Capital Structure Decisions - Kellogg School of Management

advertisement

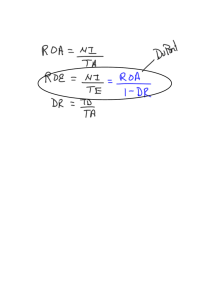

Capital Structure Decisions Professor Artur Raviv Kellogg School of Management Capital Structure Decisions 1 Capital Structure decisions Discussion Agenda A. What is Financial Leverage B. Effects of Leverage C. Optimal Financing in Perfect Markets D. Optimal Financing in Imperfect Markets Capital Structure Decisions 2 What is Financial Leverage All-equity Firm A firm that uses only equity to finance operations is called an all equity or an unleveraged firm. Equity Value Debt Value Firm Value E = V Capital Structure Decisions 3 What is Financial Leverage Leveraged Firm A firm that uses sources of financing other then equity, typically debt, has financial leverage and is called a leveraged firm. Equity Value Debt Value Firm Value D+E = V Capital Structure Decisions 4 Effects of Leverage Four important effects of financial leverage: 1. 2. 3. 4. Increases expected rates of return on equity and expected EPS Increases risk of equity: both variance and beta Increases the probability of bankruptcy and expected bankruptcy costs Increases the interest tax shield Which effect is positive (improves shareholders welfare) and which is negative (reduces shareholders welfare)? Capital Structure Decisions 5 Effects of Leverage 1. Leverage Increases Expected Rates of Returns on Equity and Expected EPS. Example Consider $100 (all-equity) investment in a house. Expected return on the house is rEu = 15%. Expected Net Income is = 15%$100 = $15. To find EPSU, suppose there are “10 $10 shares outstanding”. Thus, EPSU = $15/10 = $1.5. Capital Structure Decisions 6 Effects of Leverage Consider the following Financial Engineering Borrow (take a mortgage) $90 and invest only $10 in own equity. The borrowing rate is the risk-free rate, rD = 10%. (Now there is only “one $10 share outstanding”.) rEL Expected return to leveraged equity and EPS, Expected Net Income 15 10% 90 Expected Net Income $6 60% , EPS L $6 Equity Investment 10 one share outstanding 1 both go up . 90 Alternatively: rEL 15% (15% 10%) 60% 10 D L U U rE rE (rE rD ) E Capital Structure Decisions 7 Effects of Leverage 2. Leverage Increases Risk: Both Variance and Beta. So far the example looked at expected return of 15%. Suppose the underlying distribution is .5 .5 30% 0% Capital Structure Decisions 8 Effects of Leverage Variability of equity returns in unleveraged firm: In “bad” state equity return is 0%. In “good” state equity return is 30% Equity returns in unleveraged firm are ± 15% around the mean of 15%. We have here ”double (to 30%) or nothing (to 0%).” Capital Structure Decisions 9 Effects of Leverage Variability of equity returns in Leveraged firm: In “bad” state cash flow to equityholders equal $100 $9 - $90 = $1. On $10 investment this gives a return of -90%. In “good” state cash flow to equityholders equals $130 - $9 - $90 = $31. On $10 investment this gives a return of 210%. Equity returns in leveraged firm are ± 150% around the mean of 60%. Volatility far exceeds the ”double or nothing” situation of the unleveraged firm. Capital Structure Decisions 10 Effects of Leverage 3. Leverage Increases the Probability of Bankruptcy and Expected Bankruptcy Costs. Probability of Bankruptcy =Probability (EBIT < Interest) It increases with leverage because interest is increased and EBIT remains the same. Capital Structure Decisions 11 Effects of Leverage Bankruptcy Costs Bankruptcy costs = the difference between the value of the assets before and after bankruptcy. The magnitude of bankruptcy costs depends on the nature of the firm and its industry. Firms with tangible assets have lower bankruptcy costs than firms whose assets are intangible. Even absent formal bankruptcy, there are costs of financial distress. These costs increase with the level of debt. Capital Structure Decisions 12 Effects of Leverage 4. Leverage Increases the Interest Tax Shield. Interest payments on corporate debt are deductible from taxable income. Therefore, debt provides a tax shield for corporations. Capital Structure Decisions 13 Effects of Leverage:Summary Leverage Increases Impact on Shareholders 1. Equity rate of return and EPS 1. Positive 2. Equity risk 2. Negative 3. Expected bankruptcy cost 3. Negative 4. Tax shields 4. Positive The question of optimal leverage is highly controversial. To gain understanding, we start with an idealized world, perfect capital markets. Capital Structure Decisions 14 Capital Structure Under Perfect Capital Markets - M&M Perfect Capital Markets are Defined: no taxes; no bankruptcy costs; no transaction costs (buying, selling or issuing securities); equal access to the markets (information, size, etc..); price taking. Capital Structure Decisions 15 Capital Structure Under Perfect Capital Markets - M&M M&M Proposition 1 Under perfect capital markets capital structure is V L = VU irrelevant to firm value the value of the firm is unchanged when proportions of debt and equity are changed. Leveraged Firm value, VL VU Capital Structure Decisions VL Debt level 16 Capital Structure Under Perfect Capital Markets - M&M Intuition Since production decisions are fixed, the total cash flow is unchanged. Different capital structures have different ways of splitting the same total. Firm Value $100 Equity Value Debt Value $50 $50 Capital Structure Decisions Equity Value Debt Value $20 $80 17 Capital Structure Under Perfect Capital Markets - M&M Conclusion Since firm value does not change with degree of leverage and since debt is sold in competitive markets for its fair value, equityholders situation is not affected by leverage. The first two effects of leverage are a perfect wash: The increase in expected return to equity just compensates shareholders for the increased risk. Capital Structure Decisions 18 Capital Structure Under Imperfect Capital Markets Tax Consideration - Debt Provides Tax Shield VL= VU + PV of tax shields • Consider a firm with perpetual debt level D that pays annual interest rate rD. • • • Annual interest payment equals rDD Annual tax shield equals TrDD PV of tax shield equals TrDD/rD = TD VL VL = Vu + TD VL = Vu + TD VU D Capital Structure Decisions 19 Capital Structure Under Imperfect Capital Markets Intuition As debt increases, the government share of the given pie decreases. The figures below assume pre-tax value of $100; thus, with T = 34%, VU = $66 (first figure on left). Shareholders Government Debtholders = $66 VL = $50 + $33 = $83 $17 $34 $66 Shareholders Debtholders Government Government Debtholders VU Shareholders $33 $50 Capital Structure Decisions VL = $80 + $13.2 = $93.2 $7 $13 $80 20 Capital Structure Under Imperfect Capital Markets Expected Bankruptcy Costs (EBC) VL= VU + PV of tax shields - EBC VL VL = Vu + TD VL* VL = Vu + TD - EBC VU D* Capital Structure Decisions D 21 Capital Structure Under Imperfect Capital Markets With bankruptcy costs, as debt levels increase the expected value lost due to expected bankruptcy cost increases. Riskless Debt Risky Debt Riskier Debt Shareholders Government Shareholders Debtholders Shareholders Debtholders Debtholders EBC Government EBC Government EBC $8 $10 $31 $20 $16 $42 $59 $30 Capital Structure Decisions $14 $10 $60 22 Capital Structure Under Imperfect Capital Markets Firms within an industry tend to have similar debt levels. Different industries tend to have different debt levels. Examples: In 1981 Chrysler restructured by mainly giving debtholders equity. Makes sense, given that Chrysler had heavy losses accumulated, so their effective TD was basically zero. Real-Estate companies tend to use extensive leverage. Makes sense, given that expected bankruptcy cost is very low. What is the capital structure of McKinsey? Why? Capital Structure Decisions 23 Capital Structure Under Imperfect Capital Markets Agency Costs Conflict Between Shareholders and Managers a) Debt increases the fraction of equity held by managers b) Debt commits the firm to pay out “free cash”. This prevents “empire building” but may result in underinvestment. Conflict Between Debtholders and Equityholders a) Equityholders may benefit from “going for broke- ”asset substitution.” b) Equityholders may refuse to contribute additional funds even if the firm has a positive NPV project because the benefits accrue to debtholders - “debt overhang” problem. Capital Structure Decisions 24 Capital Structure Under Imperfect Capital Markets Asymmetric Information Capital markets underprice equity issuance since they view the firm as issuing equity when it is overpriced. This results in “pecking order” theory - issue new securities in order of increasing sensitivity to market valuation (risk free debt, risky debt, convertible debt, and equity as last resort) Firms issuing debt signal that they are of high quality. Capital Structure Decisions 25 Capital Structure Under Imperfect Capital Markets Product/ Input Market Interactions Increase in leverage gives incentive to equityholders to pursue riskier more aggressive strategies. Also, to avoid bankruptcy, they are pushed toward strategies that generate early cash. Predation - More highly leveraged firms might be easier predation targets. Interaction with customers/ suppliers - more debt affects these interactions since customers and suppliers bear the costs of bankruptcy. Capital Structure Decisions 26 Capital Structure Under Imperfect Capital Markets Corporate Control Capital structure affects the outcome of takeover contests and their likelihood through its effect on the distribution of votes. It will affect the fraction of votes owned by large “insiders”. Debt contracts give various level of control to debtholders (covenants could be very restrictive). Capital Structure Decisions 27 Capital Structure under Imperfect Capital Markets Personal Taxation The firm tries to minimize PV of all taxes, not just corporate. On the personal level, equity has a more favorable treatment than debt thus, offsetting part of debt’s corporate tax advantage. Capital Structure Decisions 28 Summary of two-day announcement effects associated with exchange offers, security sales with designated uses of funds, and calls of convertible securities. With sources and uses of funds associated, these transactions represent virtually pure financial structure changes. Type of Transaction Security Issued Security Retired Average Sample Size Two-Day Announcement Period Return Debt Debt Preferred Debt Income bonds Common Common Common Preferred Preferred 45 52 9 24 24 21.9% 14.0 8.3 2.2 2.2 Debt Debt Debt Debt 36 83 0.6* 0.2* Common Common Convertible debt Common Preferred Common Common Convertible preferred Convertible bond Debt Preferred Debt Debt Debt 57 113 15 30 9 12 20 -0.4* -2.1 -2.4 -2.6 -7.7 -4.2 -9.9 LEVERAGE-INCREASING TRANSACTIONS Stock Repurchase Exchange Offer Exchange Offer Exchange Offer Exchange Offer TRANSACTIONS WITH NO CHANGE IN LEVERAGE Exchange Offer Security Sale LEVERAGE-REDUCING TRANSACTIONS Conversion-Forcing Call Conversion-Forcing Call Security Sale Exchange Offer Exchange Offer Security Sale Exchange Offer *Not statistically different from zero. Source: C. W. Smith, "Investment Banking and the Capital Acquisition Process," Journal of Financial Economics, 1986, p. 12. Capital Structure Decisions 29