Cash - baba

advertisement

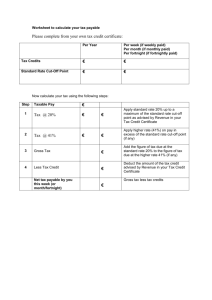

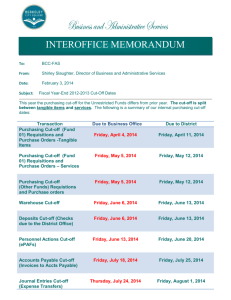

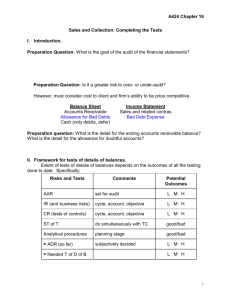

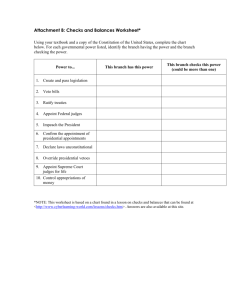

Cash Audit Procedures Assertions & Objectives Management Cash • Exists • Include all transactions that should be presented • Represents rights of the entity • Valued appropriately • Presented and disclosed properly within the financial statements Audit • Existence or occurrence • Completeness • Rights and obligations • Valuation or allocation • Presentation and disclosure Approach to audit • Nature – using persuasive procedures (bank account confirmation) • Timing – perform procedures at the balance sheet date (cut-off) • Extent – test more extensively (increase sample size) DUE TO: 1. Detection risk 2. Control risk 3. Inherent risk Audit Procedures CASH Substantive Tests: Cash Balance Assertions Existence, rights valuation Procedures 1. Confirm year-end cash balance with all banks and other depositories valuation 2. Verify mathematical accuracy of recorded cash balance: • Foot cash journals • Trace totals to the general ledger and to yearend bank reconciliations prepared by client • Test cash on hand as necessary Existence Completeness Valuation 3. Test cut-off • Obtain cut-off bank statements directly from banks Assertions Procedures Existence Completeness Valuation 3. Test cut-off (continued) • Obtain cut-off bank statements directly from banks a. Verify accuracy of cut-off bank statements b. Examine information and trace to reconciling items in year-end bank reconciliation and to entries in cash journals c. Consider necessity of preparing proof of cash • Reconcile recorded cash balance with returned bank confirmations • Examine intercompany and interbank transfer near year end Presentation and disclosure 4. Review financial statements to determine whether: • Cash balance are properly classified and described • Disclosures are adequate Confirm cash balances • Standard form to confirm account balance with financial institutions Verify mathematical accuracy • Recompute totals in cash journals and clientprepared bank reconciliations • Trace cash journal totals to postings in general ledger • Counts cash on hand (petty cash) Test cut-off • Test if cash receipts and disbursements are recorded in the proper accounting period Cash journals General ledger Bank reconciliations VS Year-end bank statements Cut-off bank statements Returned bank confirmations BANK RECONCILIATION Reconciliation of Bank Balances Schedule explaining any differences between the bank’s and the company’s records of cash. Reconciling Items: 1. Deposits in transit. 2. Outstanding checks. 3. Bank charges and credits. Time Lags 4. Bank or Depositor errors. LO 10 Explain common techniques employed to control cash. Reconciliation of Bank Balances LO 10 LO 10 Explain common techniques employed to control cash. Illustration: Journalize the adjusting entries at November 30 on the books of Nugget Mining Company. Nov. 30 Cash 542 Office expense Accounts receivable 18 220 Accounts payable 180 Interest revenue 600 LO 10 Explain common techniques employed to control cash. Review Question The reconciling item in a bank reconciliation that will result in an adjusting entry by the depositor is: a. outstanding checks. b. deposit in transit. c. a bank error. d. bank service charges. LO 10 Explain common techniques employed to control cash. Issues related to Cash FINANCIAL STATEMENT PRESENTATION AND DISCLOSURE What is Cash? A financial asset—also a financial instrument. Financial Instrument - Any contract that gives rise to a financial asset of one entity and a financial liability or equity interest of another entity. What is Cash? ► Most liquid asset. ► Standard medium of exchange. ► Basis for measuring and accounting for all other items. ► Current asset. Examples: coin, currency, available funds on deposit at the bank, money orders, certified checks, cashier’s checks, personal checks, bank drafts and savings accounts. LO 1 Identify items considered cash. Reporting Cash Cash Equivalents Short-term, highly liquid investments that are both (a) readily convertible to cash, and (b) so near their maturity that they present insignificant risk of changes in interest rates. Examples: Treasury bills, commercial paper, and money market funds. LO 2 Indicate how to report cash and related items. Restricted Cash When material in amount: Segregate restricted cash from “regular” cash. Current assets or non-current assets Examples, restricted for: (1) plant expansion, (2) retirement of long-term debt, and (3) compensating balances. Bank Overdrafts When a company writes a check for more than the amount in its cash account. Generally reported as a current liability. Offset against cash account only when available cash is present in another account in the same bank on which the overdraft occurred. LO 2 Indicate how to report cash and related items. Summary of Cash-Related Items Illustration 7-3 LO 2