 of 11 2-Cost of Goods Sold Statement Cost of Beginning finished-goods Inventory *** (+) Cost of goods manufactured *** (=) Cost of goods available for sale **** (-) Cost of ending finished-goods inventory (***) Cost of Goods Sold ***** By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts Managerial-KU 3- Cost of Goods Manufactured Statement Direct Material Beginning raw-material inventory *** (+) purchases of raw material *** (=) Raw material available for use **** (-) Ending raw-material inventory (***) (=) Raw material used = (Direct Material) **** Add: direct Labour **** Add: Manufacturing Overhead Indirect material *** Indirect labour *** Depreciation on factory *** Depreciation on equipment *** Manufacturing utilities *** Insurance, factory = Total Manufacturing Overhead *** ………… **** Total manufacturing costs ………… ***** Add: Beginning of the period work-in-process inventory ………… **** Deduct: Ending of period work in process inventory ………… (****) Cost of Goods Manufactured ………… ****** Types of Income Statement Traditional Format Sales (-) Cost of Goods Sold (=) Gross Margin (Profit) (-) Selling and Administrative Exp. (=) Net Operating Income Page 7 of 11 Contribution Format 10,000 2,000 8,000 3,500 4,500 Sales (-) Variable expenses Cost of Goods Sold Variable Selling Variable administrative (=) Contribution Margin (-) Fixed expenses Fixed Selling Fixed administrative (=) Net Operating Income 10,000 2,000 500 1,500 1,000 500 4,000 6,000 1,500 4,500 By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts Managerial-KU Understanding Cost Behavior ?? Cost behavior refers to: How cost will react or changes as a change in the level of Activity. Understanding cost behavior helps managers in Predicting Costs under various levels of activity. How?? Let us Look at the following example. Nour Company Produce 4,000 units at a total cost of $10,000. Segregation of Mixed Costs: Managers can use a variety of method to estimate the fixed and variable components of a mixed cost such as: 12345- Account analysis approach Engineering approach Scattergraph plot High low method Least squares regression Page 8 of 11 By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts Managerial-KU High Low Method: Is a cost-estimation method in which a cost line is fit using exactly two data points – the high and low activity levels Exercise: Nourhan Inc. has provided the following data concerning its maintenance costs: March .................... April ...................... May........................ June........................ July ........................ August ................... September .............. October .................. November .............. Machine-Hours Maintenance Cost 4,440 $50,950 4,431 $50,877 4,412 $50,696 4,460 $51,113 4,414 $50,711 4,433 $50,900 4,443 $50,976 4,415 $50,730 4,425 $50,530 Management believes that maintenance cost is a mixed cost that depends on machine-hours. Required: A) Estimate the variable cost per machine-hour and the fixed cost per month using the high-low method. B) Estimate the cost formula for maintenance cost. C) Assume that the company plans to Work 5,000 Hours during December , How much Maintenance Cost will be? Solution: A) Estimate the variable cost per machine-hour and the fixed cost per month using the high-low method. 1- Selecting the High and Low activity and its related Costs: 2- Computing the Variable Cost per units [ Slop ] or [ b ]. $51,113−$50,696 𝐶𝑜𝑠𝑡−𝐿𝑜𝑤 𝐶𝑜𝑠𝑡 b= 𝐻𝑖𝑔ℎ𝐻𝑖𝑔ℎ = 4,460−4,412 = $8.678 𝐴𝑐𝑡𝑖𝑣𝑖𝑡𝑦−𝐿𝑜𝑤 𝐴𝑐𝑡𝑖𝑣𝑖𝑡𝑦 3- Computing the fixed cost [a]. a = Y – bX = $51,113 – ( $8.678 ×4,460 ) = $12,409 Page 9 of 11 By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts Managerial-KU B) Estimate the cost formula for maintenance cost. Y=a+bX Y = $12,409 + $8.678 X C) Assume that the company plans to Work 5,000 Hours during December , How much Maintenance Cost will be? Y = $12,409 + ( $8.678 X 5,000 hours ) = $55,799 Multiple choices: 1- The variable costs per unit are $4 when a company produced 10,000 units of production . what are the variable costs per unit when 8,000 units are produced ? a. $ 4.00 b. $ 4.50 c. $ 5.00 d. $ 5.50 e. Some other amount 2- The fixed costs per unit are $10 when a company produced 10,000 units of product , what are the fixed costs per unit when 12,500 units are produced ? a. $ 4.00 b. $ 6.00 c. $ 8.00 ($10*10,000) / 12,500 d. $ 10.00 e. some other amount 3- Total costs are $80,000 when 8,000 units are produced ; of this amount, variable costs are $48,000 , what are the total costs when 10,000 units are produced ? a. $ 80,000 T.F.C = 80,000 – 48,000 = 32,000 b. $ 92,000 V.C/U = 48,000 / 8,000 = 6 c. $ 98,000 T.C = 32,000 + ( 6 * 10,000) = 92,000 d. $ 100,000 e. $ 108,000 Page 10 of 11 By: Ehab Abdou (97672930) Ch 02: Managerial Accounting and Cost Concepts Managerial-KU Exercise: The following data were taken from the cost records of Morrey Company for last year: Depreciation, factory Indirect labor Administrative salaries Factory supervision Advertising expenses Utilities, factory Property taxes, (60% administrative,40% selling) Insurance, factory Depreciation, administrative office equipment Lubricants for machines Direct labor Purchases of raw materials Sales $60,000 $100,000 $14,000 $16,000 $20,000 $40,000 $30,000 $10,000 $ 12,000 $15,000 $200,000 $150,000 $900,000 Inventories at the beginning and at the end of the year were as follows: Raw materials Work in process Finished goods Beginning $10,000 $25,000 $30,000 Ending $20,000 $5,000 $50,000 Required: Prepare a schedule of cost of goods manufactured. Prepare a schedule of cost of goods sold. Prepare income statement. Page 11 of 11 By: Ehab Abdou (97672930)