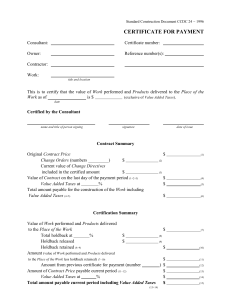

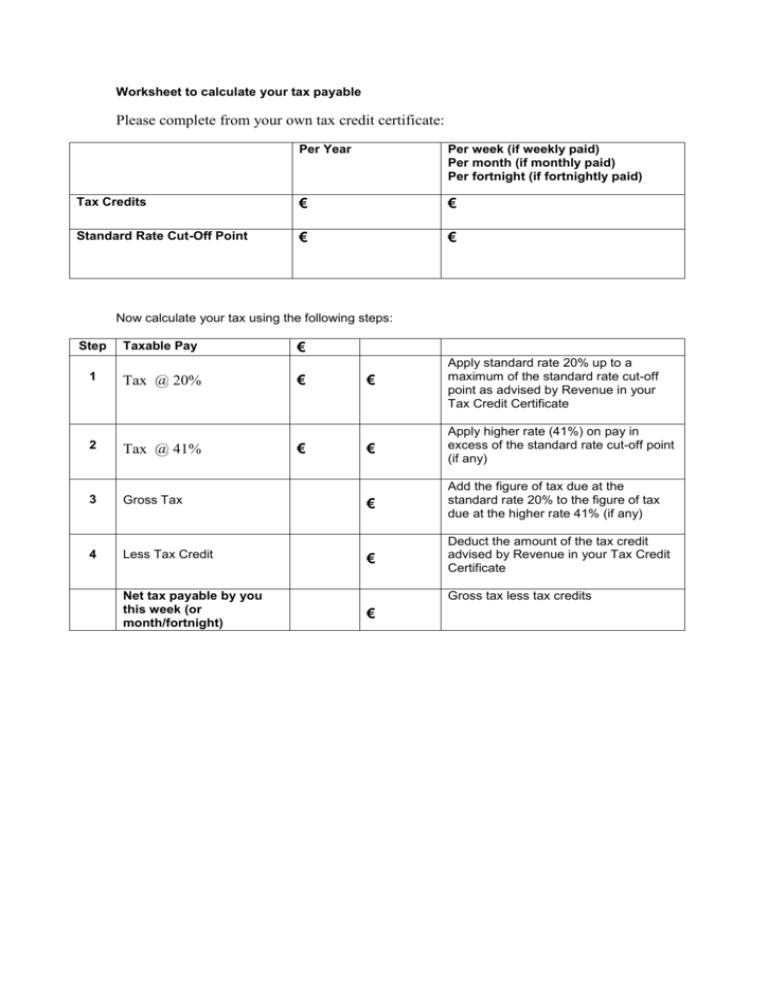

You can use this worksheet to calculate your tax payable

advertisement

Worksheet to calculate your tax payable Please complete from your own tax credit certificate: Per Year Per week (if weekly paid) Per month (if monthly paid) Per fortnight (if fortnightly paid) Tax Credits € € Standard Rate Cut-Off Point € € Now calculate your tax using the following steps: Step 1 Taxable Pay Tax @ 20% € € € Apply standard rate 20% up to a maximum of the standard rate cut-off point as advised by Revenue in your Tax Credit Certificate € Apply higher rate (41%) on pay in excess of the standard rate cut-off point (if any) € Add the figure of tax due at the standard rate 20% to the figure of tax due at the higher rate 41% (if any) Deduct the amount of the tax credit advised by Revenue in your Tax Credit Certificate 2 Tax @ 41% 3 Gross Tax 4 Less Tax Credit € Net tax payable by you this week (or month/fortnight) € € Gross tax less tax credits