Delphi's Account Reconciliation Process

advertisement

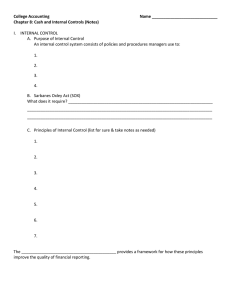

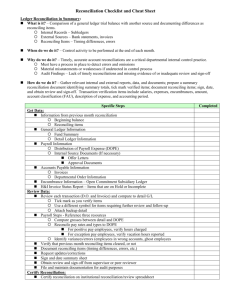

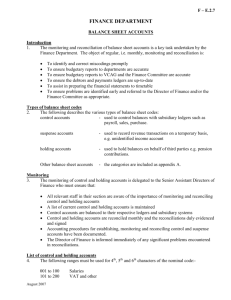

Account Reconciliations Account Reconciliations • Account Reconciliation Process Policy The Four Types of Recons Warning Signs Roll-Forwards Accountability • CARS Tips • Best Practices • Statutory Account Reconciliations 2 Security Classification Foundation of Financial Accuracy • SEC Reporting Control Processes Ongoing Control &Monitoring Activities Pre-close accounting issue reviews Controller’s Roundtable File 10Q Audit Committee Annual SOX Assessment Accounting memos SOX/KMC Certification Environmental reserve analysis Executive Review DGM Restructuring Approvals Warranty Council Quarterly Accounting Close Reviews Prepare Management Financial review & Statements analysis & Exhibits Trial balance submissions Divisional SubConsolidation Monthly account reconciliations Disclosure Committee Review Post FAS 5 Legal Analysis Closing Adjustments Tax & Corp. consolidation Prelim. Financial Results Judgmental reserves (warranty and restructuring) roll forwards Bi-weekly CAO calls with divisional and regional controllers 3 Security Classification Internal audit procedures Reconciliation Process: Policy Basics • Every balance sheet account -- Every month Reconciliations completed by workday 13 or 18 (quarter vs. non-quarter end) All accounts are required to be in CARS • Every account must be assigned a reconciler and a reviewer Reconciler and reviewer must be appropriate 3rd party (Genpact) reconciled accounts have a Delphi owner (“Approver”) • Reconciliations must have sufficient supporting documentation Must support the balance and the reconciling items / activity • Outstanding reconciling items must be addressed on a timely basis $100,000 or more must be resolved by the next month close Under $100,000 must be resolved within 60 days (2 months after) or written off • Zero balance accounts must be monitored and reconciled Ensure that no balances are present and, generally, no activity occurred • All accounts in local ledger must be represented in CARS Note: Account Reconciliation policy available on the DCAP (Corporate Accounting Policy page) Security Classification Reconciliation Process: Policy Basics • Reconciliations are a key control to ensuring that: General ledger balances match the local supporting detail records Any differences between the GL and detail are properly explained • To be considered reconciled, all reconciling differences must be identified, investigated and resolved $100,000+ resolved within 30 days (i.e. next month) Under $100,000 resolved within 60 days (i.e. 2 months) If an insignificant item remains unexplained for more than two months an adjusting entry should be recorded to clear (i.e. write-off) the amounts • Reconciliations should not focus on just the activity in the account, but also on the account balance The accounts assigned to you are your responsibility In your personal bank account, do you care just about the activity, or do you also care about the balances? Security Classification Reconciliation Process: Accountability • Finance Directors have the ultimate responsibility for ensuring that all divisional accounts are reconciled. Responsibility may be formally delegated (in a written document) to Assistant Finance Directors • Each division should have a formal account reconciliation review and sign-off process. Documented (in writing) and maintained in the record of the division’s accounting procedures. Reviews of reconciliations should focus on ensuring the quality and completeness of the reconciliation. Divisional review process must include a detailed supervisor review of the account reconciliations (i.e. agreeing to source documents, etc.) on monthly basis. Security Classification Reconciliation Process: Accountability • Preparer self-review should include the following steps: Review of nature and purpose of activity Verification of accuracy of amounts recorded (e.g., agrees to related support) Verification of appropriate accounts and classification (e.g., P&L line item, current vs. long-term, asset vs. liability, etc.) Verification that timing of activity is appropriate (e.g. accrual not cash basis, out of period adjustment, etc.) Ensure that appropriate (objective, verifiable) support is included Ensure that no extraneous information is included with the final support package Provide information to supervisor for review Address any supervisor review points or questions prior to finalization Security Classification Reconciliation Process: Accountability • First-line supervisor review should be as if the reviewer was preparing the account reconciliation, the following additional elements should be included: Provide review points to preparer Ensure review points are appropriately addressed prior to finalization Document supervisor review through formal sign-off of work product • Certain accounts or other items may require additional review beyond the preparer and supervisor. These include: Unusual or non-recurring items Subjective items All inventory reserves Items for which there were differing viewpoints on the appropriate accounting treatment Security Classification Reconciliation Process: Accountability • Each division / trial balance / site is responsible for appropriately reconciling and reviewing the accounts assigned to them Reconciler: Completes the reconciliation by the required due date. Completes a self-review to ensure that you have: • Accounted for the balances • Investigated reconciling items • Attached sufficient supporting documentation Reviewer: Review the account to ensure that: • Balances and activity are accounted for • Proper documentation is attached • Review is completed in a timely manner Approver (Third Party Reconciled) • Ensure proper and timely reconciliation and review • The Delphi approver is the owner of this account – not the outside party Accounts assigned to you are your responsibility! You are the expert on these accounts. These accounts are pieces of the total puzzle that eventually become our financial statements. Security Classification Reconciliation Process: Types of Recons • The assigned reconciler and reviewer are responsible for the accounts assigned to them – they must understand the nature of the account, what type of activity flows through it, the unique risks, etc. • Four types of account reconciliations Sub-ledger to general ledger General ledger to specific source documents General ledger to estimates / calculations Statutory to U.S. GAAP (covered separately) Security Classification Reconciliation Process: Types of Recons • Sub-Ledger to General-Ledger • A/R, A/P, inventory, PP&E, etc. accounts are based on information contained in the local sub-ledger. The balances must equal the balances in the general ledger • For some accounts based in SAP, or other systems, there can be no manual adjustments – the balances are generated automatically In these cases, you may not need to reconcile the activity in the account, but you do need to ensure that the sub-ledger equals the GL and that there are no reconciling items • Some account balances are system set and only change annually (retained earnings, PP&E beginning balances, etc.) Review monthly to confirm that the account has not changed (system errors do happen) Document which accounts meet this criteria – an exemption is not needed If accounts have unexpected changes, you must perform monthly reconciliations until it is confirmed that the system issues have been corrected Security Classification Reconciliation Process: Types of Recons • Account to Specific Source Documents • Accounts such as cash are based on source documents. The account must be reconciled to the bank statement and properly adjusted, if needed. The balance in the GL must agree to the source documentation, plus or minus reconciling items • Example: Cash Balance per bank statement Add: Deposits in transit Deduct: Outstanding checks Adjusted bank balance Deduct: Service charges Balance per general ledger Security Classification $2,000 1,000 (600) $2,400 (100) $2,300 Reconciliation Process: Types of Recons Accounts Involving Estimates • Certain accounts involve management estimates in addition to sub-ledger or other details Example: Reconciliation of the A/R reserve for doubtful accounts: Balance as of January 31 February credit activity posted to ledger Balance at February 28 $ (775,000) (100,000) $ (875,000) Balance at February 28 is compared to management analysis supporting required level of reserves: GM & outside customers 90+ days past due (reserve at 25%) $ (312,500) GM & outside customers 31-89 days past due (reserve at 10%) (375,000) Additional specifically identified accounts (reserved at 100%) (175,000) Required level of reserve $ (862,500) Additional adjustment required to A/R Allowance reserve $ (12,500) 1 1 Reconciliation should contain adequate detail to support the adjustment made by management. including copies of G/L screen prints, A/R sub-ledger detail, credit manager sign-off and approval forms and journal vouchers. Security Classification Reconciliation Process: Types of Recons Source Document Type of Reconciliation • Bank Statements Cash Accounts • Inventory Subledger Detail Accounts Payable Accounts Receivable Plant & Equipment • Debt Agreements Security Classification Accrued Interest Payable Reconciliation Process: No Source Documents Exist • Need to calculate what the balance should be Do not confuse a calculation with detail of the account activity! Compare calculated balance with ledger balance Do not assume the ledger balance is correct • Transactions can be recorded in the wrong account • Journal entries can be missed or forgotten • Entries can be made for the incorrect amount Security Classification Reconciliation Process: Accounts Reconciled to Calculations Accrued liabilities Prepaid items Reserves and allowances Taxes Insurance Excess and obsolete Interest Rent Warranty Retirement benefits Impaired assets Allowance for doubtful accounts Security Classification Reconciliation Process: Warning Signs & Issues • Warning Signs: Balances that appear incorrect at first review • • • Debit balances in a liability account or credit balances in an asset account Significant change from the prior period No change at all from the prior period Aged reconciling items that are not being explained or written-off • Items that linger well past the 60 day cut-off without any reason or documentation to support Reconciliations that have inadequate or missing supporting documentation • • • Unexplained screen prints of activity Unidentified reconciling items No supporting detail – either of activity or balances Reconciliations that just are inconsistent with underlying business processes • • Security Classification Often indicates an account that has been assigned to someone who is not familiar with the balances, processes, etc. Not every account is the same – some accounts require specific skills or knowledge to properly reconcile. Make sure employees assigned to accounts are appropriate for those accounts Reconciliation Process: Roll Forwards • Roll-Forward vs. Reconciliation: A common mistake is to perform a roll-forward that summarizes activity as opposed to a true reconciliation that substantiates the balance in the account • Roll-Forward Summary of debits and credits in the account Does not provide assurance regarding the balances • Reconciliation Explains the balances – provides evidence and comfort that balances are accurate Explains differences between the local sub-leger and the general ledger balances - including supporting documentation Will include activity summary as well as additional information about the account and the balances Security Classification Reconciliation Process: Best Practices • Assign resources to ensure adequate time to complete Make account reconciliations a priority for staff Make sure staff are not just “doing the easy ones” Consider authorizing overtime or short-term contract staff Consider adding staff – perhaps co-op or intern • Have process to resolve complex issues Call team together Schedule weekly report-outs on status Quickly elevate concerns to management • Have process to flag potential income statement impacts Work to resolve all accounts Forecast and address concern Keep divisional management and CAO informed Security Classification Reconciliation Process: Best Practices • Set up periodic review sessions Best practice – Each month finance executive should randomly select accounts for detail review with the account owner and manager • Managers should keep logs of accounts that they are responsible for reconciliation Finance Executives should review regularly Focus should be on high risk accounts • Consider “independent” review of accounts Switch accounts between Finance Executives Rotate account reconcilers Security Classification Reconciliation Process: Best Practices • Divisional Internal Control should perform account reconciliation tracking Verify list is complete and accurate including third party reconciliations (i.e., ACS/Accenture) Spot check sample of reconciliations • Set divisional policies on thresholds for required adjustments • Close accounts that are not needed • Combine accounts if possible • Have documented issue resolution process Security Classification CARS: Tips & Ideas • All accounts are required to be reconciled in the CARS system Key sites are required to review data quarterly to ensure that all accounts present in the local ledger are present in CARS • CARS does not force a person to do high quality reconciliations, it is simply a tool to use Just because you see something noted as ‘reconciled’ in the system, doesn’t mean it is necessarily correct – it is still up to the account owners to ensure quality • CARS offers many features that may be underutilized by sites Detailed reporting Review / Audit capabilities Contact your local Super-User or the CARS team for support / help • CARS performance is often limited by network capabilities Limit / eliminate large attachments, but be sure to indicate where back-up documentation can be located for future review Work with your local accounting team to close and eliminate unnecessary accounts in your local ledger • Security Classification Additional accounts, even zero balances, drives additional traffic Best Practices / Summary Account reconciliations are the foundation of our financial records. Accurate and complete reconciliations help to ensure that we present accurate financial information and that management has the correct information to help make decisions. • Make sure you allocate sufficient time to give the account reconciliation process the attention it deserves Make accurate, high-quality reconciliations a priority for your staff • Develop a local process or key contact to help resolve complex or difficult issues – designate a local expert • Monitor your completion, outstanding reconciling items, timeliness, total accounts, etc. – all available from CARS Including “Accounts Pending Modification” (returned to reconciler by reviewer) • Consider implementing an independent review Rotate review responsibilities within your staff – make sure the review process does not become a ‘check-the-box’ exercise Security Classification Best Practices / Summary • Close accounts that are not needed – both in your local ledger as well as the CARS system Consider combining similar or related accounts if feasible • If you can’t comply with the reconciliation policy requirements, follow the proper steps for obtaining a deviation (refer to Section IV. Policy Deviations in the Account Reconciliation Policy) • Ensure that accounts are assigned to the correct staff – don’t expect everyone to be able to manage every account • Reconciliations are about the activity and the balances – a rollforward of activity is only half of the job Remember, this process is your responsibility. Every reconciliation performed rolls up to the corporate financial statements. Mistakes or neglect of your accounts has a direct impact on the company. Your efforts make a difference. Security Classification Statutory Account Reconciliations • Each trial balance Finance Manager has the ultimate responsibility for ensuring that all statutory accounts have been reconciled to the U.S. GAAP accounts as required by this policy. • Each trial balance location should have a formal review and sign-off process. This process must be formally documented and maintained in the accounting records of the trial balance location. The location of these records is at the discretion of the location. • Reviews should focus on ensuring the quality and completeness of the reconciliation. • There is no exemption from the statutory reconciliation requirement. If circumstances arise that prohibit a statutory reconciliation, the respective trial balance Finance Manager or delegate must contact the Divisional Finance Director. 25 Security Classification Statutory Account Reconciliation - Example • Assume the machine tool was placed in service on January 1, 20x5. The reconciliation is for the year 20x5. This example is simply an example; units are permitted to complete statutory to U.S. GAAP reconciliations in any format that provides the information clearly. • Local Statutory Accounts Machine Tool with a cost of $3,500 was capitalized The current gross book value of property, plant and equipment is $5,503,500 1 year of depreciation on this asset has been charged to expense $350. The current balance in accumulated depreciation is 2,300,350 Local Statutory Net Income is $1,255,350 • U.S. GAAP Accounts The Machine Tool was expensed No depreciation expense was charged The current gross book value of property, plant and equipment is $5,500,000 The current balance in accumulated depreciation is 2,300,000 U.S. GAAP Net Income is 1,252,200 26 Security Classification Statutory Account Reconciliation - Example • Delphi XYZ would prepare the following reconciliation within 45 days after the accounting period ends: Property, Plant & Equipment Account • Amount per Statutory Books $5,503,500 • Balance per US GAAP Books $5,500,000 • Difference $3,500 Reconciling Item: • Machine tool capitalized for local statutory purposes • Remaining difference ($3,500) $0 Accumulated Depreciation Account • Amount per Statutory Books $2,300,350 • Balance per US GAAP Books $2,300,000 • Difference $350 Reconciling Item: • 27 Security Classification • Depreciation expense on machine tool capitalized for Local statutory purposes ($350) Remaining difference $0 Statutory Account Reconciliation - Example Net Income • Amount per Statutory Books $1,255,350 • Balance per U.S. GAAP Books $1,252,200 • Difference $3,150 Reconciling Items: 28 Security Classification • Machine tool capitalized for local statutory purposes ($3,500) • Depreciation expense on Machine tool – local statutory $350 • Remaining difference $0 Questions? • For more information, please contact Technical Accounting or Internal Audit Security Classification Account Reconciliation Examples 30 Good Example Cash Asset Account Delphi Corporation Reconciliation of Account March 2005 Account Numbers: EW 1001 00000 12000 000 000 0000 Description: Cash *** Subledger/ General LedgerDetailed Records $ 527,545 $ 534,045 Ending Balance: Reconciling Items: Mar. Stop payments booked by Bank not adjusted to G/L: #481 $3,000; #482 $1,000; #484 $5,000 Mar. Outstanding checks: #401 $10,000; #410 $2,500 Mar. Deposits in Transit: Dep#123 $15,000 Reconciled Balance (G/L should equal detailed records) 9,000 12,500 $ *** - Please Specify: Bank Statement (e.g. bank statement, Physical inventory records, DACOR, Olimpic, etc.) Prepared by: Approved by: GL balance reconciled to bank statement No unreconciled differences Security Classification (15,000) 534,045 $ Variance $ 534,045 - Good Example Equipment Asset Account Delphi Corporation Reconciliation of Account March 2005 Account Numbers: EW EW EW EW EW Description: Capitalized IT Hardware & Accumulated Depreciation March 2005 Balance: EW EW EW EW EW 3264 00000 62001 000 000 0000 3264 00000 62012 000 000 0000 3264 00000 62501 000 000 0000 3264 00000 62507 000 000 0000 3264 00000 62596 000 000 0000 3264 00000 62001 000 000 0000 3264 00000 62012 000 000 0000 3264 00000 62501 000 000 0000 3264 00000 62507 000 000 0000 3264 00000 62596 000 000 0000 Book Value per DGL Book Value per SAP Variance IT Hardware Beginning Balance IT Hardware Current Year Addition Accum Depr Beginning Balance Accum Depr Current Year Accum Depr Other Current Year Adjustments $ 3,177,272 - (1,208,459) (267,727) 1,701,086 Balances should agree to the general ledger. 1,704,041 $ (2,955) A Balance should agree to SAP (sub-ledger). Reconciling Item: March 2005 EWF93 reversing - IT accrual of depreciation asset to be booked in SAP in April 2005 $ Net unreconciled difference$ Prepared by: Approved by: Security Classification 2,955 A - One reconciling item explains the difference. Plan to resolve is documented. Good Example Prepaid Asset Account Account Number: EW-2690-02138-00000-000-000-0000 Description: Prepaid Expense - Sundry - IT Department 5/1/2005 Beginning Balance $ 89,200.00 5/31/2005 Ending Balance $ 72,900.00 AMR - 3 months remaining at $4,300 per month Gartner - 5 months remaining at $12,000 per month $ $ 12,900.00 60,000.00 5/31/2005 Calculated balance $ 72,900.00 May Activity EWE10 AMR Amortization 9 of 12 Gartner Amortization 7 of 12 $ $ (4,300.00) (12,000.00) Notes EWE10 - Setup AMR $51,600.00 invoice in prepaid to be expensed 1/12 September 2004 through August 2005 ($4,300/month) EWE10 - Setup Gartner Group $144,000 invoice in prepaid to be expensed 1/12 of November 2004 through October 2005 ($12,000/month) Prepared by: Security Classification Approved by: Calculated expected balance Good Example Allied A/P Liability Account Delphi Corporation Reconciliation of Account March 2005 Account Numbers: EW 4201 00000 00280 000 000 0000 Description: Accounts Payable - Allied Ending Balance: *** Subledger/ General Ledger Detailed Records $ (10,769,639) $ (17,363,876) Reconciling Items: Mar. 2005 wire transfers to Asia and Europe, not recorded in DACOR 6,646,082 Mar. Rebills not invoiced to the customer Mar. 2005 Packard cross charge incorrectly classified to 4201 - 00280 Mar. 2005 Mexico cross charge not booked in DACOR Mar. 2005 Singapore receipts not booked in DACOR Account classification error posted in March (should be 00266) Difference in Mar. wire transfer to Asia to be written off Apr. 2005 75,121 11,143 (102,102) (79,122) 43,064 51 Reconciled Balance (G/L should equal detailed records) $ (10,769,639) $ Variance $ *** - Please Specify: DACOR (e.g. bank statement, Physical inventory records, DACOR, Olimpic, etc.) Prepared by: Approved by: GL balance reconciled to sub-ledger No unreconciled differences All reconciling items current Security Classification (10,769,639) - Bad Example Allied A/R Asset Account Delphi Corporation Reconciliation of Account March 2005 Account Numbers: EW 1601 00000 00501 000 000 0000 Description: Accounts Receivable Subledger/ General Ledger Detailed Records $ 8,268,412 $ 15,625,035 Ending Balance: Reconciling Items: Incorrect posting to 1601-00501 (Will be reclassified to 1601-00577 in April) (2,949,694) Material in transit (FOB Destination) Warranty receivable from vendors, not processed by A/R - Approval pending Sales for last 2 days of month un-invoiced A/P - correcting entry to be done in April Unapplied credits/payments (Cannot identify invoices being paid) Debit balances as a result of short paid invoices or unidentified deductions by customer (9,228,792) 212,338 628,824 897,035 Reconciled Balance (G/L should equal detailed records) (e.g. bank statement, Physical inventory records, DACOR, Olimpic, etc.) Prepared by: Security Classification Approved by: $ (1,326,267) 304,615 - 6,215,753 $ 6,215,753 Variance $ - Contains unidentified reconciling items Bad Example Audited Accrued Liabilities Delphi Corporation Account Reconciliation February 2005 Non-SAP Account Number Sub Account SAP SAP Account S441199997 Profit Center All Description Audited Accrued Liabilities (SAP Account S441199997) Month and Year Feb-05 Month-end Balance per General Ledger (attach copy) $72,393,074.72 Details of Month-end Balance (use attachments if required) Month Booked Journal/Document Explanation of Entry Dec-04 102865965 Doc was input into wrong account - Joe Delphi to correct Jan-05 102918735 Mfg. Doc was entered as perm - should be an accrual (Jane Delphi) Feb-05 102936590 Holt Module System - Jim Delphi - booked as perm entry s/b accrued ($700,000.00) ($937.16) ($10,682.80) Prior month entries to be reversed $62,977,591.77 Total Reversals from Prior Month ($62,977,591.77) Total Current Month Activity less recons above Total (must equal month-end balance) $73,104,694.68 $72,393,074.72 Contains old reconciling item (December 2004) Contains unexplained reconciling items (no detail for last 3 items) Does not support balance Security Classification Debit/Credit Bad Example Accrued Accounts Receivable Delphi Corporation Account Reconciliation April 2005 Non-SAP Account Number Sub Account SAP SAP Account S221000NFT Profit Center H201 Description Accrued Accounts Receivable - NAFTA Custom Refunds Month-end Balance per General Ledger (attach copy) $197,741.47 Details of Month-end Balance (use attachments if required) Month Booked Journal/Document Explanation of Entry NAFTA Recievable Balance Debit/Credit $197,741.47 MEMO: Delphi A Tax Staff Maintains detail of the outstanding expected refunds. Account represents expected refunds for 2003 forward. Total (must equal month-end balance) $197,741.47 Should attach tax staff detail Does not show preparer understands account Security Classification